CURE Car Insurance Review for 2026 [See if They’re a Good Fit]

CURE car insurance offers some of the most competitive rates, starting at $69 per month, making it a strong choice for high-risk drivers. In this CURE car insurance review, you’ll learn how their no-credit-score policy helps drivers with bad credit find affordable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2025

Read our CURE car insurance review to find out why this provider stands out for its simple policies and customer-centric approach.

CURE has the best car insurance in Pennsylvania, New Jersey, and Michigan, where it offers flexible options and robust support to local drivers who need basic coverage at an affordable price. But it’s only available in those three states.

CURE Car Insurance Rating

| Rating Criteria | Score |

|---|---|

| Insurance Rating | 2.8 |

| Business Reviews | 3.0 |

| Claim Processing | 1.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.5 |

| Coverage Value | 2.9 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 2.5 |

| Discounts Available | 2.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 2.5 |

| Policy Options | 3.1 |

| Savings Potential | 3.2 |

Keep reading to explore the pros and cons of choosing CURE car insurance, including unique programs tailored for high-risk drivers.

Get the right car insurance at the best price — enter your ZIP code above< to shop for coverage from the top insurers in your state.

- CURE auto insurance has a 2.8 rating from customer reviews

- CURE does not use credit scores when setting car insurance rates

- CURE is an insurance cooperative and not a for-profit business

Comparing CURE Car Insurance Rates vs. The Competition

Younger drivers typically face higher car insurance costs, and CURE charges teens and young drivers much more than older drivers.

CURE Car Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $267 | $489 |

| Age: 16 Male | $314 | $528 |

| Age: 18 Female | $241 | $422 |

| Age: 18 Male | $289 | $479 |

| Age: 25 Female | $133 | $217 |

| Age: 25 Male | $157 | $243 |

| Age: 30 Female | $111 | $198 |

| Age: 30 Male | $127 | $215 |

| Age: 45 Female | $94 | $177 |

| Age: 45 Male | $69 | $143 |

| Age: 60 Female | $82 | $165 |

| Age: 60 Male | $93 | $172 |

| Age: 65 Female | $87 | $159 |

| Age: 65 Male | $99 | $183 |

For example, 16-year-old males have the highest monthly rates, starting at $314 for minimum coverage and $528 for full coverage. In contrast, 45-year-old males enjoy much lower rates, with minimum coverage at just $69/month and full coverage at $143/month.

While it provides affordable options for many age and gender groups, comparing CURE car insurance rates with those of top competitors ensures drivers make the most cost-effective choice.

Where can you get cheap full coverage car insurance? This table shows how CURE is more affordable than some of the best car insurance companies.

CURE Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $240 | $275 | $105 | $110 | $90 | $93 | $85 | $88 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | 74 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $522 | $626 | $174 | $200 | $171 | 174 | $148 | $159 |

| $591 | $662 | $131 | $136 | $112 | 105 | $92 | $95 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | 99 | $89 | $90 |

CURE car insurance rates vary based on age and gender, offering competitive pricing that can stand out against top competitors. Analyzing these rates helps drivers understand where they might find the best value for their specific profile.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

