Best Car Insurance in Connecticut for 2026 [Your Guide to the Top 10 Companies]

The best car insurance in Connecticut comes from Geico, State Farm, and Progressive, with rates starting at just $32 a month. Geico offers the lowest rates in Connecticut, with additional savings through policy bundling. State Farm offers strong local agent support, while Progressive fits Connecticut's varied driving needs with flexible policies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

UPDATED: May 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Connecticut

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Connecticut

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Connecticut

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive are the best car insurance in Connecticut, offering monthly rates beginning at $32. Geico offers a 25% bundling discount and affordable rates.

State Farm has the best local agents and a monthly cost of $47, and Progressive features flexible policies with a 15% early signup discount.

Our Top 10 Company Picks: Best Car Insurance in Connecticut

| Company | Rank | Claims-Free Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A++ | Affordable Rates | Geico | |

| #2 | 11% | A++ | Customer Service | State Farm | |

| #3 | 10% | A+ | Usage-Based Discounts | Progressive | |

| #4 | 10% | A+ | Digital Claims Tools | Allstate | |

| #5 | 20% | A++ | Military Families | USAA | |

| #6 | 13% | A++ | Hybrid/Electric Vehicle Discounts | Travelers | |

| #7 | 8% | A | Custom Coverage Options | Liberty Mutual |

| #8 | 14% | A+ | Family Discounts | Nationwide | |

| #9 | 9% | A | Policy Bundling | Farmers | |

| #10 | 15% | A | Loyalty Rewards | American Family |

Check out the best insurance companies in Connecticut. This guide provides a broader range of options for local drivers for the most suitable Connecticut car insurance company.

- Connecticut requires claims to be filed within 2 years of an accident

- CT’s accident forgiveness programs require 5 years of clean driving

- A clean driving record can reduce Connecticut premiums by up to 32%

Enter your ZIP code to compare affordable Connecticut car insurance rates for more direct and informative estimates.

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: Geico offers the most affordable rates in Connecticut for local drivers, providing a 25% discount for bundling services, and has an A++ financial strength.

- Policy Customization: Provides specialized Emergency Road Service and Mechanical Breakdown protection options for Connecticut’s dense traffic areas.

- Convenient Digital Tools: Connecticut customers report 93% satisfaction with Geico’s digital claim filing system, allowing rapid claims processing within 24-48 hours.

Cons

- Inconsistent Local Service: 14% of Connecticut customers report dissatisfaction with agent support, which may make it less appealing, even though it has high ratings.

- Limited Office Locations: Connecticut customers needing in-person assistance may experience longer wait times. Learn more in our Geico car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

Pros

- Personalized Assistance: 87 local offices throughout Connecticut, providing personalized service with agents familiar with Connecticut’s specific insurance regulations.

- Safety Incentives: The “Drive Safe & Save” program offers Connecticut drivers up to 30% in savings based on Connecticut’s typical driving patterns and road conditions.

- Multiple Discounts Available: Drivers can save more with various discounts, including multi-policy, good driver discount after 3 years, and up to 25% student discount.

Cons

- Stricter Underwriting: 23% higher rejection rates for applicants from Connecticut’s urban centers like Bridgeport and New Haven compared to suburban areas like Glastonbury.

- Few Tech Features: As mentioned in our State Farm car insurance review, its app lacks advanced features like virtual damage assessment and real-time claim tracking.

#3 – Progressive: Best for Flexible Policies

Pros

Pros

- Snapshot Program Rewards: Connecticut drivers save an average of $23 monthly through Progressive’s Snapshot program tailored to Connecticut’s driving conditions.

- Early Signing: Customers in Connecticut can save up to a 15% discount by enrolling in Progressive’s car insurance at least 7 days before their current policy expires.

- Affordable Full Coverage: Starting rates for full coverage make it competitive for Connecticut’s average driver profile. Learn more in our Progressive car insurance review.

Cons

- Inconsistent Claims Experiences: Connecticut policyholders feedback indicates that claims resolution times vary widely, from 5 to 32 days.

- Coverage Lapse Penalties: Premiums increase by an average of 29% if a policy lapses for more than 7 days, significantly higher than the state average penalty of 19%.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Coverage Choices: Allstate offers specialized protection for Connecticut’s winter weather damage with the lowest comprehensive deductibles at $250.

- Bundling Discounts: Connecticut residents save 25% (average annual savings of $423) when bundling home and auto insurance through Allstate’s Total Protection Plan.

- Technology Integration: The mobile app integrates with Connecticut’s Department of Transportation systems to provide real-time accident assistance on state highways.

