Best Car Insurance in Louisiana for 2026 [Check Out the Top 10 Companies]

Farmers has the best car insurance in Louisiana, with rates starting at $26 per month. The company stands out. Liberty Mutual provides first accident forgiveness and 10% savings for its driver safety program. Allstate has new car replacement and low-mileage programs. Discover how to get these best and lowest deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsFarmers, Liberty Mutual, and Allstate offer the best car insurance in Louisiana, with coverage starting at $26 per month.

Farmers is best known for its comprehensive calamity coverage, such as roadside assistance. Liberty Mutual offers driver safety incentives of 10% off.

Allstate offers a plan for low-mileage drivers to save when they drive less. Additionally, these companies have a B to A++ from A.M. Best, which proves its strong financial stability.

Our Top 10 Company Picks: Best Car Insurance in Louisiana

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A | Customer Service | Farmers | |

| #2 | 25% | A | Quick Claims | Liberty Mutual |

| #3 | 25% | A+ | Innovative Discounts | Allstate | |

| #4 | 10% | A+ | Competitive Rates | Progressive | |

| #5 | 20% | A+ | Broad Coverage | Nationwide |

| #6 | 25% | A++ | Affordable Premiums | Geico | |

| #7 | 13% | A++ | Flexible Policies | Travelers | |

| #8 | 25% | A | Personalized Service | American Family | |

| #9 | 17% | B | Trusted Reputation | State Farm | |

| #10 | 10% | A++ | Military Focus | USAA |

This car insurance guide ensures that you get the best coverage for your needs while having a wide choice of providers. If you want to quickly check the best car insurance rates in Louisiana, just enter your ZIP code.

- Farmers is known for its comprehensive calamity and telematics program

- The top 10 companies provide savings of up to 25% on bundling policies

- The minimum coverage rate starts at $26, and full coverage at $98

#1 – Farmers: Top Overall Pick

Pros

- Comprehensive Calamity Coverage: Farmers insurance review provides offers like towing and roadside assistance to help Louisiana drivers against weather damage.

- Rideshare Insurance: A coverage intended for Uber and Lyft drivers in Louisiana that is usually not covered in car insurance policies.

- Strong Agent Network: The Farmers app can locate and direct you to local agents for support.

Cons

- Limited Discounts: Though discounts are available, they are not as extensive as the discounts offered by competitors.

- Slower Processing Claims: Some Louisiana customers said delays in claims happen during weather events.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Quick Claims

Pros

- Extensive Local Agent Support: Agents are present to offer customers in-person assistance and policy guidance.

- Drivewise Safety Incentives: This Liberty Mutual car insurance program uses a telematics program to track driving habits and offer 10% discounts.

- First-Accident Forgiveness: Initial at-fault accident rates remain unchanged after the first accident—no premium hikes.

Cons

- Rideshare Policy Gap: To completely guard against potential liabilities, additional endorsements might be necessary for Uber and Lyft drivers’ coverage.

- Varied Premiums in High-Claim Area: Louisiana policies are more expensive than those of other providers because of its insurance fraud concern and high accident rates.

#3 – Allstate: Best for Innovative Discount

Pros

- Superior Weather Protection: Allstate insurance review provides extensive add-ons to cover weather damage, such as roadside assistance and rental reimbursement.

- Unique Options: Offers a flexible plan for low-mileage drivers, which is beneficial to Louisiana’s residents who drive less to save up to 23%.

- New Car Replacement: This policy protects against depreciation losses in the event of an accident by paying the entire cost of replacing a new car that has been totaled.

Cons

- Coastal Areas Higher Rates: The increased risk of storm-related damage significantly affects the cost in regions like Baton Rouge and New Orleans.

- Claims Response Inconsistency: Policyholders have experienced claim delays due to high demand caused by major disasters.

#4 – Progressive: Best for Competitive Rates

Pros

- Snapshot Program: This program tracks drivers’ driving habits and offers up to $19 monthly off on safe driving behaviors, especially in high-traffic areas.

- Name Your Price Tool: Louisiana drivers can set their own prices, and the coverage is adjusted to fit their budget.

- Calamities Protection: Extensive coverage against frequent storms and flooding. Get more details in our Progressive car insurance review.

Cons

- Limited Local Agent: Progressive relies more on digital service, which may not suit some who prefer in-person agents.

- Risky Drivers Higher Rates: Drivers with accidents, violations, and bad credit scores often get expensive premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Broad Coverage

Pros

- Vanishing Deductibles: Maintaining a good driving record can reduce the deductibles up to $100 to $500 in a year.

- SmartRide Program: 10% discounts on new enrollees and 40% over time as long as safe driving habits are observed.

- On Your Side Review: This is a personalized insurance assessment where policyholders change coverage based on their needs.

Cons

- Strict Usage-Based Discount: The SmartRide Program requires app tracking, which might not appeal to privacy-conscious customers.

- Expensive Premiums: The premiums are above average compared to competitors like Allstate. Read the company’s comparison of car insurance.

#6 – Geico: Best for Affordable Premiums

Pros

- Competitive Low Rates: Geico had the most affordable auto insurance in Louisiana, at $38, and was even cheaper for good drivers, according to the Geico insurance review.

- Emergency Roadside Assistance: This company offers 24/7 lockout services, towing, and battery jump-starts, which are helpful for those in rural areas of Louisiana.

- Variety of Discounts: Discounts for federal employees up to 12%, 10% off for military personnel, and 10% to 25% off for multi-vehicle coverage.

Cons

- Slower Claims Procedure: Wait times are longer in processing claims during high-demand periods like flooding season.

- High Rates For High-Risk Drivers: Rates for those with traffic violations or accidents tend to be higher.

#7 – Travelers: Best for Flexible Discounts

Pros

- Premier Weather Protection: Extensive coverage for storm damage, flooding, and hurricanes, beneficial for Louisiane residents.

- IntelliDrive Program: Provides a 30% discount for safe driving habits as a reward.

- Wide Policy Customization: Drivers can have add-ons like gap insurance, new car replacement, and rideshare coverage.

Cons

- Strict IntelliDrive Fines: Risky drivers tracked by the IntelliDrive app impact the increase in premiums.

- Premium Variations: Premiums fluctuate based on credit score, driving history, and location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Service

Pros

- Strong Bundling Choices: 13% savings when customers opt for bundle coverage for car insurance with home, renters, or life insurance policies.

- Generous Loyalty Discounts: Substantial savings for long-term customers over time; check these in the American Family review.

- KnowYourDrive Program: Safe driving habits make customers eligible for personalized discounts, which are ideal for varied road conditions in Louisiana.

Cons

- Not Customizable Coverage: It doesn’t specialize in tailored policies as it only has fewer add-on options.

- Digital Tools Gap: The online tools and mobile apps have limited features and are less advanced than competitors like State Farm.

#9 – State Farm: Best for Trusted Reputation

Pros

- Exceptional Local Agent Network: It provides real-time customer service and claims assistance because it has a solid presence in 40 cities in Louisiana.

- Multiple Discounts Opportunity: Savings for good driving records, bundling policies (17%), and young drivers completing safety driving courses.

- Drive Safe & Save Program: Customers who practice safe driving behaviors can take advantage of this discount. Get extra details on car insurance with telematics.

Cons

- No Gap Insurance: Unlike other providers, State Farm does not provide gap insurance for financed cars.

- Less Competitive Usage-Based Discount: The Drive Safe & Save discount is not as competitive as other programs in Progressive or Geico.

#10 – USAA: Best for Military Focus

Pros

- Exclusive Membership Perks: This program provides personalized policies for military members, veterans, and their families.

- Affordable Premiums: Consistent low premiums of $26 per month, especially for good drivers and on-duty militaries.

- High Customer Approval Rate: USAA is known for its good customer service and quick claims processing, and it has an A++ rate from AM Best.

Cons

- Restricted Eligibility: Non-military personnel cannot obtain the most affordable and maximum coverage. The USAA car insurance review provides a detailed discussion.

- Limited Physical Stores: Fewer local offices are available in Louisiana, which affects those who prefer in-person service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Monthly Cost in Louisiana

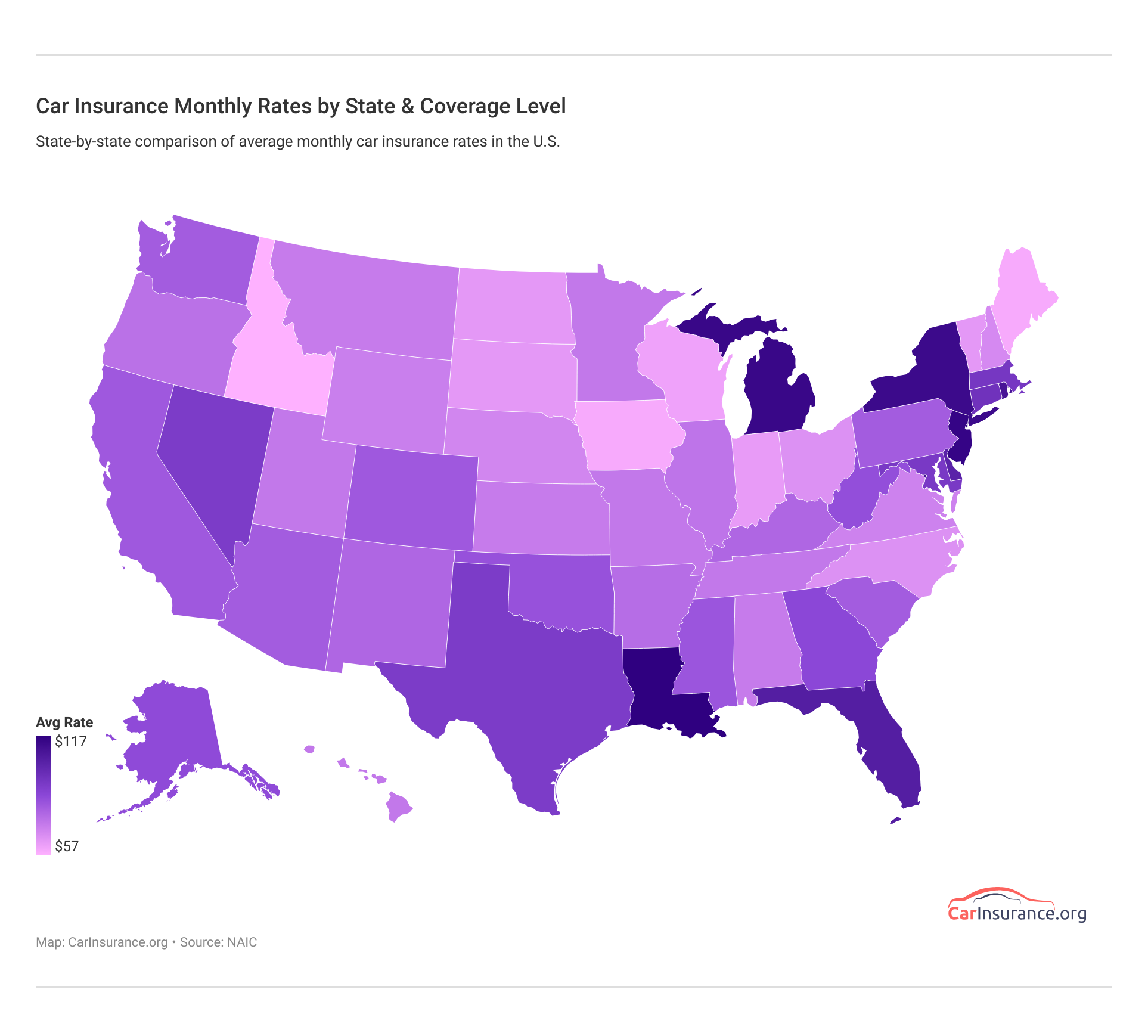

Your average car insurance cost in Louisiana may be cheaper than expected for additional coverage like comprehensive. Review rates for best car insurance by state map below.

