American Family vs. Liberty Mutual Car Insurance in 2026 [Head-to-Head Review]

American Family vs. Liberty Mutual car insurance comparison highlights that American Family provides lower monthly rates starting at $44, compared to Liberty Mutual's $68. Evaluate their coverage options and discounts to determine which insurer aligns best with your insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated March 2025

American Family vs. Liberty Mutual car insurance comparative highlights major price and service differences with American Family starting low at $44 monthly while Liberty Mutual tops it off from $68.

This side-by-side comparison explores their coverage, discounts, and customer service, helping you gain insight into how car insurance works to make the right choice.

American Family vs. Liberty Mutual Car Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.1 | 4.3 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.8 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 3.9 | 5.0 |

| Coverage Value | 4.0 | 4.1 |

| Customer Satisfaction | 4.0 | 4.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.7 | 4.2 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 4.1 | 4.4 |

| American Family Review | Liberty Mutual Review |

See how the two compare across various driver segments and records to determine which provider is a better fit for you.

Enter your ZIP code to compare American Family and Liberty Mutual car insurance rates and find the best coverage at the right price.

- American Family offers customizable coverage to meet unique driver needs

- Liberty Mutual grants diverse discounts catering to different driver profiles

- Assess service in American Family vs. Liberty Mutual car insurance

Comparing Costs: American Family vs. Liberty Mutual by Age and Gender

In the table below, we compare the two insurers for several groups, showing the monthly car insurance prices offered by American Family and Liberty Mutual by both age and gender. This graph visually shows how much lower rates are with American Family versus Liberty Mutual in every single category.

American Family vs. Liberty Mutual Full Coverage Car Insurance Monthly Rates by Age & Gender

| Age & Gender |  |

|

|---|---|---|

| Age: 16 Female | $414 | $723 |

| Age: 16 Male | $509 | $785 |

| Age: 30 Female | $116 | $174 |

| Age: 30 Male | $137 | $200 |

| Age: 45 Female | $115 | $171 |

| Age: 45 Male | $117 | $174 |

| Age: 60 Female | $104 | $148 |

| Age: 60 Male | $105 | $159 |

For instance, a 16-year-old female driver could be insured by American Family for only $414, reflecting American Family Insurance rates for young drivers, whereas the same driver would cost $723 with Liberty Mutual, showing Liberty Mutual auto insurance rates for this age group.

They’re all cheaper to some degree, following the same trend with AmFam but at a demographic where that is par for the course for a family seeking the different types of car insurance coverage that are more budget-friendly, especially with a teen driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Market Share Snapshot: American Family vs. Liberty Mutual in Car Insurance

