How to Get a Car Out of Impound in 2026 [5 Simple Steps]

To get a car out of impound, costs generally range from $100 to $1,000, depending on the location and storage duration. Begin by locating your car, gathering documents, paying fees, confirming no legal holds, and picking up your car. Knowing how to get a car out of impound simplifies the process and avoids delays.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated June 2025

How to get a car out of impound can cost between $100 and $1,000, depending on location, towing fees, and storage time. To reclaim your vehicle, you’ll need your driver’s license, proof of insurance, and payment for all fees. Understanding how car insurance works can help you prepare if insurance issues were a reason your car was impounded.

This guide explains the five essential steps for getting a car out of impound, including locating your vehicle, gathering documents, and checking for legal holds. You’ll also learn what to expect with impound fees and how to avoid delays in the process.

- Step #1: Locate Your Vehicle — Find out which lot your car is in

- Step #2: Gather Documents — Bring ID, title, and proof of insurance

- Step #3: Pay Fees — Cover towing and storage charges

- Step #4: Clear Legal Holds — Settle any tickets or violations

- Step #5: Pick Up Vehicle — Retrieve your car from the impound lot

Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

5 Steps to Get a Car Out of Impound

Getting your car out of impound can be a stressful experience, but following the right steps can make the process smoother. From locating your vehicle to paying the necessary fees, here’s a quick guide to help you reclaim your car efficiently.

Step #1: Locate Your Vehicle

Your first priority is to determine exactly where your vehicle is and why it was towed. Contact your local police department’s non-emergency line or use an online impound lookup tool (if available in your city or county) to verify that your car has been impounded and to get the details you’ll need to proceed.

When you call, be sure to ask for the following:

- The name, address, and phone number of the impound lot where your vehicle is being held

- The lot’s hours of operation are to ensure you arrive during business hours

- The reason your car was impounded (e.g., illegal parking, expired registration, involvement in an accident) may affect any legal or procedural steps required for release

- A reference or case number tied to the impound can help streamline further communication

- A breakdown of the total impound fees due, so you can prepare for payment—this typically includes towing, daily storage charges, and possibly administrative fees

Confirming these details early on helps you avoid unnecessary delays and surprises during the recovery process. Having the exact location, operating hours, and impound charges allows you to plan ahead and bring the correct documents and payment. This preparation makes picking up your vehicle quicker and less stressful.

You’ll need insurance to get a car out of impound. Same-day policies can help, but they often cost more.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Understanding the cost to get your car out of impound and ensuring you meet all necessary requirements, such as proof of impound insurance if applicable, will make the process smoother.

Read more: Safe Driving Tips: How to Keep Your Insurance and Car Safe

Step #2: Gather Necessary Documents

To ensure a smooth process when picking up your vehicle from the impound lot, make sure you have the following documents prepared:

- Proof of Insurance: Verifies your vehicle is insured or indicates new coverage if impounded for lack of insurance.

- Driver’s License: Authenticates your identity so that you can claim the vehicle.

- Vehicle Title: Proves legal ownership of the car.

- Vehicle Registration: Ensures your vehicle is properly registered in your name.

If someone else is picking up your vehicle on your behalf, they must present a Power of Attorney or written authorization from you.

Having all the required documentation in hand will ensure you can pay the impound cost and retrieve your car promptly. If your car was impounded with no insurance, additional steps, such as providing proof of new insurance coverage, may be necessary before the car can be released. Be prepared to handle any related fees or documentation to avoid delays in the process.

Learn more about why you need car insurance to understand how it protects you and ensures you can recover your impounded vehicle without added complications.

Step #3: Pay the Impound Fees

Once you’ve confirmed where your car is held and gathered the necessary documents, the next step is to pay all outstanding fees to recover your vehicle. These fees vary based on your location, the reason for the tow, and the type of vehicle you drive—but they can add up quickly, so it’s important to act fast.

Typical impound-related charges include:

- Towing Fee: $250 or more. Additional mileage or flatbed fees may apply if your vehicle is undrivable.

