Dollar-a-Day Car Insurance in 2026 [New Jersey SAIP]

Dollar-a-day car insurance is a New Jersey state government program called the Special Automobile Insurance Policy (SAIP) that helps low-income drivers on Medicaid get coverage for about one dollar a day. Find out how you could get auto insurance for only a dollar a day below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated August 2025

New Jersey’s Special Automobile Insurance Policy (NJSAIP), also known as dollar-a-day car insurance, is a state program that helps low-income drivers on Medicaid access limited auto insurance coverage for about $1 a day.

Learn More: Best Car Insurance in New Jersey

It’s not a comprehensive policy, but it offers some medical coverage for accidents. Many people use it as a stopgap until they can afford a regular plan.

- Low-income Medicaid recipients can get New Jersey’s dollar-a-day insurance

- It covers $250K for brain and spinal injuries and a $10K death benefit

- California and Hawaii offer government auto insurance for low-income

In this article, we’ll explain what it covers, who qualifies, and how to apply. Enter your ZIP code to compare free car insurance quotes and find affordable dollar-a-day insurance options in your area.

Dollar-a-Day Car Insurance in New Jersey

Dollar-a-day car insurance refers to New Jersey’s Special Automobile Insurance Policy (NJSAIP), also known as “dollar insurance.” This program offers cheap car insurance for low-income drivers who qualify for Medicaid in New Jersey.

New Jersey’s SAIP insurance policy costs $365 a year or $360 if you pay in full upfront.

Often called “NJ $1 a day car insurance,” SAIP is designed for New Jersey drivers at risk of driving without coverage due to financial struggles.

It doesn’t cover damage you cause to others or their property, leaving major gaps since it doesn’t meet New Jersey’s liability requirements. It’s best viewed as a last-resort safety net, not a complete insurance policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Dollar-a-Day Car Insurance Covers

Dollar-a-day car insurance only covers emergency treatment for the policyholder immediately after an accident and additional medical treatment for critical brain and spinal cord injuries up to $250,000. There is also a $10,000 death benefit paid out to the policyholder’s family should they die in a collision.

Read More: How Car Insurance Works

To qualify for New Jersey dollar-a-day insurance, you must be enrolled in Medicaid with hospitalization coverage. Not all Medicaid plans qualify, so check with an insurance producer to verify your eligibility using your Medicaid ID number.

New Jersey’s SAIP policy doesn’t meet state minimum requirements since it lacks liability coverage for injuries or property damage you cause.Michelle Robbins Licensed Insurance Agent

The key benefit of dollar-a-day car insurance is its affordability, making it a viable option for low-income drivers or those who need immediate coverage (check out cheap insurance companies that only look back 3 years). However, it usually doesn’t cover repairs for the vehicle or any additional medical costs for you, which can be a drawback.

If you’re looking for $1 a day car insurance near you, you’ll find that this unique coverage is unfortunately only available in New Jersey, and only if you meet the state’s specific dollar-a-day insurance NJ requirements.

However, plans similar to New Jersey’s Special Automobile Insurance Policy (SAIP) are available in states like California and Hawaii.

How much insurance do you need for your car? In New Jersey, drivers are required to carry specific minimum amounts of liability, personal injury protection (PIP), and uninsured motorist coverage.

New Jersey Minimum Car Insurance Requirements

| Coverage Type | Basic (Minimum) | Standard (Optional) |

|---|---|---|

| Bodily Injury Liability | $10,000 per accident | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $5,000 per accident | $25,000 per accident |

| Personal Injury Protection (PIP) | $15,000 per person, per accident | $15,000 per person, per accident |

| Uninsured/Underinsured Motorist (UM/UIM) | None | Must match your liability limits |

| Right to Sue | Limited | Limited or unlimited |

You can choose either a basic or standard policy. The basic policy costs less but provides limited coverage and restricts your right to sue after an accident.

Still, it may vary depending on the state and local regulations and the insurance providers operating these. By entering your ZIP code, you can compare the best dollar-a-day providers are available directly in your area.

Who Qualifies for Dollar-a-Day Insurance Coverage

To meet New Jersey’s Medicaid car insurance requirements for dollar-a-day coverage, you must be enrolled in Medicaid with hospitalization benefits and be an uninsured driver in New Jersey. Other Medicaid plans don’t qualify for this coverage.