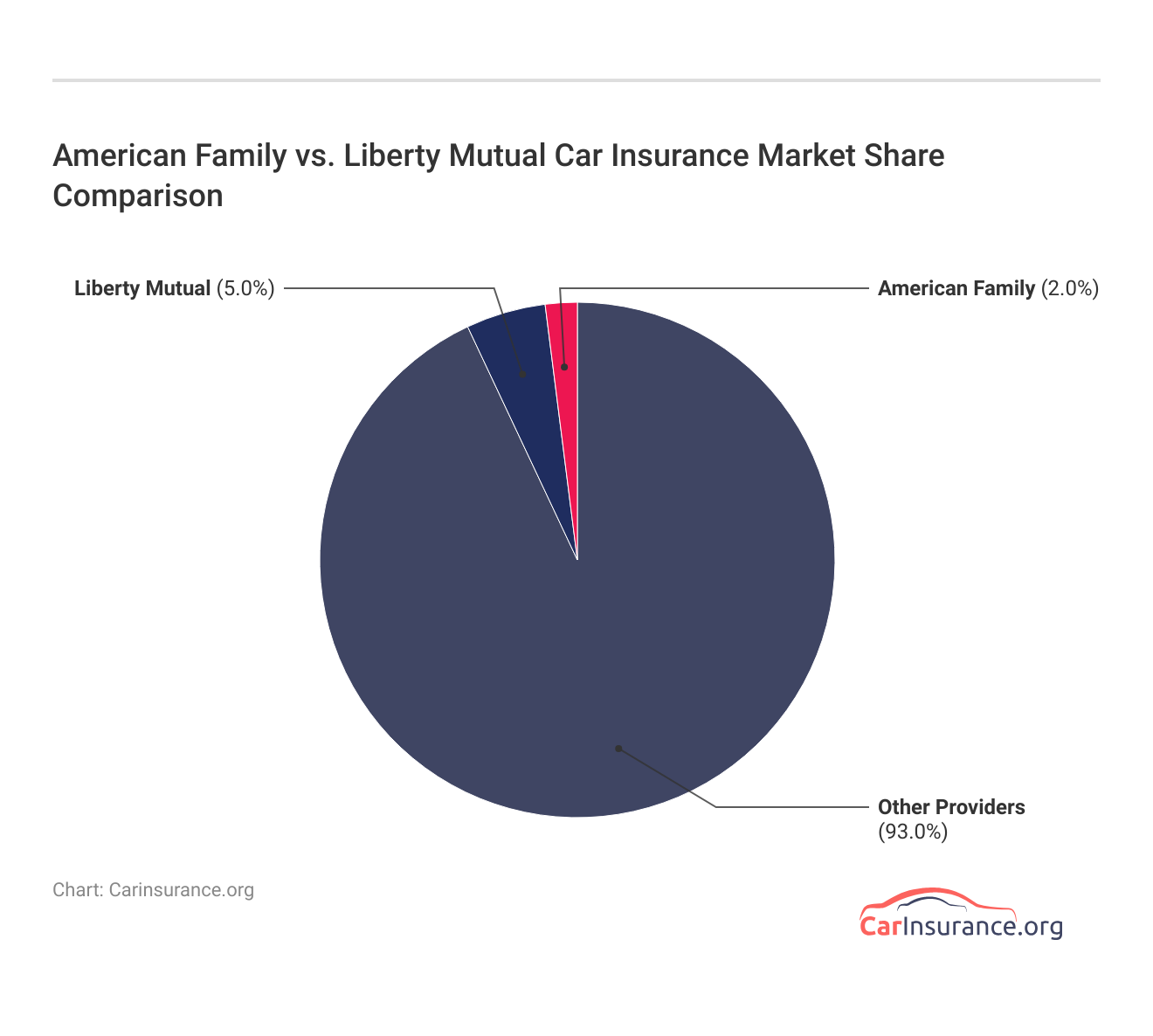

The chart illustrates the car insurance market share distribution among American Family, Liberty Mutual, and other providers. American Family holds a 2.0% market share, while Liberty Mutual has a 5.0% share, reflecting why you need car insurance and how different providers stand within the market.

Various other insurance providers comprise 93.0% of the market. This graphic serves to remind one of the competitive backdrop in which these two firms operate as they stand, having pulled ahead of the pack of many other insurers.

Insurance Costs by Record: American Family vs. Liberty Mutual

This table provides a clear comparison of monthly car insurance rates with full coverage by driving records between American Family and Liberty Mutual. It highlights the cost differences across four categories: clean driving record, not-at-fault accidents, speeding tickets, and DUI/DWI incidents.

Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $117 | $174 |

| Not-At-Fault Accident | $176 | $234 |

| Speeding Ticket | $136 | $212 |

| DUI/DWI | $194 | $313 |

That average, independent of record category, is still likely to be a better deal for drivers who fall in the middle of the road regarding their driving records, along with following safe driving tips to maintain affordable premiums.

This side-by-side has you covered for whatever your budget and coverage needs are, whether you’re the proud owner of a pristine driving record, have a few dings on it, or are just window-shopping no-fault insurance options.

