Safety Car Insurance Review in 2026 [See if They’re a Good Fit]

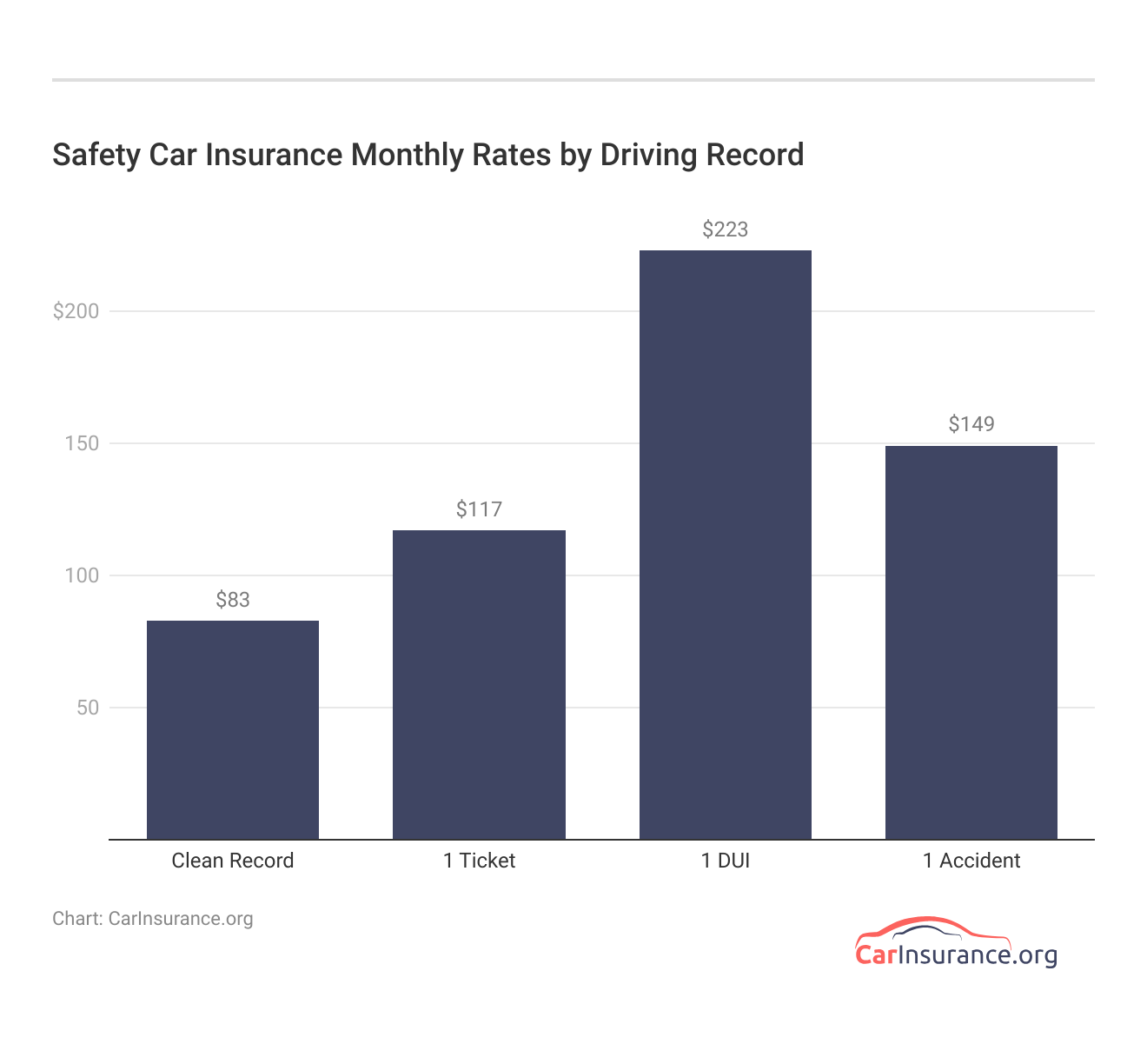

This Safety car insurance review highlights a top provider offering dependable coverage, with rates starting at $83/month. Safety Insurance is known for providing competitive rates, which are great for New England drivers looking for value-focused, customizable vehicle coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated March 2025

Our Safety car insurance review found the company’s rates start at just $83 monthly, and it’s also a popular choice for New England drivers.