Cons

- Premiums Above Average: At $198 a month for full coverage, rates are 18% higher than the Connecticut average, even though it has a great A+ financial strength ranking.

- Strict Discount Criteria: The Safe Driving Bonus requires 5 consecutive years without accidents. Learn more in our Allstate car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Lowest Claims Dispute Rate: Only 1.2% of Connecticut claims result in disputes, according to Connecticut Insurance Department data.

- Specialized Coverage: Enhanced military installation protection for vehicles stored at naval submarine base in New London and Connecticut National Guard facilities.

- Military Family Benefits: USAA’s military service discount provides Connecticut service members with up to 15% premium reduction during deployment.

Cons

- Restricted Eligibility: Only service members, veterans, and their immediate families in Connecticut can qualify.

- Fewer Physical Locations: Connecticut customers face an average 62-mile drive for in-person assistance. Visit our USAA car insurance review to know more.

#6 – Travelers: Best for Customizable Policies

Pros

Pros

- Hybrid Vehicle Discounts: Offers 10% premium reduction for hybrid vehicles registered in Connecticut. Learn more in our Travelers car insurance review.

- Reliable Financial Support: A++ financial strength rating with particularly swift processing of Connecticut winter weather claims.

- Multi-Policy Savings: Travelers’ Quantum Auto 2.0 program offers up to 28% savings when bundling auto with homeowners or renters insurance.

Cons

- Higher Full Coverage Rates: Premium rates for comprehensive coverage average 27% higher than Connecticut’s statewide mean across all insurers.

- Reduced Options in Coastal Regions: Limited policy choices and higher deductibles for vehicles in shoreline communities.

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Forgiveness Features: Liberty Mutual’s Accident Forgiveness ensures first-time accidents won’t increase rates for Connecticut drivers with 5+ years of clean driving records.

- Eco-Friendly Savings: 12% premium reduction through the alternative energy discount for electric vehicles, supporting Connecticut’s goal of 500,000 electric vehicles by 2030.

- Simplified Digital Access: The mobile app allows Connecticut-specific features like electronic insurance ID cards and digital claims submission.

Cons

- Costly Coverage Options: Full coverage policies with Liberty Mutual’s New Car Replacement and Gap Coverage typically exceed state medians by 32%.

- Delays in Claims: Non-priority claims processing averages 14.3 days in Connecticut, 23% longer than the state median of 11.6 days. Read our Liberty Mutual car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Family Discounts

Pros

- Paid in Full Discount: 15% premium reduction for Connecticut drivers who pay annually through Nationwide’s EasyPay program.

- More Discount: Homeowners in Connecticut can benefit from the 15% discount provided by Nationwide’s home and auto bundle.

- Personalized Consultations: The “On Your Side Review” ensures that policies fit the wants of drivers in Connecticut. Discover more in our Nationwide car insurance review.

Cons

- Selective Discounts: Nationwide’s SmartRide program discount is available in only 7 of Connecticut’s 8 counties, excluding Litchfield County.

- Limited Digital Features: Its mobile app scores 2.8/5 stars in user reviews, lacking real-time accident reporting and instant digital ID card features available from other competitors.

#9 – Farmers: Best for Policy Bundling

Pros

- Accident-Free Rewards: Farmers’ Signal Program offers rewards like a 25% discount for Connecticut drivers maintaining safe driving habits over a 6-month period.

- New Car Replacement: Farmers’ New Car Pledge offers full replacement value for cars under 2 years old and less than 24,000 miles, important in Connecticut.

- Homeowner Discounts: Connecticut property owners save an average of $237 annually through the 15% Home/Auto Bundle discount with Farmers’ Smart Plan.

Cons

- Higher Initial Rates: Base premiums for full coverage which are higher than other competitors in Connecticut. Learn more in our Farmers car insurance review.

- App Limitations: The Farmers mobile app lacks Connecticut-specific features like real-time accident reporting, and scores just 3.2/5 stars in user satisfaction.

#10 – American Family: Best for Loyalty Rewards

Pros

- Advance Signing: American Family’s early bird discount provides Connecticut residents a 15% premium reduction when enrolling at least 7 days before their current policy expires.

- Multi-Vehicle Savings: The Family Plan offers 15% reduction for households insuring multiple vehicles. This is important in Connecticut where 65% of families own 2+ vehicles.

- Eco-Friendly Incentives: Connecticut drivers enrolled in American Family’s Go Paperless program receive 8% off premiums for choosing digital documentation.

Cons

- Restricted State Availability: Service unavailable in several Connecticut counties, as mentioned in our American Family car insurance review.

