Lemonade Car Insurance Review for 2026 [See if They’re a Good Fit]

Our Lemonade car insurance review highlights it as a great option for lower-mileage, safe drivers, with rates starting at $41/mo. However, potential Lemonade customers should note customer complaints about pricing and claim processing, which may affect overall satisfaction with Lemonade's services.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated March 2025

This Lemonade car insurance review highlights its competitive rates starting at $41/month and a generous 15% discount for safe drivers with clean records.

Lemonade is advantageous for lower-mileage, good drivers seeking affordable car insurance coverage, although car insurance rates by state will vary. It’s essential to consider Lemonade’s drawbacks, such as customer complaints about pricing and claims processing.

Lemonade Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 4 |

| Claim Processing | 4 |

| Company Reputation | 4 |

| Coverage Availability | 4.3 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 4.8 |

| Digital Experience | 4.5 |

| Discounts Available | 5 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4 |

| Policy Options | 2.2 |

| Savings Potential | 4.2 |

While Lemonade provides free roadside assistance and has strong financial stability, it is not the best fit for drivers with DUI histories.

Prospective Lemonade customers should carefully evaluate these factors. It would be best if you also compared multiple insurance quotes with our free tool to ensure you find the right company for your needs.

- Lemonade car insurance rates start at $41/mo for good drivers

- The largest discount is a 15% reduction for safe drivers with no accidents

- Lemonade has free roadside assistance for up to three incidents

Cost of Lemonade Car Insurance

Several factors will affect your Lemonade car insurance rates on a policy, beginning with your age and gender.

Lemonade Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $220 | $350 |

| Age: 16 Male | $250 | $375 |

| Age: 18 Female | $170 | $310 |

| Age: 18 Male | $190 | $335 |

| Age: 25 Female | $95 | $160 |

| Age: 25 Male | $110 | $180 |

| Age: 30 Female | $65 | $140 |

| Age: 30 Male | $70 | $150 |

| Age: 45 Female | $40 | $135 |

| Age: 45 Male | $41 | $147 |

| Age: 60 Female | $38 | $130 |

| Age: 60 Male | $40 | $135 |

| Age: 65 Female | $37 | $125 |

| Age: 65 Male | $39 | $130 |

Because young drivers pay so much more for car insurance at companies, including Lemonade, young drivers should stay on a parent’s policy as long as possible (Perks of Staying on Your Parents’ Car Insurance Policy).

