SR-50 Insurance in 2026 [Definition + High-Risk Rates]

SR-50 insurance is required in Indiana after you've been cited for not having car insurance during a traffic accident. If you don't file SR-50, your license may be suspended. Although you can't get specific SR-50 car insurance quotes, an SR-50 form increases your insurance rates by $50 a month on average.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated May 2025

What is an SR-50? Anyone who needs SR-50 car insurance has been ticketed for driving without proof of insurance. Indiana car insurance law dictates that drivers caught without coverage need SR-50 insurance certification.

Unfortunately, this type of violation makes you a higher risk to insurance companies, and they can raise your rates significantly.

- You can lose your license for driving without insurance in Indiana

- SR-50 insurance is required if you failed to provide proof of car insurance

- SR-50 forms must include the start and end dates of an up-to-date policy

However, there’s a way to recover. We’ll cover everything you need to know about the SR-50 filing, including where to buy SR-50 insurance and how to get affordable rates.

Comparing car insurance providers is essential if you need an SR-50 insurance filing. Enter your ZIP code to compare multiple companies in your area.

SR-50 Insurance Explained

It’s essential to maintain continuous auto insurance that meets state minimum requirements. Driving without insurance in Indiana can lead to serious consequences, including fines ranging from $150 to $300, potential license suspension, and the requirement to file an SR-50 form to prove you have the necessary coverage.

The SR-50 form isn't actual insurance. It's a certificate that proves you currently carry the minimum car insurance requirements in Indiana.Michael Leotta Insurance Operations Specialist

Failing to file SR-50 can result in fines, license suspension, and additional penalties. Here’s how much insurance you need on your car in Indiana:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

It can be labeled SR.50, SR 50 insurance, or SR50 insurance. The “SR” in SR-50 insurance stands for Safety Responsibility.

Why Indiana? Don’t other states have SR-50 insurance? The short answer is no. Indiana is the only state with SR-50 insurance certification. Therefore, you won’t see any company identified as an SR-50 insurance company.

SR-50 vs. SR-22 in Indiana

An SR-50 is necessary due to a lack of auto insurance during an accident or moving violation and proves to the BMV that you have current insurance. It doesn’t carry the requirement of future coverage.

SR-22 insurance in Indiana is required for drivers who have been convicted of certain offenses, such as DUIs or driving without insurance. The main difference between SR-50 and SR-22 insurance is that SR-50 is for proof of current insurance, and an SR-22 proves future insurance coverage.

Ultimately, SR-50 insurance is only required by the Indiana BMV and not court-ordered. You need an Indiana BMV certificate of compliance for SR-50 only after you’ve been caught driving uninsured. Many Indiana drivers need SR-22 insurance because of a traffic accident, moving violation, or DUI that shows proof of insurance in place for the duration of the next three years.

Learn More: Does your car insurance and registration need to be under the same name?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Rates After Filing SR-50

Since you can’t buy SR-50 insurance, you won’t find SR-50 insurance quotes from companies. However, we can show you how much you could pay with the top-rated insurance companies in Indiana based on common driving record issues, including driving without insurance.

Indiana Car Insurance Monthly Rates by Provider & Driving Record

| Company | Clean Record | At-Fault Accident | No Insurance | DUI |

|---|---|---|---|---|

| $68 | $134 | $150 | $241 | |

| $43 | $59 | $68 | $143 | |

| $27 | $41 | $49 | $49 | |

| $34 | $50 | $58 | $120 |

| $32 | $134 | $150 | $140 | |

| $38 | $52 | $60 | $130 |

| $94 | $130 | $145 | $194 |

| $54 | $106 | $120 | $177 | |

| $29 | $41 | $50 | $111 | |

| $31 | $39 | $45 | $105 |

How much is SR-50 insurance? Rates range from $45 to $150 per month. Although your situation may vary, this is a close estimate of what you could pay when you buy car insurance with SR-50 attached. USAA, Auto-Owners, and State Farm have cheap auto insurance in Indiana after driving with no insurance.

How much is car insurance in Indiana? There are many different factors that affect the price of car insurance in Indiana, such as your age, driving record, location, and the level of coverage you choose. Car insurance companies will increase your rates if there’s a gap in coverage, so filing an SR-50 may indirectly increase your Indiana car insurance rates.

