The General Car Insurance Review for 2026 (See Rates & Discounts Here)

Our The General car insurance review found that it's a good fit for high-risk drivers struggling to find coverage. However, with The General car insurance rates starting at $54/month for minimum coverage and a high customer complaint ratio, good drivers should shop elsewhere for more affordable car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated March 2025

Our The General car insurance review found that The General is ideal for high-risk drivers who can’t find auto insurance elsewhere, but good drivers should shop with another company.

While the company is suitable for high-risk drivers, we gave The General an overall 3.4 insurance rating, which we’ve broken down in the table below.

The General Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 3.5 |

| Claim Processing | 2.5 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.5 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3.5 |

| Discounts Available | 4 |

| Insurance Cost | 3.3 |

| Plan Personalization | 3.5 |

| Policy Options | 3.1 |

| Savings Potential | 3.5 |

The General is not one of the cheapest car insurance companies available, but it may be the right choice for you if you need SR-22 insurance. Read on to learn more about the company.

If you want to find affordable car insurance today, enter your ZIP in our free quote tool to find cheap quotes from companies in your area.

- The General has an A- financial rating from A.M. Best

- The General is best for high-risk customers

- The General car insurance scored a 3.4/5 for poor claims service

The General Car Insurance Rates

We’ve summarized average car insurance rates based on coverage, gender, and age at The General below.

The General Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $330 | $846 |

| Age: 16 Male | $369 | $903 |

| Age: 18 Female | $269 | $624 |

| Age: 18 Male | $316 | $734 |

| Age: 25 Female | $104 | $276 |

| Age: 25 Male | $109 | $287 |

| Age: 30 Female | $95 | $250 |

| Age: 30 Male | $99 | $250 |

| Age: 45 Female | $89 | $233 |

| Age: 45 Male | $54 | $232 |

| Age: 60 Female | $85 | $218 |

| Age: 60 Male | $87 | $222 |

| Age: 65 Female | $85 | $223 |

| Age: 65 Male | $86 | $222 |

What you’ll pay for The General car insurance policies will depend on several factors that affect the price of car insurance, such as what coverage level you choose and how old you are.