Here is a comprehensive summary of providers’ coverage levels and rates to get you the whole picture.

Louisiana Car Insurance Monthly Rates by Provider and Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $206 | |

| $47 | $176 | |

| $57 | $212 | |

| $38 | $141 | |

| $73 | $274 |

| $48 | $181 |

| $43 | $161 | |

| $33 | $124 | |

| $42 | $156 | |

| $26 | $98 |

The affordable Louisiana car insurance is spotted at the bottom, with minimum rates of $28 and a full coverage rate of $98. The most expensive is Liberty Mutual, with $73 minimum coverage and $274 full coverage quotes.

It’s important to have minimum liability coverage on your vehicle. It’s smarter to carry full coverage car insurance. In the case of an accident, you’ll be so thankful you’re not paying out of pocket to cover accident expenses.

Car Insurance Additional Liability Coverage in Louisiana

The additional coverage types listed below are optional coverage in the state of Louisiana. Although being uninsured is against the law, people still try to drive without car insurance.

Loss Ratios in Louisiana

| Coverage Type | 2023 | 2022 | 2021 |

|---|---|---|---|

| Medical Payments | 78% | 74% | 80% |

| Uninsured/Underinsured Motorist | 72% | 69% | 75% |

If an uninsured driver causes an accident and you are involved in that accident, chances are, the uninsured driver is going to owe you money to cover the costs of property damages (and possibly medical bills). Because the uninsured driver is uninsured, they may go bankrupt while trying to pay for your damages.

When examining a company's loss ratio percentages, look for two things. Make sure the rate isn't under 50 percent or over 100 percent.Jeffrey Manola Licensed Insurance Agent

If the ratio is too low (under 50 percent), the company probably overpriced its premiums or hasn’t received as many claims as it anticipated. However, if it is too high (over 100 percent), the company might pay too many claims. This means that car insurance rates will rise to make up for the unprofitable period.

Loss ratios calculate the proportion of premiums insurers pay in claims to show financial health. In 2023, vehicle liability decreased from 76% to 71%, while vehicle physical damage loss ratios improved from 79% to 63%. These decreases show improved insurer stability and claim handling.

Car Insurance Add-ons, Endorsements, and Riders

Insurance is a tricky subject. There are many policies to choose from. If you’re interested in learning more about add-ons, endorsements, and extra coverage, take a look at the list below. Click on each link to learn more.

- Gap insurance

- Umbrella

- Rental reimbursement

- Roadside assistance

- Mechanical breakdown insurance (MBI)

- Non-owner coverage

- Modified car insurance

- Classic car insurance

Add one, or add them all. The choice is up to you. Whatever fits your lifestyle and needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

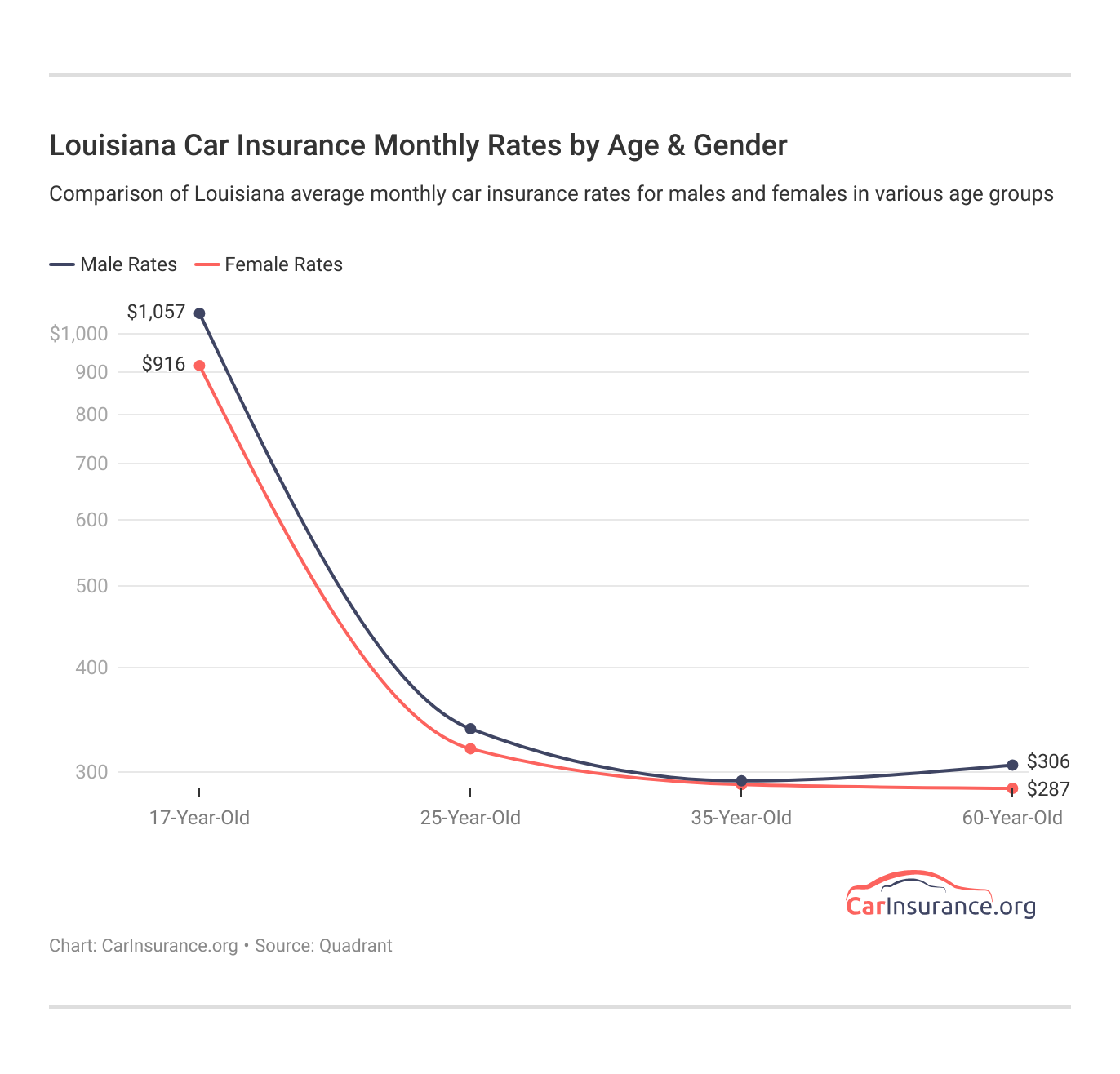

Car Insurance Rates in Louisiana by Age & Gender

Did you know that gender, marital status, and age are some of the factors that affect your car insurance rate? Men usually pay more for car insurance than women do.

Check out the table below that specifies the rates of different providers based on gender and age.

Louisiana Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 17 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $771 | $971 | $391 | $424 | $355 | $355 | $366 | $366 | |

| $850 | $1,030 | $390 | $420 | $340 | $350 | $365 | $375 | |

| $910 | $1,100 | $400 | $420 | $355 | $355 | $375 | $380 | |

| $1,064 | $1,122 | $276 | $267 | $286 | $329 | $342 | $417 | |

| $990 | $1,150 | $375 | $400 | $330 | $340 | $355 | $365 |

| $1,050 | $1,150 | $380 | $410 | $335 | $355 | $365 | $375 |

| $1,377 | $1,531 | $396 | $403 | $347 | $323 | $290 | $314 | |

| $700 | $878 | $265 | $297 | $238 | $238 | $218 | $218 | |

| $900 | $1,120 | $385 | $405 | $340 | $355 | $360 | $370 | |

| $668 | $784 | $274 | $300 | $223 | $220 | $218 | $216 |

The younger you are, the more you will pay for car insurance. Usually, if you keep a clean record, your rate will decrease after you turn 25. Moreover, Geico and USAA are among the best car insurance for under-25 females, with lower costs than competitors.

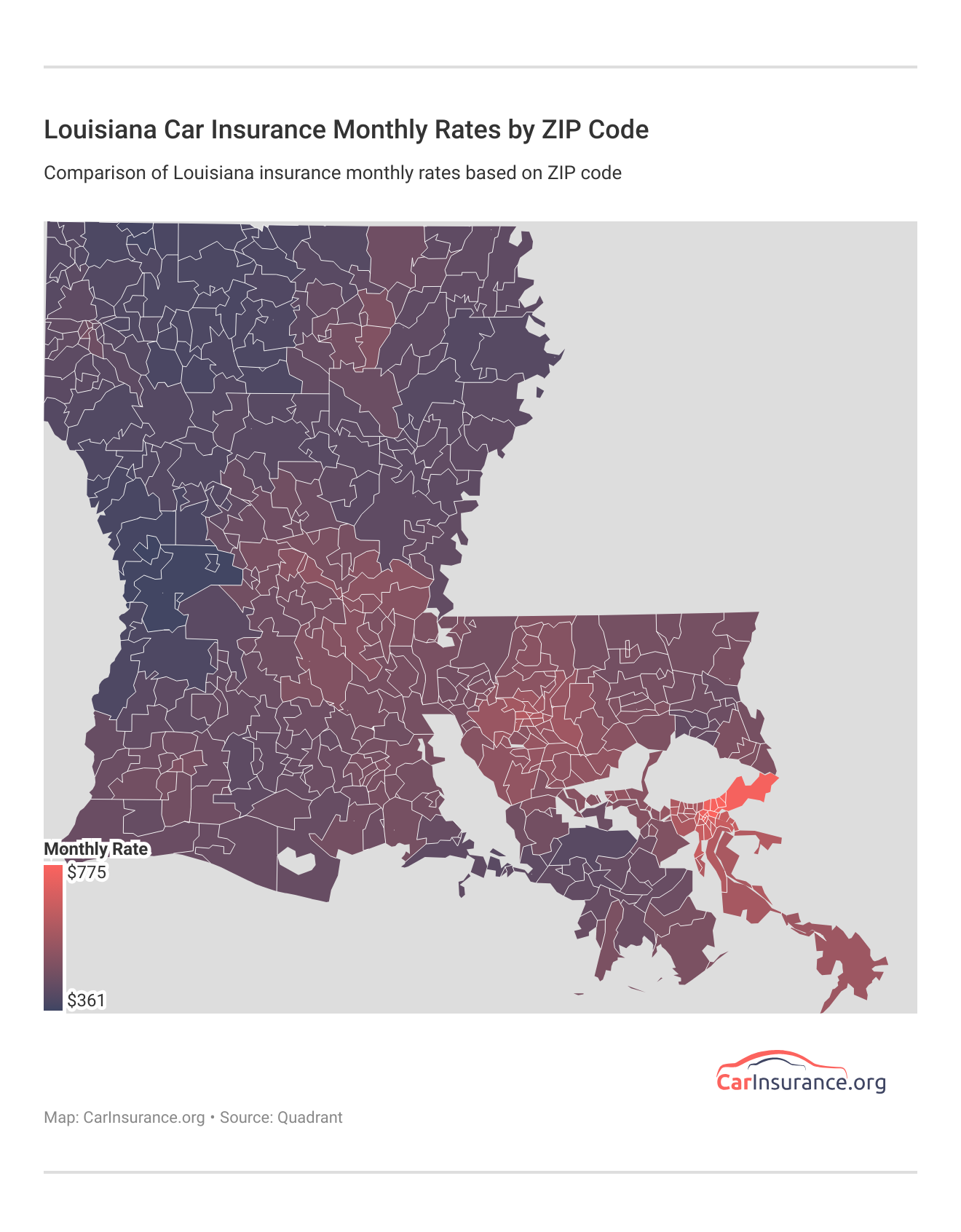

Cheapest Car Insurance Rates by ZIP Code

The 71222 ZIP code refers to Louisiana and this has a lot to do with your car insurance rate.