SR-50 Car Insurance Rates by Driver

Your age and gender will have the biggest impact on SR-50 auto insurance rates. Young drivers pay the most, but driving without insurance raises rates more than an accident for all age groups. Read more about the things drivers do that raise premiums.

Indiana Car Insurance Monthly Rates by Age & Driving Record

| Driver | Clean Record | At-Fault Accident | No Insurance | DUI |

|---|---|---|---|---|

| Female: Age 16 | $305 | $366 | $390 | $427 |

| Male: Age 16 | $377 | $452 | $480 | $526 |

| Female: Age 20 | $130 | $156 | $166 | $182 |

| Male: Age 20 | $158 | $190 | $202 | $221 |

| Female: Age 25 | $92 | $110 | $117 | $128 |

| Male: Age 25 | $98 | $117 | $125 | $137 |

| Female: Age 30 | $74 | $89 | $95 | $104 |

| Male: Age 30 | $76 | $91 | $97 | $107 |

| Female: Age 40 | $70 | $84 | $90 | $99 |

| Male: Age 40 | $72 | $86 | $92 | $101 |

| Female: Age 50 | $66 | $79 | $84 | $93 |

| Male: Age 50 | $68 | $81 | $87 | $96 |

| Female: Age 60 | $65 | $77 | $82 | $91 |

| Male: Age 60 | $67 | $79 | $85 | $94 |

| Female: Age 70 | $70 | $83 | $89 | $98 |

| Male: Age 70 | $72 | $86 | $92 | $101 |

Filing an SR-50 can raise Indiana insurance rates by as much as $30 a month and over $80 monthly if you’re a teen driver. Using free online tools to get Indiana SR-50 insurance quotes can simplify the process. These tools allow you to input your information once and receive multiple quotes, helping you find the best coverage at the best price.

