State Auto Car Insurance Review for 2026 [See Rates & Discounts Here]

The State Auto car insurance review covers company coverage options, pricing, and customer service, featuring affordable rates starting at $90. When analyzing policies, consider the state auto claims process to ensure they can handle your needs for convenience and dependability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2025

State Auto car insurance review shows rates as low as $90 and good coverage options. State Auto Insurance Company boasts competitive pricing, while the State Auto Financial Corporation delivers good customer service.

Meanwhile, some consumers found State Auto’s coverage less comprehensive than their competing rival. State Auto Property and Casualty Insurance Company is outstandingly great about processing their car insurance claim readily and hassle-free; hence, they explain other types of car coverage.

State Auto Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.0 |

| Business Reviews | 4.0 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.0 |

| Policy Options | 4.1 |

| Savings Potential | 4.4 |

State Auto is the best option for drivers looking for cheap, reliable coverage with good customer service. Compare several quotes to get the best policy for your needs.

Begin saving on your State Auto car insurance by entering your ZIP code and comparing personalized quotes.

- Get up to 30% off with auto and home insurance bundling

- State Auto’s claims process boasts a customer satisfaction rate of $90

- Enjoy accident forgiveness and discounts for safe driving with State Auto

State Auto Car Insurance Coverage Cost: A Detailed Analysis

State Auto Financial Corporation charges competitive rates at an average cost of $90 per month for standard policies. Premiums vary depending on many factors, including driving record, age, and location.

State Auto Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $225 | $325 |

| Age: 16 Male | $250 | $350 |

| Age: 18 Female | $215 | $310 |

| Age: 18 Male | $240 | $335 |

| Age: 25 Female | $110 | $180 |

| Age: 25 Male | $125 | $195 |

| Age: 30 Female | $100 | $160 |

| Age: 30 Male | $115 | $175 |

| Age: 45 Female | $90 | $150 |

| Age: 45 Male | $105 | $165 |

| Age: 60 Female | $85 | $140 |

| Age: 60 Male | $100 | $155 |

| Age: 65 Female | $85 | $140 |

| Age: 65 Male | $100 | $155 |

For example, younger drivers may pay more, whereas good drivers with no records may get huge discounts. With a 3.7/5 rating in the review, the company provides affordable rates and fair pricing on different driver profiles, addressing questions like, “Is it bad to have a car insurance driver monitor?”

Average Cost vs. Competitors

State Auto Insurance Company is affordable for high-risk drivers compared to providers such as Geico and Progressive.

Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $145 | $180 | $210 | |

| $110 | $135 | $170 | $200 | |

| $115 | $140 | $175 | $215 | |

| $100 | $125 | $160 | $190 | |

| $130 | $155 | $190 | $225 |

| $105 | $130 | $165 | $195 |

| $120 | $150 | $185 | $220 | |

| $110 | $140 | $175 | $210 | |

| $125 | $150 | $180 | $215 | |

| $95 | $120 | $155 | $185 |

For instance, a 30-year-old male with a clean driving record in Texas might pay $90 per month with State Auto, whereas State Farm would be $135 and Progressive $142. It is a cost-effective option for those who want value without compromising coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Discounts Available From State Auto

Auto insurance rates are a significant factor for most people when searching for coverage. There can be a surprising difference between companies in the rates they charge. Comparing rates between State Auto and other companies in your area helps you select a policy that works for you.

While the type of insurance you choose impacts your rates, several other factors affect the price of car insurance. Your geographic location makes a difference, as cost varies between and within states. You may even notice that your rates change when you move from one neighborhood to another within the same town. Age, marital status, and credit rating also play a role.

Insurance companies usually offer discounts, and State Auto is no exception. This company provides numerous discounts that customers can take advantage of to lower their rates. Even if you only qualify for a couple, they can reduce your rates and sometimes significantly. State Auto’s discounts include:

- Good student

- Driver training

- Accident prevention course

- Anti-theft device

- Pain-in-full

- Multi-policy

The company also offers a discount program called State Auto Safety 360®, which utilizes a device attached to your windshield to track your driving habits. If you enroll in the program, you receive an immediate 10% participation discount, and based on your driving score, you can get up to 50% off when your policy renews.