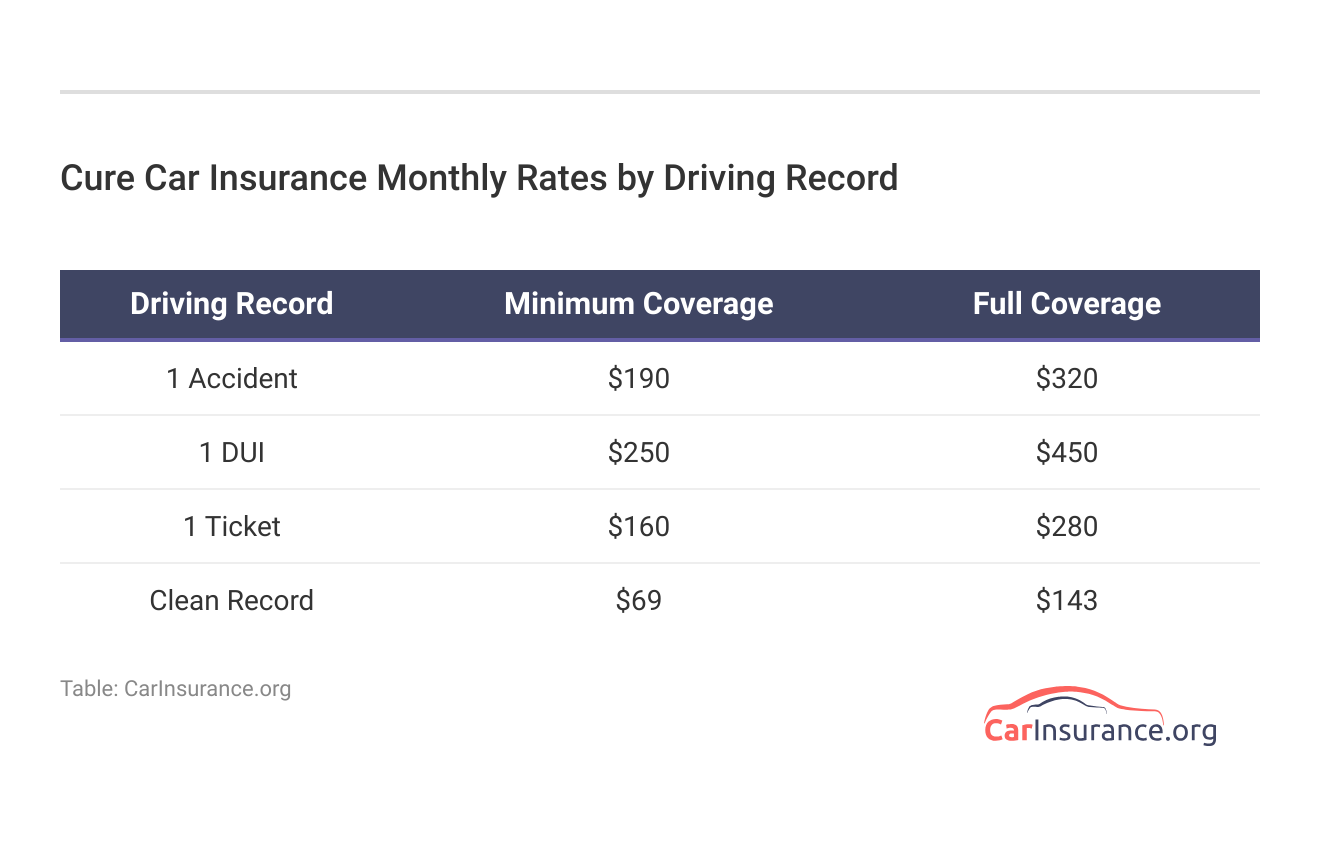

Comparing CURE Car Insurance Rates by Driving Record

Cure Auto Insurance focuses on providing affordable car insurance to all types of drivers, no matter their driving or credit history, making it a competitive choice if it’s available in your area. Many factors affect car insurance rates, and CURE Auto Insurance adjusts its monthly rates significantly based on an individual’s driving record.

The following table illustrates how past incidents such as accidents, DUIs, or tickets can impact both minimum and full coverage costs, compared to rates for those with clean records.

However, car insurance companies judge driving records differently. CURE Insurance offers varying monthly rates influenced by driving records, so it’s crucial to compare it with other providers.

CURE Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $160 | $167 | $170 | $200 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

CURE not only has cheaper car insurance rates for high-risk drivers after a speeding ticket or DUI, but it also won’t increase rates as high as other companies after one incident.

Unlocking Savings With CURE Car Insurance Discounts

CURE Auto Insurance offers a range of discounts designed to reduce the cost of car insurance for eligible drivers. The most popular discounts reward safe driving and policy bundling.

CURE Car Insurance Discounts

| Discount Name | Savings Potential |

|---|---|

| Multi-Car Discount | 10% |

| Prior Coverage Discount | 9% |

| Safe Driver Discount | 15% |

| Good Student Discount | 10% |

| Military Discount | 11% |

| Homeowner Discount | 17% |

| Renewal Discount | 10% |

| Welcome Back Discount | 10% |

| Affinity Discount | 12% |

| Senior Citizen Discount | 15% |

Multi-policy bundle discounts are one of the simplest ways to save on car insurance, rewarding you for keeping multiple policies with CURE. This shows loyalty to your insurer, which often leads to even more savings when it’s time to renew.

By leveraging CURE’s discounts, policyholders can significantly reduce their insurance costs while maintaining comprehensive coverage.

