American Access Car Insurance Review for 2026 [Insider Evaluation]

Our American Access car insurance review reveals rates starting at $58/mo. They specialize in non-standard coverage for those with poor records. While they cater to drivers who struggle to get insured elsewhere, their B financial rating and high complaint index raise service reliability concerns.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2025

This American Access car insurance review explores how the company’s rates begin at $58 monthly, as this Kemper subsidiary serves drivers with international licenses and SR-22 requirements.

Operating in Arizona, Illinois, Indiana, Nevada, and Texas, American Access provides different types of car insurance coverage, including liability, collision, and comprehensive insurance.

American Access also offers optional coverage like rental reimbursement and roadside assistance in select states.

American Access Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.3 |

| Business Reviews | 4.0 |

| Claim Processing | 2.9 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3,0 |

| Policy Options | 2.2 |

| Savings Potential | 3.9 |

After learning about American Access claims and customer reviews, remember to enter your ZIP code into our free quote tool to receive rates from the top companies in your region.

- American Access provides auto coverage to high-risk drivers at $58/mo

- American Access lacks a mobile app and online claims filing capabilities

- The insurer’s rating and high complaint ratio suggest service concerns

American Access Insurance Rates

American Access Casualty Company offers high-risk auto insurance with monthly rates starting at $58 for minimum coverage. Based on American Access insurance reviews, they provide liability, collision, and comprehensive coverage options, plus SR-22 filing services.

American Access Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $325 | $475 |

| Age: 16 Male | $375 | $550 |

| Age: 18 Female | $275 | $425 |

| Age: 18 Male | $320 | $470 |

| Age: 25 Female | $175 | $280 |

| Age: 25 Male | $200 | $300 |

| Age: 30 Female | $150 | $250 |

| Age: 30 Male | $180 | $275 |

| Age: 45 Female | $130 | $205 |

| Age: 45 Male | $58 | $125 |

| Age: 60 Female | $115 | $175 |

| Age: 60 Male | $125 | $200 |

| Age: 65 Female | $110 | $165 |

| Age: 65 Male | $120 | $185 |

The table shows significant premium variations based on age and gender – teen drivers face the highest rates (up to $550 for full coverage), while mature drivers enjoy more affordable premiums. Female drivers generally pay less than males, with rates decreasing steadily with age across all coverage levels.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, and Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $400 | $460 | $210 | $220 | $180 | $185 | $160 | $165 | |

| $360 | $420 | $190 | $200 | $170 | $175 | $155 | $160 | |

| $380 | $440 | $200 | $210 | $175 | $180 | $160 | $165 | |

| $350 | $400 | $180 | $190 | $160 | $165 | $145 | $150 | |

| $410 | $470 | $220 | $230 | $190 | $195 | $170 | $175 |

| $375 | $425 | $190 | $200 | $170 | $175 | $155 | $160 |

| $390 | $440 | $200 | $210 | $175 | $180 | $155 | $160 | |

| $370 | $420 | $185 | $195 | $165 | $170 | $150 | $155 | |

| $370 | $430 | $195 | $205 | $175 | $180 | $160 | $165 | |

| $320 | $380 | $170 | $180 | $155 | $160 | $140 | $145 |

The following table illustrates how driving history impacts American Access car insurance rates, with violations significantly increasing monthly premiums:

American Access Car Insurance Monthly Rates by Driving History

| Driving History | Minimum Coverage | Full Coverage |

|---|---|---|

| One Accident | $78 | $150 |

| One DUI | $95 | $200 |

| One Ticket | $65 | $135 |

| Clean Record | $58 | $125 |

While American Access Casualty Company specializes in high-risk drivers, the table clearly shows how maintaining a clean record can lead to substantial savings, with rates nearly doubling for those with DUIs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Coverage From American Access Car Insurance

American Access only serves its five-state area (Arizona, Illinois, Indiana, Nevada, and Texas) and offers basic car insurance coverages from this company, like liability, collision, and comprehensive insurance coverage. In select states, uninsured or underinsured motorist protection and personal injury protection (PIP) insurance coverage are also available.

