Amica Mutual Car Insurance Review for 2026 [See How Much You Can Save]

Use our Amica Mutual car insurance review to discover rates as low as $42/month. It leads the market with customer satisfaction and affordable car insurance rates. Amica Mutual’s standout feature is its dividend program, which offers policyholders potential annual payments based on company-wide claims.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2025

Our Amica Mutual car insurance review reveals why it stands out as a top provider with exceptional customer satisfaction and strong financial stability.

With a reputation for responsive agents and adjusters, Amica is one of the best companies for filing a car insurance claim after an accident. It also caters to diverse driver needs with customizable policy options.

Amica Mutual Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.2 |

Its commitment to transparent coverage and consistent quality sets Amica apart from its competitors. Keep reading to discover if it’s the best car insurance company for you.

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Amica Mutual boasts a 4.4 rating for customer satisfaction

- Responsive claims handling enhances its strong reputation

- Customizable policies boost Amica’s high industry ratings

Amica Mutual Car Insurance Rates Overview

Amica Mutual car insurance rates vary significantly based on age, gender, and coverage level, reflecting tailored pricing strategies. It isn’t the cheapest for teen drivers, but Amica insurance costs start to drop as soon as drivers turn 25.

Amica Mutual Car Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $215 | $695 |

| Age: 16 Male | $238 | $735 |

| Age: 18 Female | $175 | $512 |

| Age: 18 Male | $204 | $597 |

| Age: 25 Female | $55 | $182 |

| Age: 25 Male | $57 | $190 |

| Age: 30 Female | $51 | $168 |

| Age: 30 Male | $53 | $176 |

| Age: 45 Female | $46 | $153 |

| Age: 45 Male | $46 | $151 |

| Age: 60 Female | $42 | $136 |

| Age: 60 Male | $44 | $140 |

| Age: 65 Female | $46 | $150 |

| Age: 65 Male | $45 | $148 |

Young male drivers face the highest premiums with Amica. For 16-year-old males, monthly minimum coverage starts at $238, while full coverage reaches $735/month. In contrast, 30-year-old female drivers enjoy more affordable options, with minimum coverage at $51/month and full coverage at $168/month.

Our teen driver guide explains why young drivers pay more for car insurance, and Amica adjusts prices to align with risk profiles, offering more economical choices for older, more experienced drivers.