We prepared a comprehensive table so you can check the cheapest car insurance in Louisiana based on your ZIP code.

Cheapest Car Insurance Monthly Rates in Louisiana by ZIP Codes

| City | ZIP | Rates |

|---|---|---|

| Hornbeck | 71439 | $361 |

| Kurthwood | 71443 | $363 |

| Fort Polk | 71459 | $366 |

| Leesville | 71446 | $367 |

| Anacoco | 71403 | $369 |

| Simpson | 71474 | $370 |

| Newllano | 71461 | $370 |

| Slagle | 71475 | $373 |

| Springhill | 71075 | $373 |

| Florien | 71429 | $373 |

| Sarepta | 71071 | $373 |

| Many | 71449 | $379 |

| Fisher | 71426 | $381 |

| Zwolle | 71486 | $382 |

| Noble | 71462 | $382 |

| Provencal | 71468 | $383 |

| Castor | 71016 | $383 |

| Shongaloo | 71072 | $383 |

| Lisbon | 71048 | $383 |

| Arcadia | 71001 | $384 |

| Jamestown | 71045 | $384 |

| Negreet | 71460 | $384 |

| Belmont | 71406 | $384 |

| Ringgold | 71068 | $384 |

| Haynesville | 71038 | $386 |

Louisiana’s cheapest ZIP codes are spread out among a number of cities.

Most Expensive Car Insurance Monthly Rates in Louisiana by ZIP Codes

| City | ZIP | Rates |

|---|---|---|

| Marksville | 71351 | $285 |

| Geismar | 70734 | $285 |

| Duplessis | 70728 | $282 |

| Darrow | 70725 | $282 |

| White Castle | 70788 | $281 |

| Laplace | 70068 | $280 |

| Donaldsonville | 70346 | $279 |

| Gonzales | 70737 | $279 |

| Carville | 70721 | $278 |

| Hessmer | 71341 | $278 |

According to these lists, New Orleans has the most expensive car insurance rate in all of Louisiana, and this makes sense, considering it’s the largest city in Louisiana.

Cheapest Car Insurance Rates by City

Let’s get to know Louisiana’s cheapest car insurance rates by city. How much does your city cost?

Cheapest Car Insurance Monthly Rates in Louisiana by City

| City | Rates |

|---|---|

| Baton Rouge | $62 |

| Hornbeck | $192 |

| Lafayette | $48 |

| New Orleans | $395 |

| Ruston | $144 |

As you see, Hornbeck is one of the smallest cities in Louisiana, whereas New Orleans is the largest city in the state, which makes the rates seem reasonable.

Most Expensive Car Insurance Monthly Rates in Louisiana by City

| City | Rates |

|---|---|

| Alexandria | $171 |

| Baton Rouge | $258 |

| Hammond | $165 |

| Houma | $167 |

| Lafayette | $200 |

| Lake Charles | $174 |

| Monroe | $169 |

| New Orleans | $329 |

| Shreveport | $179 |

| Slidell | $163 |

Now that we’ve discussed what can affect your car insurance rate let’s move on to discuss car insurance company ratings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance Financial Ratings in Louisiana

With literally hundreds of car insurance companies out there, it’s difficult to know which one to choose. No one has time to sift through websites and rating pages all day, so that’s exactly why we made this list an access point for some of Louisiana’s best car insurance companies.

Louisiana Car insurance Financial Rating by Provider

| Insurance Company | A.M. Best |

|---|---|

| A+ | |

| A | |

| A | |

| A++ | |

| A |

| A+ |

| A+ | |

| B | |

| A++ | |

| A++ |

The table above shows the financial strength ratings for Louisiana’s top ten major insurance companies. AM Best ratings are another way we measure a company’s financial strength. Geico, Travelers, and USAA have the highest A++ ratings.

As you can see, all of the companies have an AM Best rating of or higher except for State Farm, which has a B rating. All of them have decent loss ratio percentages, above 50 percent and below 100 percent.

Louisiana is lucky to have car insurance providers with high ratings from AM best. Customers and drivers go for the company with the highest rate as it shows their financial stability during claims.Kristen Gryglic Licensed Insurance Agent

Of course, it is normal to doubt yourself when making big decisions like this, but with the aid of these ratings from the trusted AM Best, drivers and policyholders can validate the company’s trustworthiness when it is most needed.

Car Insurance Companies and its Ratings

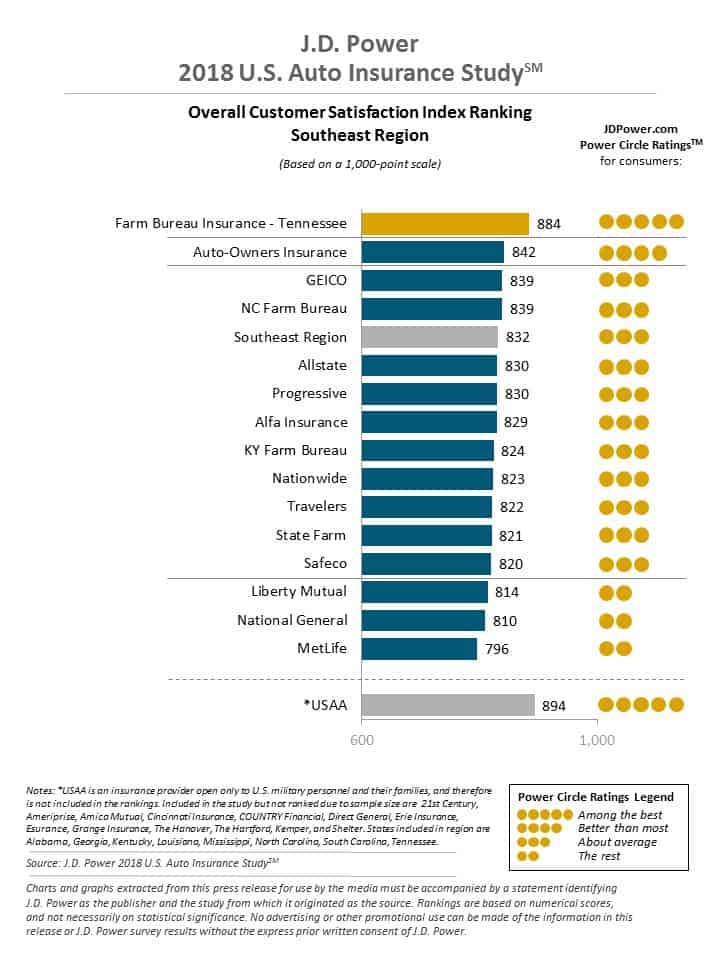

In 2018, J.D. Power conducted an overall satisfaction survey and ranked car insurance companies based on five key factors: interaction, policy offerings, price, billing process, policy information, and accident claims.

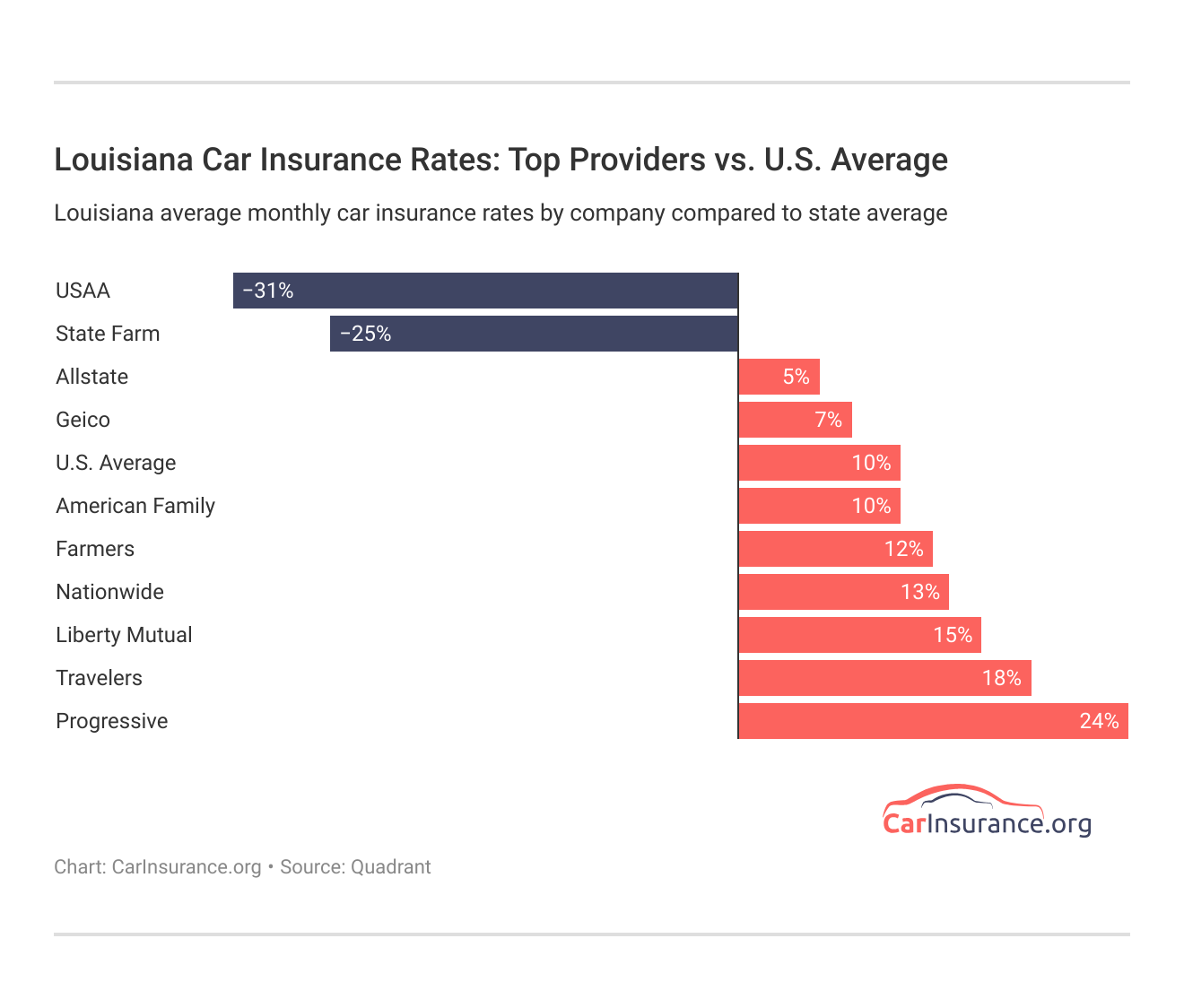

The image compares Louisiana car insurance rates by company to the state average. USAA and State Farm offer significantly lower rates, at 31% and 25% below the state average. In contrast, Allstate and GEICO have slightly higher rates (5% and 7% above average), while Progressive is the most expensive at 24% above the state average

With the exception of USAA (a company that services military members and their families), Farm Bureau Insurance of Tennessee was ranked number one in overall customer satisfaction.