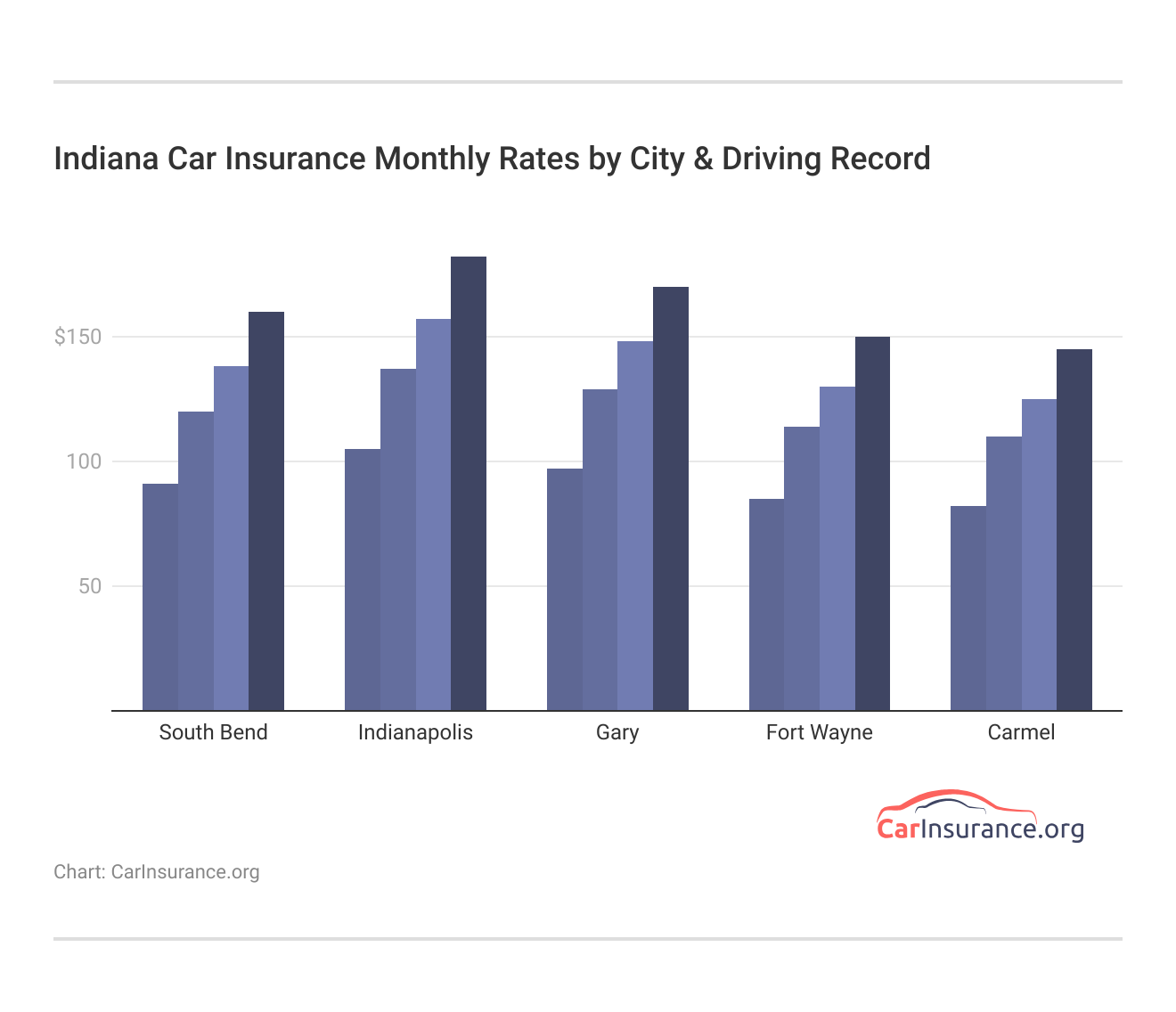

SR-50 Car Insurance Rates by City

As you can see in the graph below, finding cheap car insurance in Indianapolis, Indiana is tricky — it’s the most expensive for coverage. Even with a clean record, it costs $20 more per month than the best car insurance companies in Carmel, the cheapest city. You’ll want to compare multiple providers to find cheap auto insurance quotes in Indianapolis.

How much are SR-50 vs. SR-22 insurance rates? When it comes to understanding how much SR-22 insurance in Indiana costs, comparing car insurance rates by city is crucial. Filing SR-22 after a DUI will raise your rates the most.

The cost of SR-22 insurance in Indianapolis is the steepest, starting at $182 a month for minimum coverage after a DUI, almost $40 more per month than what drivers in Carmel pay and $30 more monthly than Fort Wayne drivers. Compare companies online to find the cheapest car insurance quotes in Indianapolis.

Read More: Indianapolis Car Insurance

What Indiana Drivers Need to File SR-50 Insurance

When you don’t have auto insurance during an accident, you’ll be in danger of losing your driver’s license. In addition to a $150 to $300 fine, you’ll need to provide an SR-50 insurance filing to the Indiana BMV.

To keep your license and maintain your vehicle registration, you’ll need an SR-50 form that lists the start and end dates of your current auto policy. Indiana drivers need to carry the minimum car insurance requirements of 25/50/25. If you know you will need SR-50 insurance, don’t wait until the last minute. It may take a few days, and you want your policy ready before the BMV’s deadline.

Before heading to a BMV branch, don’t forget to schedule an appointment! While many BMV branches have reopened, Hoosiers are required to schedule an appointment online at https://t.co/4vxJFkjHv5 before making the trip. #INBMV #INThisTogether pic.twitter.com/86eRzKVQA7

— Indiana BMV (@INBMV) May 20, 2020

How can you get SR-50 car insurance? After you get a ticket for driving without insurance, tell your car insurance provider about your situation so an agent can file the SR-50 right away. If your insurer doesn’t offer SR-50 filings, start searching for an auto insurance company that can get you a policy.

How to Obtain Non-Owner SR-50 Insurance in Indiana

If you don’t own a vehicle but still need to meet Indiana’s insurance requirements, you can get non-owner SR-50 insurance. This type of policy is designed for individuals who frequently drive cars they do not own, so they are still covered in case of an accident or violation.

Non-owner SR-50 insurance in Indiana is essential for maintaining your driving privileges, especially if you’ve been cited for driving without proof of insurance. Ensure that the insurance company you choose can file the SR-50 form with the Indiana BMV promptly to avoid any interruptions in your driving privileges.

Getting SR-50 Car Insurance Quotes for Permit Drivers in Indiana

When you have a learner’s permit in Indiana, it’s essential to understand your auto insurance options. Even though you might not yet have a full license, you still need coverage to drive legally. Indiana law requires all drivers, including those with learner’s permits, to be covered by auto insurance.

Often, the easiest and most cost-effective way to insure a permit driver is to add them to an existing family policy. In this case, the policyholder would need to file an SR-50 to prove that all insured drivers on the policy have up-to-date coverage, which will raise rates.