Exploring CURE Car Insurance Coverage Options

CURE car insurance offers a variety of coverage options, including basic liability and uninsured motorist protection. What does car insurance cover? This table explains the types of insurance CURE offers and when drivers might need it:

CURE Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers injury, property damage in at-fault accidents |

| Collision Coverage | Pays for repairs or replacement after accidents |

| Comprehensive Coverage | Covers non-collision damage like theft or disasters |

| Personal Injury Protection (PIP) | Covers medical costs, lost wages, regardless of fault |

| Uninsured/Underinsured Motorist Coverage | Protects against drivers with little or no insurance |

| Roadside Assistance | 24/7 help for breakdowns like towing, jump-starts |

| Rental Car Reimbursement | Covers rental costs while your car is repaired |

| Medical Payments Coverage | Pays medical expenses for you and passengers |

| Gap Insurance | Covers difference between car value and loan owed |

Choosing the right coverage with CURE means selecting a plan that aligns perfectly with your personal and financial requirements.

With flexible coverage options and 24/7 roadside assistance, CURE caters to a wide range of insurance needs. Unfortunately, it lacks some popular add-ons you often see with larger providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding CURE Insurance Ratings & Reviews

CURE customer service reviews and insurance ratings reflect a mix of customer satisfaction and coverage reliability. It does not operate like a typical for-profit insurance company but as a cooperative business where policyholders pool their premiums. This is why it doesn’t have an A.M. Best rating.

CURE Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: B Fair Financial Strength |

| Score: 1.20 More Complaints Than Avg. |

|

| Score: 68/100 Mixed Customer Feedback |

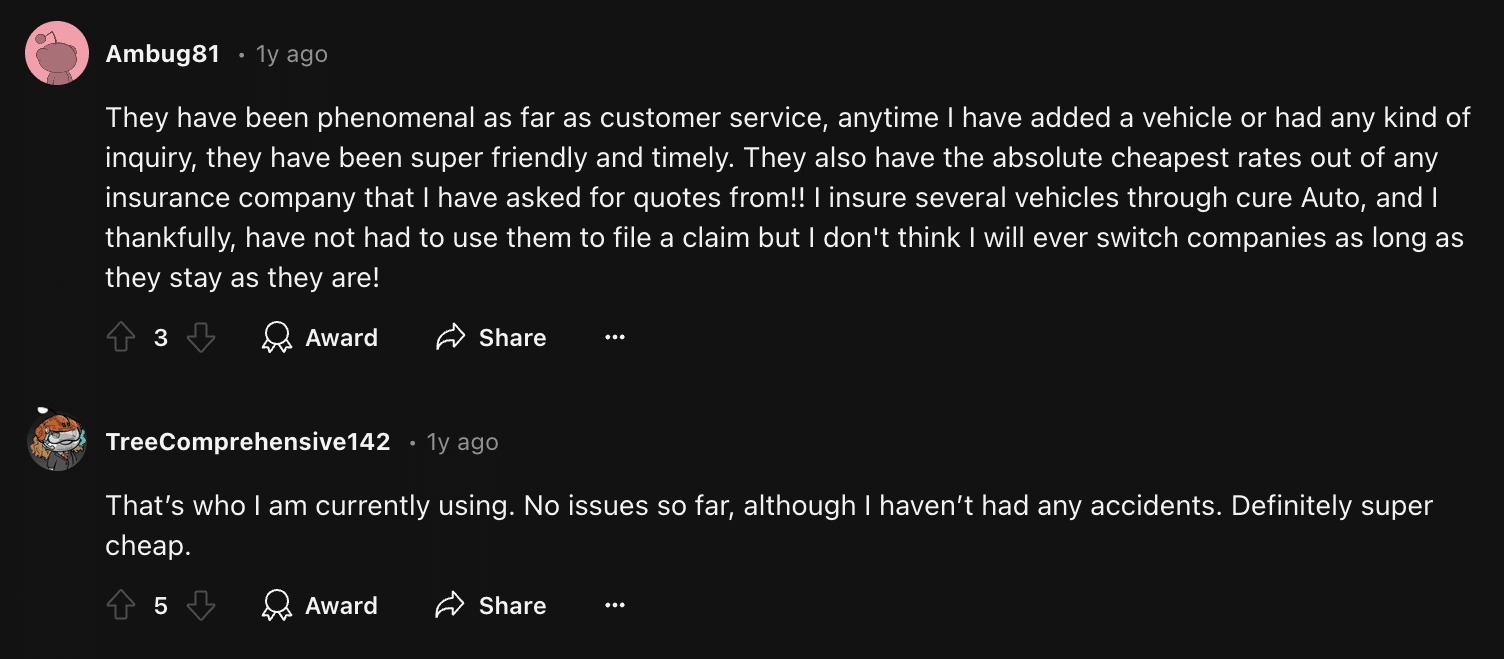

It also receives five times more customer complaints, although experiences vary by state. Local Reddit users report positive experiences with premiums and customer service agents, with a few negative claims reviews. While customer reviews are generally positive, especially regarding premiums and service, its claims process could be riskier due to its unique business structure.

