Best Car Insurance in Tennessee for 2026 [10 Standout Companies]

Allstate, Nationwide, and Liberty Mutual are Tennessee's top car insurance companies, with starting prices starting at $18 a month. Allstate has strong local agent backing, Nationwide offers substantial multi-policy discounts, and Liberty Mutual offers the best rental and roadside assistance coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

UPDATED: Apr 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsThe Best Car Insurance in Tennessee includes Allstate, Nationwide, and Liberty Mutual, with Allstate being the top pick overall.

Allstate offers competitive rates starting at $18 monthly, excellent customer service, and comprehensive coverage. Nationwide glows with budget-friendly multi-policy discounts.

Our Top 10 Company Picks: Best Car Insurance in Tennessee

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Comprehensive Coverage | Allstate | |

| #2 | 20% | A+ | Strong Financials | Nationwide |

| #3 | 25% | A | Customizable Policies | Liberty Mutual |

| #4 | 25% | A | Family Focus | American Family | |

| #5 | 17% | B | Wide Availability | State Farm | |

| #6 | 25% | A++ | Competitive Pricing | Geico | |

| #7 | 10% | A+ | Technology Integration | Progressive | |

| #8 | 20% | A | Customer Satisfaction | Farmers | |

| #9 | 13% | A++ | Innovative Discounts | Travelers | |

| #10 | 10% | A++ | Military Focus | USAA |

– Our Top 10 Company Picks: Best Car Insurance in Tennessee

Liberty Mutual stands out for its superb roadside assistance and rental car coverage. These insurers address the specific needs of Tennessee motorists with dependable, affordable solutions.

Compare auto insurance quotes in Tennessee instantly by entering your ZIP code into our free online tool. You’ll get side-by-side rates from top providers to help you find the best coverage at the lowest price.

#1 – Allstate: Top Overall Pick

Pros

- Broad Coverage Choices: Broad coverage choices are available through Allstate in Tennessee.

- Customized Service: Area agents offer personalized insurance guidance in Tennessee.

- Prompt Claims Resolution: The claims process in Allstate is quick and hassle-free in Tennessee.

Cons

- Higher Premiums: Insurance premiums can be expensive in Tennessee.

- Limited Online Tools: Online management may be less efficient for Tennessee drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Strong Financials

Pros

- Solid Financial Position: Nationwide’s strong financial position provides Tennessee with secure insurance.

- Multi-Policy Savings: Discounts for bundling insurance policies in Tennessee.

- Safe Driver Discount: No ticketed driver in Tennessee needs to spend more for auto insurance.

Cons

- Service Delays: Customer service may have longer response times in Tennessee.

- Limited Customization: Fewer options for policy add-ons in Tennessee.

#3 – Liberty Mutual: Best for Customizable Policies

Pros

- Custom Insurance Coverage: Policies can be tailored to fit Tennessee drivers’ needs.

- Safety Feature Discounts: Discounts in Tennessee are available for vehicles with safety features.

- Flexible Payment Plans: Multiple payment options for Tennessee policyholders.

Cons

- Higher Premiums for Young Drivers: Rates may be higher for younger drivers in Tennessee.

- Limited Local Access: Fewer agents are available in rural Tennessee areas.

#4 – American Family: Best for Family Focus

Pros

- Family-Oriented Insurance: Tailored for families with teen drivers in Tennessee.

- Safe Driver Discounts: Tennessee drivers with good records benefit from discounts.

- Educational Incentives: Discounts for teen drivers completing defensive driving in Tennessee.

Cons

- Higher Premiums for High-Risk Drivers: Rates can be expensive for drivers with infractions in Tennessee.

- Slow Online Claims Processing: For Tennessee drivers, online claims handling can be slower.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Wide Availability

Pros:

- Easy Agent Access: State Farm has many agents throughout Tennessee for personalized insurance services.

- Competitive Rates: State Farm offers affordable basic insurance in Tennessee.

- Good Student Discounts: Tennessee students with good grades can save on insurance

Cons

- Limited High-Risk Insurance: State Farm might not provide the most competitive high-risk Tennessee driver insurance.

- Customer Service Discrepancies in Rural Areas: Tennessee rural inhabitants may experience service delays.

#6 – Geico: Best for Competitive Pricing

Pros

- Low Premiums: Geico has some of the cheapest Tennessee insurance rates.

- Multi-Policy Discounts: Get cheaper Tennessee insurance by combining car and home policies.

- Military Discount: Geico gives discounted rates to military personnel in Tennessee.

Cons

- Limited Local Agents: Geico’s access to local agents is limited in some Tennessee locales.

- Basic Coverage Options: Geico’s coverage choices could be limited for Tennessee motorists.

#7 – Progressive: Best for Technology Integration

Pros

- Snapshot Program: Drivers in Tennessee can save based on their driving habits.

- Comprehensive Coverage Plans: Progressive has a variety of insurance plans in Tennessee.

- Practical Online Tools: The app gives Tennessee drivers easy control over insurance.

Cons

- High Initial Premiums: New customers in Tennessee might pay high premiums.

- Limited Availability of Local Agents: Few Tennessee agents for face-to-face interaction exist.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Farmers are rated very high for their insurance service in Tennessee.

- Payment Flexibility: Farmers provides several payment methods for Tennessee motorists.

- Eco-Friendly Discounts: Tennessee motorists with electric or hybrid vehicles qualify for discounts.

Cons

- Higher Premiums for Younger Drivers: Younger drivers in Tennessee pay higher premiums.

- Fewer Add-Ons: Farmers provide fewer add-on choices for insurance coverage in Tennessee.

#9 – Travelers: Best for Creative Discounts

Pros

- Hybrid Car Discount: Tennessee drivers of hybrid vehicles receive a discount on their insurance rates.

- Safe Driver Rewards: Responsible Tennessee drivers receive discounted insurance premiums.

- Flexible Coverage: Tennessee drivers can customize policy details.

Cons

- Few Local Agent Offices: Travelers’ agents in Tennessee may be challenging to find in specific locations.

- Slow Claims Processing: Claims take longer to complete in Tennessee.

#10 – USAA: Best for Military Concentration

Pros

- Exclusive Military Discounts: USAA provides exclusive insurance for Tennessee military families.

- Superb Customer Service: Tennessee’s military personnel receive exceptional insurance service from USAA.

- Competitive Military Prices: Military personnel in Tennessee enjoy competitive prices.

Cons

- Military-Exclusive Eligibility: USAA is exclusive to Tennessee military families.

- Fewer Add-On Coverages: There are fewer add-on coverage options in Tennessee.

Tennessee Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $45 | $144 | |

| $32 | $102 | |

| $27 | $86 | |

| $24 | $78 | |

| $33 | $184 |

| $37 | $118 |

| $29 | $92 | |

| $22 | $72 | |

| $28 | $88 | |

| $18 | $58 |

– Tennessee Car Insurance Monthly Rates by Provider & Coverage Level

Car Insurance Discounts From the Top Providers in Tennessee

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy Discount, Safe Driver Discount, Anti-Theft Device Discount, New Car Discount | |

| Multi-Policy Discount, Safe Driver Discount, Defensive Driving Course Discount, Good Student Discount | |

| Multi-Policy Discount, Safe Driver Discount, Good Student Discount, Alternative Fuel Discount | |

| Multi-Policy Discount, Defensive Driving Discount, Good Student Discount, Military Discount | |

| Multi-Policy Discount, Good Student Discount, Anti-Theft Device Discount, New Car Discount |

| Multi-Policy Discount, Safe Driver Discount, Accident-Free Discount, Defensive Driving Discount |

| Multi-Policy Discount, Snapshot Discount, Good Student Discount, Homeowner Discount | |

| Multi-Policy Discount, Safe Driver Discount, Defensive Driving Discount, Good Student Discount | |

| Multi-Policy Discount, Safe Driver Discount, Hybrid/Electric Vehicle Discount, New Car Discount | |

| Multi-Policy Discount, Safe Driver Discount, Good Student Discount, Military Discount |

– Car Insurance Discounts From the Top Providers in Tennessee

![Best Car Insurance in Tennessee for 2026 [10 Standout Companies]](https://dev.carinsurance.org/wp-content/uploads/2025/02/Best-Car-Insurance-in-Tennessee.png)

Uninsured Motorists 20%

Tennessee car insurance rates cost an average of $889 per year or $74 per month. There are a lot of factors that affect car insurance rates in Tennessee. It can be confusing, and we understand that. Tennessee car insurance laws changed in 2017 when the state adopted a new bill to decrease the number of uninsured drivers in the state.

This guide will help you understand Tennessee auto insurance laws from 2019, 2020, 2021, and more. We will look at everything you need to know from auto insurance rates specific to the state of Tennessee, as well as coverage options in the Tennessee insurance market.

Start comparing Tennessee car insurance rates right now by entering your ZIP code in the FREE comparison tool above!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Tennessee car insurance coverage requirements and rates?

In this section, we’re going to cover the various types of car insurance coverage and rates in Tennessee. We know this information can be a little bit overwhelming, but we’ve tried to lay out the data in an easy to read format.

The Volunteer State is home to both the Grand Old Opry and Graceland, making it a destination choice for both rock & roll and country music lovers. From Memphis BBQ to Nashville Hot Chicken, Tennessee has a flavorful culture that’s all its own.

For this insurance guide, we looked at everything from Tennessee’s car culture and Tennessee’s minimum coverage, to the forms of financial responsibility required in Tennessee, premiums as a percentage of income, and much more.

How much insurance is required for Tennessee minimum coverage?

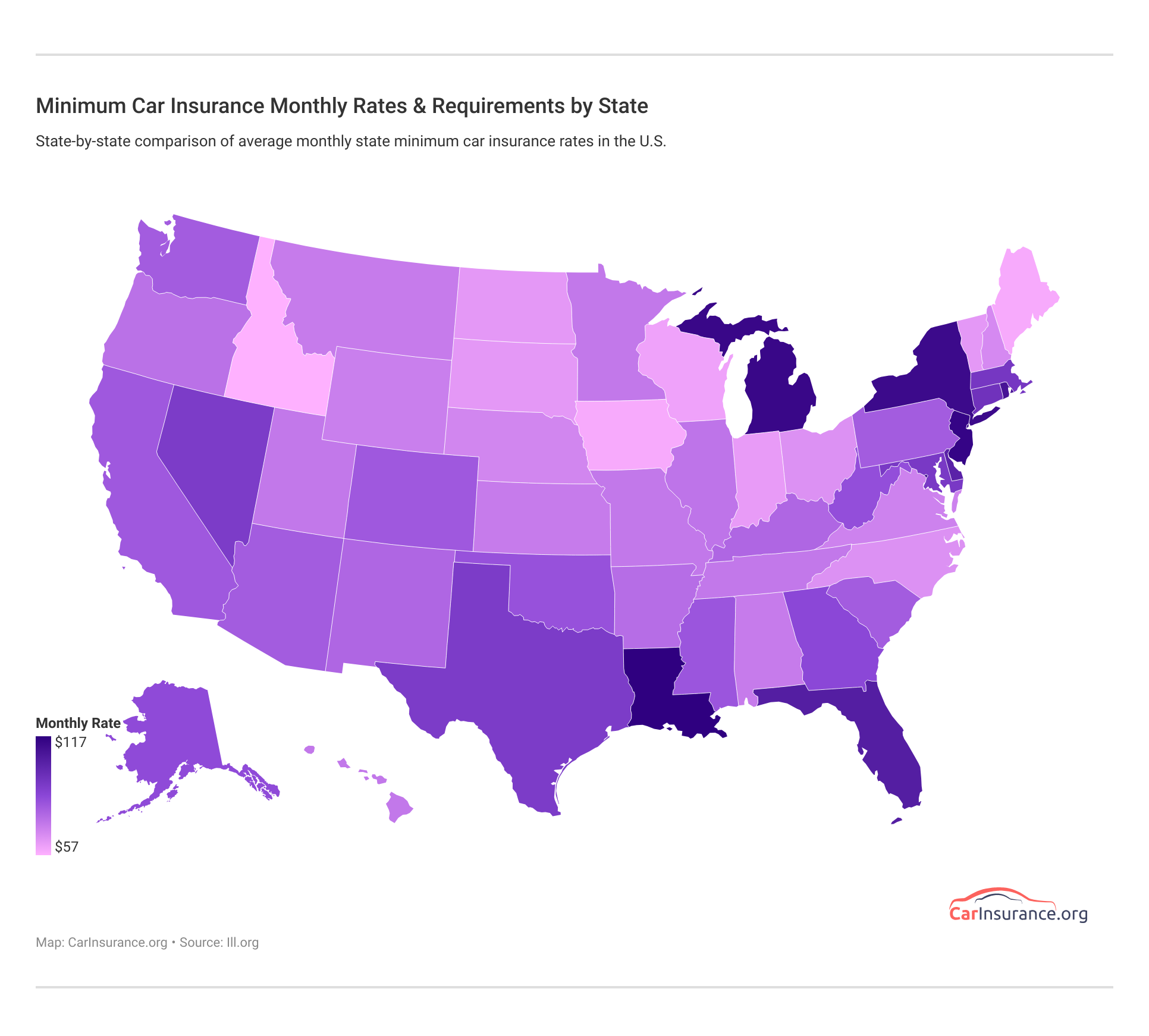

In Tennessee, there is a minimum amount of coverage you need to drive. If you’re a resident purchasing minimum coverage, you’ll be happy to know that the average cost of insurance in Tennessee is one of the lowest in the US.