For permit drivers, comparing auto insurance quotes in Indiana is essential. SR-50 insurance costs more for new drivers, but having insurance as a permit driver helps build your driving history, which can lead to better rates in the future.

Finding The Best SR-50 Car Insurance in Indiana

Not having car insurance will affect your rates when you finally get a policy. Car insurance companies may see you as a high-risk driver, and you’ll pay more than the average for SR-50 insurance. Fortunately, many companies offer competitive rates — USAA, Auto-Owners, and State Farm all have low SR-50 insurance rates for under $50 per month.

When shopping for SR-50 insurance in Indiana, it’s crucial to provide accurate information about your driving history and insurance needs to get the best possible rates. Finding cheap SR-50 insurance can be challenging due to the nature of the violation.

If you happen to qualify for discounts specific to young or permit drivers, you can get more affordable SR-50 insurance rates.Michelle Robbins Licensed Insurance Agent

Many factors influence insurance rates, so consider exploring various discounts offered by insurers, such as safe driver discounts, multi-policy discounts, and more, to reduce costs. You’ll find the best SR-50 quotes using these easy ways to lower car insurance costs:

- Maintain Good Grades: Some insurance companies offer better rates to students who maintain a certain GPA.

- Complete Driver Course: Completing a defensive driver course can sometimes reduce your insurance premium.

- Pay in Full: Paying your annual car insurance at once instead of in monthly payments can result in cheaper rates.

- Compare Quotes: Use free online tools to compare car insurance quotes in Indiana from different providers.

If you’re looking for a reliable insurer, you can get quotes from local companies that might be more familiar with SR-50 forms. Any insurance company that does business in Indiana should be able to fulfill this requirement for you, but comparing quotes from different insurance providers can help you find the most affordable options. Enter your ZIP code to get free insurance quotes today.

Frequently Asked Questions

What is SR-50 insurance?

SR-50 insurance in Indiana is a certification that proves a driver currently holds the minimum required auto insurance coverage. It is mandated for drivers who have caused serious accidents or been caught driving without insurance.

How long must you hold an SR-50?

An SR-50 certification is typically required as long as you maintain your driving privileges and are required to prove financial responsibility to the Indiana BMV.

How much is the SR-50 filing fee?

It doesn’t cost anything to file an SR-50 in Indiana, but it can cost between $150 and $300 to reinstate your license if it’s revoked for driving without car insurance (Learn More: How much is a ticket for driving without a license?).

How much is an SR-50?

While it’s free to file, having an SR-50 will raise your rates. USAA has cheap SR-50 insurance in Indiana starting at $45 per month. Enter your ZIP code to compare SR-50 insurance costs by city.

Do you need SR-50 insurance for a moving or non-moving violation?

SR-50 insurance is only for people who’ve been in an accident and have no car insurance coverage.

What is SR-22 insurance in Indiana?

Indiana SR-22 insurance is a form of financial responsibility certification that proves that the driver has the required insurance coverage. Who needs SR-22 insurance in Indiana? It’s required for drivers who have been convicted of certain traffic offenses, such as DUIs, driving without insurance, or other serious violations. It

What’s the difference between SR-50 insurance and SR-22 insurance?

To put it simply, SR-50 is proof of current car insurance that meets Indiana minimum requirements, and an Indiana SR-22 is proof that you carry minimum car insurance and will continue to in the future (Read More: Is it bad to just carry minimum coverage car insurance?).

How long do you need an SR-22 in Indiana?

The duration for which you need SR-22 insurance in Indiana varies based on the offense. Typically, it ranges from three to five years, depending on the nature of the violation.

How much is SR-22 insurance in Indiana?

The cost of an SR-22 in Indiana can vary among insurance providers. Typically, there is a filing fee of around $25, but the total cost also includes increased insurance premiums due to the associated high-risk status.

How much does Progressive charge for SR-22?

The cost of SR-22 insurance from Progressive can vary depending on individual circumstances. Start comparing quotes in our Progressive Insurance review.

How much is SR-22 insurance without a vehicle in Indiana?

How much is SR-22 insurance from State Farm?

How long does an SR-22 stay on your insurance in Indiana?

How long is your license suspended for no insurance in Indiana?

How much does car insurance cost in Indiana?

What is Indiana state insurance called?

How many insurance companies are in Indiana?

What is standard insurance coverage in Indiana?

What is the insurance coverage limit in Indiana?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.