Below is a graph of the number of insurers available in Louisiana, both domestic and foreign.

Total Number of Licensed Insurers in Louisiana

| Category | Count |

|---|---|

| Domestic Insurers | 34 |

| Foreign Insurers | 819 |

| Total Number of Licensed Insurers | 853 |

Domestic insurance laws are formed under the laws of the state of Louisiana. Foreign insurance laws are formed under the laws of the U.S. or any state in the U.S.

A domestic insurance company in louisiana must meet the minimum liability standards known as the 15/30/25 policy.

Car Insurance Minimum Coverage in Louisiana

Let’s get back to the basics: What is minimum coverage? Louisiana has the most expensive car insurance, with a minimum cost of $110.

Louisiana’s minimum liability insurance requirements are:

- $15,000 for bodily injury liability or death of one person in an accident caused by the driver of the insured vehicle

- $30,000 for total bodily injury liability or death liability in an accident caused by the driver of the insured vehicle

- $25,000 for property damage per accident caused by the driver of the insured vehicle

Therefore, the state requires a minimum policy worth $70,000. However, insurance experts agree that policyholders should purchase more than the minimum requirements to protect themselves financially.

Every driver in Louisiana must have minimum liability insurance coverage for their vehicle. Drivers can absolutely have more insurance than the minimum requirements. In fact, this is highly recommended because if you cause an accident and the damages surpass the insurance amount, you’ll need to pay out of pocket.

If you need coverage for the damages to your vehicle, you should buy full coverage, which includes comprehensive and collision insurance. This is particularly important if you have a loan or lease on your vehicle.Eric Stauffer Licensed Insurance Agent

Minimum liability car insurance is there to act as a safety net — you probably won’t die if you fall into it, but you’re going to have injuries. In the same way, minimum car insurance isn’t going to protect you from every possible cost out there.

Read more: How much insurance do I need for my car?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Form of Financial Responsibility

This is just a really fancy term for “proof of insurance.” Have you ever heard those words spoken by a police officer before? Louisiana law states that any time you are asked by a law enforcement officer to hand over your proof of insurance, you must comply.

Acceptable forms of proof of insurance are:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance card

If you drive without proof of insurance, you are breaking the law.

According to the Louisiana Department of Insurance, driving without insurance—or being involved in a crash without insurance—can result in a fine of $500 to $1,000, plus the suspension of driving privileges, impoundment of a vehicle, revocation of registration, or cancellation of license plates.

Moreover, if you drive without insurance in Louisiana, the state’s “No Pay, No Play” law may also prohibit you from collecting certain amounts after a car accident, even if the other driver is at fault; specifically:

- the first $25,000 in property damages

- the first $15,000 in personal injuries

Thus, friendly advice: Don’t drive without proof of insurance, and definitely don’t drive without insurance.

Car Insurance Percentage of Income as Premiums

Louisiana’s annual per capita disposable income was $58,845 in 2023. This is the average amount of money made by Louisiana residents.

Louisiana drivers paid an average of $2,883 for one year of car insurance, which is $240 monthly. This means drivers paid 5< percent of their total income directly to their car insurance company.

When we look at surrounding states like Texas, Arkansas, and Mississippi, Louisiana still has the highest cost for car insurance, but these state rates are close behind.

From 2022, Louisiana’s average car insurance rate has increased by about $30. However, we have prepared ways to make you save a dollar or more. Check out these car insurance discounts in Louisiana.

Car Insurance Discounts From Top Louisiana Providers

| Insurance Company | Bundling | Safe Driver | Multi-Vehicle | Defensive Driving | Accident-Free |

|---|---|---|---|---|---|

| 15% | 10% | 12% | 8% | 20% | |

| 12% | 8% | 10% | 6% | 18% | |

| 14% | 9% | 11% | 7% | 19% | |

| 20% | 15% | 18% | 10% | 22% | |

| 16% | 10% | 14% | 9% | 21% |

| 18% | 12% | 16% | 8% | 20% |

| 17% | 13% | 15% | 9% | 20% | |

| 13% | 8% | 10% | 7% | 18% | |

| 14% | 9% | 11% | 6% | 19% | |

| 22% | 18% | 20% | 12% | 25% |

The most known way for you to save is to avail yourself of the multi-policy discount, which allows you to bundle your insurance from car to home or life insurance. Of course, if this doesn’t seem to be of your liking, there is a long list of discounts you can explore. Explore more ways to lower your car insurance cost.

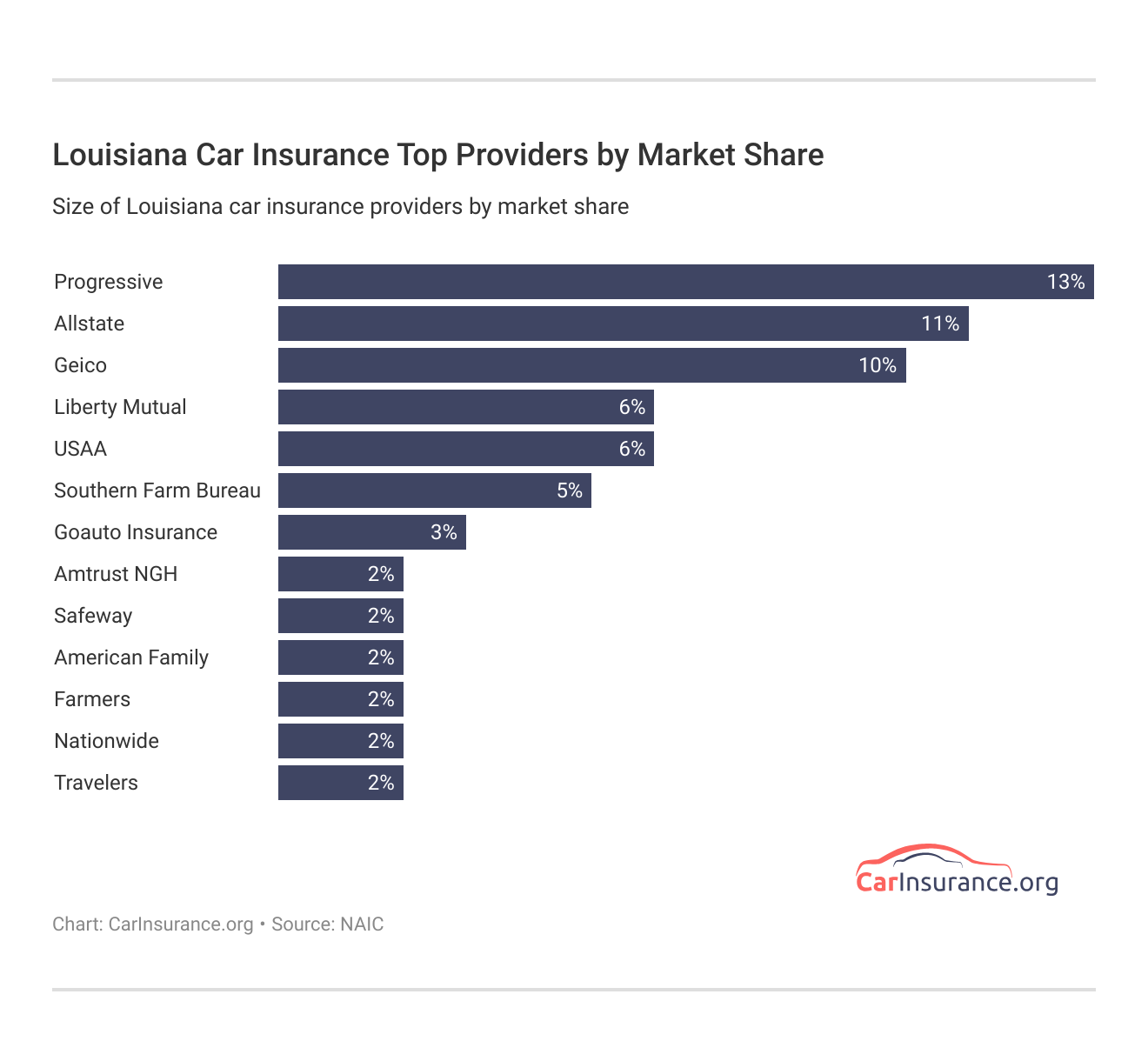

Cheapest Car Insurance Companies in Louisiana

The average cost for full coverage car insurance in Louisiana is $227 per month. These drivers pay more for car insurance than other states in the US.

Louisiana Car Insurance Monthly Rates by Top Provider vs. U.S. Average

| Insurance Company | Monthly Rate | U.S. Average | Percentage vs. U.S. Average |

|---|---|---|---|

| $500 | $24 | 5% | |

| $525 | $49 | 10% | |

| $510 | $34 | 7% | |

| $513 | $37 | 7% | |

| $540 | $64 | 12% |

| $515 | $39 | 8% |

| $623 | $147 | 24% | |

| $382 | -$94 | -25% | |

| $505 | $29 | 6% | |

| $363 | -$113 | -31% |

According to the list, USAA and State Farm Mutual are the affordable car insurance in Louisiana, with -25% and -31% rates compared to the state.

Discover more about the cheapest company in 2025.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Level Rates in Louisiana by Company

If you choose to carry more coverage than the minimum required, sometimes car insurance companies will lower your rate.

Louisiana Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| $432 | $509 | $559 | |

| $435 | $515 | $585 | |

| $455 | $535 | $640 | |

| $424 | $515 | $600 | |

| $450 | $530 | $610 |

| $440 | $520 | $590 |

| $516 | $617 | $734 | |

| $330 | $381 | $434 | |

| $430 | $510 | $580 | |

| $315 | $368 | $405 |

A few dollars difference in coverage rates can make a big difference in times of need. Check the affordable insurance in Louisiana for the most valuable options.