The following are Tennessee car insurance requirements:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $15,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle.

It’s also worth noting that Tennessee is a state that accepts electronic proof of insurance. So if you don’t have a paper card, you can pull up your insurance card on your phone, tablet, or other mobile device.

This minimum coverage is designed to cover your liability if you cause an accident. A minimum coverage auto insurance policy does not cover the policyholder’s auto damage or medical bills if they are at fault. If another party was at fault, you would need to make your claim with their insurance company if you only had liability coverage.

You can find Tennessee car insurance quotes by using our FREE comparison tool! Enter your ZIP code to start comparing rates from local car insurance companies!

What are the forms of financial responsibility in Tennessee?

In Tennessee, there are certain forms of financial responsibility. You must have to prove you have insurance that can cover any potential accidents.

According to Tennessee law, the forms you can use to prove you have adequate insurance include a document (or electronic document) confirming that you have an auto liability insurance policy.

According to Tennessee state law, other ways that you can prove financial responsibility are by posting a bond with the Department of Revenue for $65,000 or making a cash deposit with the Department of Revenue for $65,000. So, you have options when you’re proving that you can legally drive. You will need to carry a certificate to back this up, though. If you’ve been in an at-fault accident, especially if uninsured, these requirements could be stricter.

How much do Tennessee residents pay for insurance?

Next, we’re going to check out the premiums as a percentage of income for car insurance for Tennessee drivers. Here is the three-year trend for Tennessee that shows the percentages from 2012 to 2014.

In 2012, the percentage was 2.12%, in 2013, it was 2.33%, and in 2014, it was 2.32%. As you can see, the highest percentage was right in the middle of 2013, and the lowest is in 2012.

Now, let’s check out the percentages of some states surrounding Tennessee. Note: the most recent year for this information is 2014, which is what we are showing you with these numbers.

For Arkansas, the percentage was 2.65%; Kentucky was 2.76%; Virginia was 1.90%; Alabama was 2.50%, and Mississippi was 3.05%.

As you can see, comparatively, Tennessee, is in the middle of its surrounding states. It’s significantly more affordable than some states. If you were to compare it to the countrywide average in 2014, which was 2.29%, Tennessee was slightly higher.

Now that you know how your income is affected, start looking for car insurance quotes in your local area by entering your ZIP code in the FREE comparison tool!

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

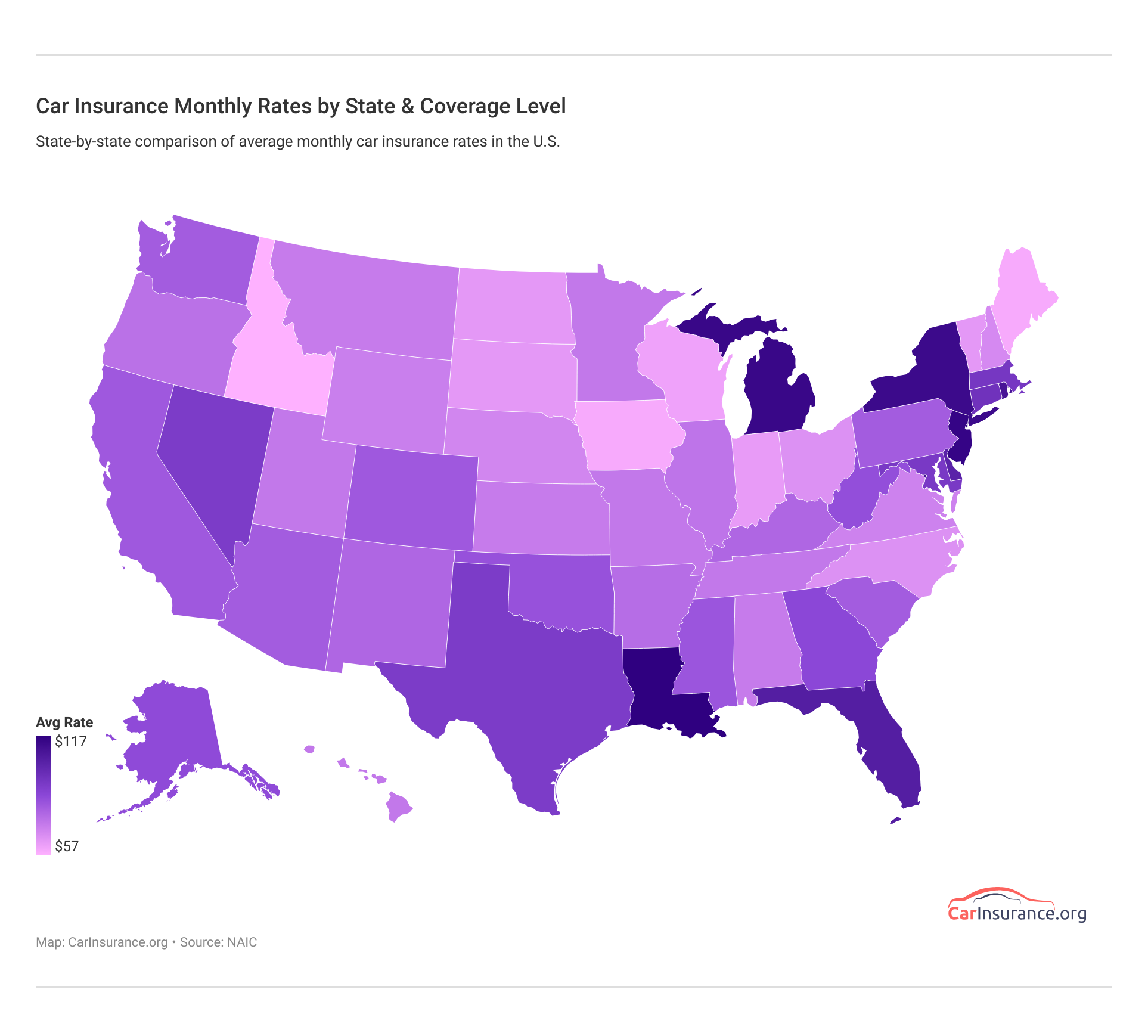

What are the average monthly car insurance rates in TN (liability, collision, comprehensive)?

Average monthly car insurance rates vary by state.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review Tennessee auto insurance rates for coverage below:

The table below shows the core coverage for Tennessee.

Tennessee Car Insurance Costs by Coverage Type

Core Car Insurance Coverage Costs In Tennessee

Liability $413.91

Collision $309.07

Comprehensive $148.45

Full Coverage $871.43

Please note that the data in this table is from the NAIC. As you can see, the cheapest core insurance coverage is comprehensive coverage at $148.45. Comprehensive coverage is the coverage you get for everything that can damage your car other than a collision.

The next cheapest coverage available is collision insurance ($309.07). Collision insurance is insurance that reimburses the insured for damage sustained to a vehicle due to the fault of the insured driver. Then there is liability insurance, which is an average of $413.91. This type of insurance gives the insured party protection against claims resulting from injuries and damage to people and property.

The final type of insurance on this list is full coverage, which is a bit more expensive, at $871.43. Full coverage is pretty self-explanatory; it’s a combination of collision insurance and comprehensive insurance.

Some drivers also have coverage to protect against uninsured motorists. Some states have made this coverage part of their minimum standards, while others allow drivers to opt out. If you’re worried about hit and run accidents, drunk drivers, etc., uninsured motorist coverage can go a long way towards peace of mind.

What additional liability coverage is available in Tennessee?

Let’s talk about additional liability insurance. Additional liability insurance is optional insurance for rental cars that protects all authorized drivers if they injure someone or damage someone else’s property.

There are a few categories that pertain to liability insurance that we’re going to share with you. These categories are personal injury protection, medical payments, and uninsured/underinsured motorists.

It’s also important to examine the loss ratio for each of these categories, too. A loss ratio is the amount of money that companies spend on claims. If a ratio is over 100%, it means a company is losing money. If it’s too low, the company isn’t paying claims. The best ratio range is from 60-70.

For personal injury protection, there was no loss ratio for any of the years listed. As for medical payments, the loss ratios for Tennessee for medical payments were 75.2 in 2015, 68.85 in 2014, and 71.22 in 2013.

For uninsured or underinsured drivers, in 2015, the loss ratio was 77.24, in 2014, it was 69.94, and in 2013 it was 67.52. Unfortunately, Tennessee has the fifth-most uninsured drivers in the United States. According to our data, 20%of drivers in Tennessee drive without car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What add-ons, endorsements, and riders are available in Tennessee?

We’ve just about covered all the essential insurance types, but they may not cover all your needs. So, we’ve compiled a list of the other insurance options available to you. You can add these on top of your property damage liability and medical coverage. Some increase your limits, while others offer other necessary benefits to keep you safe and happy on the road.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Make sure to check out these coverages. Some of them might be helpful for your specific needs.

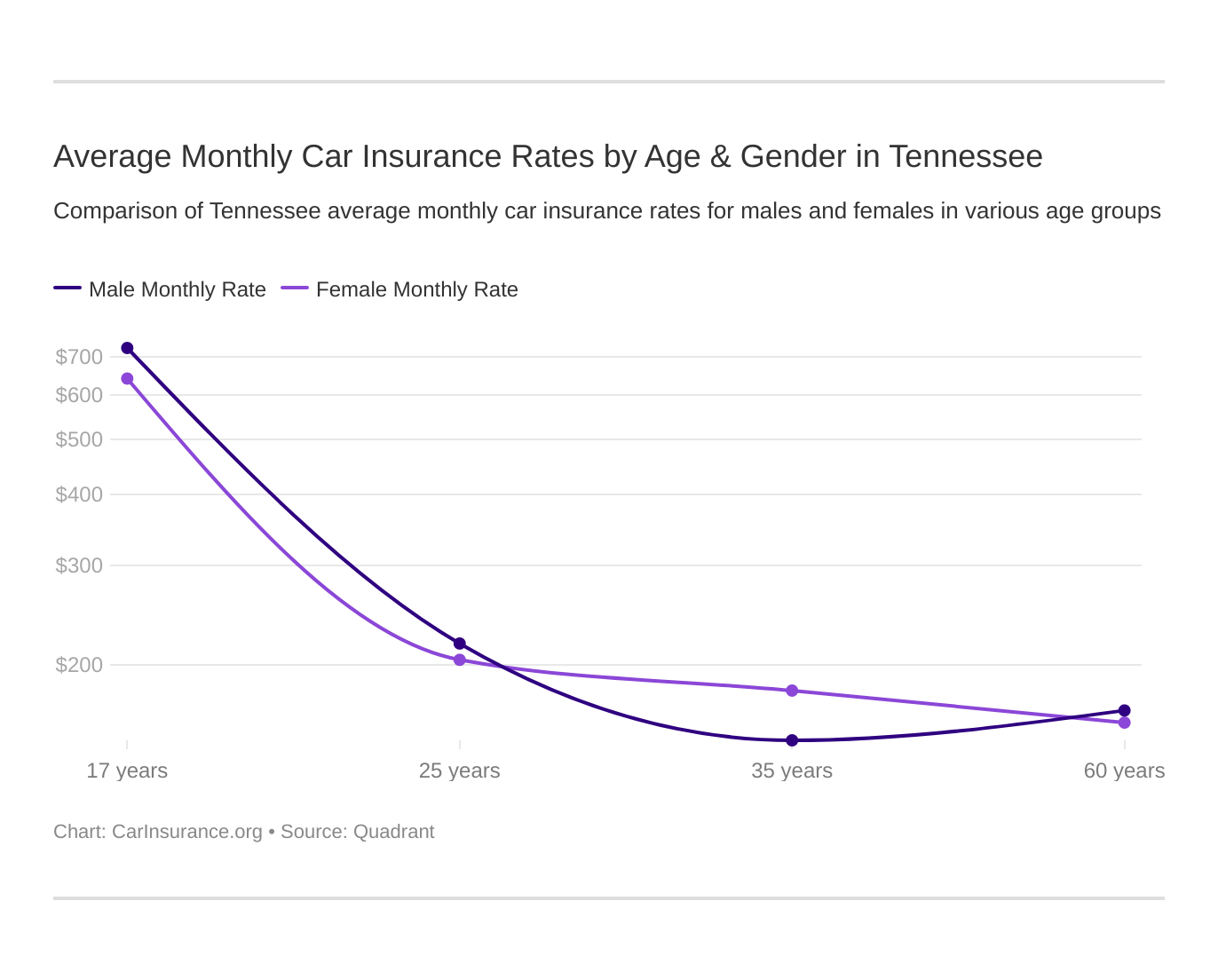

What are the average monthly car insurance rates by age & gender in TN?

