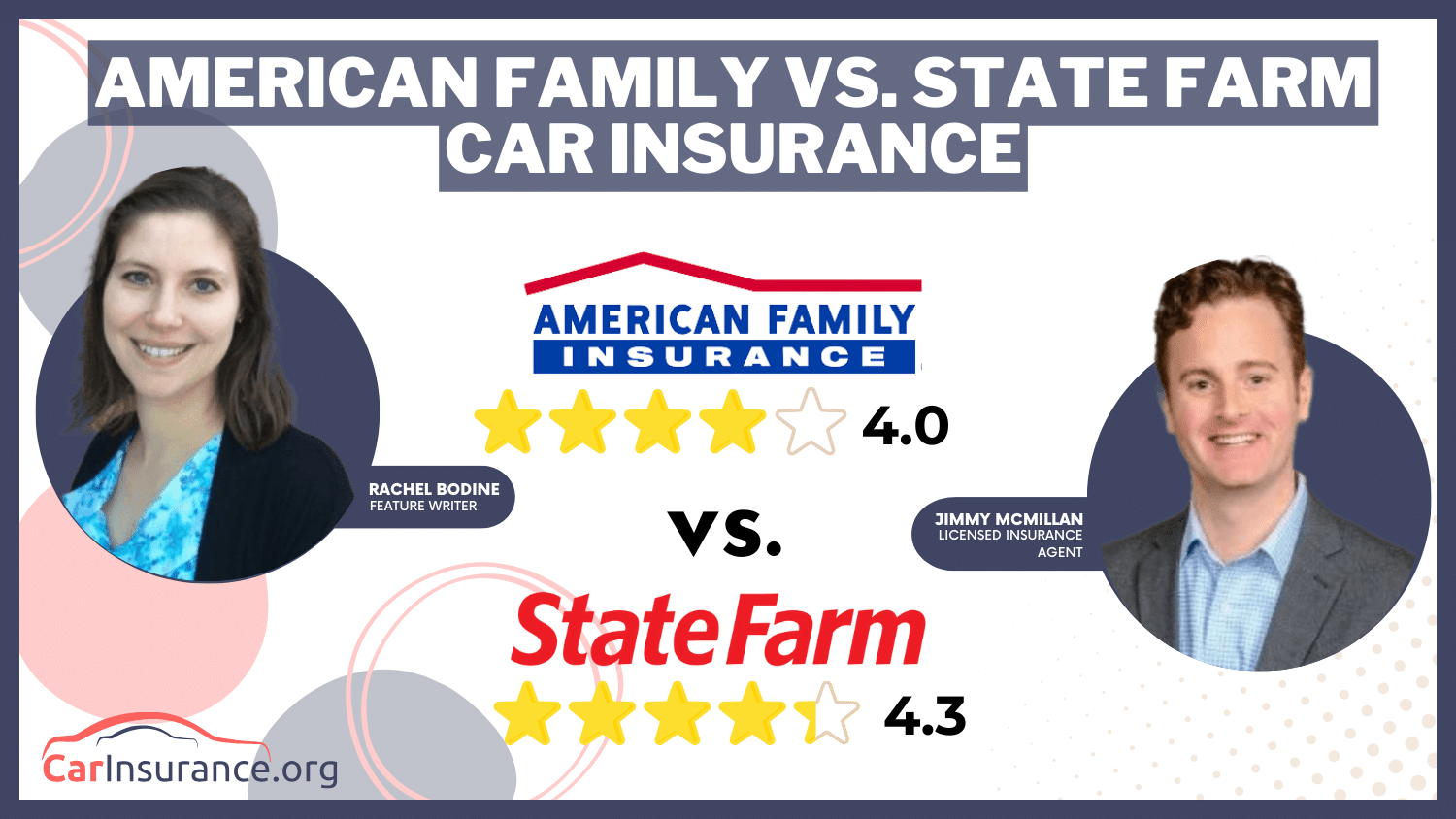

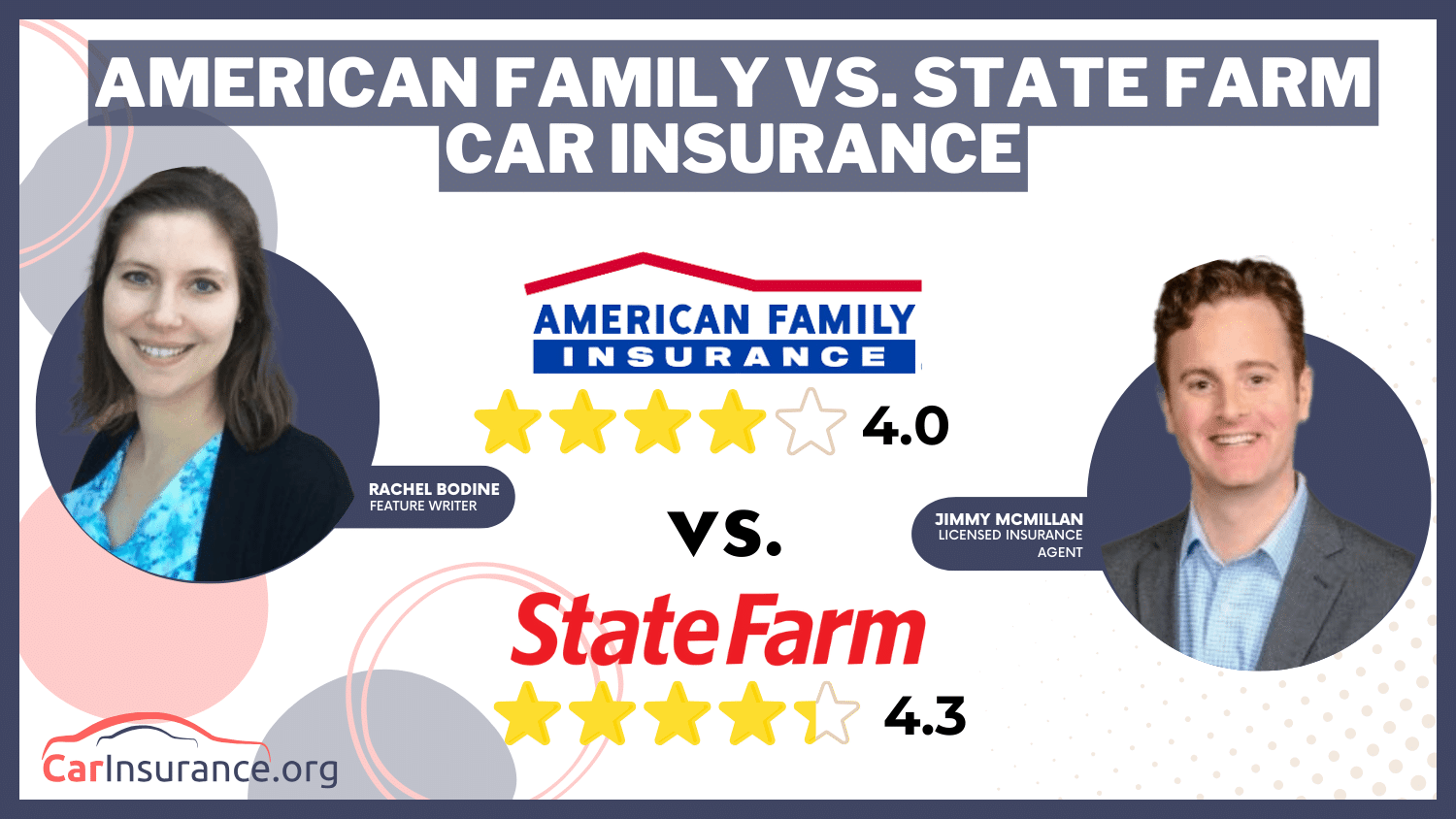

American Family vs. State Farm Car Insurance in 2026 [Side-by-Side Review]

American Family vs. State Farm car insurance compares directly with rates at $62 and $47. State Farm excels with accident forgiveness and safe driving bonuses, while American Family provides robust gap coverage and optional emergency road service, catering specifically to diverse driver needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated March 2025

2,235 reviews

2,235 reviewsCompany Facts

Monthly Rates

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,155 reviews

18,155 reviewsCompany Facts

Monthly Rates

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsAmerican Family vs. State Farm car insurance comparisons reveal unique coverage options tailored to individual needs and how car insurance works.

