Fred Loya Car Insurance Review for 2026 [Find Savings Here]

Fred Loya car insurance offers minimum coverage starting at $41 per month, making it affordable. This Fred Loya car insurance review highlights its flexible payment programs with customizable options for drivers who need accessible coverage solutions and cheap car insurance rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Chris Tepedino is a feature writer that has written extensively about car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. He has been a...

Chris Tepedino

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated March 2025

This Fred Loya car insurance review explores the company’s distinctive flexible payment choices. These options are made to suit drivers with different financial requirements.

Fred Loya Insurance is famous because it’s easy to access. It provides special plans for drivers who are considered high-risk, making sure these people can still get coverage.

Drivers can easily adjust their policies, and the company provides support in many different areas through its large network of offices. Fred Loya’s main focus is on being dependable and convenient for customers.

Fred Loya Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.6 |

| Business Reviews | 2.0 |

| Claim Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.1 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 2.0 |

| Discounts Available | 2.3 |

| Insurance Cost | 3.4 |

| Plan Personalization | 2.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.0 |

Keep reading to compare Fred Loya Insurance services for a useful option, especially for drivers looking for reliable but affordable car insurance solutions. Find expert advice on buying car insurance and saving money.

Discover cheap car insurance quotes by entering your ZIP code here.

- Fred Loya’s car insurance has a 2.6 rating for affordability

- Flexible payment plans make it budget-friendly for drivers

- Fred Loya Insurance Company is only in 11 states

Exploring Fred Loya Car Insurance Rates

This table shows the car insurance rates of Fred Loya based on age, gender, and coverage levels. Those who are younger, specifically boys, have to pay more due to their heightened risk factors. For instance, a 16-year-old boy might end up paying as much as $385/month for comprehensive coverage.

Fred Loya Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $288 | $367 |

| Age: 16 Male | $300 | $385 |

| Age: 18 Female | $198 | $310 |

| Age: 18 Male | $210 | $330 |

| Age: 25 Female | $75 | $215 |

| Age: 25 Male | $85 | $225 |

| Age: 30 Female | $58 | $207 |

| Age: 30 Male | $65 | $215 |

| Age: 45 Female | $48 | $267 |

| Age: 45 Male | $48 | $267 |

| Age: 60 Female | $43 | $225 |

| Age: 60 Male | $43 | $225 |

| Age: 65 Female | $41 | $210 |

| Age: 65 Male | $41 | $210 |

When people get older, Fred Loya car insurance prices drop significantly. The starting cost can be as low as $41 monthly for minimum coverage. Discover if carrying minimum coverage car insurance is a smart choice.

Teen male drivers could pay as much as $385 per month for comprehensive coverage due to higher risk factors.Dani Best Licensed Insurance Producer

Also interesting is that the male-female insurance rate difference becomes smaller as drivers gain experience, which shows fair pricing.