- Higher Entry-Level Premiums: Initial rates for new policyholders average 36% above other Connecticut competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance Rates in CT

With more than two million cars that need to be insured in Connecticut, deciding among many providers may be a daunting task. Connecticut motorists shell out $123 per month for full coverage, with premiums differing greatly across companies. See the table below:

Connecticut Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $101 | $196 | |

| $65 | $125 |

| $78 | $151 | |

| $32 | $62 | |

| $104 | $201 |

| $58 | $112 | |

| $69 | $133 | |

| $47 | $91 | |

| $43 | $83 | |

| $40 | $77 |

As this table is easily able to show, Connecticut monthly premiums can vary by more than $140 between carriers for the same amount of coverage.

Connecticut Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Premium Savings | A | Competitive rates for safe drivers |

| Policy Options | A- | Offers customizable coverage options |

| Claims Processing | B+ | Moderate speed in processing claims |

| Customer Support | B | Responsive but room for improvement |

| Discounts Availability | B | Fewer discount opportunities compared to competitors |

Geico has the lowest rates at $32 per month for bare-bones coverage, and Liberty Mutual has the highest rates for full coverage at $201 per month.

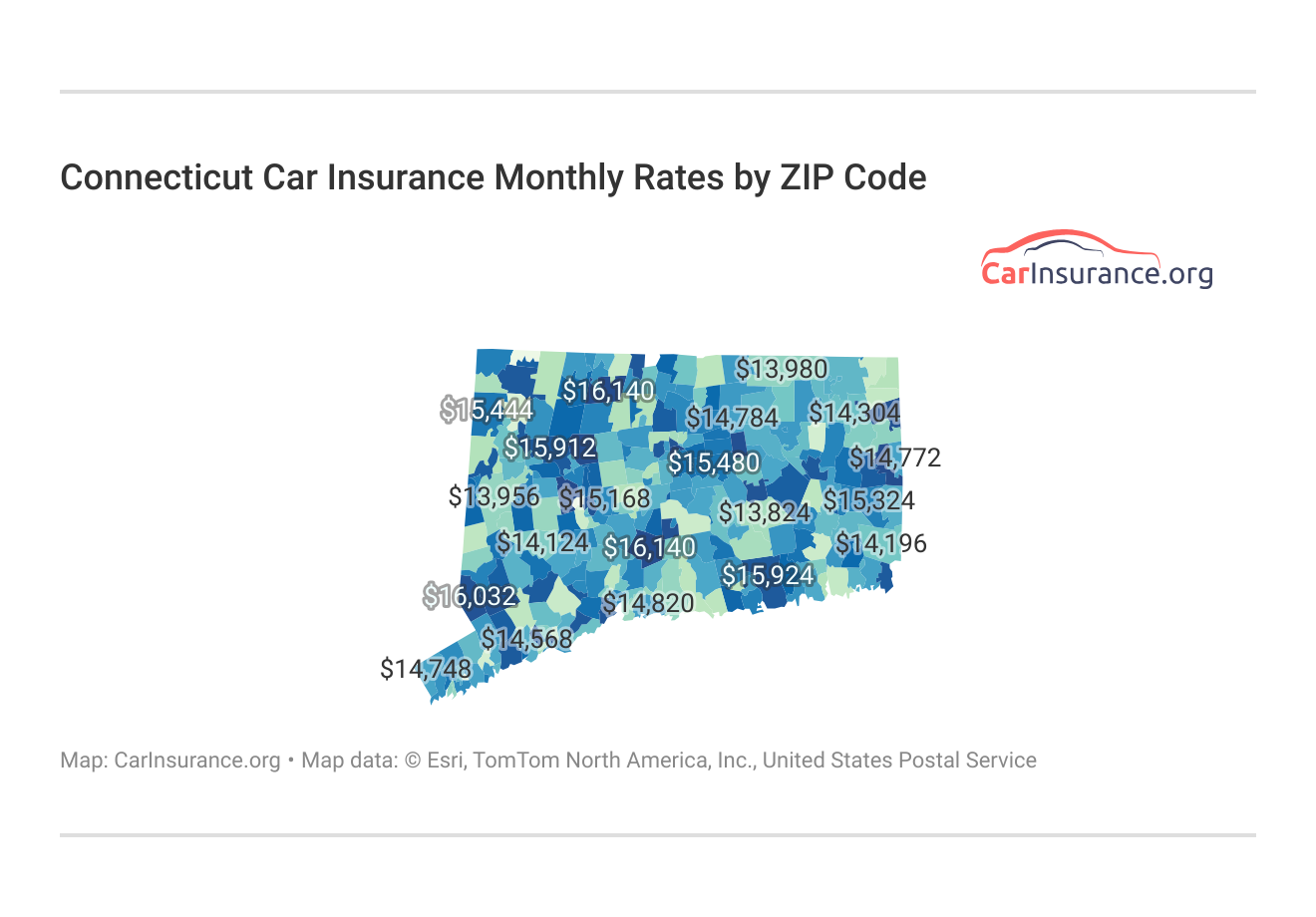

Rates differ throughout Connecticut. Drivers in suburban areas such as Glastonbury pay much less than those in urban centers like New Haven.

