Travelers Car Insurance Review for 2026 [See Pros & Cons]

This Travelers car insurance review explains why it ranks as a top provider, with rates starting at $35/month. Travelers offers cheap auto insurance to high-risk drivers without raising rates as high as other companies after an accident or ticket. Drivers can also lower costs with Travelers insurance discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from Seve...

D. Gilson, PhD

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated March 2025

Our Travelers car insurance review emphasizes why it’s a leading option for motorists looking for dependable and complete protection.

Recognized for its industry experience and adaptable plans, The Travelers Companies, Inc. excels in providing personalized types of car insurance coverage that cater to different drivers.

Travelers Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.3 |

Travelers offers numerous savings opportunities, from discounts to usage-based programs, and provides cheaper rates for high-risk drivers with accidents.

Whether combining policies or taking advantage of accident forgiveness, Travelers offers unparalleled benefits. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

Comparing Travelers Car Insurance Rates by Driver

The table highlights how Travelers car insurance rates vary significantly based on age, gender, and coverage level. Younger drivers, especially males, face notably higher rates, with 16-year-olds paying the most for both minimum and full coverage.

Travelers Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $274 | $719 |

| Age: 16 Male | $362 | $910 |

| Age: 18 Female | $223 | $530 |

| Age: 18 Male | $310 | $740 |

| Age: 25 Female | $40 | $107 |

| Age: 25 Male | $44 | $116 |

| Age: 30 Female | $37 | $99 |

| Age: 30 Male | $40 | $108 |

| Age: 45 Female | $37 | $98 |

| Age: 45 Male | $37 | $99 |

| Age: 60 Female | $35 | $89 |

| Age: 60 Male | $35 | $90 |

| Age: 65 Female | $36 | $96 |

| Age: 65 Male | $37 | $97 |

As drivers age, rates drop considerably, with 25-year-olds and older seeing much lower premiums. Overall, the trend shows that age and gender are crucial in determining car insurance costs with Travelers.