For this section of the article, we’re going to look at the Tennessee car insurance rates for male and female drivers. California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and certain parts of Michigan have outlawed basing rates on gender. However, Tennessee allows gender as a determining factor for car insurance.

Tennessee Car Insurance Males vs Females Rates

Company Demographic Average Annual Rate Rank

SAFECO Ins Co of IL Single 17-year old male $16,572.79 1

SAFECO Ins Co of IL Single 17-year old female $14,916.05 2

Allstate P&C Single 17-year old male $11,441.86 3

Allstate P&C Single 17-year old female $10,516.65 4

Progressive Hawaii Single 17-year old male $9,440.45 5

Progressive Hawaii Single 17-year old female $8,386.68 6

Mid-Century Ins Co Single 17-year old male $7,883.17 7

Nationwide Mutual Single 17-year old male $7,760.40 8

Mid-Century Ins Co Single 17-year old female $7,410.65 9

Geico General Single 17-year old male $6,739.05 10

Geico General Single 17-year old female $6,620.63 11

USAA Single 17-year old male $6,309.85 12

Travelers Prop Cas Ins Co Single 17-year old male $6,143.14 13

State Farm Mutual Auto Single 17-year old male $6,139.77 14

Nationwide Mutual Single 17-year old female $6,012.22 15

USAA Single 17-year old female $5,501.37 16

Travelers Prop Cas Ins Co Single 17-year old female $4,956.52 17

State Farm Mutual Auto Single 17-year old female $4,907.17 18

SAFECO Ins Co of IL Single 25-year old male $4,159.27 19

SAFECO Ins Co of IL Single 25-year old female $3,902.85 20

SAFECO Ins Co of IL Married 35-year old female $3,639.40 21

SAFECO Ins Co of IL Married 60-year old male $3,342.39 22

Allstate P&C Single 25-year old male $3,082.46 23

SAFECO Ins Co of IL Married 60-year old female $2,991.77 24

Allstate P&C Single 25-year old female $2,980.14 25

Allstate P&C Married 35-year old female $2,796.09 26

Nationwide Mutual Single 25-year old male $2,739.66 27

Allstate P&C Married 35-year old male $2,684.61 28

Allstate P&C Married 60-year old male $2,612.46 29

Mid-Century Ins Co Single 25-year old male $2,601.27 30

Nationwide Mutual Single 25-year old female $2,520.95 31

Allstate P&C Married 60-year old female $2,516.49 32

Mid-Century Ins Co Single 25-year old female $2,457.63 33

Progressive Hawaii Single 25-year old male $2,451.94 34

Geico General Single 25-year old male $2,286.01 35

Progressive Hawaii Single 25-year old female $2,246.65 36

Geico General Single 25-year old female $2,216.18 37

Nationwide Mutual Married 35-year old male $2,211.90 38

Geico General Married 35-year old male $2,202.22 39

Nationwide Mutual Married 35-year old female $2,192.98 40

Geico General Married 35-year old female $2,182.11 41

USAA Single 25-year old male $2,157.82 42

State Farm Mutual Auto Single 25-year old male $2,116.70 43

USAA Single 25-year old female $2,023.45 44

Geico General Married 60-year old female $2,010.58 45

Geico General Married 60-year old male $2,010.58 45

Nationwide Mutual Married 60-year old male $1,997.15 47

Travelers Prop Cas Ins Co Single 25-year old male $1,981.27 48

Nationwide Mutual Married 60-year old female $1,964.40 49

Travelers Prop Cas Ins Co Single 25-year old female $1,882.49 50

Progressive Hawaii Married 35-year old female $1,864.12 51

Travelers Prop Cas Ins Co Married 35-year old male $1,860.42 52

Mid-Century Ins Co Married 35-year old male $1,850.03 53

State Farm Mutual Auto Single 25-year old female $1,821.23 54

Mid-Century Ins Co Married 35-year old female $1,817.48 55

Mid-Century Ins Co Married 60-year old male $1,788.38 56

Travelers Prop Cas Ins Co Married 35-year old female $1,767.42 57

Progressive Hawaii Married 35-year old male $1,757.10 58

Travelers Prop Cas Ins Co Married 60-year old male $1,710.20 59

As you can see, male drivers who are in their teens have the highest rates, which is typical for most states. The most expensive company for this demographic is Safeco Insurance. Teenage females have the second-highest rates (Safeco), followed by a 25-year-old single male (Safeco, again). While boys may pay more automatically in the state of Tennessee, there is often a small division between boys and girls in states that don’t allow insurance companies to consider sex or gender. Teen boys, in particular, are more likely to be caught speeding or to get in at-fault accidents.

In addition to the age and gender of drivers, the marital status of a person also affects car insurance rates. If you bundle policies and take advantage of other opportunities, it can even lead to insurance discounts. Typically, if one is married, one tends to have lower insurance rates. We can see examples of this for a married 60-year-old male, which is the demographic with the cheapest insurance in Tennessee (Travelers).

This principle applies to women, too, regardless of age, as we can see that a woman who is 35 and married has the third least expensive insurance (Travelers, again).

Please note that this is based on purchased coverage by the state population, and this data includes rates for high-risk drivers and those drivers. They choose to purchase more than the state minimum for insurance coverage.

What are the cheapest rates by ZIP code in Tennessee?

ZIP codes affect auto insurance because of factors like traffic, crime, to name a few. Insurers look at the rate of break-ins and vandalism, collision claims, and much more. Find out how your ZIP code stacks up in TN.

The table below reveals the cost of insurance for each ZIP code in Tennessee.