American Family emphasizes customizable policy enhancements, such as gap insurance and accident forgiveness, appealing to drivers looking for added security.

American Family vs. State Farm Car Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.0 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 4.8 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.9 | 5.0 |

| Coverage Value | 4.0 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 3.8 |

| Savings Potential | 4.2 | 4.4 |

| American Family | State Farm |

State Farm offers strong programs like Drive Safe & Save, which rewards safe driving habits. Both insurers take into account things like vehicle type and driving records, which means every policyholder gets a plan tailored to how they live their life.

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

- State Farm provides a $47/month rate with safe driver discounts

- American Family’s rate is $62/month, including discounts for teen drivers

- AmFam & State Farm offers significant savings with multi-policy bundles

Comparing Costs: State Farm vs. American Family Car Insurance Rates

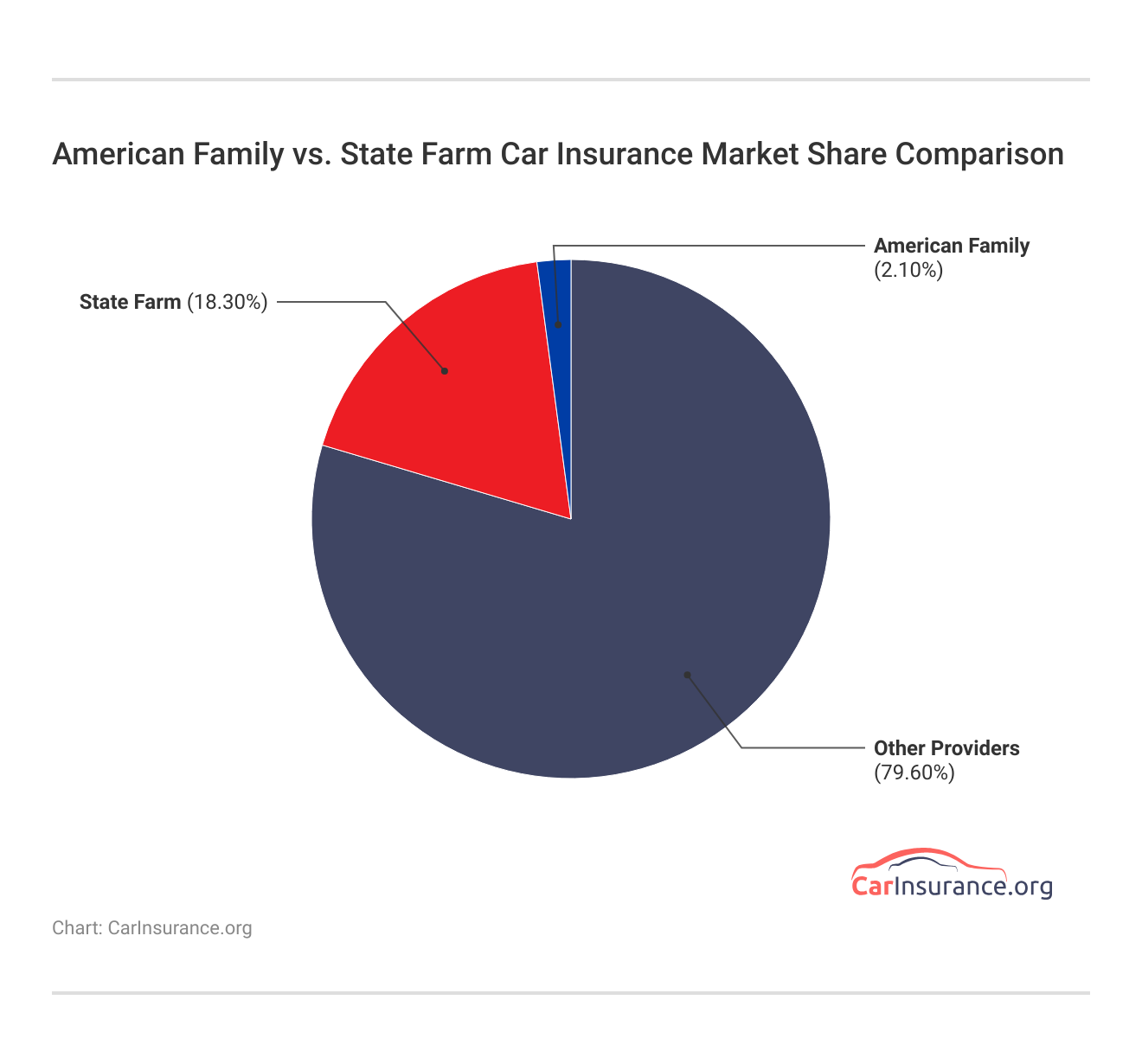

By checking the monthly rates and market shares, it is clear that American Family and State Farm target different segments using different pricing strategies across genders and age groups. American Family is usually the cheaper option for younger drivers, especially at age 16, when its rates are much lower than State Farm’s.

American Family vs. State Farm Full Coverage Car Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $590 | $444 |

| Age: 16 Male | $726 | $498 |

| Age: 30 Female | $165 | $133 |

| Age: 30 Male | $195 | $147 |

| Age: 45 Female | $164 | $123 |

| Age: 45 Male | $166 | $123 |

| Age: 60 Female | $148 | $108 |

| Age: 60 Male | $150 | $108 |

The rates are significantly lower for older ages, though, which makes State Farm more competitive as age increases. It is also one of the lowest rates for older ages. This price may reflect their market shares, with State Farm holding a significant share, indicating a wider acceptance, perhaps as a result of competitive pricing or perceived value.

With this comparison, pay attention to your needs and preferences when choosing between different types of car insurance coverage, as each insurer provides distinct benefits tailored to various client profiles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family Insurance vs. State Farm Insurance: Driving Record Rate Comparison

