Kemper Car Insurance Review for 2026 [See if They’re a Good Fit]

Kemper car insurance offers SR-22 coverage from $44 monthly for high-risk drivers with violations, lapses, or accidents. This Kemper car insurance review covers unique benefits, like accident forgiveness and diminishing deductibles for those needing proof of state-required financial responsibility.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

Discover Kemper car insurance review detailing SR-22 coverage for high-risk drivers needing proof of financial responsibility.

Kemper provides accident forgiveness and a diminishing deductible, helping policyholders lower long-term costs. Discover key insights on how car insurance works easily.

Kemper Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.5 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 2.8 |

| Digital Experience | 4.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.1 |

Drivers who have had past mistakes or gaps can get necessary insurance while taking advantage of special savings plans.

Find out how Kemper’s specific policy options could benefit your requirements. Enter your ZIP code to explore Kemper car insurance savings instantly.

- Kemper car insurance review covers SR-22 for high-risk drivers

- Offers accident forgiveness and a diminishing deductible

- Provides coverage for drivers with violations or insurance gaps

How Kemper Car Insurance Rates Compare to Competitors

This table depicts Kemper car insurance monthly prices by coverage level, age, and gender, giving minimum and full coverage options in different age ranges. Kemper car insurance rates vary significantly by age and gender. Younger drivers pay more, especially full coverage.

Kemper Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $239 | $619 |

| Age: 16 Male | $258 | $639 |

| Age: 18 Female | $194 | $456 |

| Age: 18 Male | $221 | $520 |

| Age: 25 Female | $57 | $152 |

| Age: 25 Male | $58 | $156 |

| Age: 30 Female | $53 | $255 |

| Age: 30 Male | $54 | $275 |

| Age: 45 Female | $48 | $128 |

| Age: 45 Male | $47 | $125 |

| Age: 60 Female | $44 | $114 |

| Age: 60 Male | $46 | $117 |

| Age: 65 Female | $48 | $122 |

| Age: 65 Male | $46 | $125 |

The older the driver, the lower the rate. The lowest rate is paid by those 45 years old. This shows how age and level of coverage affect insurance costs.

The table below compares Kemper car insurance rates with top competitors. It outlines the monthly costs for both minimum and full coverage and shows how rates vary.

Kemper Car Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $209 | |

| $80 | $255 | |

| $34 | $99 | |

| $123 | $149 | |

| $70 | $200 |

| $53 | $129 |

| $65 | $148 | |

| $47 | $95 | |

| $50 | $113 | |

| $29 | $87 |

USAA offers the lowest minimum coverage, $29, while Farmers has the highest, $80. Full coverage costs range from $87 with USAA to $255 with Farmers. Consult the best car insurance companies to learn more.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