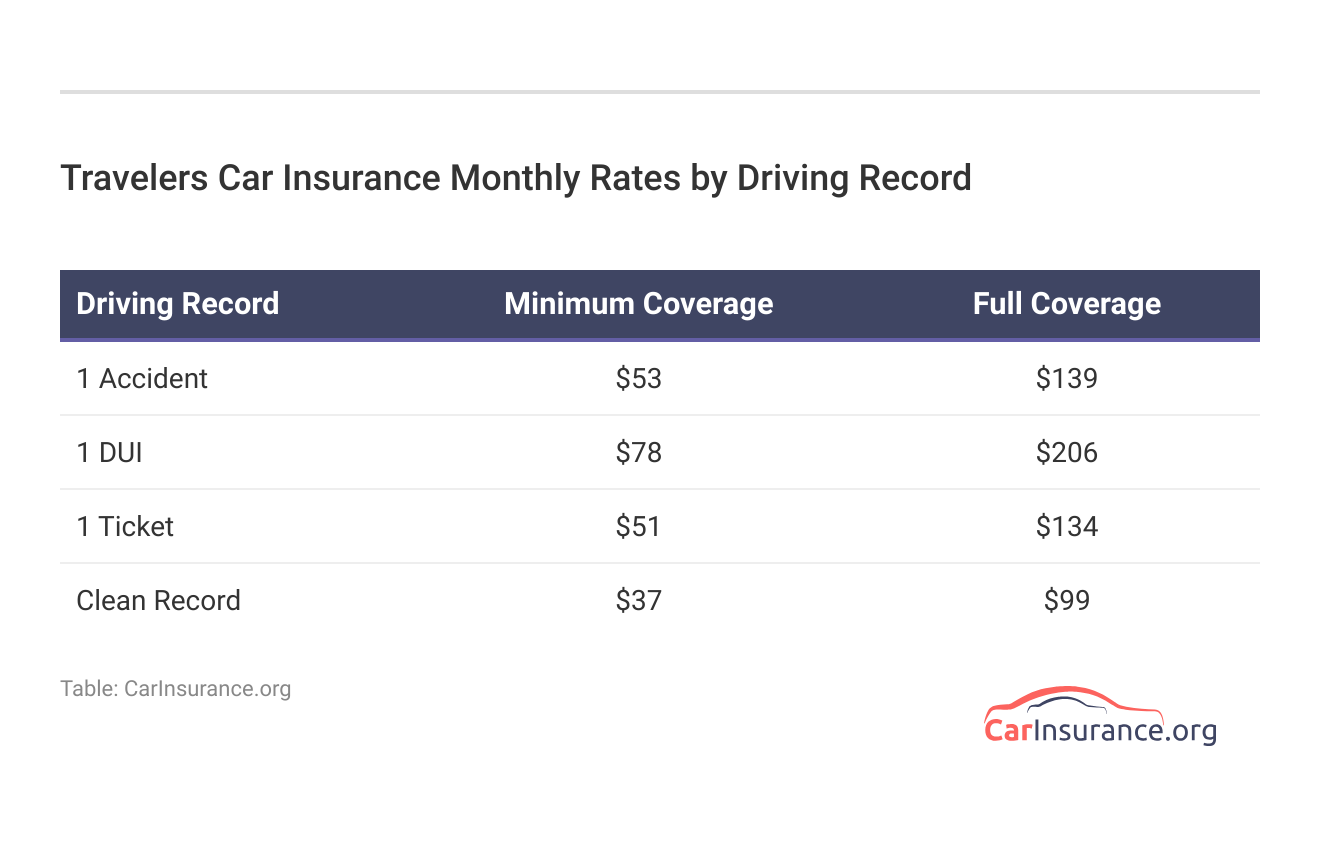

Drivers with infractions such as DUIs or accidents tend to pay considerably more for both minimum and full coverage. However, those with a clean record enjoy the lowest Travelers insurance rates.

If you do have an accident or DUI, Travelers auto insurance is more affordable than some other providers. Scroll down to see how Travelers rates compare to companies near you.

Read More: Is it bad to just carry minimum coverage car insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Travelers Car Insurance Rates vs. The Competition

Travelers car insurance offers competitive rates across ages and genders, particularly for middle-aged drivers. Comparing its rates to top competitors reveals that Travelers offers more affordable options than most companies.

Travelers Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

While Travelers provides solid rates, some competitors, like USAA and Geico, offer lower premiums for both men and women. It’s important to explore multiple options to find the best coverage that fits your needs and budget.

🔔 #SafeDrivingTip: Turning on your phone’s “do not disturb” function before you begin driving can help reduce the temptation to browse online at a red light or immediately respond to a text message.

Find more tips from the @NatlDDCoalition: https://t.co/iS4wx4sbQW #FocusOn pic.twitter.com/y0btT0vBOt

— Travelers (@Travelers) October 19, 2023

We’ve already established that maintaining a clean record is key to locking in the most affordable rates, but even with a violation, there are options for drivers to still secure competitive pricing. Travelers is one of the cheapest car insurance companies for high-risk drivers, especially those with accidents or speeding tickets.

Travelers Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

Travelers is more expensive for drivers with DUIs, but it’s still cheaper than Geico and Nationwide, making it a competitive choice for drivers with less-than-perfect records or claim history.

Travelers Comprehensive Car Insurance Coverage

Travelers offers a wide range of car insurance coverage options, from accident forgiveness to new car replacement, ensuring drivers are prepared for unexpected situations.

Travelers Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Accident Forgiveness | Prevents premium hike after first at-fault accident |

| Collision | Covers collision damage with vehicles or objects |

| Comprehensive | Covers theft, fire, and non-collision damage |

| Gap Insurance | Pays loan balance if car is totaled |

| Liability | Covers injury and damage if you're at fault |

| Medical Payments | Covers medical bills for you and passengers |

| New Car Replacement | Replaces totaled new car with a similar model |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages, regardless of fault |

| Rental Reimbursement | Pays for rental car during repairs |

| Roadside Assistance | Provides assistance for towing, flat tires, or dead battery |

| Uninsured/Underinsured Motorist | Protects against uninsured or underinsured drivers |

Travelers’ varied coverage options allow drivers to customize their policies when buying car insurance, ensuring the right protection no matter the circumstances. From basic liability to extras like rental reimbursement, Travelers has you covered.