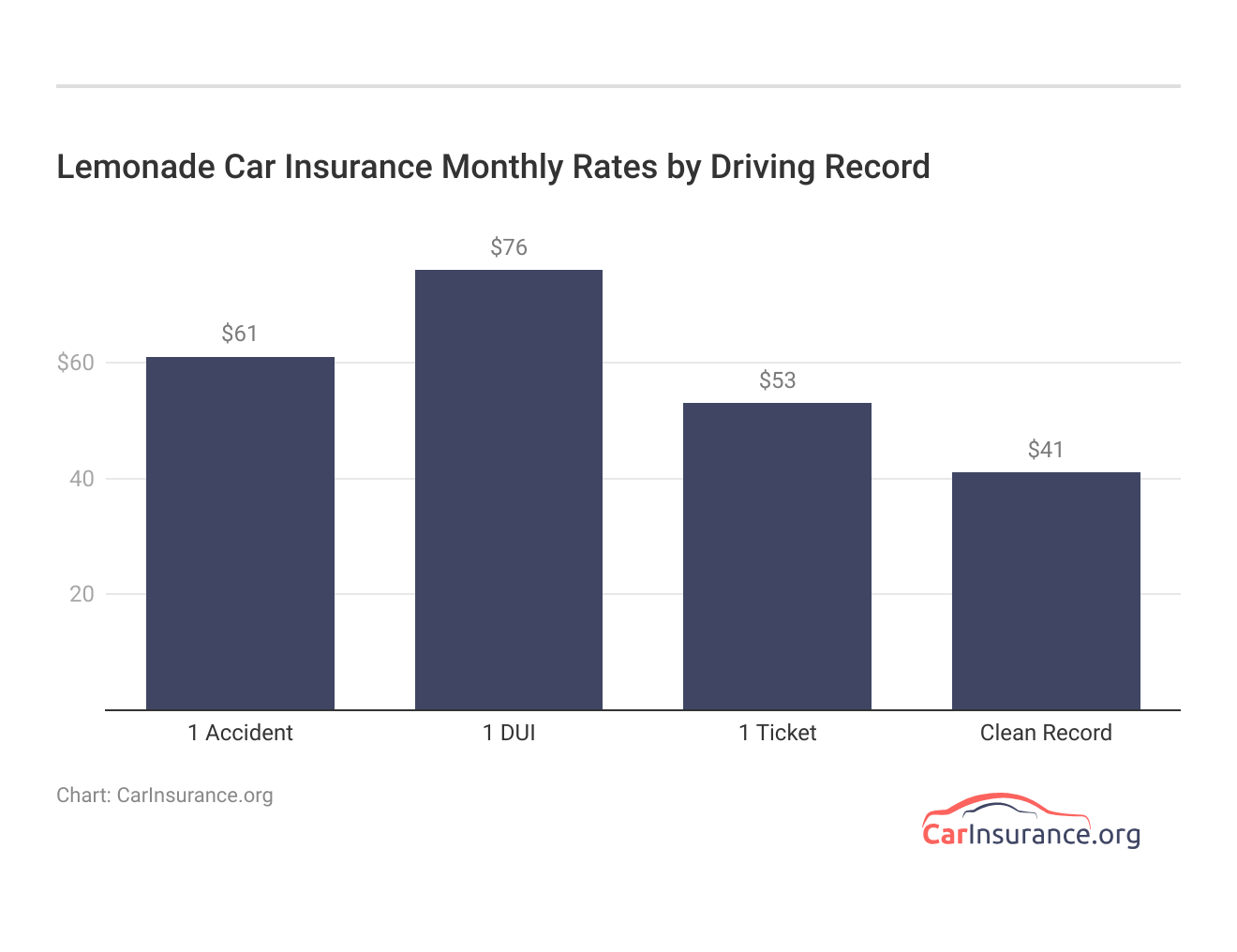

Another major factor affecting Lemonade auto insurance rates is driving record. See what Lemonade charges for different driving records below.

Lemonade is not the best affordable option for DUI drivers, as Lemonade’s DUI rates are quite expensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Car Insurance Rates vs. the Competition

Lemonade is an affordable option for most drivers with clean driving records, even when compared to other popular auto insurance companies.

Lemonade Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $135 | $147 |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

Lemonade is less affordable among its competition when it comes to other factors that affect the price of car insurance, such as driving records.

Lemonade Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $147 | $175 | $207 | $267 |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

If you have a poor driving record, other car insurance companies may be a better choice than Lemonade.