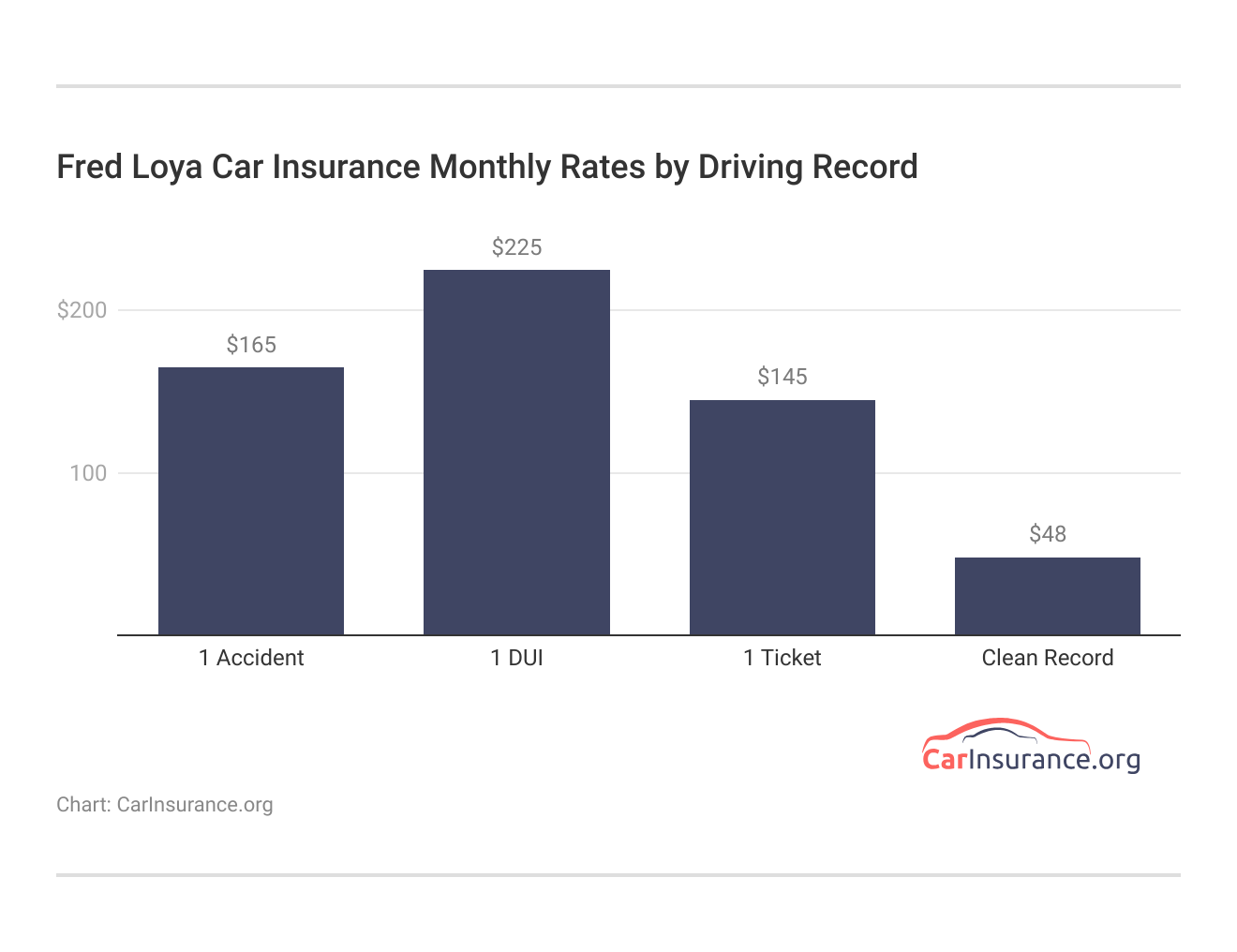

This table shows how driving histories can affect Fred Loya car insurance quotes, for both minimum and full coverage. This reflects Fred Loya’s strategy of setting prices according to risk evaluation in different population groups.

Like most companies, Fred Loya favors good driving records. Its prices can go up from $120 for a clean driving record to $210 if you have a DUI. However, it is cheaper than many other companies for high-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Fred Loya Car Insurance Rates to Top Competitors

Compare Fred Loya car insurance monthly rates with its competitors for both minimal and complete coverage. Fred Loya has lower prices than other companies, making it an economical option for a lot of drivers.

Fred Loya Car Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $190 | |

| $85 | $180 | |

| $80 | $175 | |

| $65 | $150 | |

| $70 | $155 | |

| $90 | $185 |

| $80 | $170 |

| $75 | $160 | |

| $85 | $175 | |

| $88 | $182 |

Fred Loya is at the forefront with the lowest monthly prices: $65 for minimum coverage and $150 for full coverage. Rivals such as Geico and Progressive, some of the cheapest car insurance companies, are not far behind.

Fred Loya auto insurance is also competitively priced for high-risk drivers, compared to what Allstate and Liberty Mutual charge, with their DUI rates going up to $270 and $313 per month, respectively.

Fred Loya Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $145 | $165 | $210 | |

| $80 | $106 | $132 | $216 | |

| $105 | $140 | $186 | $141 | |

| $86 | $96 | $102 | $112 | |

| $160 | $188 | $225 | $270 | |

| $174 | $212 | $234 | $313 |

Geico has the cheapest rate at first, with just $80 for a clean record, but after getting a DUI, Fred Loya is the cheaper provider at $210/month. Only State Farm and Progressive are cheaper than Fred Loya after an accident or DUI.

Fred Loya Car Insurance Discounts Overview

This table points out the various discounts offered by Fred Loya, demonstrating how drivers can reduce their insurance payments if they meet certain conditions. Explore expert tips on how to lower your car insurance cost quickly.

Fred Loya Car Insurance Discounts by Savings Potential

| Discount Name | Savings Potential | Description |

|---|---|---|

| Safe Driver Discount | 20% | For drivers with a clean driving record for 3+ years |

| Multi-Vehicle Discount | 15% | For insuring more than one vehicle with Fred Loya |

| Good Student Discount | 10% | For students maintaining a good GPA |

| Defensive Driving Course | 10% | For completing an approved defensive driving course |

| Homeowner Discount | 5% | For homeowners who also insure their car with Fred Loya |

| Pay-in-Full Discount | 5% | For paying the full premium upfront |

| Electronic Payment Discount | 5% | For setting up automatic electronic payments |

| Affinity Group Discount | 10% | For members of certain organizations or professions |

The discount for safe driving provides the biggest potential to save, offering 20%. It is beneficial for those drivers who have had a spotless record for more than three years. Other discounts, such as a multi-vehicle discount (15%) or a good student discount (10%), are attractive to families with young drivers.

Discounts that are smaller, like the homeowner (5%) and pay-in-full(5%), aren’t as competitive as some other companies.

Fred Loya Car Insurance: Ratings and Consumer Insights

Fred Loya gets a score of 780 out of 1,000 from J.D. Power, showing customer satisfaction that is less than average. Consumer Reports gives it a ranking of 74 out of 100 which shows low customer reactions and complaints higher than the usual amount.