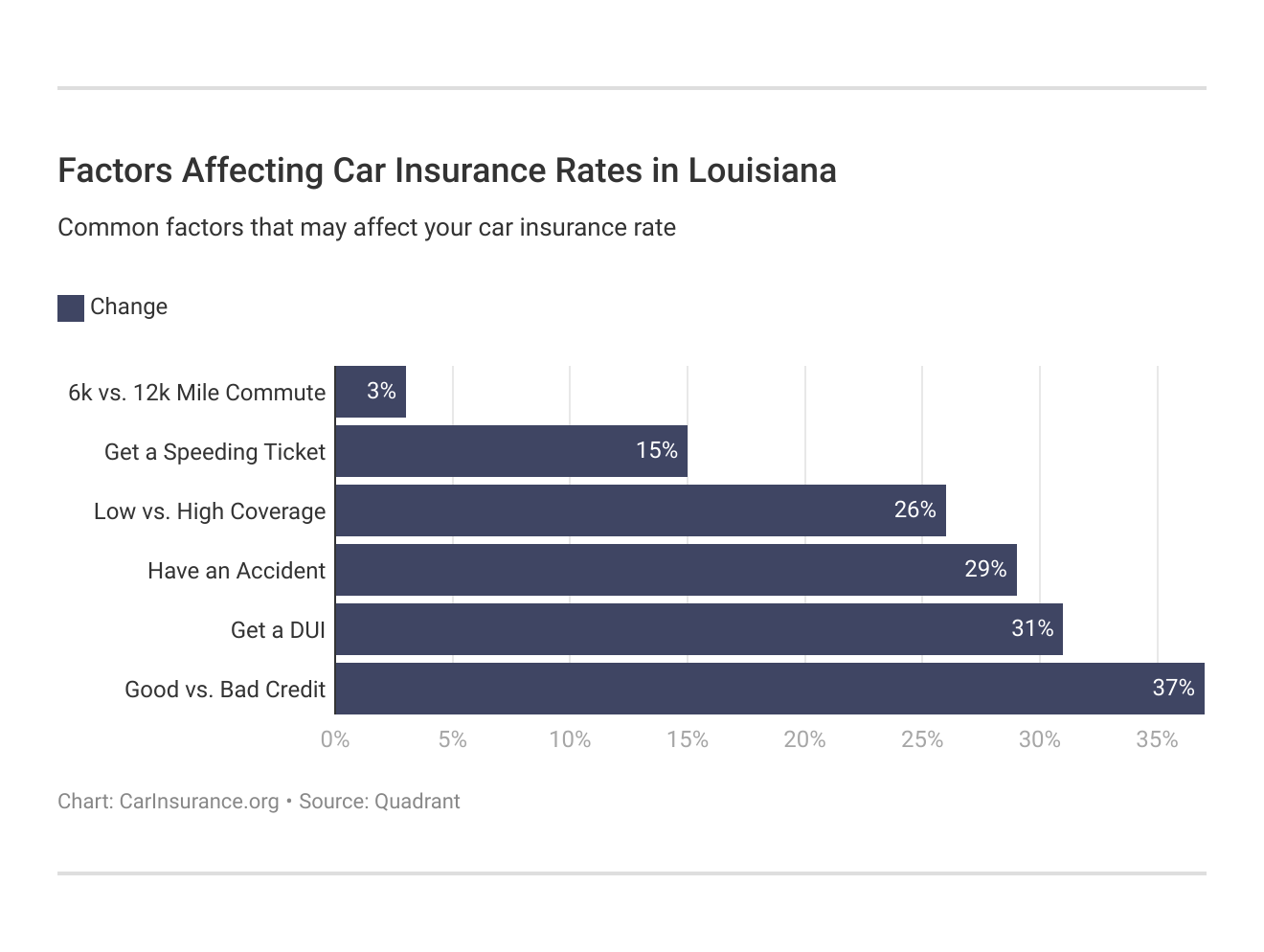

Credit History Rates in Louisiana by Company

Credit can also affect your car insurance rate. If you have poor credit, you will most likely pay hundreds to thousands of dollars more a year for your car insurance policy.

Louisiana Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $394 | $451 | $655 | |

| $410 | $470 | $650 | |

| $420 | $480 | $660 | |

| $399 | $529 | $610 | |

| $425 | $485 | $670 |

| $430 | $490 | $675 |

| $561 | $603 | $704 | |

| $275 | $341 | $529 | |

| $415 | $475 | $640 | |

| $267 | $320 | $501 |

Credit is indeed a strong factor in determining your car insurance rates. However, USAA and State Farm are the best car insurance for bad credit as they have lower costs than competitors. Of course, go for USAA if you fall under the exclusive policy. Moreover, having a poor credit history in Allstate can raise your rate by about three thousand dollars.

According to Experian, Louisiana has one of the lowest credit scores in the US. The average credit score in the U.S. in 2023 was 715. And Louisiana’s average credit score was 677. This puts Louisiana at 49th on the list of states with the lowest credit scores.

Read more: The factors that affect the car insurance rates

Commute Rates in Louisiana by Companies

Did you know how far you drive daily can affect your car insurance rate? Car insurance companies know that the more you drive, the more likely you will get into an accident.

Bad credit raises Louisiana car insurance rates by 37%, followed by DUIs (31%) and accidents (29%). High coverage (26%) and speeding tickets (15%) also increase costs, while commute distance has the least impact (3%).

Louisiana Car Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $480 | $500 | |

| $482 | $488 | |

| $508 | $525 | |

| $503 | $523 | |

| $517 | $538 |

| $492 | $500 |

| $623 | $635 | |

| $372 | $391 | |

| $475 | $483 | |

| $352 | $374 |

Most of these companies have pretty reasonable rates based on miles. If you drive a little farther each day, the rates are only a couple of hundred dollars more a year.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Record Rates in Louisiana by Company

This might be the number one factor car insurance companies care about. Your record reflects your behavior, and car insurance companies want to know if you are a safe or reckless driver.

Louisiana Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $396 | $465 | $602 | $537 | |

| $420 | $490 | $630 | $580 | |

| $425 | $495 | $635 | $590 | |

| $348 | $447 | $563 | $693 | |

| $410 | $485 | $625 | $590 |

| $415 | $490 | $630 | $600 |

| $519 | $607 | $696 | $669 | |

| $350 | $382 | $413 | $382 | |

| $430 | $505 | $645 | $610 | |

| $277 | $330 | $384 | $460 |

If you get just one speeding violation, your rates will likely increase by up to $1000 or more. Drinking and driving is against the law, but if you violate this law, be prepared to take a major hit on your car insurance rate.

Read more: Your Guide to your best car insurance.

Car Insurance Companies in Louisiana with Most Complaints

The data about company complaints below is from the NAIC.

Louisiana Car Insurance Complaint Ratios by Providers

| Insurance Company | National Median Complaint Ratio | Company Complaint Ratio 2023 | Total Complaints 2023 |

|---|---|---|---|

| 1 | 0.50 | 163 | |

| 1 | 0.65 | 98 | |

| 1 | 0.75 | 110 | |

| N/A | 0.007 | 6 | |

| 1 | 5.95 | 222 |

| 1 | 1.20 | 150 |

| 1 | 0.75 | 120 | |

| 1 | 0.44 | 1,482 | |

| 1 | 0.90 | 130 | |

| N/A | 0.00 | 2 |

Every company gets complaints—it’s inevitable. According to the survey, State Farm had the most complaints listed in 2023. However, what really matters is how a company handles a complaint; it has established a site to handle customers’ concerns.

The good thing is, not just in State Farm; every provider is solidifying the customer support system to carry out every concern with utmost urgency. You’ll know if the company sucks through different external ratings like J.D. Power and others.

Car Insurance Laws in Louisiana

Every driver in Louisiana must have car insurance—that’s non-negotiable. State laws have a considerable influence on car insurance. Each state determines the type of tort law and threshold, the type and amount of liability insurance required, and the system used for approval of insurer rates and forms.

Louisiana always uses what’s called “prior approval” when car insurance companies want to file a new law. But what does prior approval mean?

Prior Approval means that rates/forms must be filed with and approved by the state insurance department before they can be used. Approval can be by means of a deemer provision, which indicates approval if rates/forms are not denied within a specified number of days.

Read more: The basics of car insurance as a state policy

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Coverage in Louisiana

Unfortunately for Louisiana drivers, car insurance companies are not liable to pay for a broken windshield – even if someone breaks into your car and smashes it in the process.

However, some car insurance providers may include windshield coverage in a comprehensive plan. Here are some laws that may apply to this coverage:

- Non-OEM aftermarket crash parts allowed for replacement with written notice

- Max comprehensive insurance deductible is $250

According to the laws above, you might still be stuck paying a $250 insurance deductible when filing for windshield repairs through your insurance company.

High-Risk Car Insurance in Louisiana

Sometimes accidents are completely unavoidable, and that’s exactly why car insurance is an important investment to have. If you’re involved in an accident, or you cause one, you might have to get what is called high-risk auto insurance or SR22 insurance.

According to the DMV, SR-22 applies to high-risk drivers in Louisiana. It’s like an added protection to ensure that these drivers have enough insurance to cover damages for bodily harm or damages to the property of others. Drivers may need to purchase for a variety of reasons including:

- Accident Judgements: Drivers who are involved in an accident must enter into an installment agreement with the OMV. They must also maintain the SR-22 policy for three years from the date the installment agreement ends

- DWI Convictions: Motorists convicted for driving with a blood-alcohol level of .08 or above must purchase insurance for three years from the date of arrest

- Affidavit of Arrest: Drivers who refuse a blood alcohol test will be automatically arrested and will be required to maintain the insurance for three years following the date of arrest

- Notice of Violation: Drivers who fail to maintain minimum liability insurance must present evidence of insurance within three days of an accident, or they may receive notice of non-compliance

Drivers must maintain Louisiana SR-22 for three years. At that time, the SR-22 may be dropped, provided there was no coverage lapse.

Car Insurance for Low-income Program

There is not a government-assisted insurance program for families with low incomes; however, if you’re discouraged by this and you’re still looking to save a few bucks on your Louisiana car insurance policy, ask your provider if they carry these insurance discounts to lower your rates and if you are eligible for them:

- Multi-car discount

- Military Discount

- Veterans discount

- Homeowners discount

- Good driver discount

- Student Discount

California, New Jersey, and Hawaii are the only states in the U.S. with a government-assisted car insurance program.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Fraud in Louisiana

What is automobile insurance fraud?

According to the IIHS, insurance fraud can be “hard” or “soft.” Hard fraud occurs when someone deliberately fabricates claims or fakes an accident. Soft insurance fraud, also known as opportunistic fraud, occurs when people pad legitimate claims.

The IIHS also says that the Insurance Research Council reported that “Auto insurance fraud and claim buildup added between $4.9 billion and $6.8 billion to closed auto injury claim payments in 2007.”

Are you worried about getting caught in insurance fraud? Here is the complete guide for you to avoid committing car insurance fraud.

If you know someone who has committed insurance fraud or you need to contact the Louisiana State Insurance Department, you can visit their website at www.ldi.la.gov, follow them on Twitter @LAInsuranceDept, or give them a phone call at 1-800-259-5300.

Statute of Limitations

When filing claims, you can’t wait 20 years from the time of your accident to finally call up your insurance company and ask for a check to cover property damage and/or medical bills. The statute of limitations prevents this from happening.

According to Louisiana state law, you have one year from the date of your accident to file and resolve a claim for personal injury and property damage.

One year can fly by pretty fast, so if you’ve been in a recent accident, file your claim so you’re not stuck paying out of pocket for those medical and property damage liability expenses.