How Credit Score Affects Your Car Insurance Rates: American Family vs. Liberty Mutual

It is legal for car insurance providers to base premiums on your credit score in most states; however, some outlaw it along with gender and marital status-dependent rates. Car insurance companies justify using credit scores to determine rates because people with lower credit scores are more statistically more likely to file a claim.

Let’s take a look at how American Family and Liberty Mutual consider your rates based on your credit score.

American Family vs. Liberty Mutual Full Coverage Car Insurance Monthly Rates by Credit Score

| Credit History |  |

|

|---|---|---|

| Good Credit (670-739) | $224 | $366 |

| Fair Credit Score (580-669) | $264 | $467 |

| Poor Credit Score (300-579) | $372 | $734 |

American Family is more lenient than Liberty Mutual on those with fair or poor credit when it comes to determining car insurance rates. Drivers with poor credit will pay twice as much as a driver with good credit with Liberty Mutual. If you have a credit score on the lower end, American Family is a better option than Liberty Mutual.

However, before you dismiss these companies and their rates solely based on credit score, understand how credit impacts your state minimums and review rates from multiple providers to determine how much insurance you need for your car.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discount Deep Dive: AmFam and Liberty Mutual Offers

Discounts from car insurance providers vary widely, and they are typically focused on the principles and ideology of a company. That’s why, particularly if you have a poor driving record or a low credit score, it pays to shop around. Discounts can help counter high costs.

American Family vs. Liberty Mutual Car Insurance Discounts

| Discounts |  |

|

|---|---|---|

| Adaptive Cruise Control | N/A | 5% |

| Adaptive Headlights | N/A | 5% |

| Anti-lock Brakes | N/A | 5% |

| Anti-Theft | N/A | 20% |

| Daytime Running Lights | N/A | 5% |

| Defensive Driver | 10% | 10% |

| Driver's Ed | N/A | 10% |

| Driving Device/App | 40% | 30% |

| Electronic Stability Control | N/A | 5% |

| Federal Employee | N/A | 10% |

| Forward Collision Warning | N/A | 5% |

| Full Payment | N/A | 5% |

| Further Education | N/A | 10% |

| Good Student | N/A | 23% |

| Green Vehicle | N/A | 10% |

| Membership/Group | N/A | 10% |

| Military | N/A | 4% |

| Multiple Policies | N/A | 20% |

| Multiple Vehicles | N/A | 10% |

| New Address | N/A | 5% |

| New Graduate | N/A | 5% |

| Newly Licensed | N/A | 5% |

| Newlyweds | N/A | 5% |

| Occupation | N/A | 10% |

| Passive Restraint | 30% | N/A |

| Recent Retirees | N/A | 4% |

| Students & Alumni | N/A | 10% |

| Switching Provider | N/A | 10% |

| Vehicle Recovery | N/A | 35% |

| VIN Etching | N/A | 5% |

Unfortunately, our data source shows only three discounts offered by American Family: defensive driver, air bags, and using their driving device or app. However, if you have a vehicle recovery system, you can save 35% with Liberty Mutual, so it really pays to check out all of the discounts every car insurance company offers.

Just as when buying auto insurance providers specifically look for different types of drivers to offer a discount, so be sure to ask about any out there. For example, you may want to ask about the American Family Insurance good student discount or car insurance Liberty Mutual options simply by contacting customer service lines.

Comparing Mobile Apps: American Family vs. Liberty Mutual Car Insurance

Car insurance has come a long way, and managing your policy is now easier than ever. With American Family and Liberty Mutual’s mobile apps, you can take control of your coverage right from your phone. These apps let you access essential features quickly, offering unique benefits that save you time and help you stay on top of your policy and savings.

The MyAmFam app from American Family is a simple solution for seeing an American Family’s full coverage insurance policy, managing claims, and paying bills via a smartphone. With MyAmFam, your access to roadside assistance, driving tips, and document access to policy details or ID cards, for example, come along for the ride.