- Impound/Administrative Fee: Often $75 or more, depending on the city or towing company.

- Storage Fee: $100 or more per day. The longer your car remains impounded, the higher the bill.

- Release Fee: $20 or more per day in some jurisdictions.

In some states, such as Hawaii, towing fees are legally capped at $65, while certain California cities limit release fees to $130. However, in most areas, impound lots have the flexibility to charge additional fees for oversized vehicles or extended storage times.

What to know before you arrive at the impound lot:

- Request a Full Breakdown of Fees: This ensures you’re prepared for all costs.

- Verify Accepted Payment Methods: Most lots accept credit or debit cards, but some may require cash or certified checks.

- Ask About Payment Options: A few locations may allow online or phone payment—helpful if someone else is authorized to retrieve your vehicle.

- Retain Receipts: Keep proof of all payments, especially if you plan to file an insurance claim.

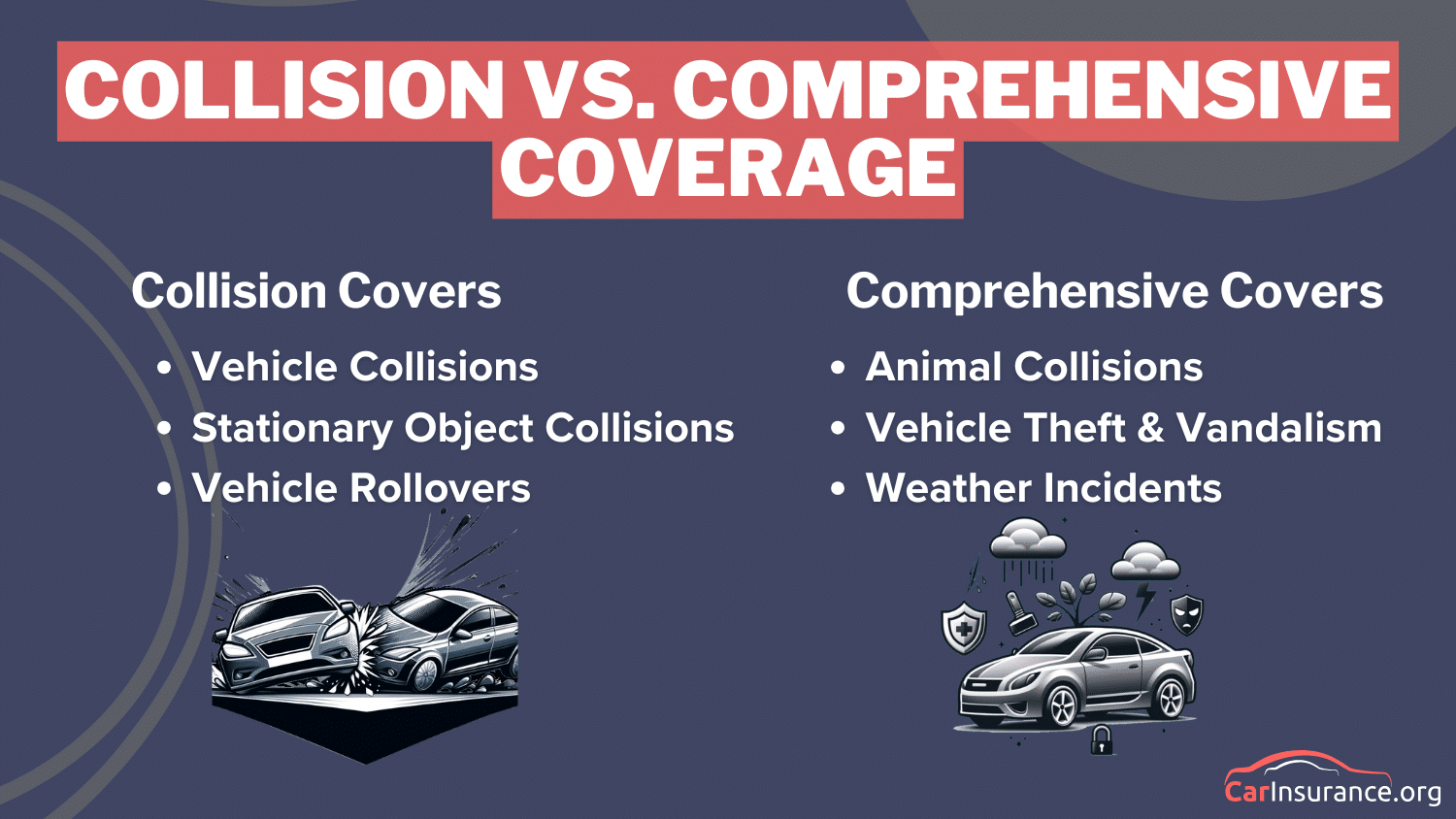

If your car was stolen and later impounded, you are still liable for the fees. However, comprehensive insurance coverage may cover these costs if you file a claim related to auto theft.

Understanding these potential fees ahead of time, along with the types of car insurance coverage available, allows you to avoid costly delays and retrieve your car more efficiently.

Step #4: Ensure There Are No Legal Holds

Before heading to the impound lot, confirm that there are no outstanding legal or administrative holds that could delay or prevent the release of your vehicle. Even if you’ve already paid the car impound cost and gathered all required documents, your vehicle may still be held due to unresolved legal issues or agency restrictions.

Common reasons for legal or administrative holds include:

- Police Evidence Hold: The vehicle is retained due to its involvement in an investigation or pending legal case.

- Court-Ordered Restrictions: Unpaid fines, active warrants, or court-imposed sanctions can block the release.

- DMV or Registration Suspension: Lapsed registration, emissions violations, or a suspended license may require DMV clearance.

- Insurance Compliance Hold: If your vehicle was impounded for no insurance, some states require proof of impounded car insurance before release.

To avoid unnecessary delays, contact the police department, local court, or DMV to ask whether a release authorization or clearance form is needed. This is a key step in understanding how to get a car out of impound without added complications.