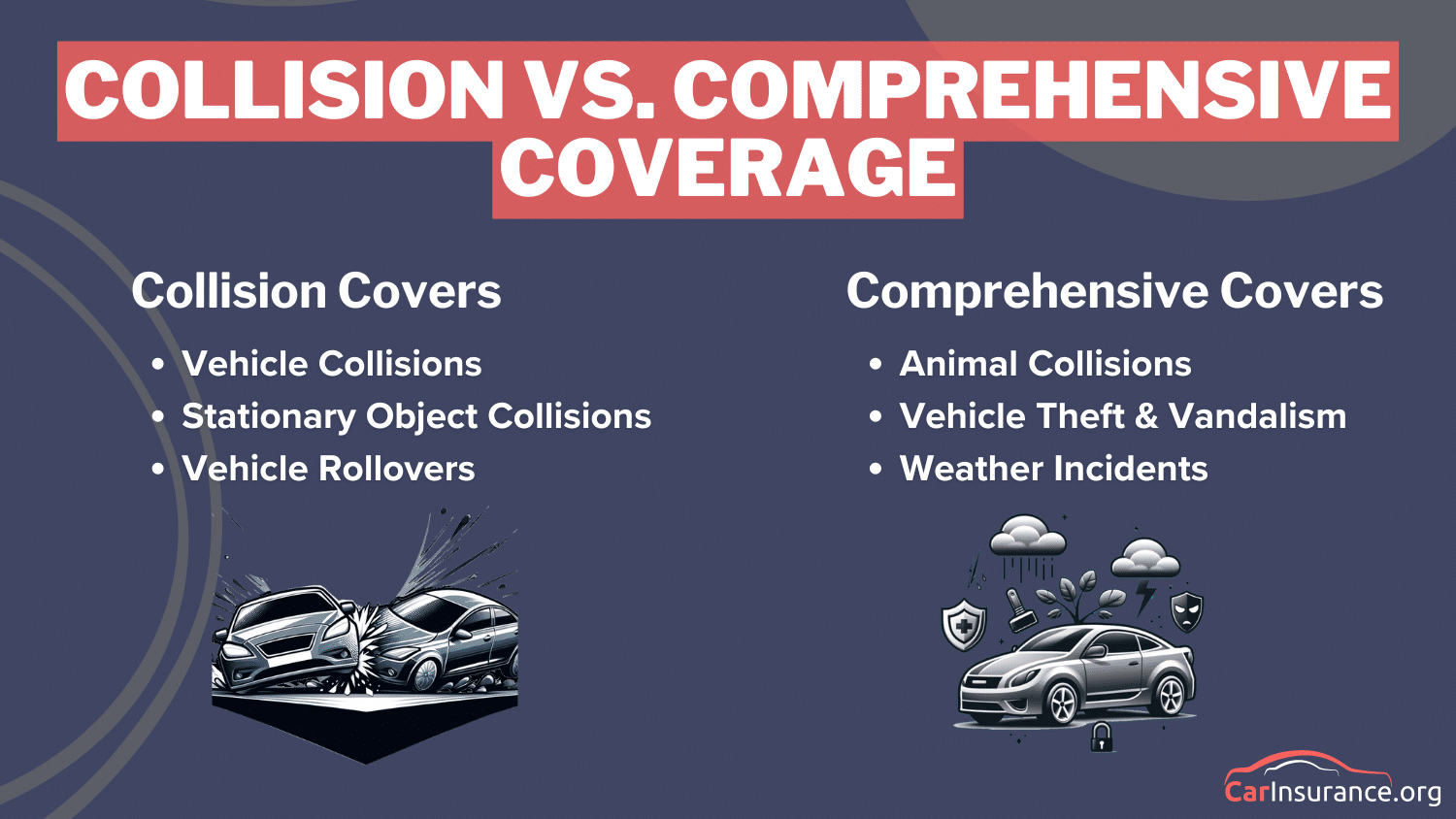

Lemonade Car Insurance Coverage Choices

If you are looking for policies with the following different types of car insurance coverage, then Lemonade may be a good fit for you.

Lemonade Car Insurance Coverage Options

| Coverage Name | What it Covers |

|---|---|

| Collision Coverage | Repairs to your car after a crash |

| Comprehensive Coverage | Theft, vandalism, and non-collision events |

| Gap Insurance | Difference between car value and loan |

| Liability Coverage | Injuries and damages to others |

| Medical Payments | Medical bills for injuries in an accident |

| New Car Replacement | Replaces a totaled car with a new one |

| Personal Injury Protection | Medical expenses for you and passengers |

| Rental Car Reimbursement | Rental costs during car repairs |

| Roadside Assistance | Towing and emergency services |

| Uninsured/Underinsured Motorist | Damages from uninsured drivers |

Liability insurance is the minimum required in most states, although most drivers opt to carry a Lemonade full coverage policy with collision and comprehensive car insurance.

Lemonade provides free roadside assistance to all Lemonade customers, covering three incidents in six months. Other add-on coverages will cost more to add to your Lemonade policy.

Lemonade Car Insurance Discounts

Lemonade provides several Lemonade discount opportunities for customers to lower their auto insurance rates (Read More: How to Lower Your Car Insurance Cost).