In terms of car insurance premiums based on driving records, American Family’s rates are higher than State Farm’s in all categories. American Family charged $166 per month for people with a clean driving record, while State Farm provided a more budget-friendly price of $123.

American Family vs. State Farm Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $166 | $123 |

| One Accident | $251 | $146 |

| One Ticket | $194 | $137 |

| One DUI | $276 | $160 |

The trend continues with drivers having one accident or one ticket, with State Farm maintaining lower rates—$146 and $137, respectively, compared to American Family’s $251 and $194. Even for drivers with a DUI, State Farm’s monthly premium of $160 remains lower than American Family’s $276.

When filing a claim, immediately gather any necessary documents like the police report and photos of the damage, and utilize your insurer’s app for streamlined processing and real-time updates.Eric Stauffer Licensed Insurance Agent

This pricing strategy highlights why you need car insurance, demonstrating State Farm’s capacity to provide competitive rates across a wide range of risk profiles, which could make it a good fit for motorists with different driving histories.

Credit Score Impact on Car Insurance: American Family vs. State Farm

American Family is behind State Farm and Progressive; anyone with an awful credit situation will not get the coverage and benefits that come with being flat. American Family consistently provides cheaper rates than State Farm for every level of credit, but the gap is most pronounced among “Very Poor” score customers, paying $161 compared to State Farm’s $293.

American Family vs. State Farm: Full Coverage Car Insurance Monthly Rates by Credit Score

| Credit Score Category | ||

|---|---|---|

| Very Poor (300-579) | $161 | $293 |

| Fair (580-669) | $108 | $167 |

| Good (670-739) | $102 | $134 |

| Very Good (740-799) | $84 | $121 |

| Exceptional (800-850) | $78 | $105 |

Throughout the score range, indicating the potential for an American Family to be the better value for consumers with better risk scores, offering lower premiums without sacrificing coverage.

This little chat informs one of those things that each other needs to compare insurance options with personal finances and incorporate safe driving tips, as choosing between American Family and State Farm could lead to substantial savings depending on your credit score.