State Auto Insurance Coverage

State Auto has been around since 1921, when it opened its doors as State Automobile Mutual Insurance Company in Columbus, OH. The company’s founder aimed to make auto insurance more affordable with a faster claims process. More than 100 years later, the company has expanded to 28 states, utilizing private agents to create insurance products for its customers.

From the State Auto family to yours, peace. pic.twitter.com/Zs3RJhBioL

— State Auto Insurance (@StateAuto) December 20, 2018

No matter what type of auto insurance policy you need, you will likely find it on offer at State Auto. The company has the following standard coverages:

- Liability: Most states legally require residents to carry liability coverage, which pays for other people’s property damages and injuries when they are at fault in an accident.

- Collision: Liability won’t pay for damages to your vehicle if you cause an accident, but collision coverage will. It also pays for repairs if you hit an object or animal.>

- Comprehensive: Comprehensive covers damages to your vehicle from hail, wind, vandalism, and other non-accident causes.

- Uninsured/underinsured driver: With this coverage, you can protected if the at-fault driver in an accident has insufficient insurance coverage to pay your medical expenses. It also covers you in a hit-and-run accident.

- Personal injury protection and medical expenses: These plans pay for your medical expenses when you have a car accident, regardless of who is at fault. In many states, the coverage is optional, but in no-fault states, residents need this coverage.

State Auto also offers optional coverages like roadside assistance, accident forgiveness, full glass coverage, and total loss coverage. With three policy levels—Standard, Protection Plus, and AutoXtended® Premier—customers can choose from standard coverages and optional add-ons, making finding affordable full-coverage car insurance easier.