Jeffrey Manola Licensed Insurance Agent

This in-depth map uncovers monthly premiums by ZIP code, from a little over $13,500 to more than $16,000 a month statewide. Geographic factors such as population, traffic, crime rates, and neighborhood weather patterns all contribute to these price variations.

To help you make the right choice, we’ve collected everything you need to know. From auto insurance companies’ ratings to premium rates, keep reading to learn everything you need about Connecticut’s insurance companies and the different types of car insurance coverage available.

Ways to Save on Your Connecticut Auto Insurance

While Connecticut’s scenic coastal highways and New England charm make it a driver’s paradise, the state’s car insurance rates can be challenging for many residents.

Connecticut drivers can reduce their monthly premiums by knowing how to lower their car insurance costs in Connecticut

Auto Insurance Discounts From Top Connecticut Providers

| Company | Multi-Car | Safe Driver | Early Signing | Paid-in-Full | Homeowner |

|---|---|---|---|---|---|

| 15% | 20% | 10% | 15% | 10% | |

| 20% | 15% | 15% | 10% | 15% |

| 10% | 25% | 10% | 10% | 10% | |

| 15% | 25% | 10% | 10% | 15% | |

| 20% | 15% | 15% | 15% | 20% |

| 15% | 20% | 10% | 15% | 15% | |

| 20% | 20% | 15% | 10% | 10% | |

| 15% | 20% | 10% | 10% | 10% | |

| 10% | 15% | 15% | 10% | 15% | |

| 20% | 25% | 10% | 15% | 20% |

Connecticut insurance companies offer substantial discounts over rate comparisons. Defensive drivers are rewarded with as much as 25% discounts by companies like USAA and Farmers, and multi-car policies can offer Connecticut families 20% discounts from American Family and Progressive.

Homeowners save the most, with USAA and Liberty Mutual providing 20% homeowner discounts, slashing monthly premiums substantially. Put these savings opportunities into context with base rates to get your best value for Connecticut coverage.

Connecticut Car Insurance Coverage

All of the top Connecticut insurers have essential coverage add-ons, but knowing which of them are most important to your driving habits will optimize your coverage while keeping expenses in check. Prior to venturing into optional add-ons, drivers in Connecticut should know these vital coverage types:

- Liability Coverage: Covers injuries to others and damage to property when you’re responsible.

- Collision Coverage: Covers repairs to your vehicle following collisions irrespective of fault.

- Comprehensive Coverage: Covers against theft, vandalism, weather-related damage, and animal strikes.

- Personal Injury Protection: Pays for your medical bills and your passengers.

- Uninsured/Underinsured Motorist: Covers you when fault drivers do not carry sufficient coverage.

Beyond the mandatory minimums, savvy Connecticut drivers often select these valuable add-ons to create truly comprehensive protection tailored to the state’s unique driving challenges. These supplemental coverages address specific risks Connecticut motorists face from coastal storms to winter driving conditions:

- Roadside Assistance: Quick towing and emergency services on Connecticut’s highways and rural roads are crucial during harsh New England winters.

- Custom Equipment Protection: Coverage for aftermarket parts that Connecticut drivers commonly add for winter driving and coastal conditions.

- Gap Insurance: Protects Connecticut residents from financial loss when they owe more than a totaled vehicle’s worth in the state’s high-value auto market.

- Rideshare Coverage: This is essential protection for drivers working with Uber or Lyft in Hartford, New Haven, and other Connecticut metropolitan areas.

- Rental Reimbursement: This program provides temporary transportation when your vehicle is being repaired after accidents on Connecticut’s busy I-95 corridor or local roads.

With so many rates and coverage options out there, it can be difficult to pick out ones that fit both your wallet and your needs. Additionally, every state has different coverage requirements, making moving even more confusing.