Safety Insurance is the top pick for New England drivers, with average low rates of $83/month, matched with perfect regional service. Uncover more by delving into our article, “Safe Driving Tips: How to Keep Your Insurance and Car Safe.”

Safety Car Insurance Rating

Rating Criteria |  |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 3.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.0 |

| Policy Options | 2.2 |

| Savings Potential | 4.1 |

Policyholders can enjoy flexible coverage options such as bodily injury, collision, and medical payments, and riders like Gap coverage and roadside assistance. Enter your ZIP code to see if you’re getting the best deal on car insurance.

- Safety car insurance review shows top coverage with rates starting at $83/month

- Tailored policies and discounts make Safety ideal for New England drivers

- Reliable claims support and regional expertise ensure peace of mind

Safety Car Insurance Coverage Cost

Safety Insurance offers a range of plans, with costs varying based on age, gender, location, driving history, and selected coverage.

Safety Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $131 | $270 |

| Age: 16 Male | $139 | $284 |

| Age: 18 Female | $127 | $263 |

| Age: 18 Male | $143 | $299 |

| Age: 25 Female | $95 | $217 |

| Age: 25 Male | $103 | $225 |

| Age: 30 Female | $89 | $208 |

| Age: 30 Male | $93 | $232 |

| Age: 45 Female | $79 | $184 |

| Age: 45 Male | $83 | $192 |

| Age: 60 Female | $73 | $179 |

| Age: 60 Male | $76 | $185 |

| Age: 65 Female | $70 | $168 |

| Age: 65 Male | $74 | $173 |

Although safety insurance rates may be higher than those of some larger national providers, its regional expertise and responsive claims service can make it a worthwhile choice for those in New England who prioritize reliability and a provider familiar with their specific needs. Expand your understanding with our article, “The Different Types of Car Insurance Coverage.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safety Car Insurance Review

Safety car insurance is a trusted provider of customizable coverage options ideal for New England drivers. It offers its policyholders various coverage options, competitive pricing, and discounts.

This guide details Safety car insurance rates, coverage, and customer reviews. To better understand the topic, read our article “Car Insurance Quotes, Tips, and Savings.”

Safety Insurance Average Cost vs. Competitors

While Safety car insurance is competitive with other non-standard providers, some rates are relatively high compared to those provided by larger national insurers.

Safety Insurance stands out for its responsive claims service and regional expertise, which is ideal for New England drivers. Reviews from customers with Safety car and home insurance policies show most are satisfied.Scott W. Johnson Licensed Insurance Agent

Safety Insurance, meanwhile, can be particularly appealing to New England drivers based on its regional focus and responsive customer service, even if larger companies have lower average prices.

Safety Insurance offers tailored coverage options and a responsive claims process, giving policyholders peace of mind if an accident does happen.

Safety Insurance is an excellent option for drivers who want to go local and those who need industry experience in their area, even for slightly higher premiums. For additional insights, refer to our “How Car Insurance Works.”

Safety Insurance Coverage Options

Such options grant policyholders sovereignty and enable them to tailor their plans according to their requirements and budgets.

- Liability Coverage: This feature of the car insurance policy offers insight into the liability coverage for bodily injuries and property damage to 3rd parties. Please highlight the coverage for other parties.

- Collision Coverage: Provides additional coverage for your vehicle to be repaired after an accident

- Complete Coverage: For incidents outside of accidents such as theft, fire, and vandalism.

- Uninsured/Underinsured Motorist Coverage: When you are hit by an uninsured or underinsured motorist that damages your vehicle.

- Medical Payments Coverage: Assists with the cost of medical care for you and your passengers in the event of an accident.

- Optional Extras: Rental reimbursement, roadside assistance, and gap coverage are available as add-ons.

This option allows policyholders to customize their plans based on their needs and budget. Our article “What does car insurance cover?” will help you gain a deeper understanding.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safety Insurance Available Discounts

Safety Insurance provides several discounts that help drivers save on their premiums:

- Cleans Driving Record: Drivers with no accidents or moving violations.

- Multi-policy Discount: For bundling auto with home or renters insurance.

- Multi-vehicle Discount: Provides savings for insuring several vehicles.

- College Student Discount: For students who maintain a high GPA

The discounts allow Safety Insurance to be an excellent option for drivers on a budget who want to maintain coverage quality for a lower price. Find out more by reading our “Car Insurance with Telematics.”