Travelers Car Insurance Discounts

By utilizing multiple discounts, Travelers policyholders can significantly reduce the cost of auto insurance. Travelers car insurance discounts cater to diverse needs, from maintaining continuous coverage to driving a hybrid vehicle:

Travelers Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| IntelliDrive Program | 30% |

| Safe Driver | 23% |

| Continuous Insurance | 15% |

| Bundling | 10% |

| Early Quote | 10% |

| Hybrid/Electric Vehicle | 10% |

| Driver Training | 8% |

| Good Student | 8% |

| Multi-Car | 8% |

| Paid in Full | 8% |

| Student Away at School | 7% |

| Home Ownership | 5% |

Travelers offers a variety of car insurance discounts that provide meaningful savings for policyholders, but its discounts are smaller than other companies. Only the Travelers IntelliDrive usage-based discount at 30% is a bigger savings opportunity than most of its competitors; programs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travelers Car Insurance Ratings & Business Reviews

Travelers’ ratings from businesses are mixed. The provider excels in financial stability but faces room for improvement in customer satisfaction according to consumer ratings.

Travelers Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 860 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 76/100 Good Customer Feedback |

|

| Score: 1.12 Avg. Complaints |

|

| Score: A++ Superior Financial Strength |

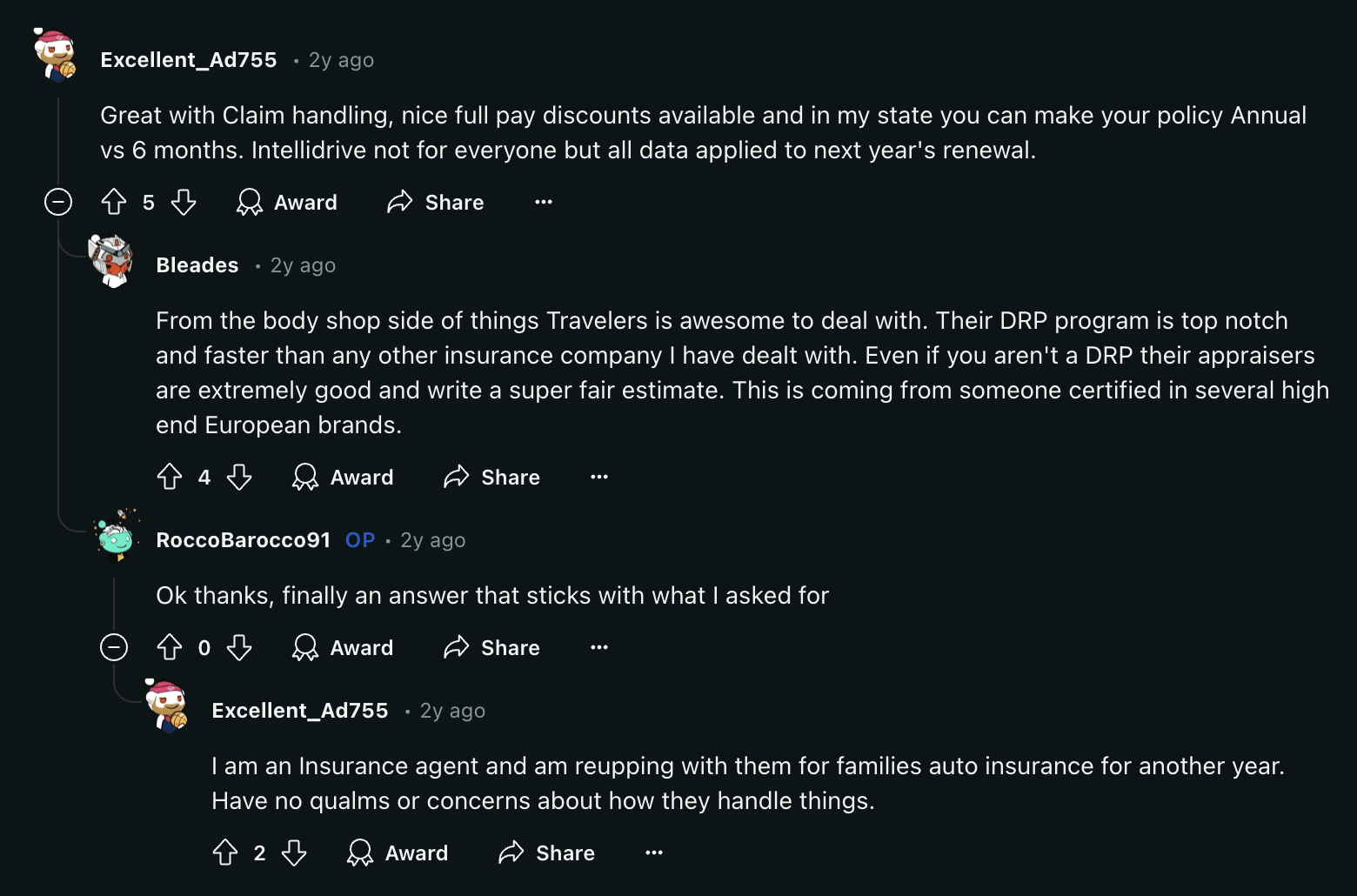

However, Travelers Insurance reviews on Reddit reflect more positive experiences. Customer service will vary by state and region, but policyholders overall have positive experiences with claims, repairs, and discounts.