Being proactive about these legal or administrative issues can help you avoid additional storage fees and retrieve your vehicle as soon as possible—especially when calculating the total car impounded by police cost.

Read more: Distracted Driving [Must Know Facts + Statistics]

Step #5: Pick Up Your Vehicle

Once you’ve paid all impound fees, cleared any legal holds, and presented the required documentation, the impound lot will authorize the release of your vehicle. Before leaving, take time to carefully inspect your car for any damage or missing items. Document the vehicle’s condition with photos or video while still on the lot, and compare it to prior records if available.

Be sure to:

- Request a final itemized receipt that details all charges you paid. This may be necessary for car insurance claims or reimbursement.

- Verify that all personal belongings are still in the vehicle. If anything is missing or damaged, report it to the lot staff immediately and file a written complaint if needed.

- Confirm that the vehicle is roadworthy before driving off. If your car was inoperable when towed or suffered damage during impound, consider having it towed to a repair shop instead of driving it away.

- Check the paperwork provided upon release, including proof of release or clearance documentation. You may need this if your car was held due to legal or DMV issues.

Leaving the impound lot is not just about reclaiming your vehicle—it’s your opportunity to ensure nothing has gone wrong during the holding period.

Comprehensive insurance may cover impound damages, but only if you document problems right away.Eric Stauffer Licensed Insurance Agent

A thorough review protects you from future disputes and gives you peace of mind after a stressful experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Reasons for Vehicle Impoundment and What to Expect

Vehicles get towed and impounded for several reasons. Illegal parking is one of the most common reasons cars get towed, but driving without insurance can also get your car impounded.

Currently, 22 states have towing and impound laws that dictate when a car can be towed, seized, and impounded. Reasons why cars get impounded include:

- Driving with no license

- Driving without insurance

- Driving while intoxicated

- Refusing to take a sobriety test

If the police impound your vehicle for any of the reasons above, you will not be able to recover your vehicle right away. Some state laws require drivers to wait between 30 and 90 days before getting their cars out of impound.