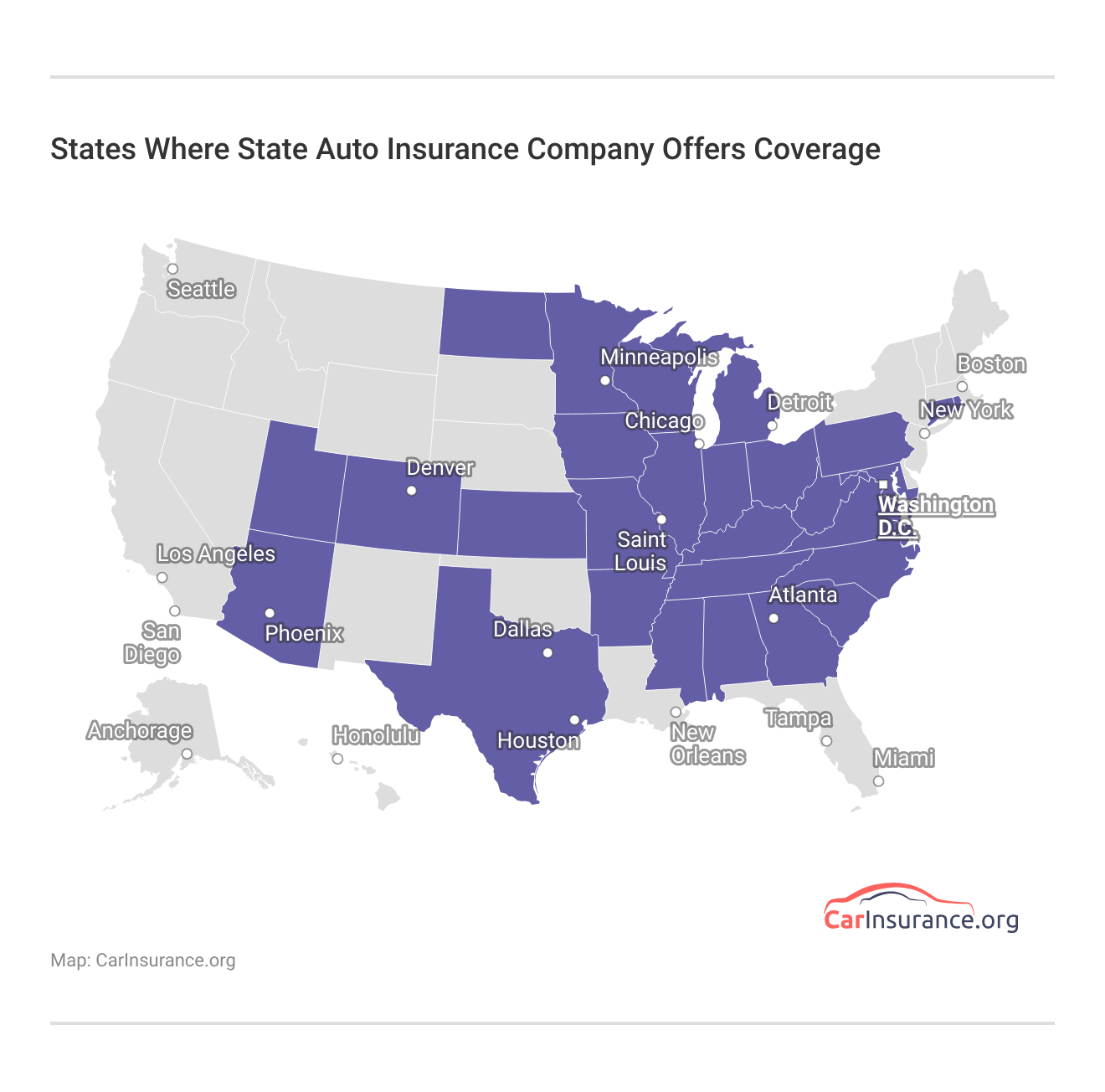

States Where State Auto Insurance Company Offers Coverage

Every state except Virginia requires its residents to demonstrate financial responsibility to pay for accidents they cause. Most people achieve this by purchasing auto insurance. However, not all companies offer insurance in every state. State Auto is available to residents in the following 28 states:

We were offered the company’s products through private agents within each state.

The Better Business Bureau does not accredit State Auto; however, the BBB gives the company an A+ rating. While consumer ratings do not affect the company’s rating, it’s worth noting that State Auto insurance reviews averaged 1.06/5 with the BBB.

State Auto Insurance is a good provider with broad coverage in several states. Its price is $90 per month, making it competitive for drivers.Eric Stauffer Licensed Insurance Agent

Furthermore, the National Association of Insurance Companies gives State Auto a Company Complaint Index Score of 1.84, which puts it well above the average number of complaints similar companies receive.

How To File a Car Insurance Claim With State Auto

If you have a car accident, you must usually contact your insurance company if the damage is over a specific amount, which varies by state. Before filing, it helps to know what to expect from the claims process. State Auto claims are online, and the company has an app available through Google and Apple, but only for its State Auto Safety 360® customers.

When you submit a claim, the company should ask for:

- Your policy number

- Accident or loss date

- Your vehicle identification number

- The mileage for your car

- Information about the other parties involved, including contact, driver’s license, insurance, and vehicle information

- Your preference for where you want to have your car repaired

You may also need to provide photos of the damage, so taking these before starting the process is a good idea. Alternatively, State Auto may send someone to look at your vehicle.

After surrendering your claim, you can check the company’s online portal status. Once the company reviews the information and your policy, examines the damage, and considers how much insurance you need for your car, it sends you a calculation for repairs, followed by payment. The company deposits costs right into your bank account.

State Auto Offers Other Types Of Insurance

State Auto offers discounts for those who purchase multiple products through them. Buying multiple policies under one company may make managing your insurance payments and plans more uncomplicated. State Auto offers the following additional personal insurance products:

- Homeowners

- Renters

- Dwelling fire

- Umbrella

You may still want to compare rates and policies for these other products to ensure you get the coverage you need at a favorable rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Reviews: How State Auto Performs Across Trusted Platforms

State Auto has received good ratings on various review sites, which reflects its financial strength and customer service. J.D. Power rates State Auto 820 out of 1,000, which is above average regarding customer satisfaction and claims handling.

State Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 820 / 1,000 Avg. Satisfaction |

|

| Score: A- Business Practices |

|

| Score: 60/100 Customer Feedback |

|

| Score: 1.89 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

BBB awards an A- rating, appreciating the response to complaints, but there are still some opportunities for improvement. Consumer Reports evaluates the company with 60/100, complimenting price transparency but noting some service issues. The NAIC Complaint Index is 1.89, meaning there were more complaints than the industry average, particularly on car insurance rates by state

Meanwhile, A.M. Best awards an A (Excellent) rating, assuring the company is financially strong and well-positioned to meet policyholder obligations. Ratings indicate that, although State Auto offers affordability with solid financial backing, customer experiences vary based on service interactions.

Pros and Cons of State Auto Insurance

Pros

- Affordable Rates: It offers a cheap rate of $90 per month.