The Liberty Mutual app includes things like personalized insurance suggestions and a safe driving rewards program that shows ways you can save on your premiums. The app tracks your driving behavior with telematics, and if you have Liberty Mutual comprehensive insurance and Liberty Mutual comprehensive coverage options, you can receive savings for safe drivers.

American Family is a top pick for wallet-friendly rates in consumer reviews, and Liberty Mutual earns high marks if you want customized savings from telematics and discounts.Michelle Robbins Licensed Insurance Agent

Both apps offer great features, although MyAmFam takes the cake when it comes to usability and direct access to essential tools with minimal fluff that lets the user hunt down different types of car insurance coverage easily. On the contrary, Liberty Mutual taps into personalized savings with its telematics approach.

Ratings Showdown: American Family vs. Liberty Mutual

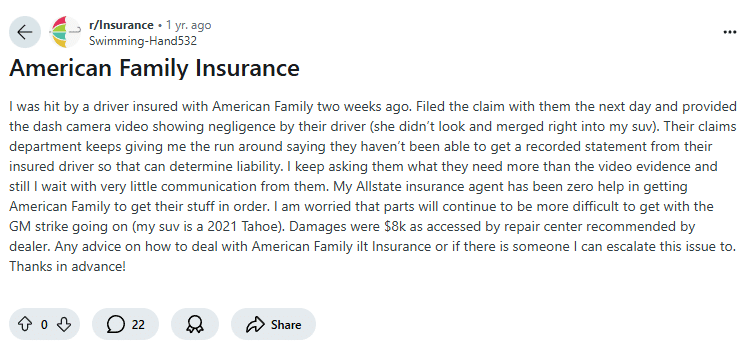

This side-by-side table provides a comparison of American Family and Liberty Mutual insurance companies including standout ratings by major agencies related to business performance as well as customer feedback giving you a look at an American Family Insurance review and a Liberty Mutual auto insurance review.

Insurance Business Ratings & Consumer Reviews: American Family vs. Liberty Mutual

| Agency |  |

|

|---|---|---|

| Score: 831 / 1,000 Avg. Satisfaction | Score: 857 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.77 Fewer Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

Both companies exhibit strong performance, with Liberty Mutual slightly edging out in customer satisfaction according to J.D. Power, while both hold an ‘A’ rating in financial strength from A.M. Best and boast excellent business practices as per the Better Business Bureau (BBB).

Ratings from Consumer Reports are also favorable for American Family, which outscored Liberty Mutual overall, and not surprisingly, it starts out with good customer service too. Both also received below-average complaints, a further sign of solid consumer confidence and satisfaction.

Every type of car coverage has its benefits and features, and American Family automobile insurance is no exception. Here are some of the biggest pros and cons for American Family to help you compare it against the best car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of American Family Car Insurance

Like any other type of coverage, American Family car insurance has its benefits and drawbacks. Cost can be an important factor when shopping for car insurance and American Family Insurance cost. Here is the breakdown of some American Family’s main advantages and disadvantages, compared to its competitors.

Pros

- Affordable Rates: With monthly premiums coming in around $44, American Family is an affordable option for drivers and families with teens on a budget.

- User-Friendly App: The MyAmFam app allows users to manage policies, file claims and make payments from their mobile device making it a good match for more tech-obsessed consumers.

- Positive Customer Service: Customers view American Family as a go-to company that can keep them secure in their coverage and has received positive reviews for customer service.

Cons

- Limited Discount: American Family offers several discounts, but fewer than some competitors, potentially leading to higher costs for some drivers.

- Fewer Customization Options: American Family may not have as many add-ons, so less desirable for drivers wanting very customized coverage.

While it may not beat other providers on customizability or discounts, American Family car insurance is a solid fit for budget-conscious drivers seeking reliable service. To learn how to lower your car insurance cost, compare multiple options to find the best rate.