State-Specific Laws in Louisiana

Every state has its own set of weird driving laws. We thought we’d include those in this section.

Louisiana revised statute 32:300.4 states that it is: “unlawful for the operator or any passenger in a motor vehicle to smoke cigarettes, pipes, or cigars in a motor vehicle, passenger van, or pick-up truck, when a child who is required to be restrained in a rear-facing child safety seat, a forward-facing child safety seat, a booster seat, or a motor vehicle’s safety belt as required in R.S. 32:295 is also present in such vehicle, regardless of whether windows of the motor vehicle are down.”

Taxi drivers are prohibited from making love in the front seat of their taxi during their shifts.

These could also fall under the distracted driving incidents. Read more: The Dangers of Distracted Driving

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalties for Driving without Insurance in Louisiana

You should know by now that driving without car insurance is against the law in the state of Louisiana, and you will be facing some serious penalties if you do so.

The first time you are caught driving without car insurance, you’ll have to pay some serious green.

- Fine: $500 to $1000

- If in a car accident, the fine plus registration revoked and driving privileges suspended for 180 days

Let’s review what kind of proof of insurance is accepted in the state of Louisiana:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Picture of proof of insurance on your smartphone

Don't be complacent that you have car insurance, it doesn't stop there. Make sure you bring proof of insurance anytime you drive around, or you'll face fines; the least is an inconvenience in your routine.Travis Thompson Licensed Insurance Agent

Anytime a law enforcement officer pulls you over and requests to see your license, proof of insurance, and registration, you must hand it over. Failure to do so can result in your car being impounded, your license plates being removed, and a yellow sticker will be attached to your rear windshield. You have three days to provide proof of insurance.

As you can see, purchasing car insurance is usually a much cheaper option than not having car insurance. See how your car insurance impacts your future traffic citations.

Teen Driver Laws

In the state of Louisiana, you must be at least 15 years old to start driver’s education classes. However, there are legal requirements that must be met before turning 16 years old and getting a restricted driver’s license.

Look below at the chart for teenage driver laws.

Driver License Requirements in Louisiana

| Requirements | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 15 of which must be at night |

| Minimum Age | 16 |

| Required Driver’s Education | 30 hours classroom, 8 hours behind the wheel |

| Learner’s Permit Restrictions | Must be accompanied by a licensed adult (21+) or sibling (18+) |

| Intermediate License Restrictions | No driving between 11 PM - 5 AM unless accompanied by a licensed adult |

| Full License Age Requirement | Must be 17 years old with no violations for 12 months |

Here are some rules for teen drivers with restricted licenses.

Teen Driver Restrictions in Louisiana

| Restrictions | Details |

|---|---|

| Nighttime restrictions | 11 p.m. - 5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | No more than one passenger younger than 21 between 6 pm - 5 am; no passenger restriction from 5 am - 6 pm |

| Minimum age at which restrictions may be lifted - Nighttime restrictions | Until age 17 (min. age: 17) |

| Minimum age at which restrictions may be lifted - Passenger restrictions | Until age 17 (min. age: 17) |

| Cellphone use restrictions | Handheld and hands-free cellphone use prohibited for drivers under 18 |

| Seatbelt requirement | All passengers, including the driver, must wear seatbelts |

| Supervised driving requirement before full license | At least 50 hours of supervised driving, including 15 hours at night |

Teenage drivers in Louisiana are subject to restrictions, such as limitations on nighttime driving, limitations on passengers, and a prohibition on the use of cell phones by anybody under the age of 18. These are just the right things to avoid accidents.

Negligent Operator Treatment System (NOTS)

Negligent or “reckless operation” of a vehicle is a crime in Louisiana. The offense is defined as driving in a “criminally negligent or reckless manner.”

In other words, a person can be convicted of reckless driving for driving in a way that a reasonably careful person would know is dangerous.

In Louisiana, reckless driving of a vehicle is a misdemeanor. The possible penalties for a violation are:

- First offense: A first reckless operation conviction carries up to 90 days in jail and/or $200 in fines

- Repeat offense: For a second or subsequent reckless operation conviction, the driver faces ten days to six months in jail and/or $25 to $500 in fines

Motorists who are convicted of three reckless operation offenses within 12 months face a 24-month license suspension. Here is a complete manual of how to keep you and your car safe.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rules of the Road: Fault or No-fault State

As mentioned, Louisiana is an at-fault state. This means that if you cause an accident, you are fully responsible for covering the costs of damages and medical bills that result from that accident. You may have caused an accident that led to 25 people being injured and 16 cars being totaled. Guess what?

You’re still responsible one way or another.

This is exactly why it is highly recommended that you have more insurance than the minimum amount required. No one wants to pay for damages out of pocket.

Seat Belt and Car Seat Laws in Louisiana

Vehicle crashes are the leading cause of death for children and adults aged between 3-33 years old. Luckily, the proper usage of seat belts, child restraints, and/or car seats can protect you and your children in the event of a collision.

Are you aware of Louisiana’s seat belt and car seat laws? Louisiana wants drivers (and passengers) to be safe while on the road. If you are unsure of seat belt laws in Louisiana, look at the chart below.

Seat Belt Laws in Louisiana

| Seat Belt Laws | Details |

|---|---|

| Effective Since | July 1, 1986 |

| Primary Enforcement | Yes; effective 09/01/95 |

| Age/Seats Applicable | 13+ years in all seats |

| 1st Offense Max Fine | $50 plus fees |

| Penalty for Subsequent Offenses | $75 for second offense, $100 for third and subsequent offenses |

| Child Restraint Requirements | Children under 2: Rear-facing car seat; Age 2-4: Forward-facing car seat; Age 4-9: Booster seat; Age 9+: Seat belt |

| Exemptions | Vehicles manufactured before 1968, rural postal carriers, medical exemptions with physician certification |

Louisiana also wants small children to be safe while riding in a moving vehicle. Check out the Louisiana car seat laws below.

Car Seat Requirements in Louisiana

| Type of Car Seat Required | Age/Details |

|---|---|

| Rear-Facing Child Restraint | Younger than 2 years and until reaching the weight or height limit as set by the manufacturer must be in a rear-facing system |

| Forward-Facing Child Restraint | At least 2 through 3 years and until reaching the weight or height limit as set by the manufacturer must be in a forward-facing restraint |

| Child Booster Seat | At least 4 years through 8 years or until reaching the weight or height limit as set by the manufacturer must be in a booster |

| Adult Belt Permissible | 9 through 17 years; children who have outgrown the height or weight limits of the child booster seat as set by the manufacturer (effective 08/01/19) |

| Rear Seat Recommendation | It is recommended that children under 13 years old ride in the rear seat for maximum safety |

| Penalties for Non-Compliance | First offense: $100 fine; Second offense: $250 fine; Additional offenses may result in higher penalties |

Protect your little riders; if you don’t, you’re looking at paying a fine of $100 plus fees the first time you break one of these laws.

Another rule to pay attention to regarding riding in a vehicle:

It is against the law to ride in the cargo area of a pickup truck. Please note that insurance will not cover your claim if you have been in an accident while riding in the cargo area.

You will not be covered if the following applies:

- people 12 and older if the truck is being moved on a non-interstate highway

- parades moving less than 15 mph

- emergencies if the child is with an adult in the cargo area

- emergencies while moving on an interstate highway

Read more: How the seat belt have gotten cars safe in the years

The Keep Right or Move Over Laws

Let’s talk about keep right or move over laws in the state of Louisiana.

Left-lane driving is only allowed for passing or turning left. However, there are exceptions to this law. On multilane highways, keep right except to pass. Move right if blocking overtaking traffic.

Moreover, state law requires drivers approaching any stationary emergency vehicle, including tow trucks, displaying flashing lights, and traveling in the same direction, to vacate the lane closest if possible to do so or slow to a reasonably safe speed. These driving tips have smoothened the flow of traffic.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Speed Limit in Louisiana

The following information is pulled from the IIHS.

Below are the maximum speed limit laws for the state of Louisiana.

Speed Limit in Louisiana

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 65 mph |

| School Zones | 20 mph |

| Residential Areas | 25-30 mph (varies by locality) |

Moreover, speed limits are essentially established to establish safe driving and safe people on the roads.

Ridesharing Mechanics in Louisiana

Have you ever heard of ridesharing? Ridesharing insurance is required when you drive people around for your job for companies like Uber or Lyft.

If you are looking for ridesharing insurance in Louisiana, check out the following insurance providers:

- Allstate

- USAA

- Geico

- State Farm

Please keep in mind that some insurance companies may refuse to insure you if you are in the ridesharing business.

Automation on the Road in Louisiana

What is automation on the road?

According to the IIHS, automation involves using radar, cameras, and other sensors to perform parts or all of the driving tasks on a sustained basis instead of the driver. One example is adaptive cruise control, which continually adjusts the vehicle’s speed to maintain a set minimum following distance.

Features such as automatic braking, which acts as a backup if the human driver fails to brake, or blind-spot detection, which provides additional information to the driver, aren’t considered automation under this definition.

In addition, driving automation is not limited to vehicles that drive themselves without human interaction; it includes technologies that vary in technical capability.

Louisiana doesn’t currently have any laws about automation, but this might change soon as technology advances.

You can read more about the type of insurance and discounts best suited for different automated vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

DUI Laws in Louisiana

In the year 2020, there were 212 alcohol-related traffic fatalities. Similar to many other states, Louisiana has strict DUI laws.

DUI Laws in Louisiana

| Category | Details |

|---|---|

| Formal Name for Offense | Operating While Intoxicated (OWI) |

| BAC Limit | 0.08% |

| High BAC Limit | 0.15% |

| Criminal Status | 1st-2nd: Misdemeanor, 3rd: Felony, 4th+: Felony |

| Look Back Period | 10 years |

| Implied Consent Law | Yes, refusal results in license suspension |

| License Suspension for 1st Offense | 90 days |

| Mandatory Jail Time for 1st Offense | - BAC 0.08%-0.14%: Minimum 2 days or 32 hours community service |

| - BAC 0.15%+: Mandatory 48 hours | |

| Fines for 1st Offense | $300 - $1,000 |

| Ignition Interlock Device (IID) | Mandatory for offenders seeking a restricted license |

| Elimination of Waiting Period | Offenders can obtain a restricted license immediately upon IID installation |

Please see the chart below for the penalties for drinking and driving.

DUI Offenses and Penalties In Louisiana

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Community Service | Additional Penalties |

|---|---|---|---|---|---|

| 1st Offense | 1 year / hBAC 2 years | 48 hours in jail + up to 6 months OR fine; up to 2 years probation | $300-$1000 + $100 reinstatement fee | 32+ hours, half must be street garbage pickup | 30 hours reeducation |

| 2nd Offense | 2 years / hBAC 4 years | Minimum 15 days to 6 months | $750-$1000 + $200 reinstatement fee | Minimum 30 days | Reeducation requirements of 1st DWI, potential IID installation |

| 3rd Offense | 3 years | 1-5 years w/ or w/o hard labor | $2000 + $300 reinstatement fee | 30 days | Evaluation for addictive disorder, IID, probation and home incarceration for any part of suspended sentence |

| 4th Offense | Vehicle seized | 10-30 years, two years served w/o suspension or parole + home incarceration for at least 1 year | $5000 + $300 reinstatement fee | 40 days | Mandatory IID, extended home incarceration, possible lifetime driver's license revocation |

If you get caught drinking and driving a fifth time in Louisiana, the consequences will be the same as if it were your fourth offense.