Lemonade Car Insurance Discounts and Savings

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Bundling | 10% | Bundle car and home/renters insurance |

| Safe Driver | 15% | No accidents or violations |

| Anti-Theft Device | 5% | Install anti-theft devices |

| Multi-Car | 10% | Insure multiple vehicles |

| Paperless Billing | 5% | Opt for electronic billing |

| Pay-In-Full | 5% | Pay annual premium upfront |

| Good Student | 10% | Maintain a "B" average or higher |

| Defensive Driving | 10% | Complete a driving course |

| Low Mileage | 10% | Drive under set mileage limit |

| Continuous Coverage | 10% | No coverage gaps |

The biggest discount Lemonade provides is a 15% discount for safe drivers. To qualify, drivers must have no accidents or violations on their driving record in the last few years.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Customer Reviews

Customer reviews of Lemonade give insight into customer satisfaction at a company. Lemonade has its fair share of customer complaints when you check customer reviews on sites like Reddit.

Recently switched to Lemonade Car insurance to save money

byu/Lower-Emergency-5311 inInsurance

Common Reddit complaints involve prices being higher than expected, as well as grievances when filing a car insurance claim after an accident.

Lemonade Business Ratings

Customer reviews are just one aspect to consider when evaluating Lemonade. Before buying car insurance, take a look at business reviews for insight into company operations, customer satisfaction, and more.

Lemonade Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction |

|

| Score: B Average Customer Satisfaction |

|

| Score: 70/100 Average Customer Satisfaction |

|

| Score: 2.50 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

J.D. Power gave Lemonade a below-average rating for customer satisfaction, and NAIC recorded more complaints than average from customers. However, Lemonade has good ratings from BBB and Consumer Reports, as well as good financial stability.

Lemonade Pros and Cons

Drivers want to find a reliable and affordable car insurance company, and Lemonade may not be right for all drivers. The pros of choosing Lemonade include:

- Add-On Coverages: Lemonade offers roadside assistance for free and has gap and rental reimbursement available for purchase (Learn More: The Perks and Pitfalls of Car Insurance Add-Ons).

- Discount Opportunities: Lemonade car insurance discounts include good student discounts, bundling discounts, and more.

- Financial Stability: Lemonade has an A rating for excellent financial strength from A.M. Best.

The issues that customers may face when choosing Lemonade vary, but the biggest potential problems are the following:

- Customer Complaints: Lemonade has many customer complaints recorded, pointing to issues with customer service, claims, and more.

- Limited Availability: Customers planning a move will likely have to switch providers, as Lemonade is sold in only a few states.

Although Lemonade has some attractive features, make sure to debate the cons before committing to a policy with Lemonade.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Considering if Lemonade Car Insurance is Best for You

This review of Lemonade car insurance reveals that its pros are competitive rates and a standout 15% discount for safe drivers with clean records.

However, while Lemonade may be one of the cheapest car insurance companies for some drivers, a notable con is the high number of customer complaints, particularly regarding claims processing.

Lower-mileage drivers are likely to benefit the most from Lemonade’s offerings, and may appreciate the ease of managing policies through the app.Dani Best Licensed Insurance Producer

However, prospective policyholders must compare multiple car insurance companies online to ensure they find the best coverage and rates tailored to their needs. Enter your ZIP in our free quote tool to get started.

Frequently Asked Questions

Is Lemonade insurance reliable?

Yes, Lemonade insurance Agency is considered reliable, as it has average ratings from several businesses.

What is the downside of Lemonade?

One of the downsides of Lemonade is that it isn’t widely available, as it’s only sold in a few select states. Lemonade is also best for low-mileage drivers with good driving skills. Poor drivers may want to shop elsewhere.

Why is Lemonade insurance so cheap?

Part of the reason Lemonade auto insurance can be affordable is because of how car insurance works at Lemonade. Because it bases rates on mileage and driving behavior, costs will be lower for low-mileage, good drivers.

Why is Lemonade better than other insurance companies?

Lemonade may be better for low-mileage drivers looking for rates based on their driving behaviors, but Lemonade may also not be the best fit for everyone.

Who owns Lemonade car insurance?

Lemonade, Inc. owns Lemonade auto insurance.

Does Lemonade actually pay out claims?