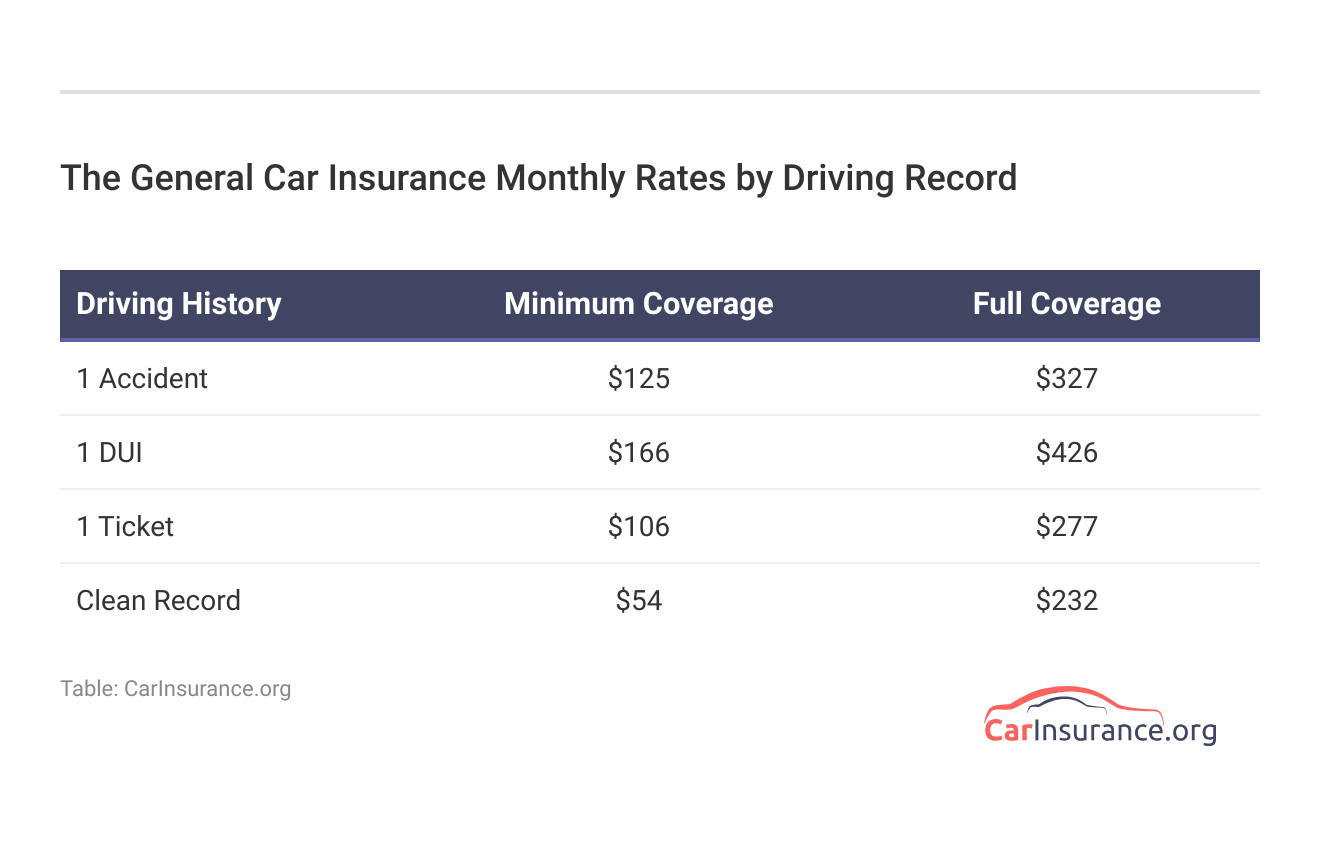

A huge factor that will affect how much you’ll pay for The General auto insurance is your driving record. While The General insures higher-risk drivers, this doesn’t mean coverage will come cheap.

Rates at The General are highest for drivers with a DUI. Generally, this is because DUI drivers need to purchase high-risk insurance, which is more expensive. DUI drivers are also seen as higher risk than drivers with an accident or ticket, as impaired driving is one of the riskiest driving behaviors to partake in.

The General Car Insurance Rates vs. the Competition

Now that you know how much The General charges for car insurance, let’s compare the company’s rates to those of its competitors. First, let’s see how rates vary among companies based on age and gender.

The General Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $233 | $232 |

| $98 | $99 | |

| $59 | $59 |

As you can see, The General auto insurance is the most expensive company on the list for both male and female drivers. It is also the most expensive among companies for drivers with different driving records.

The General Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One DUI | One Accident | One Ticket |

|---|---|---|---|---|

| $160 | $270 | $225 | $188 | |

| $117 | $194 | $176 | $136 | |

| $139 | $193 | $198 | $173 | |

| $80 | $216 | $132 | $106 | |

| $174 | $313 | $234 | $212 |

| $115 | $237 | $161 | $137 |

| $105 | $140 | $186 | $140 | |

| $86 | $112 | $102 | $96 | |

| $232 | $426 | $327 | $277 |

| $99 | $206 | $139 | $134 | |

| $59 | $108 | $78 | $67 |

If you can find auto insurance at a different company, it will likely be cheaper than The General’s car insurance rates.

The General is more expensive because it insures drivers who have issues finding coverage elsewhere due to poor driving records, so customers should ask for discounts on coverage.Dani Best Licensed Insurance Producer

How long your rates will stay high will depend on how long the company looks back on your driving record. At most companies, incidents will affect your rates for at least three years (Learn More: Cheap Car Insurance Companies That Only Look Back 3 Years).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The General Car Insurance Coverage Options

So what coverages can you buy from The General? The company offers the following different types of car insurance coverage to customers:

The General Car Insurance Coverage Options

| Coverage Type | What it Covers |

|---|---|

| Liability Coverage | Covers injury and damage to others if you're at fault |

| Collision Coverage | Pays for vehicle damage from a collision |

| Comprehensive Coverage | Covers non-collision damage like theft or weather |

| Uninsured/Underinsured Motorist | Protects against drivers with no or insufficient insurance |

| Medical Payments (MedPay) | Covers medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages after an accident |

| Rental Reimbursement | Pays for a rental car during repairs after an accident |

| Roadside Assistance | Provides towing, battery jumps, and tire changes |

| Custom Equipment Coverage | Covers aftermarket parts and customizations |

| SR-22 Insurance | Proof of insurance for high-risk drivers |

The General sells all the basic coverages that drivers need to meet their state requirements. It also sells add-ons like roadside assistance or rental reimbursement coverage.