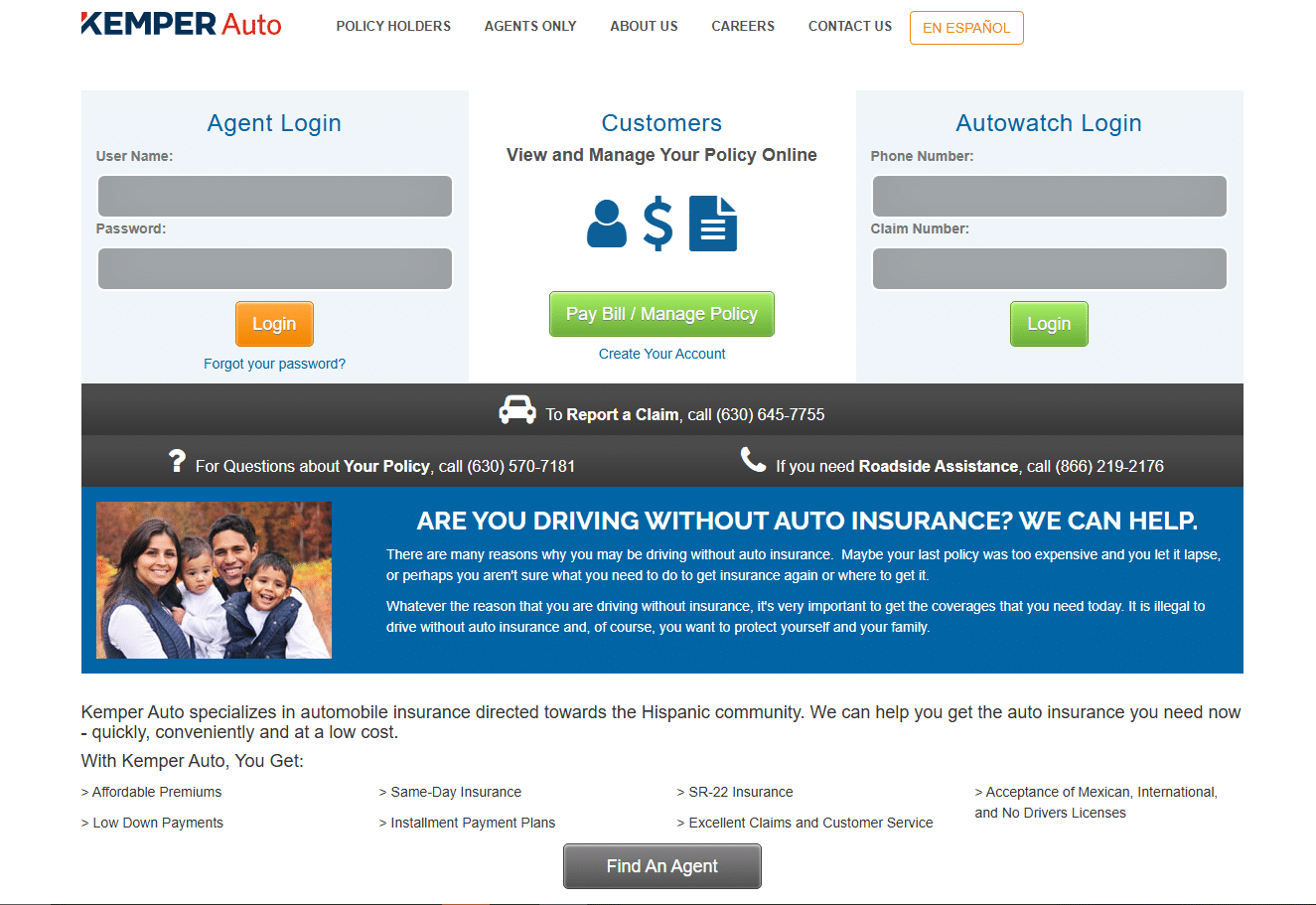

They are a subsidiary of Kemper Insurance that deals with nonstandard policies and specializes in insuring high-risk drivers. (For more information, read our “Kemper Car Insurance Review“).

American Access Car Insurance Discounts

While American Access auto insurance doesn’t publicly advertise discounts, American Access auto claims representatives and local agents can help lower your car insurance cost. American Access Casualty company’s claims process requires working directly with an agent who may offer rate reductions like a bundling car insurance discount.

Though there is a minimal discount program, drivers can save by opting for higher deductibles or choosing minimum state-required coverage limits.