Safety Insurance Customer Reviews

Safety Insurance has received cheerful customer reviews overall, with several praising the company for its friendly local service and dependable customer support claims. New England policyholders often say the claims process is simple, and agents respond quickly.

Other reviews say premiums are higher than with more significant national carriers and that offerings can be limited outside New England. Broaden your knowledge with our article “How to Lower Your Car Insurance Cost.”

Safety Insurance Business Review

Safety Insurance has a good reputation and a significant market share in New England. The company pays claims well, evidenced by its A (Excellent) rating from A.M. Best for financial stability.

Safety Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Safety Insurance may not have a nationwide appeal, but because it specializes in New England, it concentrates on the needs and regulations of drivers in that area. Explore further with our article, “How to Find a Safe, Budget-Friendly Car for your Teen.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safety Insurance Pros and Cons

New England drivers seeking tailored coverages and local expertise can turn to Safety Insurance, although you may find regional premiums higher than standard national providers.

Pros

- Strong local presence in New England

- Variety of customizable coverage options

- Positive claims experience and responsive customer service

- Numerous discount options

Cons

- Higher premiums compared to some national insurers

- Limited to New England states, with no coverage outside the region

Safety Insurance specializes in New England drivers, and while it is not widely available and is a little more expensive, it packs regional solid support, customizable plans, and reliable claims service into its offering. Gain insights by reading our article “Best Car Insurance by Vehicle.”

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Overview of Safety Car Insurance

Safety Insurance is a great option if you live in New England and want a tailored policy with a local presence. Although its premiums may be higher than some of its competition, Safety Insurance is a smart option with a highly responsive customer service team, discounts based on lifestyle habits, and an easy and quick claims process.

From the regional focus to the niche discounts, safety insurance car insurance will be a good choice for motorists in New England. Our article, “Buying Car Insurance: How to Find the Best Policy for You,” will deepen your understanding. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

Frequently Asked Questions

What do Safety Insurance Company reviews say?

Safety Insurance company reviews generally highlight vital customer service and responsive claims handling. For further details, consult our article, “The Perks of Staying on Your Parents’ Car Insurance Policy.”

What is Safety, and what coverage does it offer?

Safety car insurance offers liability, collision, comprehensive, and add-on coverages like roadside assistance.

How does Safety Insurance compare with other car insurance providers in Massachusetts?

Safety Insurance is known for its strong local expertise, customer service, and flexible policy options for New England drivers.

Does Safety Insurance provide a low-mileage discount for drivers?

Yes, Safety Insurance offers discounts for low-mileage drivers to help reduce premiums. Discover more by reading our article “How to Drive Safely, No Matter the Time of Day.”

What is the Safety Insurance cancellation policy for car insurance?

Safety Insurance requires a written notice to cancel a policy; fees may apply depending on the timing.

Can I get a Safety car insurance quote online?

Yes, quotes are available online or through a local agent.

Does Safety Insurance offer rental car coverage after an accident?

Yes, Safety Insurance provides rental car coverage if added to your policy. To understand the topic better, read our article “Best Car Insurance in Arizona.”

What is the Safety Insurance rating for customer satisfaction and claims?

Safety Insurance has a strong customer satisfaction rating, particularly for its claims service.

What roadside assistance options does Safety Insurance offer to policyholders?

Safety Insurance offers roadside assistance for towing, flat tires, and other emergencies.

Are there Safety Insurance complaints about customer service or claims processing?

While generally positive, some customers report issues with claims processing times. Uncover additional insights in our article “Best Car Insurance in California.”

What are some common types of discounts available with Safety Insurance?

Is Safety Insurance a good choice for drivers in Boston, MA?

How do I obtain a quote for Safety Insurance for my car in Massachusetts?

Does a Safety Insurance Company offer health and safety insurance policies?

What should I know about Safety Insurance’s policies for New England drivers?

Does Safety Insurance cover rental cars as part of its auto insurance policies?

What is the process for getting a Safety car insurance quote for Massachusetts drivers?

How does Safety Insurance handle complaints and resolve issues for customers?

What are the main factors affecting a Safety Insurance quote?

Is Safety Insurance available only in Massachusetts, or does it cover other areas?

What is Safety Insurance’s approach to handling roadside assistance claims?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.