Tennessee Car Insurance Rates by Zip Code

ZIP code Average Annual Rate

38118 $4,991.62

38112 $4,984.00

38128 $4,967.47

38132 $4,958.99

38116 $4,954.44

38131 $4,952.11

38126 $4,950.53

38111 $4,919.47

38127 $4,916.69

38122 $4,912.60

38107 $4,906.85

38115 $4,904.13

38105 $4,889.05

38108 $4,886.59

38114 $4,883.14

38109 $4,879.55

38106 $4,855.29

38152 $4,820.32

38104 $4,818.28

38141 $4,774.38

38163 $4,759.35

38103 $4,753.52

38157 $4,658.51

38125 $4,510.60

38134 $4,485.51

38120 $4,400.44

38117 $4,360.18

38018 $4,340.28

38133 $4,323.93

38119 $4,302.46

38016 $4,289.19

38053 $4,265.27

38137 $4,219.83

38135 $4,219.79

38138 $4,184.91

38139 $4,136.05

38002 $4,114.08

38011 $4,105.10

38029 $4,102.16

38023 $4,094.22

38028 $4,080.50

38054 $4,079.26

38017 $4,078.89

38004 $4,075.14

38058 $4,056.03

38015 $4,042.45

38066 $4,041.12

38076 $4,036.66

38377 $4,029.52

38019 $4,010.68

38057 $4,004.99

38060 $4,003.01

38049 $3,966.47

38378 $3,963.50

38550 $3,945.78

38014 $3,941.45

38068 $3,939.49

38235 $3,925.54

38254 $3,923.76

38071 $3,923.43

37217 $3,921.40

38393 $3,921.11

38338 $3,913.21

38346 $3,909.40

38389 $3,907.41

38223 $3,900.59

38039 $3,898.63

38067 $3,894.39

37115 $3,893.03

38052 $3,884.72

38455 $3,878.41

38042 $3,875.17

38365 $3,872.80

38075 $3,870.39

37076 $3,865.64

38008 $3,864.80

38381 $3,861.98

38331 $3,860.33

38044 $3,851.70

37206 $3,845.82

38336 $3,838.12

37013 $3,837.12

37189 $3,821.98

37207 $3,819.83

38063 $3,817.32

37863 $3,808.45

37766 $3,807.39

38313 $3,801.79

38069 $3,799.78

38061 $3,799.67

37710 $3,794.50

37214 $3,791.89

38392 $3,789.20

37080 $3,788.41

37714 $3,787.19

38041 $3,786.20

37876 $3,786.11

38037 $3,784.49

37862 $3,784.30

37819 $3,784.17

38305 $3,782.99

38012 $3,773.88

37211 $3,772.78

38301 $3,769.73

37843 $3,767.75

37722 $3,760.56

37204 $3,760.39

37072 $3,758.35

38046 $3,755.78

37753 $3,755.45

37779 $3,755.34

37729 $3,755.23

37762 $3,755.07

38356 $3,754.97

37727 $3,754.41

38352 $3,754.34

37138 $3,754.05

38388 $3,753.13

37082 $3,752.45

38048 $3,752.37

38391 $3,752.29

37915 $3,752.13

37764 $3,750.77

38036 $3,750.75

38366 $3,749.46

38345 $3,749.29

37917 $3,745.66

37841 $3,744.53

38340 $3,743.56

37866 $3,742.36

37807 $3,741.65

37756 $3,739.65

37755 $3,739.28

37821 $3,738.24

37754 $3,738.01

37923 $3,737.89

37738 $3,737.41

37208 $3,737.25

37902 $3,737.16

37143 $3,736.56

37887 $3,734.89

37916 $3,734.16

37396 $3,731.40

37909 $3,730.75

37849 $3,729.26

37892 $3,729.23

38347 $3,729.19

37938 $3,728.69

38045 $3,728.11

37829 $3,727.15

37035 $3,726.24

37921 $3,726.02

37015 $3,725.68

38010 $3,725.49

38351 $3,725.42

37919 $3,720.70

37146 $3,720.19

38332 $3,719.81

37340 $3,719.22

37871 $3,719.22

37886 $3,718.43

38362 $3,718.02

37996 $3,716.14

38315 $3,715.97

37374 $3,715.24

37932 $3,713.28

37918 $3,711.75

37840 $3,710.95

37209 $3,708.97

37721 $3,706.19

37716 $3,706.18

37394 $3,705.27

37059 $3,704.74

37095 $3,704.73

37356 $3,703.63

37854 $3,703.33

38387 $3,702.13

38328 $3,701.85

37397 $3,701.84

38390 $3,701.12

37922 $3,701.11

37166 $3,700.04

37847 $3,698.46

37912 $3,697.59

38220 $3,697.53

37853 $3,697.15

37701 $3,696.82

37757 $3,696.47

37347 $3,695.64

38040 $3,692.60

38321 $3,691.92

38348 $3,691.92

37380 $3,691.77

37387 $3,689.63

38334 $3,688.79

37998 $3,688.70

37737 $3,687.62

37705 $3,687.62

38504 $3,687.12

38368 $3,685.48

38556 $3,685.18

37201 $3,684.92

38258 $3,684.92

37929 $3,683.35

37806 $3,683.33

37852 $3,683.04

37769 $3,682.43

37865 $3,682.41

37301 $3,682.41

37870 $3,681.68

37339 $3,681.58

37872 $3,680.59

37221 $3,679.02

38367 $3,678.13

37366 $3,677.89

38371 $3,677.85

37713 $3,676.61

37219 $3,675.94

38374 $3,674.63

37804 $3,674.52

37051 $3,674.29

38569 $3,673.77

37216 $3,673.53

37218 $3,671.00

38482 $3,669.87

37777 $3,668.90

38342 $3,667.97

37924 $3,667.63

38359 $3,667.57

38236 $3,666.96

37238 $3,666.11

38355 $3,664.78

37313 $3,664.45

37931 $3,664.15

37205 $3,663.87

37326 $3,662.86

37801 $3,661.47

37305 $3,660.65

38401 $3,658.28

38047 $3,658.16

37934 $3,657.33

37235 $3,657.12

38487 $3,656.85

37742 $3,655.32

37882 $3,655.29

37367 $3,654.74

37830 $3,654.55

37165 $3,653.64

37378 $3,652.61

37228 $3,652.37

37210 $3,652.08

37029 $3,650.60

37365 $3,649.90

37036 $3,648.69

38376 $3,648.22

37825 $3,647.88

37063 $3,646.30

37848 $3,644.86

38320 $3,643.59

37723 $3,642.99

38476 $3,640.87

37752 $3,640.68

38553 $3,639.95

38565 $3,638.90

37748 $3,638.35

38451 $3,638.09

37061 $3,637.96

38222 $3,637.36

37213 $3,637.16

38333 $3,636.96

38256 $3,636.89

38339 $3,636.71

37763 $3,636.51

37220 $3,636.24

37878 $3,636.19

38221 $3,635.53

37178 $3,635.43

38474 $3,635.11

38581 $3,634.59

38589 $3,634.56

38329 $3,634.40

37203 $3,634.30

38549 $3,633.69

37828 $3,631.92

38585 $3,631.85

38363 $3,630.92

37715 $3,629.25

37175 $3,628.44

37861 $3,627.48

38380 $3,627.39

38080 $3,626.88

38370 $3,626.42

37709 $3,626.19

37215 $3,626.17

38337 $3,626.01

37724 $3,625.79

38357 $3,625.75

38077 $3,625.71

38034 $3,625.49

38261 $3,625.46

37772 $3,625.19

37181 $3,625.18

37760 $3,624.24

38251 $3,623.49

37803 $3,623.30

37240 $3,622.30

37726 $3,622.29

37888 $3,621.96

38021 $3,621.42

37012 $3,621.07

38201 $3,621.00

37845 $3,620.34

38260 $3,618.75

38079 $3,618.42

38375 $3,618.04

38344 $3,617.26

38232 $3,615.82

37770 $3,615.58

38318 $3,615.10

38001 $3,614.42

37074 $3,614.03

38242 $3,612.99

38560 $3,610.82

37314 $3,609.62

38257 $3,609.57

37025 $3,609.47

37327 $3,609.40

38253 $3,608.83

38226 $3,608.77

37771 $3,608.71

37725 $3,608.03

37317 $3,607.25

37879 $3,606.82

37101 $3,606.70

37914 $3,604.41

37820 $3,602.70

37421 $3,602.35

38317 $3,602.06

37357 $3,601.59

38006 $3,600.08

38341 $3,598.22

37765 $3,598.22

37411 $3,598.21

37391 $3,597.00

37316 $3,596.68

37119 $3,595.93

38311 $3,594.50

37338 $3,593.87

37732 $3,593.43

37034 $3,592.61

37920 $3,592.23

37026 $3,591.69

37412 $3,591.53

37055 $3,591.50

37171 $3,591.14

37187 $3,589.90

37042 $3,588.65

37212 $3,588.07

38463 $3,587.20

37172 $3,586.98

37404 $3,586.57

37190 $3,586.30

37869 $3,585.71

37140 $3,585.27

38030 $3,584.11

37057 $3,583.66

37867 $3,583.39

37047 $3,583.13

38475 $3,582.38

37307 $3,581.87

37450 $3,581.37

37032 $3,581.16

37145 $3,581.10

37890 $3,580.63

37333 $3,580.63

38310 $3,580.57

38471 $3,580.31

38577 $3,579.78

38259 $3,578.83

38240 $3,578.80

37019 $3,578.08

37385 $3,577.92

38024 $3,577.44

37110 $3,577.44

38563 $3,577.23

38224 $3,576.66

37341 $3,576.48

38449 $3,575.89

37098 $3,574.99

38361 $3,573.44

38452 $3,573.04

37086 $3,572.89

38231 $3,571.63

37137 $3,571.44

38567 $3,571.01

37153 $3,570.82

37023 $3,570.34

38379 $3,570.32

38564 $3,570.13

37151 $3,569.34

37362 $3,568.84

37885 $3,568.68

37851 $3,568.48

37050 $3,568.28

37091 $3,567.11

37030 $3,566.60

38327 $3,566.38

37325 $3,565.67

37361 $3,565.16

37369 $3,564.85

37136 $3,564.78

37058 $3,564.34

38326 $3,563.41

38580 $3,563.21

38554 $3,563.17

37708 $3,561.43

37185 $3,560.03

37028 $3,559.17

37149 $3,558.93

37040 $3,557.92

37046 $3,557.89

38372 $3,557.50

37060 $3,557.42

37403 $3,553.92

38551 $3,553.88

37085 $3,552.01

37128 $3,551.85

37773 $3,551.71

38481 $3,551.26

38588 $3,550.98

38007 $3,550.93

38545 $3,549.78

37406 $3,549.45

38238 $3,549.20

37043 $3,548.94

37033 $3,548.57

38070 $3,548.55

37408 $3,548.54

38468 $3,548.34

37409 $3,548.12

37846 $3,548.01

37407 $3,547.92

37335 $3,547.58

37382 $3,547.33

37014 $3,547.21

38457 $3,546.99

38454 $3,546.10

37707 $3,546.02

38486 $3,545.80

37052 $3,545.61

38461 $3,544.45

37774 $3,544.23

38464 $3,543.97

37778 $3,542.90

37348 $3,542.78

38547 $3,541.94

37096 $3,541.31

37037 $3,541.16

38469 $3,541.15

37071 $3,541.04

38330 $3,540.76

38562 $3,540.39

37354 $3,539.52

37027 $3,539.46

38543 $3,539.20

38230 $3,539.14

38552 $3,538.77

37078 $3,538.20

37402 $3,537.68

38477 $3,537.00

38059 $3,536.92

38473 $3,536.08

37130 $3,533.43

37359 $3,532.89

37062 $3,530.69

38459 $3,530.58

37142 $3,530.51

37730 $3,530.20

37743 $3,529.76

38460 $3,529.75

37118 $3,529.60

38382 $3,529.46

37877 $3,529.26

37044 $3,528.26

37127 $3,527.90

37328 $3,526.48

37134 $3,526.25

37129 $3,525.46

37132 $3,525.40

38555 $3,524.86

37379 $3,522.44

38488 $3,522.33

38316 $3,522.00

38478 $3,521.73

38572 $3,521.24

37410 $3,520.83

37179 $3,520.71

37874 $3,520.70

38542 $3,519.84

38241 $3,519.75

38450 $3,519.73

37174 $3,519.21

38050 $3,518.80

37302 $3,518.67

37150 $3,518.40

37334 $3,518.06

37881 $3,517.81

37135 $3,517.77

38369 $3,517.50

37073 $3,517.27

38255 $3,517.26

37167 $3,516.54

38571 $3,515.44

38578 $3,513.30

38229 $3,512.31

38575 $3,512.15

38483 $3,511.57

37309 $3,511.10

37308 $3,510.33

38558 $3,510.10

37818 $3,509.85

38485 $3,509.64

37373 $3,509.45

38568 $3,508.27

37809 $3,508.07

37079 $3,507.93

38225 $3,505.95

38425 $3,505.63

37813 $3,505.08

37329 $3,504.31

38570 $3,504.20

38456 $3,503.91

38237 $3,503.49

37097 $3,503.33

37336 $3,503.13

37405 $3,500.65

37745 $3,497.81

37083 $3,497.57

38472 $3,496.70

37069 $3,496.10

38358 $3,494.75

38343 $3,494.39

37343 $3,494.03

37416 $3,493.87

37144 $3,493.25

37810 $3,492.79

38541 $3,491.02

38453 $3,490.91

37363 $3,490.63

37826 $3,490.46

37860 $3,489.95

37350 $3,488.34

38462 $3,486.76

37351 $3,486.50

37415 $3,486.50

38233 $3,486.45

37010 $3,484.72

37322 $3,484.29

37814 $3,483.95

37141 $3,483.80

37377 $3,483.53

38573 $3,482.45

37733 $3,481.93

37337 $3,481.20

37331 $3,476.20

37049 $3,475.62

37880 $3,474.18

37020 $3,473.96

37891 $3,473.64

37304 $3,472.06

37419 $3,469.93

37355 $3,468.40

37075 $3,465.56

37064 $3,463.78

37303 $3,463.23

37388 $3,457.09

37370 $3,455.49

37616 $3,452.95

37353 $3,450.98

37048 $3,449.31

37122 $3,449.02

37031 $3,448.77

37180 $3,446.66

37160 $3,443.42

37090 $3,443.35

37066 $3,442.39

37148 $3,442.16

37323 $3,440.30

37311 $3,438.68

37352 $3,437.77

37018 $3,435.75

37183 $3,429.88

37312 $3,428.67

37345 $3,426.74

37186 $3,425.58

37398 $3,424.23

38587 $3,421.54

37191 $3,421.12

37087 $3,420.40

37310 $3,418.31

37022 $3,417.65

37016 $3,417.50

38579 $3,415.69

37375 $3,415.49

37360 $3,414.87

37641 $3,414.36

37318 $3,413.15

37324 $3,412.92

37376 $3,412.29

37381 $3,410.88

37067 $3,410.24

37731 $3,410.17

37306 $3,407.39

37389 $3,406.20

37342 $3,406.03

37811 $3,405.57

37873 $3,401.96

38559 $3,401.21

37383 $3,398.63

38574 $3,398.30

37184 $3,397.64

37332 $3,396.69

37188 $3,396.54

37642 $3,393.56

37321 $3,390.17

37645 $3,386.37

37711 $3,385.92

38505 $3,385.52

38501 $3,373.08

38583 $3,373.07

37330 $3,367.08

37857 $3,361.55

38506 $3,361.19

37640 $3,361.10

37683 $3,359.00

37691 $3,358.19

38582 $3,353.11

38548 $3,328.08

38544 $3,319.72

37681 $3,308.69

37687 $3,298.94

37658 $3,294.15

37664 $3,286.44

37665 $3,282.60

37656 $3,275.84

37688 $3,269.32

37680 $3,266.48

37660 $3,265.10

37618 $3,259.15

37682 $3,257.45

37686 $3,248.25

37617 $3,226.34

37657 $3,222.95

37663 $3,220.96

37659 $3,217.01

37650 $3,212.85

37694 $3,210.85

37643 $3,200.59

37615 $3,199.74

37690 $3,197.59

37684 $3,188.99

37604 $3,187.79

37692 $3,177.19

37620 $3,176.81

37614 $3,175.79

37601 $3,173.65

As you can see from the table, the 28 most expensive ZIP codes are all in Memphis. The most expensive ZIP code, 38118, has an average rate of $4,991.6, but the 29th-most expensive ZIP code (38018) is in Cordova, with an average rate of $4,340.28. The cheapest ZIP code is 37601 in Johnson City, and its average is $3,173.65.

As far as prices of insurance companies go, the highest prices tend to be Allstate, and the least expensive tend to be USAA car insurance, regardless of the ZIP code.

What are the cheapest rates by city in Tennessee?

We know that car insurance prices vary based on ZIP code. So it makes sense that car insurance rates also change based on the city you live in, too. Tennessee farmers in rural areas don’t face the same challenges residents of Nashville might face.