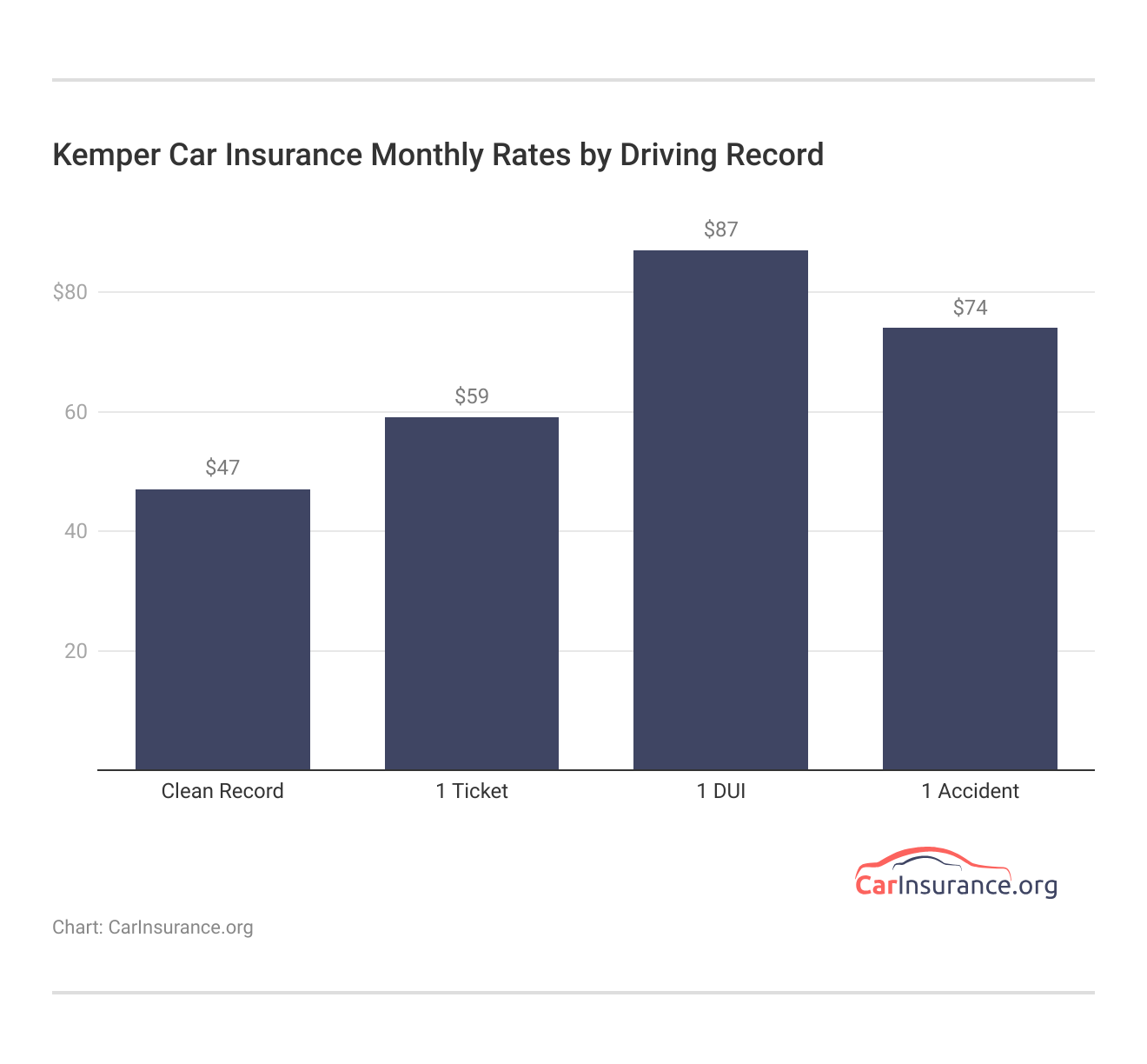

Kemper Car Insurance Monthly Rates by Driving Record

This table outlines Kemper car insurance rates based on driving records. A clean record secures the lowest minimum coverage rate, $47, while a DUI raises it to $87.

Full coverage rates also increase with violations. Tickets and accidents lead to higher premiums, showing how driving history affects insurance costs. To gain more information, browse the best car insurance by vehicle.

Analyzing Kemper Car Insurance Customer Reviews and Ratings

However, Kemper’s insurance rating from A.M. Best has earned an A++ grade, indicating superior financial strength in J.D. Power.

Kemper Car Insurance Business Ratings and Consumer Reviews

| Agency | |

|---|---|

| Score: 795 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A++ Superior Financial Strength |

In an auto insurance study, Kemper ranked below average, particularly in customer satisfaction areas such as ease of claims filing and agent communication.

Did you know? There are a few differences between personal and commercial auto insurance. Here are a few: pic.twitter.com/Fk8Ebeg5rK

— Kemper (@KemperInsurance) February 20, 2025

While customer feedback regarding Kemper is mixed, many policyholders appreciate the extensive coverage options. However, several have expressed frustration with customer service and claim handling.

The NAIC reports a higher-than-average number of customer complaints at Kemper during recent years, primarily related to claims processing, billing issues, and customer service concerns. This Reddit post has mixed opinions in the comment section about why people switch to Kemper. Read more about the perks and pitfalls of car insurance add-ons.

Exploring Kemper Car Insurance Coverage Benefits

Kemper car insurance delivers essential coverage, from bodily injury liability for at-fault accidents to collision and comprehensive insurance for vehicle protection. Kemper provides standard coverage options such as:

- Bodily Injury Liability

- Property Damage Liability

- Comprehensive

- Collision

- Medical Payments (MedPay)

- Personal Injury Protection (PIP)