Your license and registration must also be valid, meaning not suspended or revoked.

Dollar-a-day car insurance is affordable, but check coverage limits to ensure it meets your needs.Eric Stauffer Licensed Insurance Agent

If you lose Medicaid coverage, your $1-a-day car insurance will remain active until your next renewal (one year). After that, you’ll need to find a different policy.

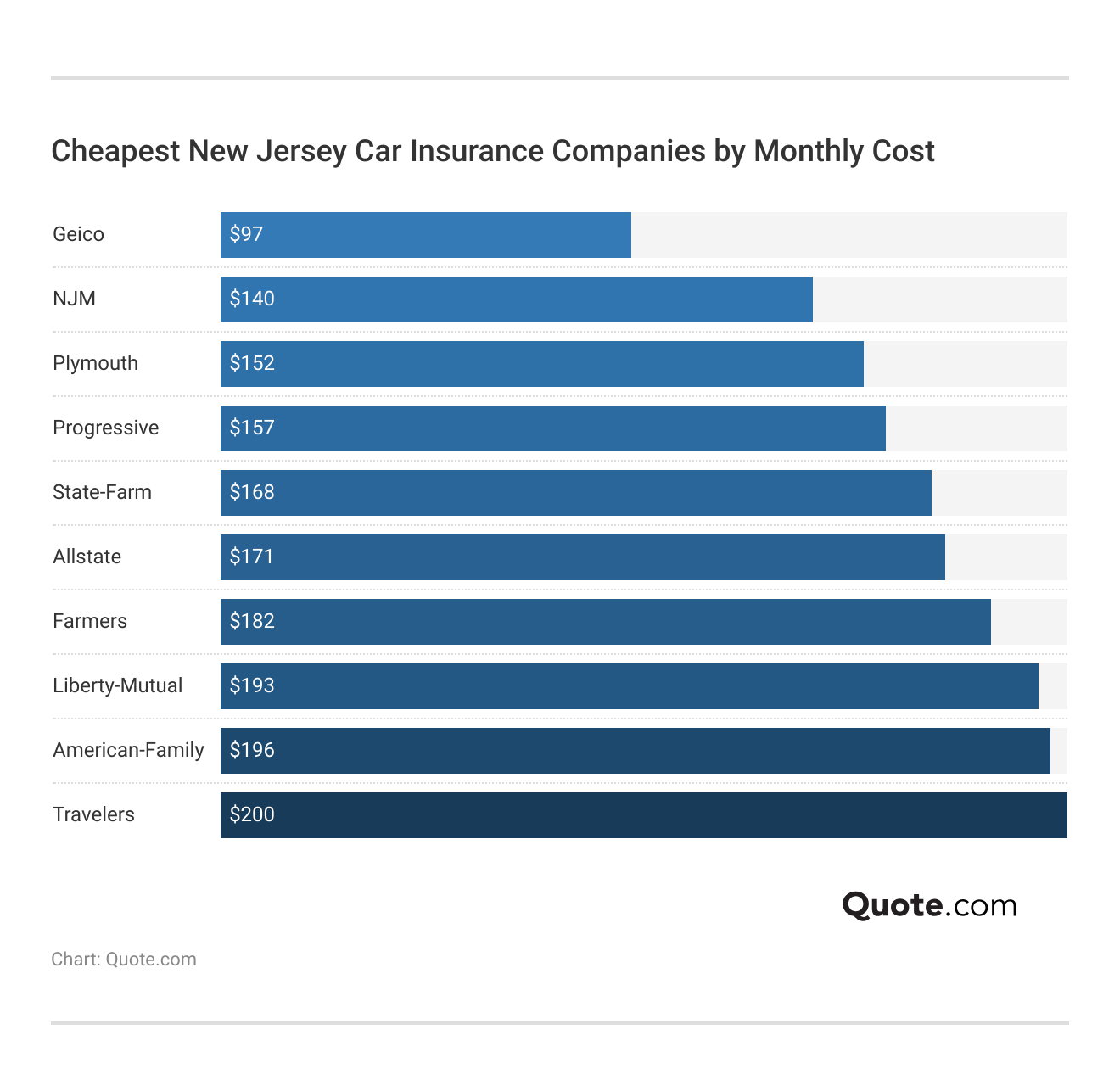

For those who don’t qualify for dollar-a-day insurance, our New Jersey car insurance guide can help you find the best rates and top companies.