Pros and Cons of Liberty Mutual Car Insurance

Liberty Mutual has unique benefits that stand out, but also comes with limits. Over here things get a little more complex because aside from price, when you go to buy Liberty Mutual average car insurance cost.

Pros

- Wide-Ranging Discounts: Liberty Mutual also offers optional telematics-based discount opportunities for safe drivers, making it a good pick for savings-oriented motorists.

- Liberal Policy Customization: Liberty Mutual has some of the broadest coverage, with particular add-ons (including accident forgiveness) for those who want a custom-fit policy.

- Savings for Telematics: If you drive carefully, then Liberty Mutual will reward you through its telematics program, allowing tech-savvy drivers to earn lower premiums.

Cons

- Higher Monthly Rates: While Liberty Mutual’s rates are competitive, aggressive-budget drivers looking for coverage could be better off with American Family.

- Complaint Ratio: Liberty Mutual has a higher customer complaint ratio, which could be an issue for some customers that consider a smooth and helpful experience to be important.

Liberty Mutual provides solid customization and tech-friendly discounts, but its relatively high starting rates and ratio of customer complaints could give potential policyholders pause when considering factors that affect the price of car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

American Family vs. Liberty Mutual: Choose Affordable Rates or Customized Savings

American Family and Liberty Mutual are both top-shelf considerations for any shopper, but American Family beats out the latter based on pricing alone, making it a must-call for thrifty motorists or families looking to insure a teen driver and understand why you need car insurance.

In contrast, Liberty Mutual gives drivers more options for tailoring their policies with its telematics and a selection of unique discounts, particularly those geared toward tech achievers looking to maximize savings. It all comes down to whether you want lower monthly premiums or more customized opportunities to save, so make your choice accordingly.

Ready to buy car insurance? Whether you’re choosing between American Family vs. Liberty Mutual or another company, you can always use our FREE comparison tool to compare car insurance quotes from local companies near you to make the decision easier.

Frequently Asked Questions

How does Liberty Mutual vs. American Family compare for affordable car insurance?

Liberty Mutual vs American Family shows that American Family generally offers lower base rates, while Liberty Mutual provides significant discounts through telematics options.

What are the benefits of getting an American Family car insurance quote?

An American Family car insurance quote can provide affordable rates and discounts tailored to young drivers and good students.

Does the American Family offer accident forgiveness as part of its car insurance?

Drivers filing a car insurance claim after an accident can benefit from American Family Insurance accident forgiveness, which prevents rate increases for their first at-fault accident.

How does Liberty Mutual’s accident forgiveness work?

Liberty mutual accident forgiveness helps policyholders avoid premium increases after their first at-fault accident.

What discounts can you get with Liberty Mutual’s car insurance?

Liberty Mutual car insurance discounts include options for safe driving, policy bundling, and telematics-based discounts.

Getting low-cost auto insurance quotes is simple—just enter your ZIP code into our free comparison tool below to instantly see options from American Family and Liberty Mutual near you.

What types of discounts are available with American Family Insurance?

American Family insurance discounts, like bundling and safe driver incentives, help customers reduce their premiums and offset the impact of things they do that can raise their premiums.

Are American Family auto insurance reviews favorable?

American Family auto insurance reviews are generally positive, particularly for customer support and claims assistance.

What features does the American Family Insurance app offer?

The American Family Insurance app includes digital ID access, claims tracking, and payment options, providing a convenient mobile experience.

Is American Family gap insurance useful for financed vehicles?

American Family gap insurance pays the difference between what a car is worth and what a driver owes on their loan if that vehicle is totaled—an advantage to those who finance their vehicles and may want to learn how to cancel gap insurance if their needs change.

Why might Liberty Mutual be considered a more affordable option?

Why Liberty Mutual is so cheap may be due to its extensive discount programs and safe driving rewards, which make rates competitive.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.