The Travelers Companies, Inc.’s industry experience gives it an edge when it comes to customer service and financial strength, but it still receives poor ratings from some drivers. Keep reading for a closer look at the pros and cons of Travelers Insurance.

Read More: How Your Car Affects Insurance Rates

Travelers Car Insurance Strengths and Weaknesses

Travelers is recognized for offering a solid combination of cost-effectiveness and dependability, particularly for individuals seeking savings across multiple coverage types. Here are some more positives about the insurer:

- Appealing Multi-Policy Discounts: Travelers provides attractive discounts when combining auto, home, or other types of insurance, making it ideal for homeowners or families.

- Highly Praised Claims Service: The insurer is appreciated for its efficient claims handling, ensuring customers receive the assistance they require when it matters most.

- Adaptable Nationwide Policies: Travelers offers customizable coverage that can meet the varied needs of drivers in all 50 states.

- Coverage for High-Risk Motorists: Travelers auto insurance rates are cheaper for high-risk drivers after an accident than other companies.

Travelers continues to stand out with its attractive pricing, excellent support services, and flexible coverage choices, making it a strong contender for most drivers.

Despite its many advantages, Travelers also has some drawbacks that could be off-putting to potential policyholders. While these issues are not widespread, they can impact your overall experience:

- Unanticipated Rate Increases: Car insurance rates vary by state, and some clients report sudden surges in Travelers insurance premiums without clear explanation.

- Sparse Local Agent Access: In specific regions, Travelers’ network of local agents is limited, making in-person support more difficult for some customers to access.

- Delayed Customer Response: A few policyholders have experienced slower-than-expected communication during claims or service inquiries.

While Travelers remains a reliable option for many, these shortcomings should be considered when weighing its overall service.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Travelers Car Insurance Review: A Solid Choice for High-Risk and Safe Drivers

With significant discounts for bundling policies and a solid reputation for insurance claims negotiation and handling, our Travelers car insurance review finds that it appeals to a broad range of customers, including high-risk drivers.

Travelers Insurance offers a balanced mix of affordability, flexible coverage, and strong customer service, making it a reliable option for drivers seeking comprehensive protection.Brandon Frady Licensed Insurance Producer

However, potential drawbacks such as unexpected premium increases and limited agent availability in certain areas should be weighed carefully. Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Is The Travelers Companies, Inc. a good insurance company?

Yes, Travelers is known for reliable coverage options, strong customer service, and competitive pricing when you need car insurance.

Is Travelers good at paying car insurance claims?

Travelers is recognized for efficiently handling claims and providing timely payouts. Learn how to file a car insurance claim after an accident.

Why is Travelers car insurance so expensive?

Travelers’ higher rates may reflect comprehensive coverage and tailored policy options, but it remains cheaper than some companies like Liberty Mutual and Allstate. If you want to find cheap car insurance, enter your ZIP code below into our free comparison tool.

What are the benefits of Travelers car insurance?

Travelers offers flexible policies, multi-policy discounts, and accident forgiveness, providing added value to customers.

How do I cancel Travelers car insurance?

You can cancel Travelers auto insurance by contacting their customer service team directly. Learn how to cancel gap insurance.

What is The Travelers Companies, Inc. known for?

Travelers is known for its customizable insurance coverage, excellent customer service, and claims handling.

Who is the CEO of Travelers Insurance?

The current CEO of Travelers is Alan Schnitzer.

Is Travelers Insurance owned by Citi?

No, Travelers is an independent company and not owned by Citi.

Does Travelers car insurance have a grace period?

Travelers only has a grace period on car insurance in states where it’s required. If it’s not required in your state, Travelers will cancel your policy as soon as a payment is missed. What if you can’t pay your deductible? Travelers may postpone your repairs until you can pay or you can call an agent to set up a payment plan.

How long has Travelers insurance been around?

Travelers has been offering insurance for over 160 years.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.