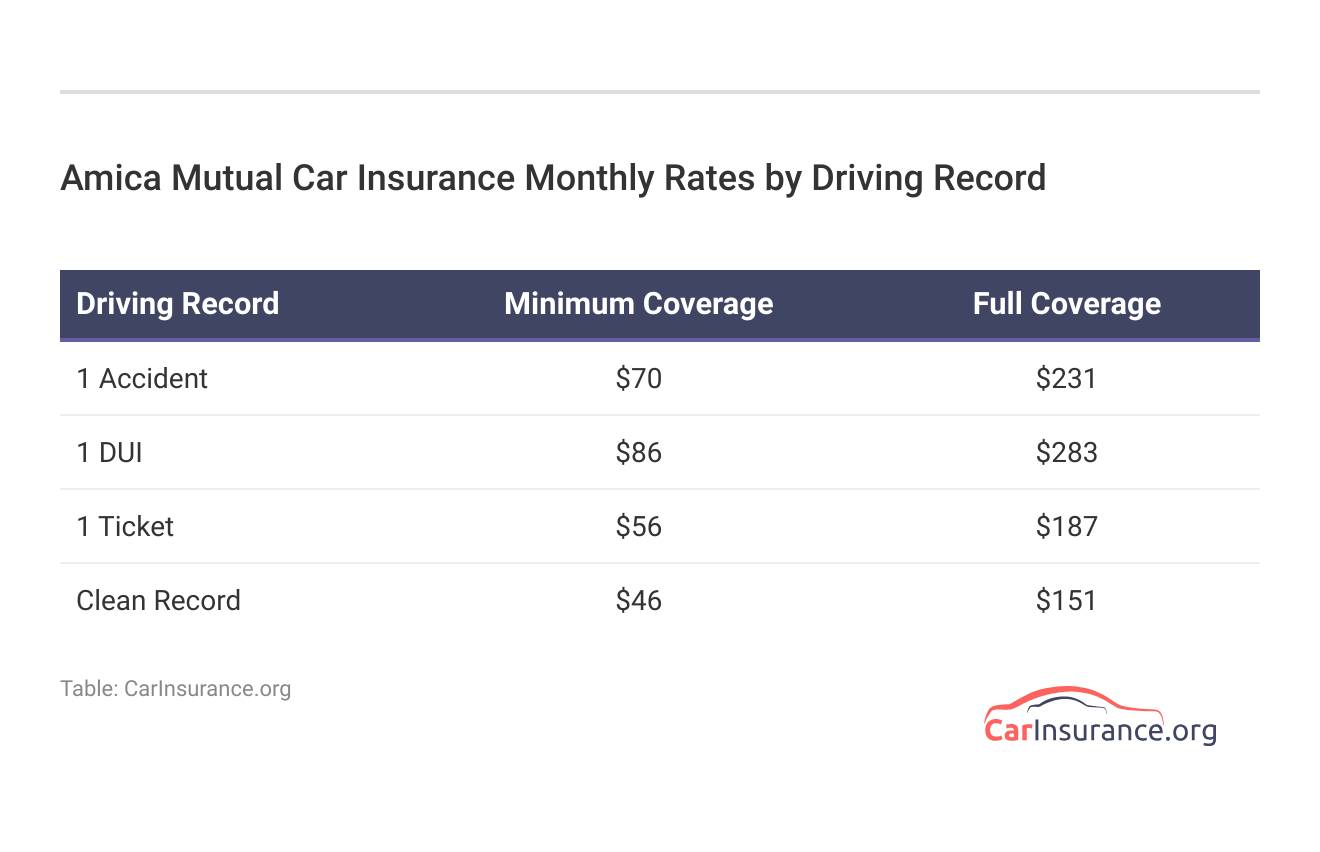

When comparing car insurance rates, it’s clear that driving history and experience significantly impact premiums across different providers. Amica, along with other insurers, adjusts its pricing based on whether drivers have clean records or past incidents.

Comparing Amica Mutual to other companies helps you find affordable insurance rates tailored to your driving background. This table highlights how Amica Insurance Company and other providers vary their rates based on driving behavior:

Amica Mutual Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $151 | $231 | $283 | $187 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

Amica is one of the more expensive car insurance companies for high-risk drivers, emphasizing the importance of maintaining a clean driving history to benefit from lower premiums.

If you’re a teen driver or have an accident or speeding ticket on your record, you may want to shop elsewhere. Keep reading to compare Amica Mutual auto insurance rates against other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Amica Mutual Car Insurance Rates With Competitors

This table outlines how Amica car insurance rates stack up against the best car insurance companies in the U.S. The comparison provides insights into how each insurer prices policies for various demographics.

Amica Mutual Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $512 | $597 | $168 | $176 | $153 | $151 | $136 | $140 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $522 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

Amica insurance is more expensive for teens and has higher rates than Geico, State Farm, and Travelers for most drivers. However, it’s a competitive option for older drivers with clean records.

Comprehensive Amica Mutual Car Insurance Coverage

Amica Mutual provides different types of car insurance designed to protect drivers and their vehicles in various situations. From basic liability to comprehensive coverage, these options cater to diverse needs and circumstances.

Amica Mutual Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers injury and damage to others if you're at fault |

| Collision Coverage | Pays for damage to your vehicle after a collision |

| Comprehensive Coverage | Covers non-collision damage like theft or weather |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages, regardless of fault |

| Uninsured/Underinsured Motorist | Covers you if the other driver lacks enough insurance |

| Roadside Assistance | Offers help for breakdowns like towing or tire changes |

| Rental Car Reimbursement | Pays for a rental while your vehicle is repaired |

| Medical Payments Coverage | Covers medical expenses after an accident |

Amica Mutual’s comprehensive array of coverage options ensures that policyholders can find protection suited to their specific driving and financial needs.

The variety of Amica Mutual insurance coverage choices provides peace of mind by offering financial security in any driving-related situations you may encounter on the road.

How to Save Money With Amica Mutual Car Insurance Discounts

Since car insurance with Amica is more expensive than other companies, you might be wondering how to lower your car insurance costs. Amica Mutual offers a variety of discounts tailored to meet the needs of different customers:

Amica Mutual Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Multi-Car Discount | 25% |

| Prior Coverage Discount | 22% |

| Safe Driver Discount | 20% |

| Good Student Discount | 15% |

| Military Discount | 22% |

| Homeowner Discount | 18% |

| Renewal Discount | 20% |

| Welcome Back Discount | 17% |

| Affinity Discount | 26% |

| Senior Citizen Discount | 19% |

From multi-car to safe driver discounts, Amica rewards policyholders for smart choices and loyalty. These discounts, such as the 26% affinity discount and the 22% military discount, make Amica Mutual a competitive choice for those looking to lower their insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica Mutual Customer Service & Business Reviews

Amica Mutual consistently earns top marks across various rating platforms, demonstrating its strong commitment to customer satisfaction and financial stability. With high scores from J.D. Power, the BBB, and A.M. Best, it solidifies its reputation as a reliable insurance company.