Here is a table that shows the average car insurance cost of each city in Tennessee.

City Average Grand Total

BRISTOL $3,176.81

UNICOI $3,177.18

JOHNSON CITY $3,184.24

MOUNTAIN HOME $3,188.99

TELFORD $3,197.59

ELIZABETHTON $3,200.59

WATAUGA $3,210.86

ERWIN $3,212.85

JONESBOROUGH $3,217.01

FLAG POND $3,222.95

BLOUNTVILLE $3,226.34

PINEY FLATS $3,248.25

MILLIGAN COLLEGE $3,257.45

BLUFF CITY $3,259.15

KINGSPORT $3,263.78

LAUREL BLOOMERY $3,266.48

SHADY VALLEY $3,269.32

FALL BRANCH $3,275.84

HAMPTON $3,294.15

ROAN MOUNTAIN $3,298.94

LIMESTONE $3,308.69

BAXTER $3,319.72

BUFFALO VALLEY $3,328.08

SILVER POINT $3,353.11

TRADE $3,358.19

MOUNTAIN CITY $3,359.00

BUTLER $3,361.10

ROGERSVILLE $3,361.55

ESTILL SPRINGS $3,367.08

SPARTA $3,373.07

COOKEVILLE $3,373.26

BULLS GAP $3,385.92

MOUNT CARMEL $3,386.37

DAYTON $3,390.17

CHURCH HILL $3,393.56

WHITE HOUSE $3,396.54

EVENSVILLE $3,396.70

WATERTOWN $3,397.64

MONTEREY $3,398.30

DOYLE $3,401.22

SURGOINSVILLE $3,401.96

MOORESBURG $3,405.57

HILLSBORO $3,406.03

ARNOLD A F B $3,406.20

SEWANEE $3,407.06

BELVIDERE $3,407.39

EIDSON $3,410.16

SPRING CITY $3,410.88

SHERWOOD $3,412.29

DECHERD $3,412.91

COWAN $3,413.15

CHUCKEY $3,414.37

NORMANDY $3,414.87

QUEBECK $3,415.69

AUBURNTOWN $3,417.50

BETHPAGE $3,417.65

CHARLESTON $3,418.31

WOODLAWN $3,421.12

WALLING $3,421.54

WINCHESTER $3,424.23

WESTMORELAND $3,425.58

HUNTLAND $3,426.74

WARTRACE $3,429.88

LEBANON $3,431.88

BEECHGROVE $3,435.75

CLEVELAND $3,435.88

LYNCHBURG $3,437.77

PORTLAND $3,442.16

GALLATIN $3,442.39

SHELBYVILLE $3,443.41

UNIONVILLE $3,446.66

CASTALIAN SPRINGS $3,448.77

MOUNT JULIET $3,449.02

COTTONTOWN $3,449.31

MC DONALD $3,450.98

AFTON $3,452.95

RICEVILLE $3,455.49

FRANKLIN $3,456.71

TULLAHOMA $3,457.09

ATHENS $3,463.23

HENDERSONVILLE $3,465.56

MANCHESTER $3,468.40

BAKEWELL $3,472.06

WHITESBURG $3,473.64

BELL BUCKLE $3,473.96

TEN MILE $3,474.18

CROSS PLAINS $3,475.62

ETOWAH $3,476.20

GRANDVIEW $3,481.20

RUGBY $3,481.93

MONROE $3,482.45

SIGNAL MOUNTAIN $3,483.53

ORLINDA $3,483.80

DECATUR $3,484.29

ADAMS $3,484.72

KENTON $3,486.45

LUPTON CITY $3,486.50

HOHENWALD $3,486.76

LOOKOUT MOUNTAIN $3,488.34

RUSSELLVILLE $3,489.95

NIOTA $3,490.47

OOLTEWAH $3,490.63

DELLROSE $3,490.91

ALLONS $3,491.02

MOHAWK $3,492.79

PETERSBURG $3,493.25

HIXSON $3,494.03

HUMBOLDT $3,494.39

MORRISTOWN $3,494.52

MILAN $3,494.75

LYNNVILLE $3,496.70

LAFAYETTE $3,497.57

GEORGETOWN $3,503.13

LOBELVILLE $3,503.33

ETHRIDGE $3,503.91

LIVINGSTON $3,504.20

ENGLEWOOD $3,504.31

CLIFTON $3,505.63

DRESDEN $3,505.96

INDIAN MOUND $3,507.93

MIDWAY $3,508.08

HILHAM $3,508.27

SALE CREEK $3,509.45

WAYNESBORO $3,509.64

MOSHEIM $3,509.85

BIRCHWOOD $3,510.33

CALHOUN $3,511.10

SUMMERTOWN $3,511.57

MOSS $3,512.15

GLEASON $3,512.32

PLEASANT HILL $3,513.30

GREENEVILLE $3,513.79

SMYRNA $3,516.54

GREENBRIER $3,517.27

SHARON $3,517.27

RUTHERFORD $3,517.51

NOLENSVILLE $3,517.77

THORN HILL $3,517.81

CROSSVILLE $3,517.91

FAYETTEVILLE $3,518.06

RED BOILING SPRINGS $3,518.40

APISON $3,518.67

MAURY CITY $3,518.80

SPRING HILL $3,519.21

COLLINWOOD $3,519.73

PALMERSVILLE $3,519.75

ALLRED $3,519.84

SWEETWATER $3,520.70

THOMPSONS STATION $3,520.71

PULASKI $3,521.73

BRADFORD $3,522.00

TAFT $3,522.33

SODDY DAISY $3,522.44

NEW JOHNSONVILLE $3,526.25

MARTIN $3,526.35

ELORA $3,526.48

TALBOTT $3,529.26

TRENTON $3,529.46

MILTON $3,529.60

GOODSPRING $3,529.75

EAGAN $3,530.20

PALMYRA $3,530.51

FRANKEWING $3,530.58

FAIRVIEW $3,530.69

MURFREESBORO $3,532.81

MULBERRY $3,532.89

MINOR HILL $3,536.09

NEWBERN $3,536.92

PROSPECT $3,537.00

HURRICANE MILLS $3,538.20

CHESTNUT MOUND $3,538.77

GREENFIELD $3,539.14

ALPINE $3,539.20

BRENTWOOD $3,539.46

MADISONVILLE $3,539.53

GAINESBORO $3,540.39

DYER $3,540.76

GLADEVILLE $3,541.04

LORETTO $3,541.15

CHRISTIANA $3,541.16

LINDEN $3,541.31

BRUSH CREEK $3,541.94

KELSO $3,542.78

LOWLAND $3,542.90

LAWRENCEBURG $3,543.97

LOUDON $3,544.23

HAMPSHIRE $3,544.45

CHATTANOOGA $3,544.84

CUNNINGHAM $3,545.61

WESTPOINT $3,545.80

ARTHUR $3,546.03

DUCK RIVER $3,546.10

FIVE POINTS $3,547.00

ARRINGTON $3,547.21

SUMMITVILLE $3,547.33

FLINTVILLE $3,547.58

PHILADELPHIA $3,548.01

LEOMA $3,548.34

TIGRETT $3,548.55

CENTERVILLE $3,548.57

BLOOMINGTON SPRINGS $3,549.78

BOGOTA $3,550.93

WHITLEYVILLE $3,550.98

SAINT JOSEPH $3,551.26

LONE MOUNTAIN $3,551.71

LASCASSAS $3,552.00

CELINA $3,553.88

CLARKSVILLE $3,555.94

EAGLEVILLE $3,557.42

SAVANNAH $3,557.50

COLLEGE GROVE $3,557.90

READYVILLE $3,558.93

BUMPUS MILLS $3,559.17

WAVERLY $3,560.03

BEAN STATION $3,561.43

CRAWFORD $3,563.18

RICKMAN $3,563.21

COUNCE $3,563.41

DOVER $3,564.34

NORENE $3,564.78

RELIANCE $3,564.85

OCOEE $3,565.17

DELANO $3,565.67

CRUMP $3,566.38

CARTHAGE $3,566.60

LEWISBURG $3,567.11

CUMBERLAND CITY $3,568.28

PRUDEN $3,568.48

VONORE $3,568.68

OLD FORT $3,568.84

RIDDLETON $3,569.34

GRANVILLE $3,570.13

STANTONVILLE $3,570.32

BIG ROCK $3,570.34

ROCKVALE $3,570.82

HICKMAN $3,571.01

NUNNELLY $3,571.44

HENRY $3,571.63

LA VERGNE $3,572.89

CYPRESS INN $3,573.04

MORRIS CHAPEL $3,573.44

LYLES $3,574.99

ARDMORE $3,575.89

HARRISON $3,576.48

COTTAGE GROVE $3,576.66

GORDONSVILLE $3,577.23

DYERSBURG $3,577.44

MCMINNVILLE $3,577.44

TELLICO PLAINS $3,577.92

BELFAST $3,578.08

OBION $3,578.80

TRIMBLE $3,578.83

PALL MALL $3,579.78

LUTTS $3,580.31

ADAMSVILLE $3,580.57

FARNER $3,580.63

WHITE PINE $3,580.63

PLEASANT SHADE $3,581.10

CEDAR HILL $3,581.16

BENTON $3,581.87

OLIVEHILL $3,582.38

CORNERSVILLE $3,583.13

SHAWANEE $3,583.39

DIXON SPRINGS $3,583.66

FINLEY $3,584.11

ONLY $3,585.27

SNEEDVILLE $3,585.71

WOODBURY $3,586.30

SPRINGFIELD $3,586.98

IRON CITY $3,587.20

WHITE BLUFF $3,589.90

SOUTHSIDE $3,591.14

DICKSON $3,591.50

BRADYVILLE $3,591.69

CHAPEL HILL $3,592.61

ELGIN $3,593.43

GRAYSVILLE $3,593.87

BATH SPRINGS $3,594.50

MITCHELLVILLE $3,595.93

CONASAUGA $3,596.68

TURTLETOWN $3,597.00

HOLLADAY $3,598.22

KYLES FORD $3,598.22

BELLS $3,600.08

MORRISON $3,601.59

BRUCETON $3,602.07

NEW MARKET $3,602.70

MC EWEN $3,606.70

TAZEWELL $3,606.82

COPPERHILL $3,607.25

DANDRIDGE $3,608.03

DUKEDOM $3,608.77

RIVES $3,608.83

DUNLAP $3,609.40

BON AQUA $3,609.47

SOUTH FULTON $3,609.57

COKER CREEK $3,609.62

ELMWOOD $3,610.82

PARIS $3,612.99

HARTSVILLE $3,614.03

ALAMO $3,614.42

BUENA VISTA $3,615.10

LANCING $3,615.58

HORNBEAK $3,615.82

LENOIR CITY $3,616.95

HUNTINGDON $3,617.26

SELMER $3,618.04

TIPTONVILLE $3,618.42

TROY $3,618.75

PETROS $3,620.34

MC KENZIE $3,621.00

ALEXANDRIA $3,621.07

CROCKETT MILLS $3,621.43

WASHBURN $3,621.96

DEER LODGE $3,622.29

PURYEAR $3,623.49

JEFFERSON CITY $3,624.24

VANLEER $3,625.18

UNION CITY $3,625.46

FRIENDSHIP $3,625.49

WYNNBURG $3,625.71

MICHIE $3,625.75

CUMBERLAND GAP $3,625.79

GADSDEN $3,626.01

BLAINE $3,626.19

SALTILLO $3,626.42

RIDGELY $3,626.89

SUGAR TREE $3,627.39

RUTLEDGE $3,627.48

STEWART $3,628.44

CLAIRFIELD $3,629.25

PARSONS $3,630.92

SPENCER $3,631.85

NORRIS $3,631.93

BYRDSTOWN $3,633.69

DECATURVILLE $3,634.41

WILDER $3,634.56

ROCK ISLAND $3,634.59

MOUNT PLEASANT $3,635.11

TENNESSEE RIDGE $3,635.43

BIG SANDY $3,635.53

TALLASSEE $3,636.19

KINGSTON $3,636.51

GUYS $3,636.71

SPRINGVILLE $3,636.89

EVA $3,636.96

BUCHANAN $3,637.36

ERIN $3,637.96

CULLEOKA $3,638.09

HARRIMAN $3,638.35

GRIMSLEY $3,638.90

CLARKRANGE $3,639.94

HARROGATE $3,640.68

PRIMM SPRINGS $3,640.87

CRAB ORCHARD $3,642.99

CAMDEN $3,643.59

POWDER SPRINGS $3,644.86

FOSTERVILLE $3,646.30

NEW TAZEWELL $3,647.88

SHILOH $3,648.22

CHARLOTTE $3,648.69

PALMER $3,649.90

BURNS $3,650.60

SMARTT $3,652.61

MARYVILLE $3,653.10

SLAYDEN $3,653.64

OAK RIDGE $3,654.55

PIKEVILLE $3,654.74

TOWNSEND $3,655.29

GREENBACK $3,655.32

WILLIAMSPORT $3,656.86

LENOX $3,658.16

COLUMBIA $3,658.28

BEERSHEBA SPRINGS $3,660.65

DUCKTOWN $3,662.86

COALMONT $3,664.45

MEDINA $3,664.78

MANSFIELD $3,666.97

MILLEDGEVILLE $3,667.57

HOLLOW ROCK $3,667.97

LOUISVILLE $3,668.90

SANTA FE $3,669.87

LANCASTER $3,673.77

CUMBERLAND FURNACE $3,674.29