These penalties aren’t inexpensive; don’t drink and drive. Every time you drink and drive, you risk your own life as well as other people on the roads and pedestrians. Read more about the dangers of driving under the influence and its impact on the pedestrians.

Marijuana-impaired Driving Laws

Currently, there are no laws about doing marijuana while driving, but this doesn’t mean you can’t be pulled over for driving under the influence.

Law enforcement officers can pull you over for what is called “impaired driving.”

If you are caught driving under the influence or driving while impaired, you could have to pay expensive fines and even face some jail time. If and when your insurance company gets wind of these charges, your car insurance rate will increase.Dani Best Licensed Insurance Producer

That is why you never risk yourself driving under the influence of this substance. Receiving fines, tickets, and violations are the fewer scenarios you could cause or involve yourself in an accident that will cost lives the worst. So, never ever drive unless you are in the clearest state of your mind.

Distracted Driving Laws

Technology has become a helpful tool, but it’s also been destructive – especially when it comes to distracted drivers and texting and driving. Look at the table below to learn more about distracted driving laws.

Cellphone Laws in Louisiana

| Hand-held Ban | Young Drivers All Cellphone Ban | Texting Ban | Enforcement | Penalty for First Offense | Penalty for Subsequent Offenses | Exceptions |

|---|---|---|---|---|---|---|

| Drivers in signed school zones; with respect to novice drivers | All novice drivers (under 18) | All drivers | Primary | Up to $500 fine | Up to $1,000 fine and possible license suspension | Emergency calls, reporting a crime, hands-free devices allowed |

IIHS requires all Louisiana learner’s permit holders, regardless of age, and all intermediate license holders are prohibited from driving while using a hand-held cellphone. Drivers younger than 18 are also prohibited from using any cell phone.

All drivers, irrespective of age, issued a first driver’s license are prohibited from using a cell phone for one year. The cellphone ban is secondary for novice drivers ages 18 and older.

Vehicle Theft in Louisiana

Did you know that some cars are more stolen than other cars?

Below is a list of vehicle car theft trends in the state of Louisiana. The year with the vehicle is just the most popular model year stolen.

Car Insurance Thefts in Louisiana by Make and Model

| Make/Model | Thefts in 2023 |

|---|---|

| Hyundai Elantra | 48,445 |

| Hyundai Sonata | 42,813 |

| Kia Optima | 30,204 |

| Chevrolet Silverado | 23,721 |

| Kia Soul | 21,001 |

| Honda Accord | 20,895 |

| Honda Civic | 19,858 |

| Kia Forte | 16,209 |

| Ford F-150 | 15,852 |

| Kia Sportage | 15,749 |

According to the table above, Hyundai Elantra, Hyundai Sonata, and Kia Optima are the most stolen vehicles in Louisiana.

If you've got the right kind of insurance and are or have been a victim of car theft, you shouldn't have to worry because your car should be replaced under the right auto insurance policy.Michael Vereecke Commercial Lines Coverage Specialist

This next list is pulled directly from the FBI. It shows the cities in Louisiana where vehicle theft occurs the most. See if you can find your city in the list below.

Vehicle Thefts in Louisiana by City

| City | Vehicle Thefts |

|---|---|

| Abbeville | 15 |

| Addis | 0 |

| Alexandria | 269 |

| Ball | 5 |

| Bastrop | 38 |

| Baton Rouge | 663 |

| Berwick | 2 |

| Blanchard | 1 |

| Bogalusa | 44 |

| Bossier City | 221 |

| Breaux Bridge | 19 |

| Broussard | 16 |

| Brusly | 2 |

| Bunkie3 | 0 |

| Carencro | 10 |

| Clarence | 0 |

| Clinton | 0 |

| Cottonport | 0 |

| Coushatta | 0 |

| Covington | 7 |

| Crowley | 91 |

| Denham Springs | 3 |

| De Quincy | 1 |

| De Ridder | 5 |

| Epps | 0 |

| Erath | 0 |

| Eunice | 15 |

| Farmerville | 5 |

| Ferriday | 5 |

| Fisher | 0 |

| Florien | 1 |

| Folsom | 0 |

| Franklin | 4 |

| Franklinton | 14 |

| French Settlement | 1 |

| Georgetown | 0 |

| Golden Meadow | 0 |

| Gonzales | 44 |

| Gramercy | 1 |

| Greenwood | 5 |

| Gretna | 24 |

| Hammond | 92 |

| Harahan | 9 |

| Haughton | 0 |

| Hodge | 0 |

| Houma | 56 |

| Ida | 0 |

| Independence | 10 |

| Iowa | 4 |

| Jena | 0 |

| Jennings | 11 |

| Kaplan | 3 |

| Kenner | 117 |

| Kentwood | 5 |

| Killian | 2 |

| Kinder | 4 |

| Krotz Springs | 4 |

| Lafayette | 379 |

| Lake Charles | 207 |

| Lake Providence | 1 |

| Leesville | 7 |

| Mandeville | 9 |

| Mansfield | 8 |

| Many | 0 |

| Marion | 0 |

| Marksville | 2 |

| Minden | 14 |

| Monroe | 224 |

| Morgan City | 26 |

| Natchitoches | 25 |

| New Orleans | 2,427 |

| Norwood | 0 |

| Oakdale | 4 |

| Oak Grove | 1 |

| Oil City | 1 |

| Olla | 1 |

| Opelousas | 50 |

| Patterson | 2 |

| Pearl River | 2 |

| Pineville | 46 |

| Plaquemine | 2 |

| Pollock | 1 |

| Ponchatoula | 16 |

| Port Allen | 8 |

| Port Vincent | 2 |

| Rayne | 0 |

| Ruston | 19 |

| Scott | 18 |

| Shreveport | 757 |

| Sibley | 0 |

| Slidell | 45 |

| Springhill | 0 |

| St. Gabriel | 6 |

| Sulphur | 53 |

| Thibodaux | 8 |

| Vidalia | 3 |

| Ville Platte | 3 |

| Vinton | 5 |

| Walker | 8 |

| Welsh | 2 |

| West Monroe | 52 |

| Westwego | 21 |

| White Castle | 0 |

| Wilson | 0 |

| Winnfield | 9 |

| Zachary | 39 |

Surprisingly, Baton Rouge had 663 incidents, which is good for those in Addis. Your motorcycle is safe. The good thing is that theft is covered in most car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Road Fatalities by Weather and Light Condition

Here are the summative numbers of fatalities at different times of the day in Louisiana.

Fatalities in Louisiana by Weather Conditions

| Weather Conditions | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 280 | 98 | 225 | 35 | 2 | 640 |

| Rain | 25 | 18 | 20 | 6 | 1 | 70 |

| Snow/Sleet | 2 | 0 | 0 | 0 | 0 | 2 |

| Fog/Smoke | 5 | 3 | 7 | 1 | 0 | 16 |

| Other | 3 | 5 | 10 | 1 | 4 | 23 |

| Unknown | 1 | 2 | 2 | 0 | 3 | 8 |

| TOTAL | 316 | 126 | 264 | 43 | 10 | 759 |

According to this list, most of these fatalities occurred in broad daylight without any weather conditions. A few occurred in the dark but lighted areas, and even fewer occurred at dawn.

Car Fatalities in Louisiana by County

This list and a few more below are pulled from the National Highway Traffic Safety Administration.

Fatalities in Louisiana by Counties

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| East Baton Rouge | 90 | 95 | 100 | 105 | 110 |

| Orleans | 50 | 55 | 60 | 65 | 70 |

| Caddo | 30 | 35 | 40 | 45 | 50 |

| Calcasieu | 25 | 30 | 35 | 40 | 45 |

| Tangipahoa | 20 | 25 | 30 | 35 | 40 |

| St. Tammany | 15 | 20 | 25 | 30 | 35 |

| Rapides | 20 | 25 | 30 | 35 | 40 |

| Lafayette | 15 | 20 | 25 | 30 | 35 |

| Jefferson | 10 | 15 | 20 | 25 | 30 |

| Livingston | 10 | 15 | 20 | 25 | 30 |

The trend of the number of fatalities since 2019 is increasing, with 5 incidents each year.

Are traffic fatalities more likely to happen in rural environments or in the city?

Fatalities in Louisiana by Traffic

| Area | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Rural | 369 | 389 | 410 | 395 | 380 |

| Urban | 390 | 405 | 420 | 410 | 400 |

| Total Fatalities | 759 | 794 | 830 | 805 | 780 |

Usually, more fatalities happen in rural environments because it takes longer for an emergency service to get to a victim. However, some cities have a higher fatality rate because there are more cars on the road, which means more fatal accidents are likely to occur, resulting in a higher fatality rate.

Below is the list of fatalities by person type in four consecutive years.

Fatalities in Louisiana by Person Type

| Person Type | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Light Truck - Other | 1 | 1 | 2 | 2 |

| Other/Unknown Nonoccupants | 4 | 5 | 5 | 6 |

| Other/Unknown Occupants | 13 | 14 | 15 | 16 |

| Light Truck - Van | 18 | 20 | 22 | 25 |

| Bicyclist and Other Cyclist | 28 | 30 | 32 | 35 |

| Large Truck | 37 | 40 | 45 | 50 |

| Light Truck - Utility | 85 | 90 | 95 | 100 |

| Total Motorcyclists | 104 | 108 | 115 | 120 |

| Pedestrian | 130 | 140 | 150 | 160 |

| Total Nonoccupants | 162 | 175 | 187 | 201 |

| Light Truck - Pickup | 155 | 162 | 170 | 178 |

| Passenger Car | 270 | 285 | 295 | 310 |

| Total Occupants | 579 | 612 | 644 | 681 |

| Total | 845 | 895 | 946 | 998 |

Accidents involving roadway departures have resulted in the most traffic fatalities in Louisiana. As you can see, the trend has been upward since 2019 involving different vehicles.

Fatalities in Louisiana by Crash Type

| Crash Type | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Involving a Large Truck | 118 | 126 | 134 | 145 |

| Involving an Intersection (or Intersection Related) | 163 | 175 | 188 | 200 |

| Involving Speeding | 192 | 205 | 215 | 225 |

| Involving a Rollover | 230 | 245 | 260 | 275 |

| Involving a Roadway Departure | 478 | 510 | 535 | 560 |

| Single Vehicle | 485 | 510 | 540 | 570 |

| Total Fatalities (All Crashes) | 845 | 895 | 946 | 998 |

A single vehicle has the most fatalities, with 285 in 2019 and 570 in 2022. Other vehicles, though lesser in number, still follow an increasing trend throughout the years.

Car Fatalities Trend in Louisiana

Here’s the five-year traffic fatality trend for the top ten largest counties in Louisiana. The highest number is from East Baton Rouge Parish, with 85 fatalities in 2022. While Terrebonne Parish, Ascension Parish, and Jefferson Parish have the smallest numbers from 31 to 40 numbers in 4 years.