Fred Loya Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 780 / 1,000 Below Satisfaction |

|

| Score: B- Average Financial Stability |

|

| Score: 74/100 Low Customer Feedback |

|

| Score: 4.50 Higher Complaints Than Avg. |

|

| Score: C Poor Financial Strength |

Worries about financial stability and claims processing exist, as shown by an A.M. Best rating of C, which indicates weak financial strength.

Still, Fred Loya continues to be a wallet-friendly choice for drivers who value affordability more than top-notch service. The main attraction of this company is its cost-effectiveness.

Learn more by checking out our guide: Why do you need car insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating Fred Loya Car Insurance Pros and Cons

Fred Loya Insurance Company offers many advantages for drivers who want to save money on car insurance with simple, accessible policy coverage.

- Affordable Coverage Options: Provides cost-effective policies tailored for drivers seeking budget-friendly insurance.

- Flexible Payment Plans: This allows changing payment conditions for various financial situations, so it becomes simpler for more people to take advantage.

- Local Office Network: Offers extensive in-person support through its many conveniently located offices.

These benefits make Fred Loya a good option for people who want affordable and custom insurance plans. However, Fred Loya faces challenges that may impact its appeal to drivers who want a more reliable provider.

Although it is very good with cheap prices, there are certain drawbacks that can discourage drivers who need more extensive coverage or expect a steady quality of service.

- Limited Availability: Coverage is not offered nationwide. Fred Loya is only available in Texas, Ohio, California, New Mexico, Colorado, Georgia, Nevada, Illinois, Arizona, Indiana, and Alabama.

- Low Insurance Ratings: Fred Loya customer service and financial ratings are lower than average, which could impact your experience if you ever need to file a claim.

For drivers looking for strong insurance choices that are reliable in all areas, Fred Loya might not be the right option. Find out where cheap full coverage car insurance is available near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Evaluating Fred Loya Car Insurance

Our Fred Loya car insurance review finds that the main good things are low cost and accessible coverage, but drivers might not be happy if they expect very high-quality customer service or many extra features in the policy.

✨✨✨✨✨✨✨Fred Loya Insurance is hiring CA, CO, AZ, IN, NM, OH, TX, IL, AL NV, and OK. Apply Now! 💼💼✨✨✨✨✨✨✨https://t.co/zBudl6iD6l pic.twitter.com/yCu3Kv9eJC

— Fred Loya Insurance (@LoyaInsurance) August 10, 2021

Fred Loya is known as a cheap option for drivers who want not expensive and flexible insurance choices. Drivers who are high-risk and those looking for affordable options will like Fred Loya’s flexible payment plans and special discounts.

Making customers happier and getting better financial strength could make it even more valuable. Dive into the details of how car insurance works to save money.

It is important to compare prices from different companies and look at what coverage you need to see if Fred Loya fits your insurance needs well. Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

Is Fred Loya the most trusted car insurance company?

Fred Loya is known for its affordability and accessibility, but customer satisfaction ratings indicate room for improvement.

Which type of car insurance is best with Fred Loya?

The best car insurance option depends on your needs, but Fred Loya offers affordable minimum coverage and comprehensive policies for excellent protection. Understand what car insurance covers and why it’s crucial for every driver.

Is Fred Loya car insurance only in Texas?

No, Fred Loya operates in 11 states across the U.S., though it has a strong presence in Texas. Enter your ZIP code to instantly compare car insurance quotes in your state.

Who owns Fred Loya Insurance Company?

Fred Loya Insurance is privately owned by its founder, Fred Loya, and his family.

What is Fred Loya’s slogan?

Fred Loya’s slogan is “Let Fred Loya Insurance help you get the coverage you need.”

What is Fred Loya’s most expensive car insurance?

The most expensive policies include full coverage high-risk car insurance, such as young male drivers, who can pay up to $385 monthly. Find out what drivers do that can raise car insurance premiums.

How many locations does Fred Loya have?

Fred Loya operates over 700 locations in 11 states.

What is considered full coverage at Fred Loya?

Fred Loya full coverage insurance typically includes liability, collision, and comprehensive coverage, offering extensive protection for your vehicle. Find out if your policy includes adequate bodily injury liability insurance coverage.

Which sedan is the cheapest to insure with Fred Loya?

Sedans like the Honda Civic and Toyota Corolla are often the cheapest to insure with Fred Loya due to their strong safety ratings and lower repair costs.

How do you file Fred Loya car insurance claims?

To claim car insurance with Fred Loya, contact their claims department, provide incident details, and submit any required documentation for review. Learn who to contact when filing a car insurance claim after an accident.

Does Fred Loya have the cheapest car insurance for seniors?

Which SUV is the cheapest to insure with Fred Loya?

Can I insure a 10-year-old car with Fred Loya?

Does Fred Loya have the most customer complaints?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.