SCOTTS HILL $3,674.63

BYBEE $3,676.61

SARDIS $3,677.85

PELHAM $3,677.89

RAMER $3,678.13

SUNBRIGHT $3,680.59

GRUETLI LAAGER $3,681.58

SPEEDWELL $3,681.69

ALTAMONT $3,682.41

SEYMOUR $3,682.42

LAKE CITY $3,682.43

ROBBINS $3,683.04

MASCOT $3,683.33

TREZEVANT $3,684.92

JAMESTOWN $3,685.18

REAGAN $3,685.48

ALLARDT $3,687.12

ANDERSONVILLE $3,687.62

FRIENDSVILLE $3,687.62

FINGER $3,688.79

TRACY CITY $3,689.63

SOUTH PITTSBURG $3,691.77

LAVINIA $3,691.92

CEDAR GROVE $3,691.93

HALLS $3,692.60

JASPER $3,695.64

JACKSBORO $3,696.47

ALCOA $3,696.82

ROCKFORD $3,697.15

ATWOOD $3,697.53

PIONEER $3,698.46

NASHVILLE $3,699.11

SMITHVILLE $3,700.04

KNOXVILLE $3,700.52

YUMA $3,701.12

WHITWELL $3,701.84

DARDEN $3,701.85

WESTPORT $3,702.13

ROCKWOOD $3,703.33

MONTEAGLE $3,703.63

LIBERTY $3,704.73

DOWELLTOWN $3,704.74

VIOLA $3,705.27

CLINTON $3,706.18

CORRYTON $3,706.19

OLIVER SPRINGS $3,710.95

SEQUATCHIE $3,715.24

BETHEL SPRINGS $3,715.97

OAKFIELD $3,718.03

WALLAND $3,718.43

GUILD $3,719.22

STRAWBERRY PLAINS $3,719.22

ENVILLE $3,719.81

PLEASANT VIEW $3,720.19

LEXINGTON $3,725.42

BRADEN $3,725.49

ASHLAND CITY $3,725.68

CHAPMANSBORO $3,726.24

OAKDALE $3,727.15

LACONIA $3,728.11

JACKS CREEK $3,729.19

WINFIELD $3,729.23

POWELL $3,729.26

WHITESIDE $3,731.40

WARTBURG $3,734.88

PEGRAM $3,736.56

GATLINBURG $3,737.42

HEISKELL $3,738.01

NEWPORT $3,738.24

HELENWOOD $3,739.28

HUNTSVILLE $3,739.65

MAYNARDVILLE $3,741.65

SHARPS CHAPEL $3,742.36

HENDERSON $3,743.56

ONEIDA $3,744.53

HURON $3,749.29

PINSON $3,749.46

GALLAWAY $3,750.75

KODAK $3,750.77

DENMARK $3,752.29

MACON $3,752.37

KINGSTON SPRINGS $3,752.45

WILDERSVILLE $3,753.13

OLD HICKORY $3,754.05

LURAY $3,754.33

DEL RIO $3,754.41

MEDON $3,754.97

JELLICO $3,755.07

DUFF $3,755.23

LUTTRELL $3,755.34

HARTFORD $3,755.45

LA GRANGE $3,755.78

GOODLETTSVILLE $3,758.35

COSBY $3,760.56

PARROTTSVILLE $3,767.75

BROWNSVILLE $3,773.88

JACKSON $3,776.36

NEWCOMB $3,784.17

GATES $3,784.49

SEVIERVILLE $3,785.21

HENNING $3,786.20

CARYVILLE $3,787.19

JOELTON $3,788.41

MERCER $3,789.20

BRICEVILLE $3,794.50

POCAHONTAS $3,799.67

STANTON $3,799.78

BEECH BLUFF $3,801.79

LA FOLLETTE $3,807.39

PIGEON FORGE $3,808.45

RIPLEY $3,817.32

WHITES CREEK $3,821.98

ANTIOCH $3,837.12

FRUITVALE $3,838.12

HORNSBY $3,851.70

EATON $3,860.33

TOONE $3,861.98

BOLIVAR $3,864.80

HERMITAGE $3,865.64

WHITEVILLE $3,870.39

PICKWICK DAM $3,872.80

HICKORY VALLEY $3,875.17

ELKTON $3,878.41

MIDDLETON $3,884.72

MADISON $3,893.03

SAULSBURY $3,894.39

GRAND JUNCTION $3,898.62

COMO $3,900.59

YORKVILLE $3,907.41

IDLEWILD $3,909.40

GIBSON $3,913.21

CHEWALLA $3,921.11

TIPTON $3,923.43

SAMBURG $3,923.76

MC LEMORESVILLE $3,925.54

SOMERVILLE $3,939.49

BRUNSWICK $3,941.45

CAMPAIGN $3,945.78

SPRING CREEK $3,963.50

MASON $3,966.47

OAKLAND $4,003.02

MOSCOW $4,004.99

COVINGTON $4,010.68

SILERTON $4,029.52

WILLISTON $4,036.66

ROSSVILLE $4,041.12

BURLISON $4,042.45

MUNFORD $4,056.03

ATOKA $4,075.15

COLLIERVILLE $4,078.89

EADS $4,080.50

DRUMMONDS $4,094.22

ELLENDALE $4,102.16

BRIGHTON $4,105.10

ARLINGTON $4,114.08

GERMANTOWN $4,160.48

MILLINGTON $4,172.26

CORDOVA $4,314.74

MEMPHIS $4,745.79

As you can see from this data, which is ranked from the cheapest city to most expensive city, the city in Tennessee with the cheapest car insurance rates is Bristol, with an average insurance cost of $3,176.81.

Conversely, the most expensive city for car insurance is Memphis, as their average cost of insurance is $4,745.79. This is not surprising, as we have seen that Memphis has the most expensive ZIP codes, and Memphis is the second-largest city in Tennessee, after Nashville.

What are the best Tennessee car insurance companies?

Now that you have an idea of how much your car insurance costs based on where you live, let’s see what the best car insurance companies in Tennessee are so you know which company is worth your hard-earned money.

We understand that finding the right car insurance company is tough because it’s based on your specific needs. But we will do our best to show you enough companies and facts about these companies so you can have an idea about what company is best for you.

In this section, we’re going to take a look at the largest companies’ financial rating, the companies with the best ratings, the companies with the most complaints, and other facts that will help you decide which company is best for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the financial ratings of the largest car insurance companies in Tennessee?

We’re going to take a look at the financial ratings of the largest companies in Tennessee, using information from the highly reputable A.M. Best.

Tennessee Car Insurance Companies Financial Rating

COMPANY A.M. BEST FINANCIAL RATING

State Farm A++

Farmers A+

Geico A++

Progressive A+

Allstate A+

USAA A++

Liberty Mutual A

Nationwide A+

Erie Insurance A+

Travelers A++

This table shows that most of the insurance companies for Tennessee have excellent grades for their financial ratings. Four companies have the highest possible rating of A++ (State Farm, Geico, USAA, and Travelers). Five companies have a very impressive A+ rating (Farmers, Progressive, Allstate, Nationwide, and Erie Insurance), and only one company has a “low” rating of an A (which is still good), which is Liberty Mutual.

Which car insurance companies have the best ratings in Tennessee?

We have a table with information from the always credible J.D. Best Power Press. This data shows a rating out of 1,000 based on customer satisfaction from 2019 for the largest car insurance companies in the Southeast region of the United States.

Southeast JD Power Ratings

Insurance Company Rating

Score: 802 / 1,000

Avg. Satisfaction

Score: 832 / 1,000

Avg. Satisfaction

Score: 870 / 1,000

Avg. Satisfaction

Score: 880 / 1,000

Avg. Satisfaction

Score: 849 / 1,000

Avg. Satisfaction

Score: 857 / 1,000

Avg. Satisfaction

Score: 725 / 1,000

Avg. Satisfaction

Score: 857 / 1,000

Avg. Satisfaction

Score: 886 / 1,000

Avg. Satisfaction

Score: 855 / 1,000

Avg. Satisfaction

Score: 833 / 1,000

Avg. Satisfaction

Score: 786 / 1,000

Avg. Satisfaction

Score: 832 / 1,000

Avg. Satisfaction

Score: 844 / 1,000

Avg. Satisfaction

Southeast Average Score: 701 / 1,000

Avg. Satisfaction

Score: 877 / 1,000

Avg. Satisfaction

Score: 860 / 1,000

Avg. Satisfaction

According to this table, the top-rated insurance company in this region is actually from Tennessee, and it’s Farm Bureau Insurance, with a rating of 888.

The next highest company is Erie Insurance with 870, and then Alfa Insurance with a rating of 855. The lowest-rated company on this list is Liberty, with a rating of 809. However, this rating is still pretty good considering that the average rating for insurance companies in this region is 841.

Which car insurance companies have the most complaints in Tennessee?

No insurance company is perfect, but some companies have fewer complaints than others. You should know about which companies have the most complaints, as this can have a profound effect on your decision about which car insurance company to use. Below, we have given you a table with the number of complaints about each company.

TN Complaint Numbers

Company Number of Complaints

State Farm 1482

Geico 333

USAA 296

Liberty Mutual 222

Allstate 163

Progressive 120

Tennessee Farmers 39

Nationwide 25

Erie Insurance 22

Travelers 2

According to this information, the company with the most complaints is State Farm, with 1482 complaints. The company with the least amount of complaints is Travelers, and they have a mere two complaints.

But while this number is impressive, you should consider that there are certainly other factors you must consider when purchasing your insurance.

It is also worth noting that State Farm is the largest insurance company, so the simple fact that they have more customers is likely one of the reasons they have more complaints. You should also see how well companies handle their complaints before making a decision, too.