Impound lots charge daily storage fees, which are listed above. If your vehicle remains in impound for 30 days or more, and you cannot pay the fees, the impound lot may auction off your vehicle.

Read more: How Much is a Ticket for Driving Without a License?

Car Impound Effects on Insurance Rates by Violation

The act of impounding your vehicle will not raise your car insurance rates, but the reason your car got impounded can raise your rates.

For example, parking illegally is a minor traffic violation and will not raise your rates, even if your vehicle gets towed. However, if the police impound your vehicle after reckless driving or driving under the influence, your insurance rates will skyrocket. Take a look at the table below to see how car insurance rates vary by driving record:

Car Insurance Monthly Rates by Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

One speeding violation can raise your rates by $500 a year with most companies, but a DUI will double your rates with every insurer. If you’re facing car insurance quotes like these, we recommend comparing car insurance by company to find the cheapest quotes.

How to Get a Car Out of Impound: A Quick Guide to Reclaim Your Vehicle

To know how to get a car out of impound means understanding the necessary steps and having the right documents. Start by locating your vehicle through your local police department or an impound lot search tool.

To release your car, you’ll need your driver’s license, proof of ownership, and valid auto insurance. If your insurance has lapsed, you must secure coverage before the vehicle can be released.

After gathering your documents, be prepared to pay all necessary fees, including towing, storage, and administrative costs, which can add up quickly. It’s also important to resolve any outstanding legal holds, such as unpaid tickets, before pickup.

Following these steps not only simplifies the process of reclaiming your car but also underscores the importance of knowing how much insurance you need for your car and staying current on local vehicle regulations.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Frequently Asked Questions

How much does it cost to get your car out of impound?

The cost to get your car out of impound depends on various factors, such as the location, reason for impoundment, and how long your car has been held. On average, impound fees range from $100 to $500 or more, with additional storage charges that can accumulate daily.

Police impounded my car. How do I get it back?

To retrieve your car from a police impound, you will need to pay the impound fees and provide necessary documentation such as proof of ownership, insurance, and a valid ID. In some cases, you may need to go to court first if your car was impounded for legal reasons.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

Can your car get towed for no insurance?

Yes, your car can be towed if you’re driving without insurance, especially if you’re stopped by law enforcement. In many states, driving without insurance is a legal violation that can result in fines, license suspension, and towing. You should also be aware of other driving restrictions, such as whether you can drive by yourself with a permit.

How much does it cost if your car gets towed?

The cost of getting your car towed varies widely depending on your location and the reason for the tow. Typically, towing fees range from $75 to $200, with additional fees for storage and other administrative charges.

How can I get my car out of police impound for free?

It’s generally difficult to get your car out of police impound for free. However, some circumstances may warrant a fee waiver, such as improper towing or errors in documentation. You will need to contact the impound lot or the local police department to discuss your situation.

How to get a car out of impound without registration?

Retrieving a car from impound without registration can be challenging. In most cases, you’ll need to provide proof of ownership, such as a bill of sale, and possibly a court order. Contact the impound lot or local authorities to understand the specific requirements in your area.

Read more: Does Your Car Insurance and Registration Need to Be Under the Same Name?

How much does a 30-day impound cost?

A 30-day impound can cost several hundred dollars, depending on the location. The daily storage fees are typically between $20 and $40, so you may end up paying anywhere from $600 to $1,200 or more for a full month of storage.

How do I find an impounded car?

To find an impounded car, contact the local police department or the impound lot. Many municipalities have online databases where you can search for your car by license plate number or vehicle identification number (VIN).

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code into our free comparison tool to get started.

Can I get my car towed without insurance?

If you’re driving without insurance, your car can be towed, especially if you’re pulled over and issued a traffic citation for another violation. Some states require proof of insurance before your vehicle can be released from impound, while others may allow you to retrieve it without insurance if other documentation is provided.

How much does it cost per day to have your car impounded?

The daily cost of impound storage can range from $20 to $50, depending on your location and the type of vehicle. Some impound lots may charge higher rates for larger or more expensive vehicles.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.