Amica Mutual Business Insurance Ratings

| Agency | |

|---|---|

| Score: 903 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 85/100 Excellent Customer Feedback |

|

| Score: 0.73 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

These impressive ratings indicate that Amica Mutual not only meets but often exceeds industry standards, making it a preferred choice for drivers looking for reliable car insurance. The company’s superior ratings from multiple respected sources highlight its dedication to excellence and customer trust.

Amica Mutual's customizable policies cater perfectly to diverse needs.Dani Best Licensed Insurance Producer

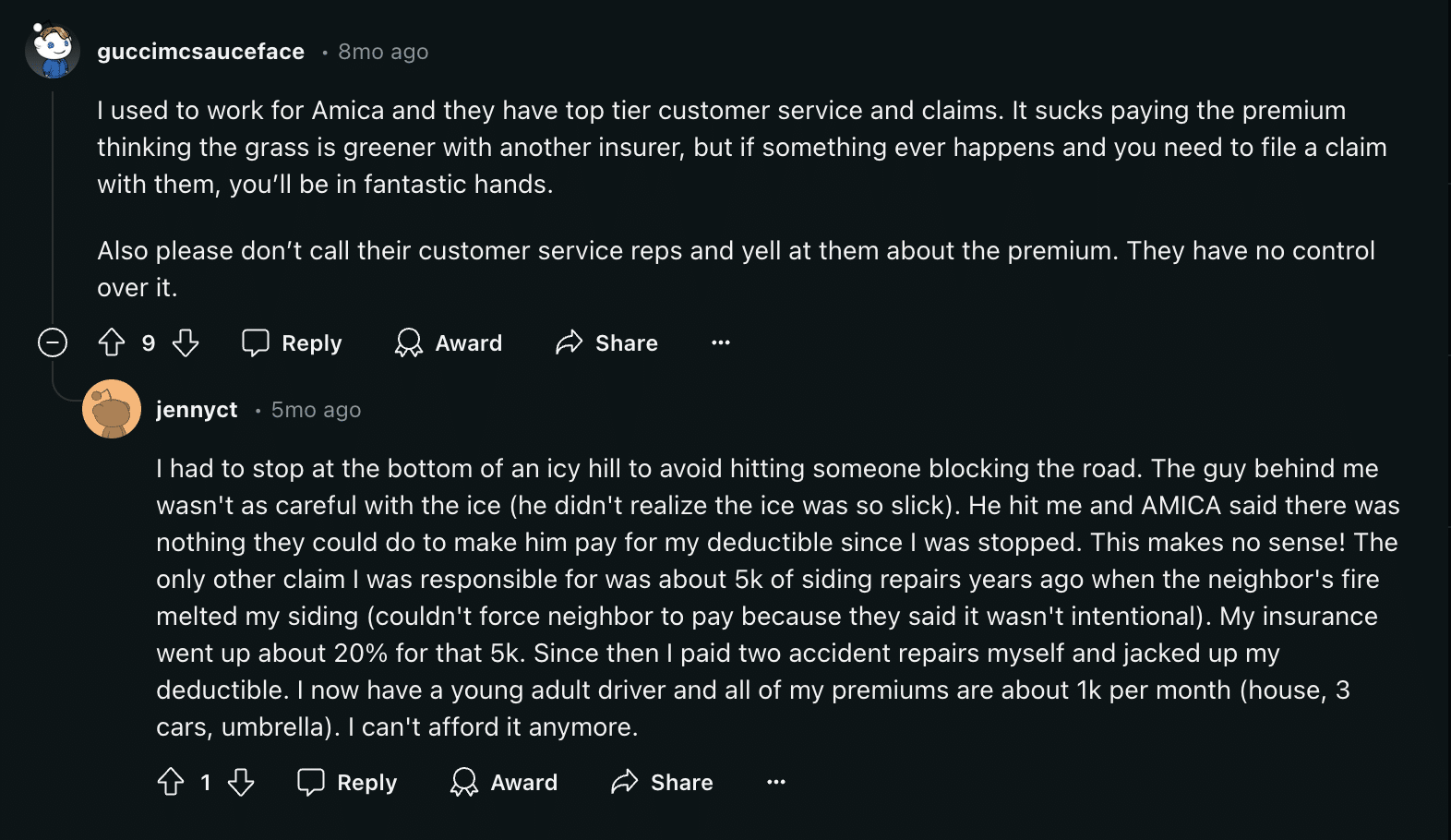

However, some Amica Mutual insurance customer service reviews on Reddit touch on coverage issues, especially involving claims support.