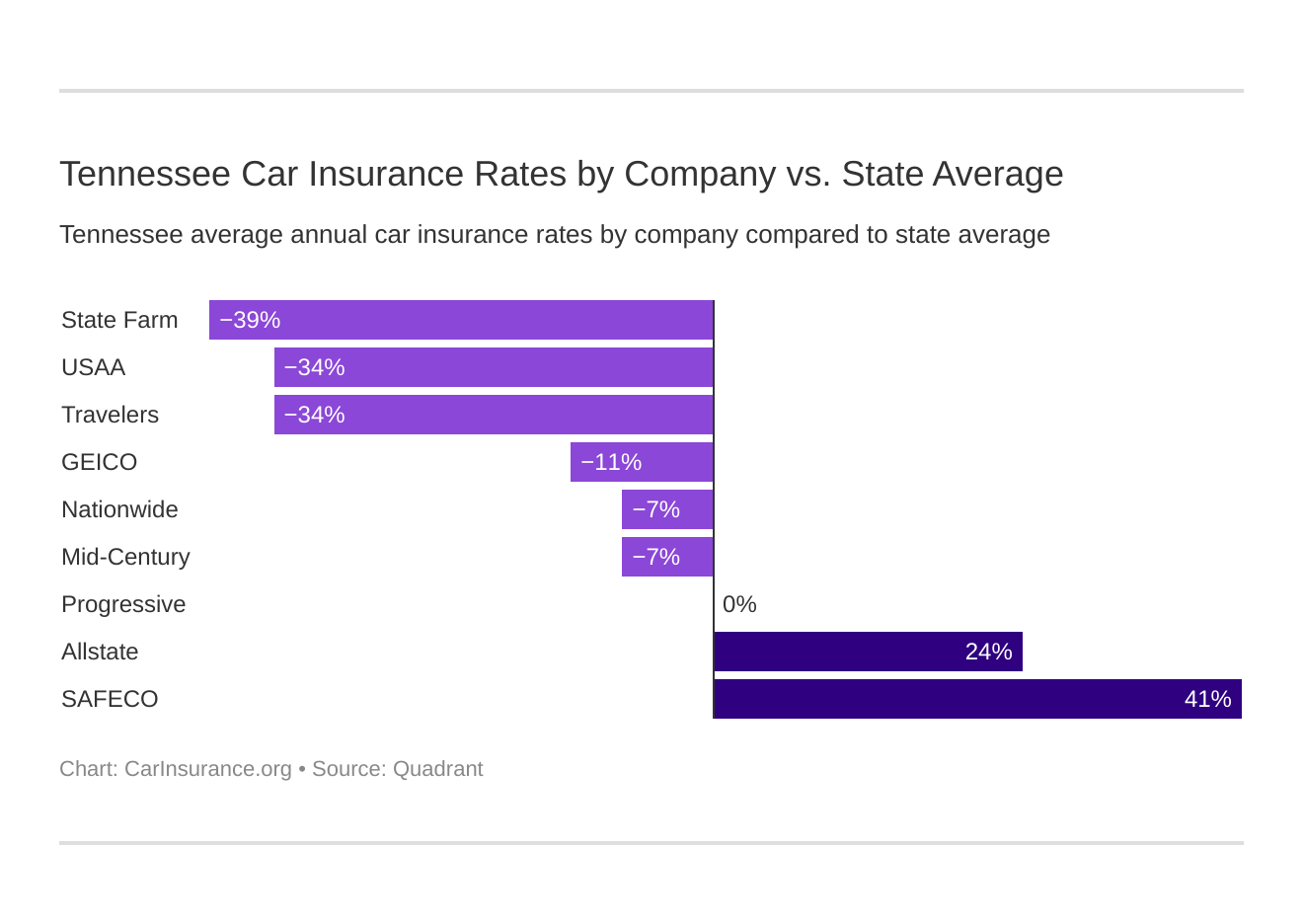

What are the cheapest car insurance companies in Tennessee?

Ah, yes. Cheap. Cheap is everyone’s favorite word when it comes to buying things with your cash. That’s why we’ve compiled a list of the insurance companies with the cheapest insurance options and arranged them in a table for you.

Tennessee Cheapest Car Insurance Rates by Company

Company Average Annual Rate Compared to State Average (Dollars) Compared to State Average (Percentage)

SAFECO $6,206.69 +$2,545.80 41.02%

Allstate $4,828.85 +$1,167.96 24.19%

Progressive $3,656.91 -$3.98 -0.11%

Mid-Century $3,430.07 -$230.82 -6.73%

Nationwide $3,424.96 -$235.93 -6.89%

Geico $3,283.42 -$377.47 -11.50%

USAA $2,739.28 -$921.60 -33.64%

Travelers $2,738.52 -$922.37 -33.68%

State Farm $2,639.30 -$1,021.59 -38.71%

This table is great because it not only shows the average cost of each insurance company, but it also shows the difference in price from the state total of $3,660.89 in dollars and percentages.

As you can see, according to this table, of these companies, the most expensive company is Safeco, and they cost $6,206.69 on average, which is $2,545.80 (41.02%) more than the state average. The cheapest company is State Farm, and their average cost is $2,639.30, which is $1,021.59 (38.71%) less than the state average.

We know that the word “cheap” is always alluring, but remember: cheaper isn’t always better. You must find out what companies work best for your specific needs. Another massive part of selecting your car insurance is not only seeing the average cost of a car insurance company, but what the particular costs are for you and your driving record. In the section below, we will share some of these costs with you.

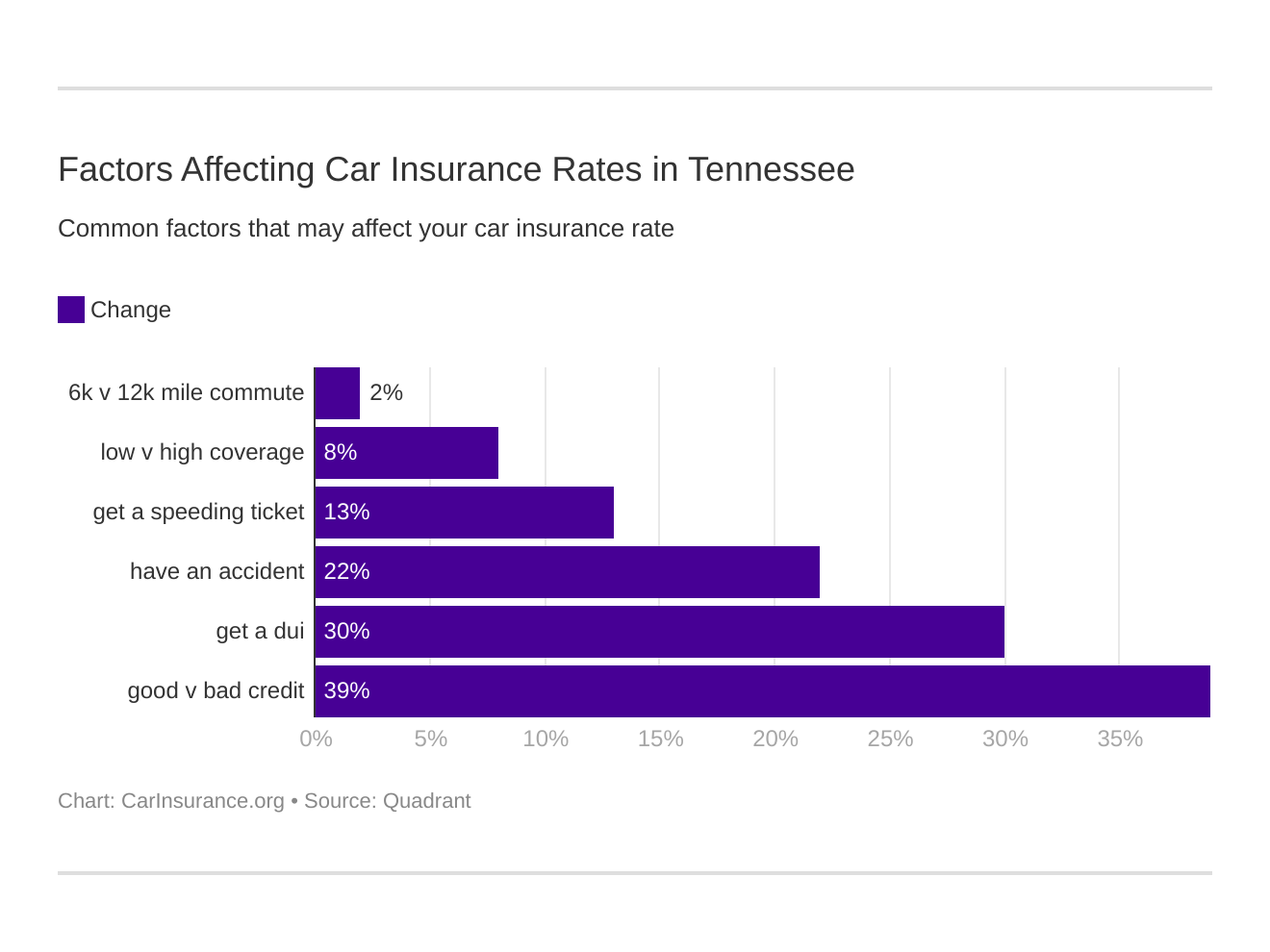

Does my commute affect my Tennessee car insurance rate?

One of the major aspects of your driving that a company considers is the number of miles that you drive for your commute. They generally separate the commutes into an average of 10 miles and 25 miles. Here is a table showing how much the major companies in Tennessee charge based on these different commute distances.

Tennessee Car Insurance Commute Rates by Company

Company 10 Mile Commute 25 Mile Commute

Liberty Mutual $6,206.69 $6,206.69

Allstate $4,828.85 $4,828.85

Progressive $3,656.91 $3,656.91

Farmers $3,430.06 $3,430.06

Nationwide $3,424.96 $3,424.96

Geico $3,263.57 $3,303.27

Travelers $2,630.93 $2,846.10

USAA $2,661.90 $2,816.66

State Farm $2,576.56 $2,702.04

The most expensive company for both a 10-mile commute and a 25-mile commute is Liberty Mutual, as they charge $6,206.69 for both distances. The cheapest company for both commutes is State Farm, and they charge $2,576.56 for a 10-mile commute and $2,702.04 for a 25-mile commute.

Something worth noting is that many companies charge the same amount for each commute distance. These companies include Liberty Mutual, Allstate, Progressive, Farmers, and Nationwide. Thus, it might be beneficial to just get longer coverage just in case.

Lastly, an interesting observation is that the cheapest companies do not charge the same amount for 10-mile and 25-mile commutes, with the 25-mile commutes costing more.

Can coverage level change my Tennessee car insurance rate with companies?

Another major factor that companies consider when charging you for insurance is the type of coverage level you purchase. There are three types of coverage that you can purchase: high, medium, and low. We’ve listed each major insurance company in Tennessee and how they charge based on coverage level in the table below.

Tennessee Car Insurance Company Coverage Level Rates

Group Coverage_Type Annual Average

Liberty Mutual High $6,477.10

Liberty Mutual Medium $6,204.78

Liberty Mutual Low $5,938.19

Allstate High $5,024.87

Allstate Medium $4,816.41

Allstate Low $4,645.25

Progressive High $3,884.63

Progressive Medium $3,657.30

Farmers High $3,639.71

Nationwide High $3,473.64

Nationwide Low $3,450.27

Geico High $3,448.43

Progressive Low $3,428.80

Farmers Medium $3,413.80

Nationwide Medium $3,350.97

Geico Medium $3,276.37

Farmers Low $3,236.69

Geico Low $3,125.46

Travelers High $2,902.69

USAA High $2,836.70

State Farm High $2,773.95

Travelers Medium $2,736.50

USAA Medium $2,729.45

USAA Low $2,651.70

State Farm Medium $2,651.21

Travelers Low $2,576.37

State Farm Low $2,492.73

According to this data, the most expensive “high” coverage level is from Liberty Mutual ($6,477.10). Liberty Mutual also has the highest “medium” coverage level ($6,204.78) and “low” coverage level ($5,938.19). The cheapest “high” coverage level is from State Farm car insurance ($2,773.95), and they have the cheapest “medium” ($2,651.21) and “low” ($2,492.73) rates, too.

Similar to rates by commute, there is a small difference between many of the different coverage levels, so it might be more cost-effective to go with a higher coverage level.

How does my credit history affect my Tennessee car insurance rate with companies?

Your credit is another part of your history that car insurance companies take into consideration when deciding how much you should pay for your rates. So, we’ll provide some information about how each type of credit score (separated into “good,” “fair,” and “bad”) affects your coverage for the major insurance companies in Tennessee.

Tennessee Car Insurance Rates based on Credit History

Company Good Credit Fair Credit Poor Credit

Liberty Mutual $4,266.12 $5,455.32 $8,898.63

Allstate $3,604.43 $4,718.43 $6,163.68

Nationwide $2,894.15 $3,265.47 $4,115.26

Progressive $3,314.09 $3,545.77 $4,110.86

Farmers $3,019.09 $3,191.56 $4,079.54

USAA $1,918.82 $2,326.47 $3,972.56

State Farm $1,785.62 $2,299.30 $3,832.98

Geico $2,933.59 $3,190.30 $3,726.36

Travelers $1,996.22 $2,735.47 $3,483.87

According to this table, the most expensive company for good credit is Liberty Mutual ($4,266.12), and they have the most expensive rates for fair ($5,455.32) and poor ($8,898.63) credit, too.