Fatalities Trend in Louisiana by Counties

| County | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Terrebonne Parish | 33 | 35 | 37 | 40 |

| Ascension Parish | 31 | 33 | 35 | 38 |

| Ouachita Parish | 32 | 35 | 37 | 40 |

| St. Tammany Parish | 34 | 37 | 39 | 42 |

| Jefferson Parish | 32 | 34 | 36 | 39 |

| Calcasieu Parish | 42 | 45 | 48 | 50 |

| Caddo Parish | 40 | 42 | 45 | 48 |

| Tangipahoa Parish | 37 | 40 | 42 | 45 |

| East Baton Rouge Parish | 70 | 75 | 80 | 85 |

| Orleans Parish | 50 | 55 | 58 | 60 |

Speeding is another major factor when it comes to traffic fatality rates. Below are the counties and a 5-year trend of fatalities in speeding. As you can see, East Baton Rouge still had the most number of fatalities.

Fatalities in Louisiana by County Involving Speeding

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Ascension | 5 | 7 | 10 | 8 | 6 |

| Caddo | 18 | 20 | 24 | 22 | 19 |

| Calcasieu | 15 | 18 | 22 | 20 | 17 |

| East Baton Rouge | 25 | 30 | 35 | 32 | 28 |

| Jefferson | 7 | 10 | 15 | 12 | 9 |

| Lafayette | 8 | 11 | 16 | 13 | 10 |

| Livingston | 5 | 8 | 12 | 10 | 7 |

| Orleans | 20 | 22 | 27 | 24 | 21 |

| Ouachita | 6 | 9 | 13 | 11 | 8 |

| Rapides | 9 | 12 | 17 | 14 | 11 |

| St. Tammany | 10 | 13 | 18 | 15 | 12 |

| Tangipahoa | 12 | 15 | 20 | 18 | 14 |

Moreover, drunk driving is another horrible thing that claims the lives of thousands of Americans each year. Louisiana has one of the highest alcohol-impaired fatality rates in the country. Sadly, the data shows that East Baton Rouge still had the most numbers in the past 5 years.

Fatalities in Louisiana by County Involving an Alcohol-Impaired Driver

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Ascension | 5 | 8 | 11 | 9 | 7 |

| Caddo | 20 | 22 | 26 | 24 | 21 |

| Calcasieu | 18 | 21 | 25 | 23 | 19 |

| East Baton Rouge | 30 | 35 | 40 | 38 | 33 |

| Jefferson | 8 | 11 | 16 | 13 | 10 |

| Lafayette | 9 | 12 | 17 | 14 | 11 |

| Livingston | 6 | 9 | 13 | 11 | 8 |

| Orleans | 25 | 28 | 33 | 30 | 26 |

| Ouachita | 7 | 10 | 14 | 12 | 9 |

| Rapides | 10 | 13 | 18 | 15 | 12 |

| St. Tammany | 12 | 15 | 20 | 18 | 14 |

| Tangipahoa | 15 | 18 | 22 | 20 | 17 |

According to responsibility.org, in 26 states and D.C., under-21 alcohol-impaired driving fatalities per 100,000 population were at or below the national average of 1.2 deaths per 100,000 population.

Under 18 DUI Arrests In Louisiana

| Category | Value |

|---|---|

| Number of Under 18 DWI Arrests | 32 |

| Total Per One Million People (DUI Under 18 Arrests) | 28.73 |

| Rank | 45 |

| Statewide Percentage of All DUI Arrests | 1.2% |

| Yearly Change in Under 18 DUI Arrests | -5.6% |

| National Average Per One Million People (DUI Under 18 Arrests) | 34.5 |

Louisiana’s average is slightly above the national average at 1.3 alcohol-impaired driving fatalities per 100,000 population. Louisiana is ranked 45th in the U.S. for under-18 DUI arrests.

Please don’t drink and drive. Every time you choose to disregard this law, you risk your life and the lives of other drivers on the road. Read more: Common risk faced by Teen Drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

EMS Response Time

Arriving seconds too late or seconds early can often mean the difference between life and death when it comes to EMS response time.

EMS Response Times in Louisiana by Area

| Area | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to EMS Arrival at Hospital | Time of Crash to Hospital Arrival | Total Fatal Crashes | Average Hospital Transport Distance | Survival Rate (%) | Availability of Advanced Life Support (ALS) |

|---|---|---|---|---|---|---|---|---|

| Rural | 6 mins | 14.32 mins | 46.13 mins | 61.82 mins | 325 | 25 miles | 78% | Limited |

| Urban | 4.19 mins | 8.92 mins | 32.77 mins | 44.29 mins | 370 | 10 miles | 85% | High |

Don’t be discouraged by these numbers, even though they seem high. Usually, it takes a little longer to reach a victim in a rural area than it does to reach one in an urban area because cities are more populated with EMS services.

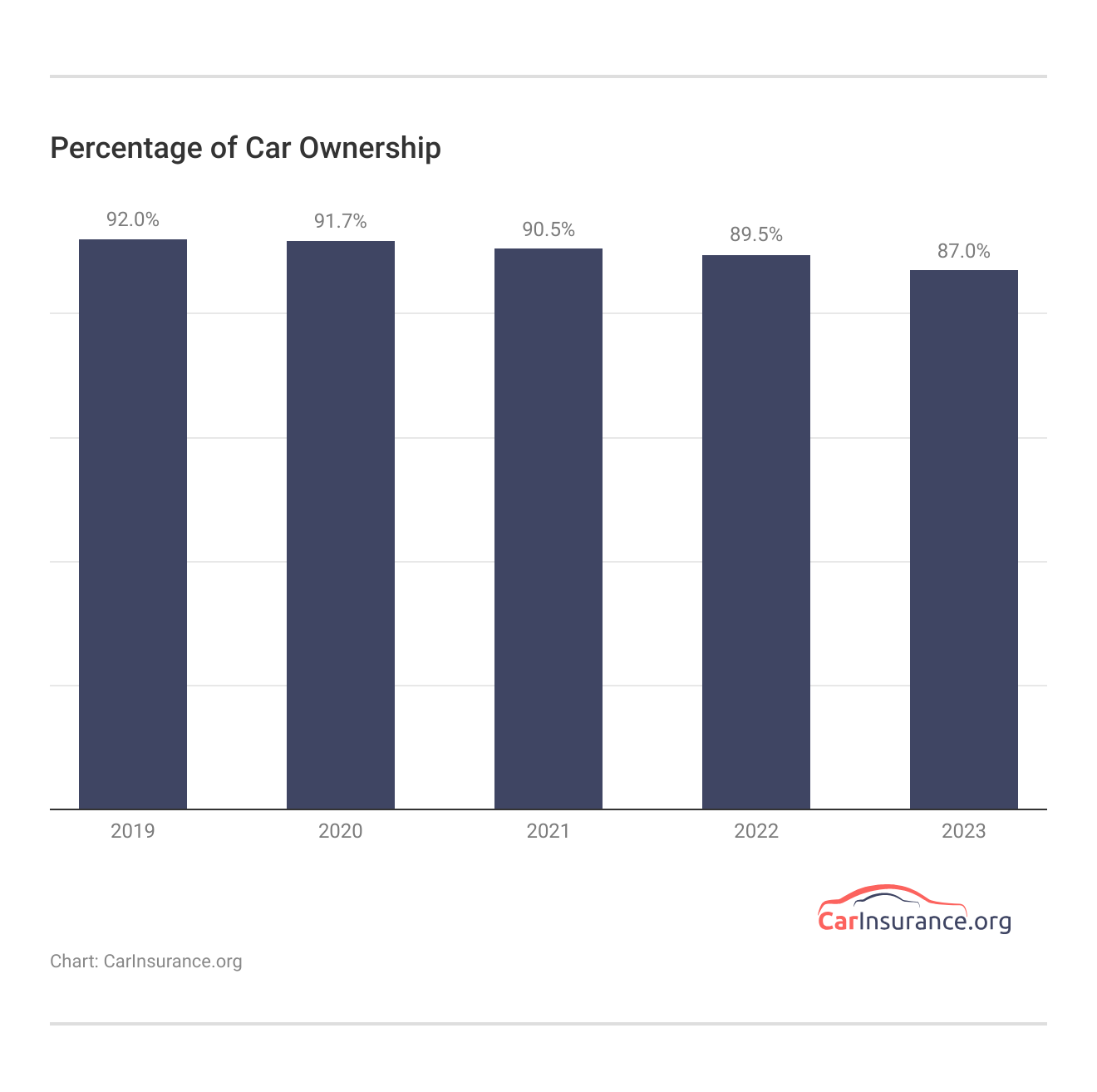

Percentage of Car Ownership in Louisiana

According to Data USA, Louisiana residents own an average of two cars. The data shows a slight difference in car ownership between Louisiana and the U.S.

The trend of car ownership declined from 2018 to 2023. Did the people in the U.S. decide not to own a car for the coming years? Perhaps they are just confused about what factors to consider. Here is everything you need to know about buying a car.

We hope this helps you decide on the best car insurance in Louisiana, tailored to your needs. Get your quotes in just a few clicks by just entering your ZIP code.

Frequently Asked Questions

How much is car insurance in Louisiana per month?

The cost of car insurance in Louisiana starts at $26 and goes up to $274 for full coverage.

What disqualifies you from getting an insurance license in Louisiana?

Suppose you have a history of regulatory infractions, unresolved criminal charges, a felony conviction, falsified facts, or a bad credit or financial background. In that case, you may not be able to obtain an insurance license in Louisiana.

Which insurance cover is best for car?

Your demands will determine the best type of auto insurance, but full coverage, which covers comprehensive, collision, and liability insurance, provides the highest level of protection. It includes coverage for weather damage, theft, accidents, and more. Liability-only coverage satisfies legal requirements but offers little protection for drivers on a tight budget. Get extensive details on insurance quotes and tips.

Why is Louisiana car insurance high?

Louisiana has expensive car insurance because of the state’s high accident rate, frequent severe weather, and many uninsured drivers. High claim payouts and expensive litigation are other factors that drive up premium costs. Theft and fraud rates are considerably greater in urban places like New Orleans, which raises expenses even more.

How much does it cost to get an insurance license in Louisiana?

In Louisiana, obtaining an insurance license costs between $129 and $167, which includes application, fingerprinting, and exam fees.

Does Allstate cover Louisiana?

Yes, Allstate car insurance coverage offers a range of policy options and add-ons for car insurance coverage in Louisiana. Other companies like Farmers, Liberty Mutual, and AAA auto insurance in Louisiana also are available.

Why is Louisiana insurance going up?

Louisiana’s escalating insurance premiums are due to many accident claims, frequent severe weather events, litigation, and repair costs.

How to lower car insurance in Louisiana?

To lower car insurance in Louisiana, compare quotes, bundle policies, increase your deductible, maintain a clean driving record, ask about discounts, and consider liability-only coverage for older cars.

How long can you go without car insurance in Louisiana?

According to the state legislature, it is illegal to drive in Louisiana without auto insurance. If you let your insurance lapse, you must promptly renew it to prevent fines or license suspension.

How long is a Louisiana insurance license good for?

An insurance license issued in Louisiana is good for two years. It must be renewed before expiration to remain active.