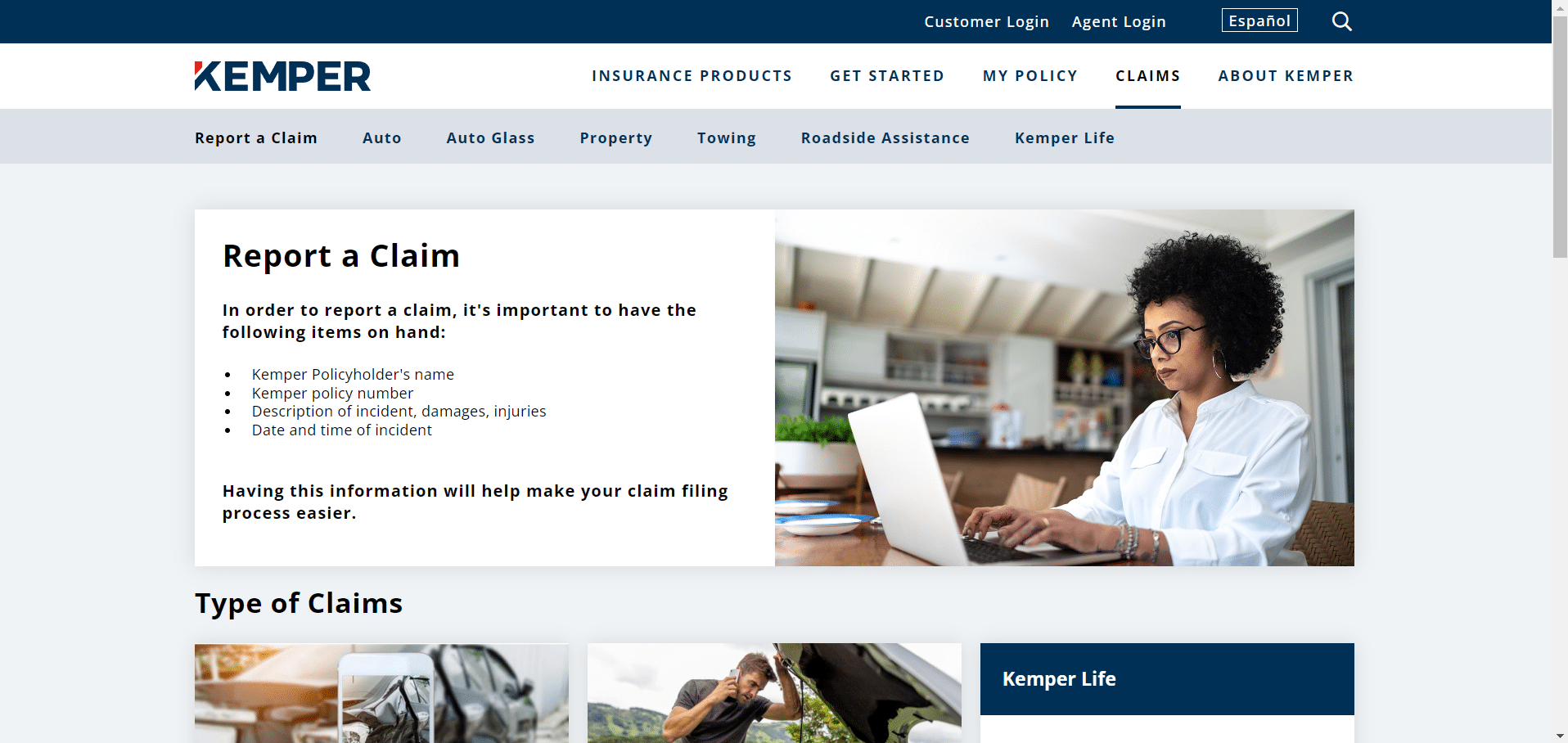

High-risk drivers can also access SR-22 insurance, meeting legal requirements after violations. Additionally, Kemper offers specialty coverage like:

- Accident Forgiveness

- GAP Insurance

- Trip Interruption Protection

Specialized options like accident forgiveness and trip interruption protection add extra security. For further insights, discover the perks of staying on your parent’s car insurance policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unlock Exclusive Kemper Car Insurance Discount Offers

This table highlights Kemper car insurance discounts and their savings potential. Bundling policies unlock up to 15% off while insuring multiple vehicles saves 25%.

Kemper Car Insurance Discounts by Savings Potential

| Discount Name | |

|---|---|

| Multi-Car | 25% |

| Safe Driver | 20% |

| Usage-Based (Kemper Co-Pilot) | 10% |

| Good Student | 10% |

| Anti-Theft Device | 10% |

| Defensive Driving Course | 10% |

| Paid-in-Full | 10% |

| Paperless Billing | 5% |

| Auto Safety Features | 5% |

| Homeowner | 5% |

Safe drivers get 20% discounts, and good students qualify for 10% savings. Extra reductions apply for security features, defensive driving courses, and paperless billing. Additional savings can be found through programs like:

- Diminishing Deductible: Lowers your deductible after a certain period without accidents

- Accident Forgiveness: Avoids rate increases after your first accident

A diminishing deductible and accident forgiveness are valuable insurance features. With a diminishing deductible, your deductible decreases after a certain accident-free period, while accident forgiveness ensures your rates won’t increase after your first accident.