Frequently Asked Questions

Is Amica Mutual a reliable insurance company?

Yes, Amica Insurance Company is known for its reliability, earning high customer satisfaction and strong ratings for service quality.

Is Amica Mutual good at paying insurance claims?

Yes, Amica Mutual is highly rated for its prompt and fair claims handling, consistently satisfying policyholders. Learn how to file a car insurance claim after an accident.

Does Amica Mutual Insurance have an umbrella policy?

Yes, Amica offers umbrella insurance, providing additional liability coverage beyond standard policies.

Does Amica have local agents?

Amica Mutual primarily operates through direct service but does provide some local agents in select areas. If you need to buy car insurance, enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Who owns Amica Mutual?

Amica Mutual is a policyholder-owned business, which means that its customers rather than shareholders own it.

Why choose Amica Mutual car insurance?

Amica Mutual is one of the best car insurance companies with excellent customer service, customizable policies, and a strong claims process.

How do I cancel my Amica Mutual car insurance policy?

You can cancel your Amica Mutual policy by contacting their customer service team over the phone. Find out how much insurance you need for your car before you do so you aren’t driving underinsured.

How long has Amica Mutual Insurance been around?

Amica Mutual has been serving customers for over a century, with a history of providing trusted insurance solutions.

What is the financial strength rating of Amica Mutual?

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Amica Mutual life insurance good?

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

Yes, Amica Insurance Company is known for its reliability, earning high customer satisfaction and strong ratings for service quality.

Yes, Amica Mutual is highly rated for its prompt and fair claims handling, consistently satisfying policyholders. Learn how to file a car insurance claim after an accident.

Does Amica Mutual Insurance have an umbrella policy?

Yes, Amica offers umbrella insurance, providing additional liability coverage beyond standard policies.

Does Amica have local agents?

Amica Mutual primarily operates through direct service but does provide some local agents in select areas. If you need to buy car insurance, enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Who owns Amica Mutual?

Amica Mutual is a policyholder-owned business, which means that its customers rather than shareholders own it.

Why choose Amica Mutual car insurance?

Amica Mutual is one of the best car insurance companies with excellent customer service, customizable policies, and a strong claims process.

How do I cancel my Amica Mutual car insurance policy?

You can cancel your Amica Mutual policy by contacting their customer service team over the phone. Find out how much insurance you need for your car before you do so you aren’t driving underinsured.

How long has Amica Mutual Insurance been around?

Amica Mutual has been serving customers for over a century, with a history of providing trusted insurance solutions.

What is the financial strength rating of Amica Mutual?

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Amica Mutual life insurance good?

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

Yes, Amica offers umbrella insurance, providing additional liability coverage beyond standard policies.

Amica Mutual primarily operates through direct service but does provide some local agents in select areas. If you need to buy car insurance, enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Who owns Amica Mutual?

Amica Mutual is a policyholder-owned business, which means that its customers rather than shareholders own it.

Why choose Amica Mutual car insurance?

Amica Mutual is one of the best car insurance companies with excellent customer service, customizable policies, and a strong claims process.

How do I cancel my Amica Mutual car insurance policy?

You can cancel your Amica Mutual policy by contacting their customer service team over the phone. Find out how much insurance you need for your car before you do so you aren’t driving underinsured.

How long has Amica Mutual Insurance been around?

Amica Mutual has been serving customers for over a century, with a history of providing trusted insurance solutions.

What is the financial strength rating of Amica Mutual?

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Amica Mutual life insurance good?

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

Amica Mutual is a policyholder-owned business, which means that its customers rather than shareholders own it.

Amica Mutual is one of the best car insurance companies with excellent customer service, customizable policies, and a strong claims process.

How do I cancel my Amica Mutual car insurance policy?

You can cancel your Amica Mutual policy by contacting their customer service team over the phone. Find out how much insurance you need for your car before you do so you aren’t driving underinsured.

How long has Amica Mutual Insurance been around?

Amica Mutual has been serving customers for over a century, with a history of providing trusted insurance solutions.

What is the financial strength rating of Amica Mutual?

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Amica Mutual life insurance good?

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

You can cancel your Amica Mutual policy by contacting their customer service team over the phone. Find out how much insurance you need for your car before you do so you aren’t driving underinsured.

Amica Mutual has been serving customers for over a century, with a history of providing trusted insurance solutions.

What is the financial strength rating of Amica Mutual?

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Amica Mutual life insurance good?

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

Amica Mutual holds a top-tier financial strength rating, ensuring its ability to meet claims obligations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Yes, Amica Mutual offers strong life insurance products with competitive rates and reliable coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.