The company that is most forgiving to poor credit with their rates is Travelers, as their average rate for poor credit is $3,483.87.

According to Experian, the average credit score for Tennessee is 662. A 662 credit score is very close to the good range, which is 670-739. So, it seems that the good and average rates for car insurance companies are the most relevant to Tennessee drivers.

It’s worth noting that many of these companies charge significantly more if you have poor credit, with some companies charging hundreds, and some thousands, more dollars for a lower credit rating. It’s important to pay close attention to which companies accommodate your credit score best and to pick that company. That way, you can pay the most reasonable price for car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does my driving record change my rates with Tennessee car insurance companies?

The final major factor that car insurance companies take into consideration when determining your rates is your driving record. When looking at your driving records, there are three offenses that the car insurance companies take into account: accidents, DUIs, and speeding tickets. You’ll receive cheaper car insurance if you have a clean record.

The table below shows you the rates for the major companies in Tennessee for each type of driving record.

Tennessee Car Insurance Rates based on Driving Records

Company Clean Record One Accident One DUI One Speeding Violation

Liberty Mutual $5,031.00 $7,257.06 $6,748.89 $5,789.80

Allstate $4,043.94 $4,821.64 $5,823.95 $4,625.86

Geico $2,386.13 $3,197.12 $5,164.31 $2,386.13

Nationwide $2,961.85 $2,961.85 $4,454.01 $3,322.14

Farmers $2,930.61 $3,622.99 $3,709.20 $3,457.46

USAA $1,992.65 $2,984.18 $3,509.42 $2,470.89

Progressive $3,221.09 $4,182.08 $3,430.36 $3,794.09

Travelers $2,220.52 $2,851.81 $3,150.18 $2,731.56

State Farm $2,406.95 $2,871.65 $2,639.30 $2,639.30

As you can see from this table, the company that is cheapest if you have a DUI is State Farm, as their average rate for a driver with a DUI is $2,639.30. The company that is cheapest for speeding violation is Geico ($2,386.13 as the average rate), and the company that is best for accidents is Travelers, with an average rate of $2,851.81 for this offense.

If you have a clean record, the best company to go with is USAA, and their rate for this category is $1,992.65.

On average,DUIs are the most expensive violation. It varies from company to company, which of these two is the most expensive. For example, the average insurance rate for someone with a DUI for Liberty Mutual is $6,748.89, while an insurance rate for someone with an accident is $7,257.06.

Conversely, the average insurance rate for someone who has had a DUI and has Allstate is $5,823.95, but someone who has Allstate who has had an accident must pay an average rate of $4,821.64.

Lastly, the most expensive company on average is Liberty Mutual, and the cheapest is State Farm.

You can find the cheapest car insurance company in your local area by entering your ZIP code in the FREE comparison tool!

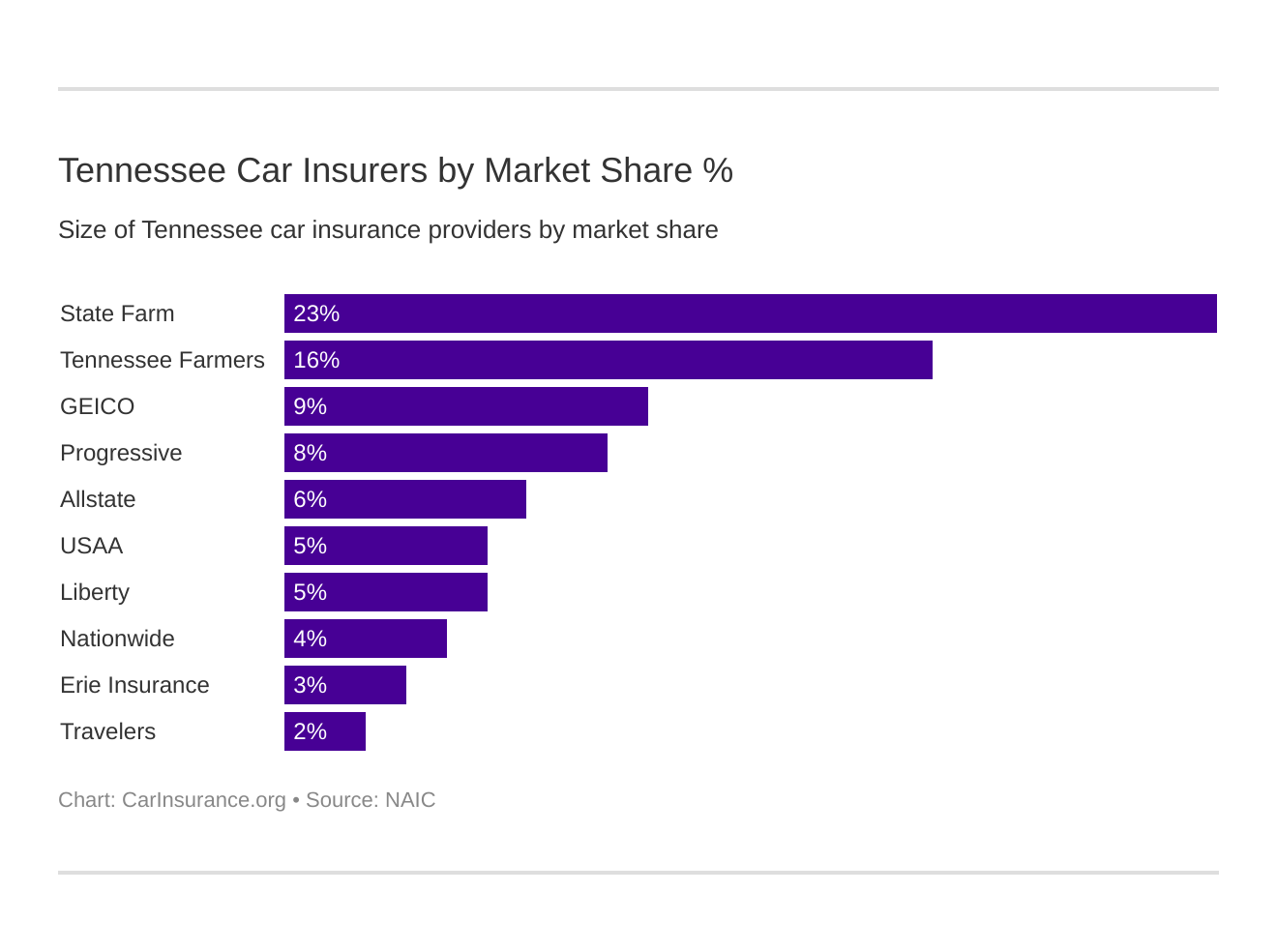

Which Tennessee car insurance companies are the largest?

You need to know about the ten largest insurance companies in Tennessee because you may end up using one of them. The table we’ve provided shows the Volunteer State’s ten largest car insurance companies, as well as some necessary information about them.

Tennessee Car Insurance Companies Market Share, Loss Ratio, and Direct Premiums

Company/ Group Direct Premiums Written Loss Ratio Market Share

State Farm $948,604 62.03% 23.23%

Farmers $654,613 74.33% 16.03%

Geico $348,059 69.97% 8.52%

Progressive $311,706 61.15% 7.63%

Allstate Insurance $254,285 47.23% 6.23%

USAA Group $221,585 71.72% 5.43%

Liberty Mutual $211,928 62.66% 5.19%

Nationwide Corp $171,166 68.01% 4.19%

Erie Insurance $114,508 76.69% 2.80%

Travelers $84,329 64.98% 2.06%

State Total $4,083,911 64.96% 100.00%

You may notice there are three categories for this table: direct premiums written, loss ratio, and the market share. If you are unfamiliar with these terms, here are some definitions. A direct premium written is the total amount of an insurance company’s written premiums during a given year, without accounting for the amount ceded to reinsurance.

A loss ratio is the proportionate relationship of incurred losses to earned premiums, expressed as a percentage. The best loss ratios are between 60 and 70. Finally, a market share is the percentage of the market for a product or service that a company supplies.

So, we can see from this table that State Farm has the most direct premiums written ($948,604), one of the best loss ratios (62.03%). And, as you can tell from this table, they have the largest percentage of the market share at 23.23%. So, based on all this information, you can see not only that State Farm is the largest car insurance company, but also why and how it is.

Travelers is the smallest of the top 10 largest car insurance companies in Tennessee, as they have $43,084 in direct premiums written, a 57.72% loss ratio, and they only control 3.44% of the market.

Finally, here are the numbers for the state total, so you can see how State Farm measures up to the rest:

- Direct Premiums Written: $4,083,911

- Loss Ratio: 64.96%

As we can see, State Farm has earned its place at the top in the state.

How many car insurance companies are available in Tennessee?

It’s important to know the largest insurance companies in Tennessee, but it’s also important to know how many insurance companies there are.

Tennessee has a total of 945 insurance companies, and of these, 15 are domestic, and 930 are foreign. The difference between these two types of insurance companies is pretty simple: domestic insurance is insurance that is based within your state, and foreign insurance is based in a state outside of your home state. You can use a foreign insurance company for coverage and have no issues, so either option works.

Are you still unsure about the number of companies in Tennessee? Enter your ZIP code in the FREE comparison tool to compare car insurance rates from different companies in your local area!

What are the laws in Tennessee?

Look, we get it: knowing your state laws can be confusing, especially the ones about driving. But it’s necessary to know these laws so you can avoid unnecessary fines and so that your roads are safe. And while it’s annoying to know all about all these laws, we hope that we can help you understand them better in a way that doesn’t require hours of studying documents that seem like they’re in another language.

In this part of the article, we’re going to explain these laws simply. We will look at laws about car insurance, windshield coverage, high-risk insurance, and all the other laws about driving that are necessary for all Tennessee drivers.

What are the Tennessee car insurance laws?

Here are some very important car insurance laws in Tennessee. Check them out to drive safely and securely in the Volunteer State.

How State Laws for Insurance are Determined

Before talking about car insurance laws, it’s important to figure out how car insurance laws are determined. According to the NAIC, Tennessee is a Prior Approval/Flex state. A state that uses prior approval requires car insurance companies in that state to justify their rate changes to state regulators before implementing them. Flex laws require insurers to get approval for rate changes that exceed a specified percentage.

So basically, this means that car insurance companies must get state approval if they want to increase their rates more than a specified amount. This law is part of Tennessee’s Title 56, which you can read more about here.

Windshield Coverage

Next, let’s take a look at the windshield coverage laws in Tennessee. There are no unique laws for windshields or regarding the choice of a repair shop or OEM (the vehicle’s manufacturer makes parts) vs. aftermarket parts (any part for a vehicle that isn’t sourced from the car’s maker).

It’s also not a law that companies have zero deductible with comprehensive coverage. Even if you have comprehensive coverage, the insurance company does not have to waive your deductible if you get a windshield replacement. However, some companies do.

High-Risk Insurance

Now, let’s examine high-risk insurance. There are three types of documents for high-risk drivers: SR-22s, SR-22As, and FR-44s. However, the only form that pertains to you is the SR-22 because SR-22As are only in Georgia, Texas, and Missouri. FR-44s are required in Virginia and Florida.

An SR-22 proves that you carry car insurance, and you usually need to get one after the following:

- DUI or DWI

- Reckless driving

- At-fault accidents

- Driving without insurance coverage

- Driving with a suspended license

An SR-22 form is what is required for “high-risk” drivers. Though it is a document proving you have the minimum insurance requirements, it is not a form of car insurance.

In Tennessee, you must contact your liability insurance representative and inform them of the needed filing within your state. The form needs to be filed by an insurance company licensed through the Tennessee Department of Commerce and Insurance issues liability insurance coverage in Tennessee.

It must also follow the minimum insurance coverage requirements in Tennessee, which are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage.

Did you know you can still get car insurance as a high-risk driver? Find out how much you can pay for insurance using our FREE auto insurance quotes comparison tool! Enter your Tennessee ZIP code to start comparing rates now!

Low-Cost Insurance

Though Tennessee has a high-risk insurance program, unfortunately, it does not have a low-cost insurance program for low-income families.

The only states that have low-cost insurance programs are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Tennessee