Connecticut Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bridgeport | 2,500 | 2,200 |

| Hartford | 4,000 | 3,500 |

| New Haven | 3,200 | 2,800 |

| Stamford | 2,700 | 2,400 |

| Waterbury | 1,800 | 1,500 |

Weather-related damage costs Connecticut drivers an average of $7,000 per claim—the highest expense category despite representing only 10% of incidents. Meanwhile, rear-end collisions constitute 30% of all Connecticut claims but average just $3,000 in damages.

5 Most Common Car Insurance Claims in Connecticut

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collisions | 30% | $3,000 |

| Single-Vehicle Accidents | 25% | $4,500 |

| Parked Car Damage | 20% | $1,500 |

| Side-Impact Collisions | 15% | $6,000 |

| Weather-Related Damage | 10% | $7,000 |

These numbers reinforce why car insurance quotes, tips, and savings matters most for Connecticut motorists, particularly those traveling through congestion points such as Hartford and New Haven.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Connecticut Minimum Car Insurance Coverage

Connecticut law mandates all drivers to carry valid car insurance. Operating a vehicle with inadequate insurance may result in fines of up to $1,000, loss of driving privileges, and cancellation of vehicle registration. Connecticut’s minimum coverage is:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured/Underinsured Motorist: $25,000 per person/$50,000 per accident

While these minimums keep you legal on Connecticut roads, is it bad to just carry minimum coverage car insurance? The answer is often yes—minimum coverage leaves you financially vulnerable, especially in high-cost accident scenarios common in Connecticut’s congested urban areas.

Choosing the Best Car Insurance in Connecticut

Geico, State Farm, and Progressive provide the best car insurance in Connecticut with distinct advantages. Geico offers a 25% bundling discount with rates from $32 monthly.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

State Farm provides 87 local offices for personalized service, and Progressive’s Snapshot program saves Connecticut drivers $23 monthly. To get the best value, it’s smart to compare quotes from different providers, whether you want good rates, full coverage, or how much insurance you need for your car.

Enter your ZIP code now to find insurance choices that match your needs and budget.

Frequently Asked Questions

How much is car insurance in CT per month?

The cost of car insurance in Connecticut varies based on factors like age, driving history, and coverage level. The average monthly premium is around $100–$150, with top-rated options starting at $32 from Geico.

Who offers the best car insurance coverage in Connecticut?

Connecticut drivers can find excellent coverage from highly-rated providers like Geico, State Farm, and USAA, which offer comprehensive protection, outstanding customer service, and competitive rates starting as low as $32 per month. Enter your ZIP code to compare top providers.

What makes certain insurers the best car insurance in Connecticut?

Top Connecticut insurers combine competitive rates, comprehensive coverage options, excellent customer service ratings, and strong financial stability. Leading providers also offer state-specific benefits like winter weather coverage and coastal storm protection. Learn more about car insurance basics to understand coverage options.

What factors affect my Connecticut car insurance rates?

Your CT car insurance premium is influenced by your age, location, driving record, coverage level, and credit score, with rates in urban areas like Hartford often higher due to increased traffic and theft risks.

How do I choose the best car insurance in Connecticut for my needs?

Selecting ideal coverage for Connecticut drivers depends on balancing protection needs, budget, and customer service preferences. Consider factors like deductibles, coverage limits, available discounts, and the insurer’s claims handling reputation. Enter your ZIP code to find personalized options.

Can I get quality car insurance in Connecticut with a bad driving record?

Yes, several top Connecticut insurers specialize in coverage for high-risk drivers, such as The General and Progressive, though expect higher rates. They often provide paths to lower premiums through safe driving programs. Check these safe driving tips to improve your record.

What’s the most affordable car insurance in Connecticut for new drivers?

Connecticut’s most budget-friendly options for new drivers include companies like Geico (starting at $32), USAA ($40), and Travelers ($43), which offer competitive rates plus discounts for good students and driver training courses.

Does quality Connecticut car insurance include additional protections?

Yes, premium Connecticut coverage goes beyond state minimums to include protection for harsh winter conditions, coastal weather damage, gap coverage, and enhanced roadside assistance suited to New England driving challenges.

What is the minimum car insurance required in Connecticut?

Connecticut law requires drivers to carry minimum liability coverage of 25/50/25: $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage. However, comprehensive protection often exceeds these minimums.

Read More: Bodily Injury Liability Coverage

Do Connecticut insurers offer discounts for eco-friendly vehicles?

Many top Connecticut providers, including Liberty Mutual and Travelers, offer specific discounts for electric and hybrid vehicles, typically ranging from 10-15% off premiums, reflecting the state’s commitment to environmental sustainability.

Pros

Pros Pros

Pros

Pros

Pros