The General Car Insurance Discounts

Because The General insurance rates are so high, it is important that customers apply for discounts to reduce rates. Discounts offered by The General include:

The General Car Insurance Discounts

| Discount Type | Savings Potential |

|---|---|

| Multi-Vehicle Discount | 25% |

| Good Student Discount | 20% |

| Homeowner Discount | 10% |

| Defensive Driving Discount | 10% |

| Paid-in-Full Discount | 10% |

| Military Discount | 15% |

| Safe Driver Discount | 15% |

Where can I get cheap full coverage car insurance? A multi-vehicle discount can save drivers 25% on their car insurance policy. Applying for as many discounts as possible will help make The General Insurance more affordable, especially if you are shopping for full coverage

The General Customer Reviews

Reading about what other customers think of The General is a great way to get feedback on customer service, claims, and more. For example, look what a customer posted on Reddit about trying to contact The General customer service below.

Sites like Reddit are a great way to get a feel for how a company handles business and how customers feel about filing a car insurance claim after an accident with a company. For the most part, The General doesn’t stand out regarding customer service or claims handling, with negative feedback and complaints posted by customers.

While some negative feedback is normal for all insurance companies, The General’s overall ratings suggest subpar service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The General Business Insurance Ratings

Reviews from businesses are another important factor to look at when reviewing The General car insurance. Business ratings will give you a comprehensive look at the best car insurance companies based on customer feedback, business practices, and more.

Take a look at the most important reviews from reputable businesses below.

The General Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 835 / 1,000 Avg. Satisfaction |

|

| Score: B+ Good Claims Handling |

|

| Score: 68/100 Avg. Customer Feedback |

|

| Score: 1.15 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

The General has good overall ratings from the BBB, J.D. Power, and Consumer Reports, as well as a strong financial stability rating from A.M. Best. However, the NAIC found that The General has a much higher customer complaint ratio than average. The normal complaint ratio is 1.0 for insurance companies, and The General Insurance has a much higher number recorded.

The General Pros and Cons

It can be difficult to choose an auto insurance company when buying car insurance, as you want to pick one that fits your needs and your budget. We found that some of the main pros of The General are:

- Insures High-Risk Drivers: The General covers drivers who may have issues finding auto insurance at other companies.

- Discount Options: The General has several discount options that can help customers lower auto insurance costs.

- Financial Stability: The General has a strong financial stability rating from A.M. Best.

Of course, not everything about The General is great. The cons of The General that may deter potential customers include:

- Customer Service: The General’s overall ratings from customers are just average.

- Higher Rates: The General is one of the most expensive car insurance companies.