Yes, Lemonade pays out claims, although it has a lower-than-average claims satisfaction rating from J.D. Power, with customers not happy about their settlement negotiations with Lemonade (Read More: How to Negotiate a Settlement after a Car Accident).

Can I cancel Lemonade insurance anytime?

Yes, you can cancel your Lemonade insurance policy at any time. If you want a new car insurance provider, compare rates for free with our comparison tool.

Does Lemonade not do monthly payments?

Lemonade does do monthly auto insurance payments.

Does Lemonade have a deductible?

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Lemonade cover stolen items from a car?

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Yes, Lemonade insurance Agency is considered reliable, as it has average ratings from several businesses.

One of the downsides of Lemonade is that it isn’t widely available, as it’s only sold in a few select states. Lemonade is also best for low-mileage drivers with good driving skills. Poor drivers may want to shop elsewhere.

Why is Lemonade insurance so cheap?

Part of the reason Lemonade auto insurance can be affordable is because of how car insurance works at Lemonade. Because it bases rates on mileage and driving behavior, costs will be lower for low-mileage, good drivers.

Why is Lemonade better than other insurance companies?

Lemonade may be better for low-mileage drivers looking for rates based on their driving behaviors, but Lemonade may also not be the best fit for everyone.

Who owns Lemonade car insurance?

Lemonade, Inc. owns Lemonade auto insurance.

Does Lemonade actually pay out claims?

Yes, Lemonade pays out claims, although it has a lower-than-average claims satisfaction rating from J.D. Power, with customers not happy about their settlement negotiations with Lemonade (Read More: How to Negotiate a Settlement after a Car Accident).

Can I cancel Lemonade insurance anytime?

Yes, you can cancel your Lemonade insurance policy at any time. If you want a new car insurance provider, compare rates for free with our comparison tool.

Does Lemonade not do monthly payments?

Lemonade does do monthly auto insurance payments.

Does Lemonade have a deductible?

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Lemonade cover stolen items from a car?

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Part of the reason Lemonade auto insurance can be affordable is because of how car insurance works at Lemonade. Because it bases rates on mileage and driving behavior, costs will be lower for low-mileage, good drivers.

Lemonade may be better for low-mileage drivers looking for rates based on their driving behaviors, but Lemonade may also not be the best fit for everyone.

Who owns Lemonade car insurance?

Lemonade, Inc. owns Lemonade auto insurance.

Does Lemonade actually pay out claims?

Yes, Lemonade pays out claims, although it has a lower-than-average claims satisfaction rating from J.D. Power, with customers not happy about their settlement negotiations with Lemonade (Read More: How to Negotiate a Settlement after a Car Accident).

Can I cancel Lemonade insurance anytime?

Yes, you can cancel your Lemonade insurance policy at any time. If you want a new car insurance provider, compare rates for free with our comparison tool.

Does Lemonade not do monthly payments?

Lemonade does do monthly auto insurance payments.

Does Lemonade have a deductible?

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Lemonade cover stolen items from a car?

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Lemonade, Inc. owns Lemonade auto insurance.

Yes, Lemonade pays out claims, although it has a lower-than-average claims satisfaction rating from J.D. Power, with customers not happy about their settlement negotiations with Lemonade (Read More: How to Negotiate a Settlement after a Car Accident).

Can I cancel Lemonade insurance anytime?

Yes, you can cancel your Lemonade insurance policy at any time. If you want a new car insurance provider, compare rates for free with our comparison tool.

Does Lemonade not do monthly payments?

Lemonade does do monthly auto insurance payments.

Does Lemonade have a deductible?

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Lemonade cover stolen items from a car?

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Yes, you can cancel your Lemonade insurance policy at any time. If you want a new car insurance provider, compare rates for free with our comparison tool.

Lemonade does do monthly auto insurance payments.

Does Lemonade have a deductible?

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Lemonade cover stolen items from a car?

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Yes, you choose an auto insurance deductible you want on your Lemonade auto insurance policy. Make sure it is a deductible you can pay when it comes time to use your deductible (Learn More: When to Use Your Deductible).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Lemonade renters or home insurance covers stolen car items, not Lemonade car insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.