- Attractive Discounts: It provides up to 30% in savings through telematics programs.

- Diverse Coverage Options: The insurance cover includes liability insurance, collision, and additional forms of endorsements. Read more for our “Do I need full coverage on a financed car?” for a full view.

Cons

- Limited Agent Network: In some places, getting in-person help from an agent may be difficult.

- Outdated Digital Tools: Online tools are less modern than competitors.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

State Auto Insurance Key Considerations

Flexible plans allow customers to determine coverage at an affordable price. State Auto Insurance claims to provide flexible coverage, but is it bad to have minimum coverage car insurance? While the cost is cheaper in the short run, drivers may not receive adequate coverage if they are involved in a bad accident.

Multi-policy discounts and safe driver options will decrease costs, but remember the company’s lower BBB ratings when deciding.

Find the best car insurance for your needs—enter your ZIP code to compare coverage options from top insurers in your area.

Frequently Asked Questions

What do State Auto home insurance reviews say about satisfaction and coverage?

State Auto home insurance reviews with customer experiences. Some appreciate the many options for customizing coverage, such as protecting valuable items and liability insurance. Customers complain about how long it takes to process claims and about representatives who do not communicate well. Given the rich options available in the policy, it is ideal for homeowners seeking customized coverage.

How do State Auto’s BBB ratings reflect its reputation and service quality?

The Better Business Bureau (BBB) rating for State Auto Insurance is average, as indicated in various reviews of state auto insurance companies. It relates to satisfactory but not excellent customer service and reliability. Some find the prompt responses commendable, while others did complain about claims handling and dispute settlement. A mixed rating here advises users to consider the company’s reputation in the BBB when choosing.

Where can you find State Auto Insurance offices and services in Dallas?

The State Auto Insurance services in Dallas, including buying car insurance, are available on the company’s website or by calling the customer service line. Offices often offer policy help, claims service, and consulting to local customers.

What services does State Auto Insurance Laredo offer to local policyholders?

State Auto Insurance Laredo gives local policyholders access to comprehensive services, including auto, homeowners, and renters insurance. Customers can also access claims support and policy customization tailored to the specific needs of Laredo residents.

Secure affordable car insurance by entering your ZIP code to explore tailored coverage plans from trusted providers.

How does State Auto’s AM Best rating compare with other insurers?

State Auto carries an AM Best rating of “A—” (Excellent), meaning it has superior financial strength and can meet its policyholder obligations. This rating makes State Auto an attractive choice compared to the competition, making it a good choice for someone looking for a financially strong insurer.

Is State Auto a good insurance company for affordable and reliable coverage?

State Auto is a good choice for affordable coverage, especially for drivers and homeowners seeking customizable options. If you’re wondering, “Can you insure a car that is not in your name?” it’s essential to review their policy flexibility to address such scenarios. Although prices are competitive, customers should review comments about claim processing and customer service to ensure they meet their needs.

How do you get an accurate auto insurance quote from State Auto?

You can get free, accurate auto insurance quotes from State Auto by visiting their website, using their online quote tool, or contacting a local agent. Reviewing the State Auto insurance rating and a State Auto quote allows you to compare these options with other providers to find the best rates and coverage options.

What coverage options does State Auto Insurance Maryland offer to drivers?

Maryland State Auto Insurance offers many coverage options, including comprehensive, liability, collision, and uninsured motorist protection, making it a great insurance choice for those searching for a State Auto Insurance plan. Add-ons, including roadside assistance and rental reimbursement, are also available to Maryland residents, which add value to the offer for drivers looking for cheap auto insurance without compromising on necessary features.

What do Safeway Insurance Company of Georgia reviews say about their services?

Safeway Insurance Company of Georgia reviews note that the company is affordable and offers basic coverage options for budget-conscious drivers. Although customers praise the competitive pricing, some reviews highlight challenges with the claims processing and responsiveness of the customer service. Safeway Insurance is an option for drivers looking for affordable state-minimum coverage, but potential policyholders should carefully review the terms and compare quotes with other providers.

How is Safeway Insurance lienholder verification accurate loan information?

Safeway Insurance lienholder verification ensures that lienholder details are accurately documented, reducing discrepancies and maintaining compliance with loan agreements. This service benefits policyholders by ensuring transparency in loan and insurance processes.

What do New Jersey State Auto reviews say about vehicle selection and financing?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.