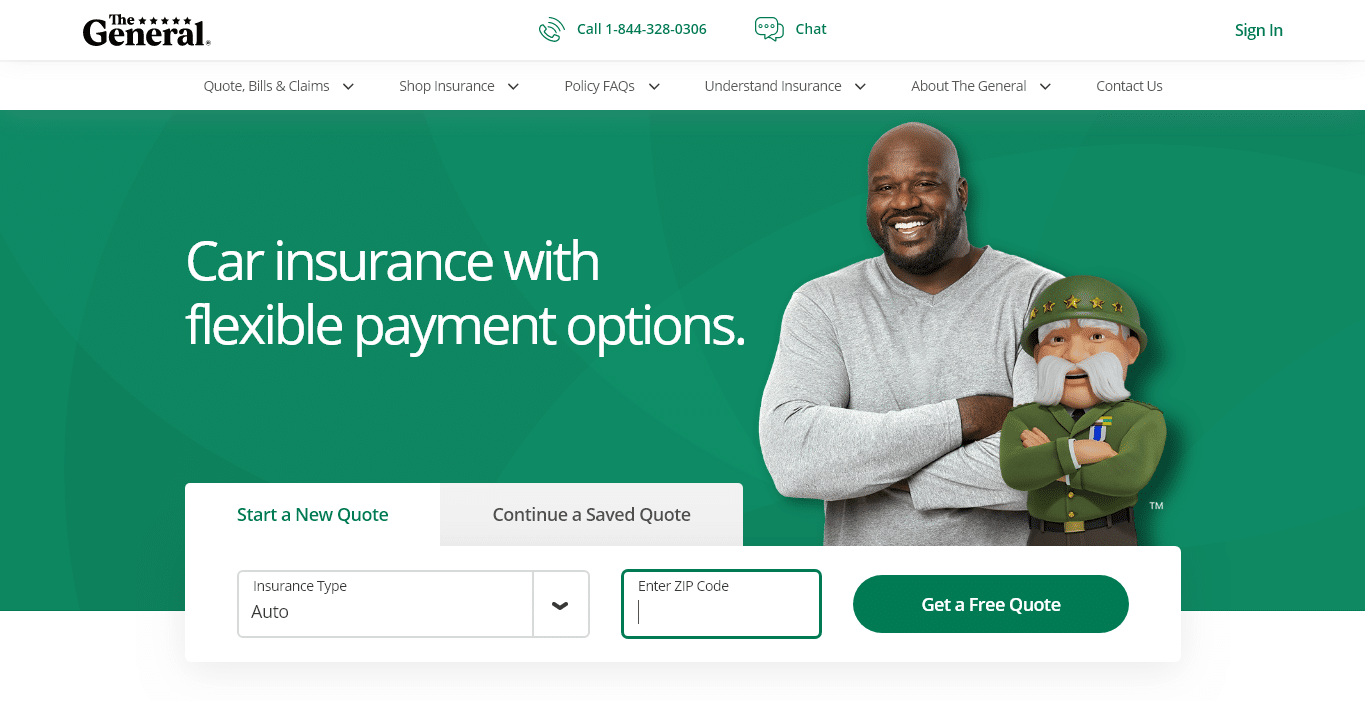

If The General is the right choice for you, then you can get quotes or sign up for insurance directly from The General’s website.

However, if you aren’t sure that The General is the right fit, make sure to shop around and compare car insurance quotes to find a company that is right for you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Deciding if The General is Right for You

Reading The General car insurance reviews and knowing how car insurance works at the company should help most customers decide whether the company is right for them. We found that while The General is a good option for drivers with poor driving records, it is not the best option for good drivers due to higher prices and fewer coverage options.

If you are ready to shop for affordable auto insurance coverage in your area, compare rates now with our free quote tool.

Frequently Asked Questions

Is The General actually good?

The General is a good high-risk car insurance company, but it has more expensive rates and just average customer satisfaction ratings.

Why is General car insurance so cheap?

The General car insurance rates are actually higher than average. To find cheap car insurance in your area, enter your ZIP in our free comparison shopping tool.

How many states is General Insurance in?

The General sells insurance in 47 states. The General’s car insurance rates by state will vary depending on what state you live in.

Is The General cheaper than Geico?

The General is actually more expensive on average than Geico.

Who typically has the cheapest car insurance?

USAA typically has the cheapest car insurance, but it only sells insurance to military members, veterans, and their families.

Who owns the General Auto Insurance Company?

American Family Insurance owns the General, but it still operates as a separate company.

What insurance does The General have?

The General sells auto, boat, motorcycle, home, renters, life, health, and pet insurance. You can bundle home or renters insurance with auto insurance to lower your car insurance cost with a bundling discount.

Does Shaquille O’Neal own the General Insurance?

Yes, Shaquille O’Neal owns part of The General and also acts as a spokesperson for the company.

How can I cancel The General car insurance?

Contact your agent or The General customer service line to cancel your policy at The General. However, make sure you have a new policy lined up before canceling, as you need car insurance to meet state requirements and drive legally.

How can I pay for The General car insurance?

You can pay The General car insurance premiums online or over the phone with a debit or credit card.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.