Comparing Discounts: American Family vs. State Farm Car Insurance

When looking at savings on discounts, State Farm tends to give a higher percentage of savings across the board than American Family, which could lead to greater affordability for consumers. For instance, State Farm’s multi-policy discount is much more generous, at 17%, than American Family’s 10%.

American Family vs. State Farm Car Insurance Discounts

| Discount Type | ||

|---|---|---|

| Multi-Policy | 10% | 17% |

| Multi-Vehicle | 12% | 20% |

| Safe Driver | 20% | 30% |

| Defensive Driving | 10% | 15% |

| Good Student | 25% | 25% |

| Low Mileage | 5% | 10% |

| Pay-in-Full | 5% | 7% |

| Auto Safety Features | 10% | 15% |

| Paperless Billing | 3% | 5% |

| Military Discount | 0% | 0% |

| Senior Discount | 5% | 5% |

| Loyalty Discount | 10% | 10% |

Similarly, State Farm offers auto discounts of 30% for good drivers, while American Family provides 20%. On the other hand, American Family offers the same 25% discount for good students as State Farm, which indicates competitive rates in individual segments.

These differences underscore State Farm’s emphasis on rewarding a broader spectrum of driver behaviors and policy bundling, which can result in more significant savings and define how much insurance you need for your car, catering to a diverse client.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Analysis: American Family vs. State Farm Insurance Ratings

Between American Family and State Farm, the insurance ratings and consumer reviews from several agencies reflect the competitive advantage. Both companies get high marks for their business practices (A+ rating from the BBB), which speaks to a strong adherence to ethical business standards.

Insurance Business Ratings & Consumer Reviews: American Family vs. State Farm

| Agency | ||

|---|---|---|

| Score: 692 / 1,000 Avg. Satisfaction | Score: 710 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.77 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: B Fair Financial Strength |

According to J.D. Power, State Farm edges out American Family with a score of 710 compared to 692, suggesting slightly higher customer satisfaction. Consumer Reports ratings show that both companies are well regarded by customers, but American Family has a slight edge with a score of 78 compared to State Farm’s 75.

The NAIC index shows both companies received fewer complaints than average, indicating an ability to address problems successfully. State Farm A.M.’s Best rating is a B rating, while the American Family holds an A grade, which is robust.

This detailed examination embodies the strengths and nuanced discrepancies in customer satisfaction and soundness of two of the best car insurance companies, highlighting their unique offerings.

Pros and Cons of American Family Car Insurance

While American Family car insurance has many advantages, there are also some disadvantages that it is worth considering when selecting a policy. Here’s a clear breakdown:

Pros

- Customizable Coverage Options: American Family gives you the option to customize your policy with add-ons such as gap insurance and accident forgiveness, providing flexibility to meet diverse insurance needs.

- Discount Opportunities: They have discounts for safe driving and good grades, which can reduce premiums by quite a bit.

- Comprehensive Young Driver Support: American Family provides distinct discounts for young drivers and those purchasing insurance on their own, promoting affordability for younger demographics.

Cons

- Higher Rates for Certain Demographics: American Family’s rates can be higher for specific age groups than for the competition, in general.

- Limited Appeal for High-Risk Profiles: For drivers with poor credit scores or a history of traffic violations, American Family’s rates may be less competitive than those offered by other insurers.

Reddit user shared their experience with the American Family who had a positive experience with a claim for an auto accident involving a tree. Their insurer paid for the damages and didn’t raise their rates, showing what a good company they had and how fairly they covered in terms of policy.

Comment

byu/sodak748 from discussion

inhomeowners

Carefully and intentionally educated on how to lower your car insurance cost, you can find a plan that offers both protection and value, ensuring your investment in car insurance is both wise and beneficial.

Pros and Cons of State Farm Car Insurance

State Farm car insurance has a lot of great features and benefits, but a few things to watch out for. Here’s a brief overview of the advantages and disadvantages:

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros

- Competitive Pricing for Older Drivers: State Farm offers more competitive rates for older demographics, making it a potentially more affordable choice for mature drivers.