Additional programs like diminishing deductibles and accident forgiveness help lower costs while maintaining coverage. Find out what car insurance brokers do to compare top insurers.

Kemper Car Insurance Pros and Cons

Kemper car insurance offers many coverage alternatives, each with inevitable trade-offs.

Pros

- Wide Range of Coverage Options: Kemper provides full coverage options, including basic liability, full coverage, and specialty policies such as SR-22, so drivers can create a protection program that suits them.

- Discount: Kemper also offers safe driver and student discounts, which further reduce the cost of premiums based on a clean driving record or good school grades.

- SR-22 Coverage: Kemper is a good option for an offender convicted of offenses before and is compelled to have SR-22 coverage. Its policies are offered at a rate that meets such requirements.

Cons

- Higher Rates than Some Competition: Kemper can be costlier than competitors, especially for complete coverage and high-risk drivers. This may also compare unfavorably to Geico or Progressive.

- Increased Complaint Levels Over the Past Years: Kemper has been subjected to increasing customer complaints, with claims and billing the leading causes cited.

Kemper’s coverage is good and includes some discounts, but higher-priced policies and concerns with customer service are likely to hold some back.

Consider these issues when determining if Kemper fits your car insurance needs. To understand more, look at when to use your deductible.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Kemper Car Insurance the Right Choice for You

Kemper auto insurance offers various coverages and discounts, so it’s a good fit for specific types of drivers, specifically those needing SR-22 coverage.

Consider a full coverage policy to protect you and other drivers, since a liability-only policy fails to protect your own car.Justin Wright Licensed Insurance Agent

However, the company falters with customer satisfaction and is often priced higher than companies like Geico or Progressive. Consider this if you are willing to accept a higher cost and can get one of their better discounts. Dive into how car insurance works for more insights. Get customized Kemper auto insurance quotes with our free comparison tool.

Frequently Asked Questions

Is Kemper insurance good for drivers looking for affordable coverage?

Kemper insurance is a good option for high-risk drivers needing SR-22 coverage, but some reviews mention higher-than-average rates and claims delays. Checking customer feedback can help you decide if it meets your needs. Explore why you need car insurance and how it safeguards your vehicle.

What do Kemper auto insurance reviews say about coverage and pricing?

Kemper auto insurance reviews highlight its SR-22 policies for high-risk drivers, but some customers report issues with claims processing. Comparing rates and coverage options can help determine if it’s the right choice for you.

What do Kemper insurance BBB reviews say about the company?

Kemper insurance reviews on BBB show mixed customer experiences, with common complaints about claims processing and billing. Use our free quote tool to lower your Kemper car insurance costs.

What do Kemper insurance consumer reports reviews indicate?

Kemper insurance consumer reports reviews highlight its SR-22 coverage and policies for high-risk drivers. However, some customers report issues with claims processing and pricing, making it important to compare options.

What do Kemper home insurance reviews say about coverage and pricing?

Kemper home insurance reviews show that policyholders appreciate flexible coverage, but some have raised concerns about claims processing times. Understand how to file a car insurance claim after an accident properly.

Is Kemper insurance going out of business?

Kemper insurance is still operating and providing coverage for auto and home policies. If you need up-to-date information, check the company’s official website or industry reports to verify its financial status.

What is the Kemper insurance phone number for customer support?

You can contact Kemper insurance customer service by calling the phone number listed on their official website. Always verify contact details directly from Kemper’s site to ensure you reach the correct department.

What are people saying about Kemper insurance on Reddit?

Kemper insurance Reddit discussions feature mixed opinions, with some users praising affordability while others report issues with claims. Checking multiple sources can give you a well-rounded view of the company’s service.

How can I reach Kemper insurance customer service for help?

Kemper insurance customer service can be contacted through its website, phone number, or email support. Customer service wait times may vary, so checking online reviews can help you set expectations. Explore ways you can insure a car that is not in your name with the right policy.

What do Kemper life insurance reviews say about policy options?

Kemper life insurance reviews highlight its affordable policies and flexible coverage options. However, some customers report delays in claims processing, so it’s important to review policy details before choosing a plan.

How does Kemper renters insurance protect your belongings?

What do Kemper insurance claims reviews say about the process?

What coverage options are available with Kemper life insurance in Houston, TX?

What does the Kemper preferred rating indicate about the company?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.