The comments reflect overall positive feedback for CURE Auto Insurance, with users praising its affordable rates and excellent customer service. However, one user hinted at potential concerns regarding privacy practices, sparking curiosity from others.

Read More Reviews: Best Car Insurance in New Jersey

CURE Insurance Pros and Cons

Always consider the pros and cons of each company before buying car insurance. Here’s a quick look at the key benefits of CURE Auto Insurance to help guide your decision:

- Competitive Rates: CURE is cheaper than most of its competitors, especially for drivers with speeding tickets or DUIs.

- SR-22 Insurance: CURE files SR-22 car insurance for higher-risk drivers who need it.

- No Credit Checks: CURE doesn’t use credit scores for determining rates.

Despite its strengths, one of the biggest drawbacks is that CURE is only available in three states. If you don’t live or drive in Michigan, New Jersey, or Pennsylvania, CURE car insurance is not available to you.

Check out https://t.co/DZPIBD0QDj for their article on discrimination within auto insurance, featuring CURE CEO Eric Poe! https://t.co/gNjWKHtqcY pic.twitter.com/iqLc3RmKfR

— CURE Auto Insurance (@CUREInsurance) December 21, 2022

These are more risks to look out for when comparing CURE against other local car insurance companies in your area:

- No Online Quotes: CURE requires phone or in-person contact for quotes, which can be inconvenient for some.

- No A.M. Best Rating: This raises concerns about financial stability

- Mixed Reviews: Customer experiences vary widely across the three states.

When evaluating CURE Auto Insurance Company, it’s important to weigh both the advantages and potential drawbacks to determine if it’s the right fit for your needs.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing CURE Auto Insurance Company

While available only in Michigan, New Jersey, and Pennsylvania, CURE offers competitive pricing. It stands out for its focus on affordability and straightforward policies, particularly for drivers seeking basic coverage without using credit scores.

CURE stands out for its focus on customer service and clear policy terms.Dani Best Licensed Insurance Producer

However, younger drivers may face higher premiums, and the cooperative structure may present some risks when it comes to filing a car insurance claim after an accident.

Overall, CURE provides a solid option for drivers looking for no-frills, budget-friendly coverage, but comparing rates with other providers is essential to ensure the best value for your individual needs.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — enter your ZIP code to get started.

Frequently Asked Questions

What car insurance is the most popular with CURE Auto Insurance?

CURE Car Insurance’s liability and collision policies are among their most popular offerings, valued for their balance of coverage and cost.

What is the best kind of car insurance that CURE offers?

The best type of auto insurance that CURE provides is full coverage, which offers extensive protection at affordable rates.

Which insurance company is best for a car accident?

CURE Car Insurance is a strong choice for car accident coverage, offering tailored policies and support for accident claims. Learn how to file a car insurance claim after an accident.

Is CURE best for handling car insurance claims?

Yes, CURE is known for its efficient and straightforward claims process, making it a reliable option for handling car insurance claims.

Who is the CEO of CURE Auto Insurance?

Eric Poe currently serves as the CEO of CURE.

What is the code for CURE Auto Insurance in New Jersey?

The insurance code for CURE Insurance in New Jersey is 945. Discover the best auto insurance in New Jersey in our guide.

Is CURE Auto Insurance legit in Michigan?

Yes, CURE car insurance policies are legitimate. It’s a licensed provider in Michigan, offering comprehensive coverage options.

Who owns CURE Auto Insurance in Michigan?

The Citizens United Reciprocal Exchange owns CURE Auto Insurance, which is present in several states, including Michigan. Find out more in our guide to the best car insurance in Michigan.

What made CURE Auto Insurance famous?

CURE car insurance coverage became well-known for its affordable rates and commitment to providing straightforward, no-nonsense policies.

Who offers the best and cheapest car insurance?

CURE Car Insurance is often regarded as one of the best and most affordable options for car insurance. But since its availability is limited, drivers in most states find cheap rates with State Farm and Geico. Ready to find cheaper car insurance coverage near you? Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.