American Access Car Insurance - Available Discounts and Savings

| Discount Name | Description | Savings Potential |

|---|---|---|

| Multi-Policy | For bundling auto with home or renters insurance | 20% |

| Good Student | For students maintaining a B average or higher | 15% |

| Low Mileage | For drivers who use their car less frequently | 15% |

| Safe Driver | For drivers with a clean record | 10% |

| Military | For active duty military members | 10% |

Customers can also manage costs by paying premiums annually instead of monthly and maintaining a clean driving record to avoid rate increases.

American Access Ratings and Reviews

Before you buy American Access car insurance, it’s essential to analyze the available customer ratings and financial reviews. This helps you determine how reliable and efficient a company is before committing to an actual policy.

American Access provides essential coverage options, including liability, collision, and comprehensive insurance.Eric Stauffer Licensed Insurance Agent

Unfortunately, American Access only earned a B score from A.M. Best, one of the leading credit rating agencies. American Access has a history of receiving less-than-perfect financial evaluations.

American Access Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 790/1,000 Below Avg. Satisfaction |

|

| Score: B Satisfactory Business Practices |

|

| Score: 65/100 Below Avg. Customer Feedback |

|

| Score: 3.10 More Complaints Than Avg. |

|

| Score: B Good Financial Strength |

American Access Casualty company reviews vary widely. While the company earned more complaints than average from NAIC, recent customers like Luke H. reported positive experiences posted on Yelp.

As seen on Luke’s Yelp review, he praised the company’s efficiency in handling his claim after a rear-end collision, specifically noting fast service for car repairs and rental car coverage.

Ultimately, it’s common for insurance companies to receive primarily negative reviews online. However, keep these evaluations in mind while shopping around for the best car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Access Auto Insurance Review: Pros and Cons

Before deciding whether American Access auto insurance is right for you, consider these key advantages and limitations of their coverage:

- High-Risk Acceptance: Provides coverage for drivers with international licenses, poor records, and SR-22 requirements.

- Bilingual Support: Offers customer service in multiple languages for easier communication.

- Basic Coverage Options: Includes essential add-ons like roadside assistance and rental reimbursement. (Read More: 7 Things to Know Before Renting a Car)

However, potential customers should be aware of these significant drawbacks:

- Limited Accessibility: Only available in Arizona, Illinois, Indiana, Nevada, and Texas.

- Poor Customer Experience: More complaints than average with a NAIC score of 3.10, B A.M. Best rating, and no mobile app.

While American Access caters well to high-risk drivers needing basic coverage, consider comparing quotes from other insurers if you have a clean driving record or live outside their service area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Making the Right Choice: American Access Insurance Review

Our American Access car insurance review shows this provider excels at serving high-risk drivers who need SR-22 insurance or have international licenses, though their NAIC complaint ratio of 3.10 raises service concerns.

Check out this guide to understand what to do after an accident and what information you need to submit a claim: https://t.co/o7eDj4cqF3 pic.twitter.com/2hdU8CZuua

— Kemper (@KemperInsurance) January 23, 2025

With minimum coverage rates starting at $58 monthly and full coverage available from $125, American Access offers competitive pricing for non-standard auto insurance across their five-state service area. However, drivers with clean records may find better rates and more comprehensive coverage options elsewhere.

Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What is the American Casualty Company?

American Access Casualty Company is a Kemper subsidiary that provides non-standard auto insurance in five states. Its claims phone number is 630-645-7755.

Is American Access part of Kemper?

Yes, Kemper acquired American Access Insurance in early 2021 for $370 million. Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

How do I file a claim with American Access Casualty Company?

To file claims, contact the American Access insurance claims phone number or your local agent. Online filing isn’t available.

What is a casualty insurance company?

A casualty insurance company covers liability and property damage from accidents and unexpected events.

What did Kemper Insurance use to be called?

Kemper was formerly Unitrin until rebranding in 2011.

How do I pay my Kemper bill over the phone?

Call Kemper for billing or use their online portal. Kemper or American Access Casualty company has the same phone number. You should know when to use your deductible if filing a claim.

What is the grace period for Kemper insurance?

Kemper typically offers a 10-day grace period for payments.

Where is Kemper headquarters?

Kemper’s headquarters is in Chicago, Illinois.

What insurance companies are under Kemper?

Subsidiaries include American Access, Infinity, Alliance United, and Merastar Insurance.

What is not covered by casualty insurance?

Casualty insurance typically excludes intentional damage, normal wear and tear, and certain natural disasters. Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.