- Drive Safe & Save Program: This program rewards safe driving habits with significant discounts, encouraging and financially benefiting cautious drivers.

- High Customer Satisfaction: With a higher score from J.D. Power, State Farm demonstrates strong customer service and satisfaction levels.

Cons

- Higher Rates for Young Drivers: State Farm’s rates tend to be higher for younger drivers, particularly those around 16 years old.

- Less Favorable for Drivers with Poor Credit: Their rates can be substantially higher for those with lower credit scores, which might be a deterrent for some customers.

This quote from a Reddit user emphasized State Farm’s long-held title of the largest auto insurer in the U.S. since 1942 and how well it’s performed over the decades. State Farm would be a good choice if you appreciate solid customer service and qualify for their discounts.

Comment

byu/Susano-o_no_Mikoto from discussion

inInsurance

However, younger drivers or those with lower credit scores might find it less appealing due to the higher costs, influenced by factors that affect the price of car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding Between American Family and State Farm: A Tailored Insurance Guide

Whether American Family or State Farm is better for you depends heavily on age, driving history, and credit score. American Family generally has better rates for these groups: young drivers and bad credit, highlighting why you need car insurance tailored to your specific demographic.

After switching to a bundled home and auto policy with American Family Insurance, I saved 23% on my premiums, which simplified managing my policies and significantly reduced my paperwork.Chris Tepedino Feature Writer

State Farm offers lower rates for higher ages and clean records, with its safe-driving and policy bundling discounts translating into huge savings. Both companies have excellent customer service, and their financial condition is solid enough to provide reliability. Determine which provider’s discounts and coverage options align most closely for the best value in car insurance.

Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

How does American Family vs. State Farm homeowners insurance compare in terms of pricing?

While specific rates can vary based on individual circumstances, American Family typically offers competitive rates for younger homeowners or those with less expensive properties. In contrast, State Farm may provide better value for older demographics or higher-value homes due to its extensive coverage options and strong financial stability.

What are the main differences between State Farm and American Family home insurance?

State Farm typically provides superior customer support and has a strong customer satisfaction score, a sign of good claims management and options. American Family might provide more opportunities for customization in policies, appealing to homeowners looking for specific coverage enhancements like credit theft or water backup coverage.

How can I qualify for the American Family Insurance good student discount?

To qualify for the good student discount and lower your car insurance cost, students must maintain a “B” average or better, be under 25, and be enrolled full-time. This discount can significantly reduce premiums for eligible policyholders.

Why is American Family insurance so expensive?

American Family insurance rates may be higher due to the extensive customizable coverage options and the specific risk profiles of insured individuals, such as young drivers or those with poor credit.

What is the American Family Insurance rating by major agencies?

American Family Insurance holds strong ratings for financial stability and customer satisfaction, typically rated as A or higher by agencies like AM Best and Standard & Poor’s.

What types of coverage does AmFam auto insurance offer?

AmFam auto insurance includes coverages like liability, collision, comprehensive, and personal injury protection. Plus, it has services like gap insurance and accident forgiveness designed to help you get a sense of how car insurance works to protect you financially in various situations.

What is the cost of State Farm full coverage?

The cost of State Farm full coverage varies based on several factors, including the driver’s profile and vehicle type, but it is typically competitive, particularly for drivers who qualify for discounts.

Where can I find State Farm’s cheap insurance options?

State Farm offers competitive pricing structures, primarily through discounts like multi-vehicle, safe driving, and bundling policies for more affordable insurance solutions.

What do reviews say about American Family auto insurance?

American Family auto insurance reviews often highlight the company’s responsive customer service and comprehensive coverage options, although some reviews mention higher rates for specific demographics.

What does State Farm’s comprehensive coverage include?

State Farm’s comprehensive coverage includes protection against non-collision incidents such as theft, vandalism, fire, natural disasters, and hitting an animal.

How does State Farm handle comprehensive claims?

How do I get an American Family car insurance quote?

How does receiving a speeding ticket affect a State Farm auto policy?

Can I bundle different types of insurance with American Family for a discount?

Are there positive State Farm auto insurance reviews?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.