How to Apply for Dollar-a-Day Car Insurance

If you’re looking for dollar-a-day insurance near NJ, residents should follow these steps:

#Step 1: Confirm Your Eligibility

To qualify, you must receive hospitalization benefits through the Medicaid program. Applicants must have a valid New Jersey driver’s license that matches their identity and own a registered vehicle in New Jersey.

If you’re wondering, “How much is a ticket if you are driving without a license?” in New Jersey, driving without a license can result in fines of up to $500.

#Step 2: Prepare Documents & Contact the SAIP Carrier

You’ll need your New Jersey driver’s license, vehicle registration, and Medicaid ID card to prove eligibility. Contact National Continental Insurance Company, the sole carrier writing SAIP policies, at 1-800-652-2471 or visit the NJ Department of Banking and Insurance website to apply.

National Continental has managed all SAIP enrollments since January 1, 2011.

#Step 3: Complete Your Application

When applying, you must present your Medicaid ID and a valid driver’s license. However, you may wonder, “Can I get car insurance with no license?”

If you don’t have a license, some insurance companies may still offer options, but this depends on their specific rules.

You can choose to pay the $365 annual premium in one lump sum or in two equal payments. Once you’re approved, you’ll have basic medical coverage in place if you’re ever in an accident.

Frequently Asked Questions

What is dollar-a-day insurance?

Dollar-a-day insurance, officially known as the Special Automobile Insurance Policy (SAIP), is a government-sponsored car insurance program in New Jersey. It provides minimal coverage at a low cost, primarily for uninsured drivers who are enrolled in Medicaid with hospitalization.

How do I apply for dollar-a-day car insurance?

To apply for dollar-a-day car insurance (SAIP) in New Jersey, you must be an uninsured driver enrolled in a Medicaid program that includes hospitalization. Contact your local insurance agent or visit the New Jersey Department of Banking and Insurance website for more details.

Looking to get government car insurance for low-income individuals? Enter your ZIP code into our free comparison tool to compare quotes in minutes.

What does dollar-a-day insurance cover?

Dollar-a-day insurance (SAIP) covers emergency medical treatment immediately following an accident, as well as additional medical expenses related to critical brain and spinal cord injuries up to $250,000. It also provides a $10,000 death benefit in case of a fatal collision.

How much is $1 dollar-a-day insurance in New Jersey?

$1 dollar-a-day insurance in New Jersey costs $365 a year. You can also choose to pay $360 upfront. This day-by-day car insurance is meant to help low-income drivers get basic medical coverage after an accident.

What states have dollar-a-day insurance?

New Jersey is the only state that offers a “dollar-a-day” car insurance program, officially known as the Special Automobile Insurance Policy (SAIP). While no other states have an identical program, some, like California and Hawaii, offer similar initiatives to assist low-income drivers in obtaining affordable auto insurance.

Read More: Best Car Insurance in California

How much does one-day insurance cost?

So, how much is one-day car insurance? One-day insurance costs between $10 and $30, depending on various factors such as your location, age, and the type of vehicle you need to insure. Contact insurance providers directly for accurate pricing.

How do you apply for low-income auto insurance?

To apply for low-income auto insurance, check with your state’s insurance department or local insurers who offer such programs. Requirements and availability can vary, so it’s best to inquire directly with insurance providers.

How can I get cheap temporary car insurance?

To get cheap temporary car insurance, compare quotes from multiple insurance providers. Consider factors like coverage options, deductibles, and discounts that may apply. Online comparison tools can simplify this process.

How can I lower my car insurance rates in NJ?

To lower car insurance costs in New Jersey, increase your deductibles, maintain a good driving record, bundle policies, and explore discounts offered by insurers.

It’s also important to understand the factors that influence car insurance prices, including your age, driving history, and vehicle type. Comparing quotes from multiple providers can also help you secure the lowest rates.

Can I get auto insurance in one day?

Yes, you can get auto insurance in one day. Many insurance companies offer same-day coverage, especially if you apply online or by phone. It’s a good option for quick coverage for a new or borrowed car.

How much is low-income car insurance in New Jersey?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.