Allstate vs. USAA Car Insurance in 2026 [Head-to-Head: Discounts & Coverage]

Allstate vs. USAA car insurance offers some different options based on who is eligible and the prices. USAA is reserved for military members and charges as low as $22/month, while the lowest rate for Allstate is $61/month. Compare USAA vs. Allstate to determine which will give you the best rates and coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated May 2025

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsAllstate vs. USAA car insurance throws the light on exclusive benefits to drivers. USAA provides military families with as little as $22 monthly and has the highest customer satisfaction.

In comparison, Allstate offers more comprehensive discounts, starting from $61 monthly for civilian drivers. USAA is exclusively provided for military personnel and their families, while Allstate reaches more people with its safe-driving discounts and bundling policies.

Allstate vs. USAA Car Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.8 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.4 | 4.7 |

| Customer Satisfaction | 4.0 | 4.7 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.2 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 3.4 | 4.7 |

| Savings Potential | 3.8 | 4.7 |

| Allstate Review | USAA Review |

Price comparisons from both companies help drivers get the best possible rates tailored to their unique coverage needs. Check out USAA Casualty insurance company news for more insights and learn how car insurance works.

Find the ideal car insurance at the most affordable rates by entering your ZIP code above to explore coverage options from leading insurers, including Allstate and USAA.

- USAA offers a free car insurance quote specifically for military families

- Allstate vs. USAA car insurance shows significant discounts for safe driving

- Recent USAA class action lawsuit concerns involve claims processing issues

Coverage Cost in Allstate vs. USAA Car Insurance

In terms of car insurance, comparing the USAA insurance vs. Allstate will vary due to coverage expenses, as many factors dictate higher or lower premiums when paying for premiums, including driving history, age, gender, and location.

Allstate vs. USAA Full Coverage Car Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $608 | $245 |

| Age: 16 Male | $638 | $249 |

| Age: 30 Female | $168 | $74 |

| Age: 30 Male | $176 | $79 |

| Age: 45 Female | $162 | $59 |

| Age: 45 Male | $160 | $60 |

| Age: 60 Female | $150 | $53 |

| Age: 60 Male | $154 | $54 |

Therefore, the average of what one can pay to make a premium in full at Allstate is 120 dollars a month; thus, its rating stands at 3.2, while USAA holds an excellent rating of 4.6, having low rates of around 45 dollars a month, targeting all military personnel and families. For example, the 16-year-old female pays $608 with Allstate but just $245 in USAA.

Allstate vs. USAA car insurance shows that USAA typically offers lower coverage costs for military members, making it an excellent choice for those eligible.Brad Larson Licensed Insurance Agent

Besides this age, there are drastic differences in the prices for other age brackets- the 30-year-old female pays $168 for Allstate coverage compared to $74 in USAA. USAA focuses on military families, offering lower rates to military members and their eligible family members, contributing to the price difference.

If a person wants insurance coverage on the cheap side, acquiring a Free car insurance quote with USAA is a brilliant idea. A comparison of USAA insurance and Allstate may help you find methods how to lower your car insurance cost.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options Offered by Allstate and USAA

Allstate and USAA serve different needs on the driver’s part, which is why they offer different coverage options. All of their full-coverage deals comprise liability and physical damage, which are the minimum requirements for meeting the liability limits required in any state, and comprehensive insurance covering collision incidences, among other things.

They offer gap insurance between the automobile’s value and the remaining amount an individual will still need to pay regarding their loan. You can obtain SR-22 filings if you need proof of financial responsibility.

Learn about the average USAA car insurance cost and the different types of car insurance coverage, and see USAA car insurance quotes. Both companies do excellent here with a 5.0 rating and broad options that help drivers customize their coverage depending on the specific situation.

Available Discounts for Allstate and USAA Car Insurance

When comparing the car insurance discounts Allstate and USAA offer, each provider offers several choices that can effectively lower premiums. For instance, USAA always provides cheap car insurance with USAA, making this coverage very popular among many drivers.

Allstate vs. USAA Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $160 | $60 |

| Not-At-Fault Accident | $225 | $78 |

| Speeding Ticket | $188 | $67 |

| DUI/DWI | $270 | $108 |

This provider offers a competitive list of discounts and earns a 5.0 rating, tying with Allstate, which also provides these discounts to eligible customers. Interestingly, the factors that affect car insurance prices are record and accident, in which USAA is typically priced less for most situations on record and accidents.

Customers can also request a quote anytime by calling the USAA phone number for car insurance quotes, where they can receive personalized assistance.

Generally speaking, both providers offer various saving opportunities, but in comparison, USAA differs in terms of its military discount and lower average rating.

Customer Reviews of Allstate vs. USAA Car Insurance

The reviews based on customer feedback from platforms like Reddit and Quora made it easy to understand which insurance firm is the best.

Analyzing such data, I realized that Allstate, with its rating score of 4.0, is highly rated for its many discount options and good services. Nonetheless, premium payments sometimes increase depending on whether the client has incurred any claims.

USAA vs Allstate for insurance?

byu/alfredrowdy inpersonalfinance

However, USAA stands out at 4.7 with compliments to its fantastic customer service, especially for military families who note that filing a car insurance claim after an accident following an accident is relatively smooth and effortless, and they are otherwise satisfied with the coverage they have received.

A comparison will highlight the strengths and weaknesses of each company and, therefore, help a potential customer find the right insurance solution, including USAA homeowners insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

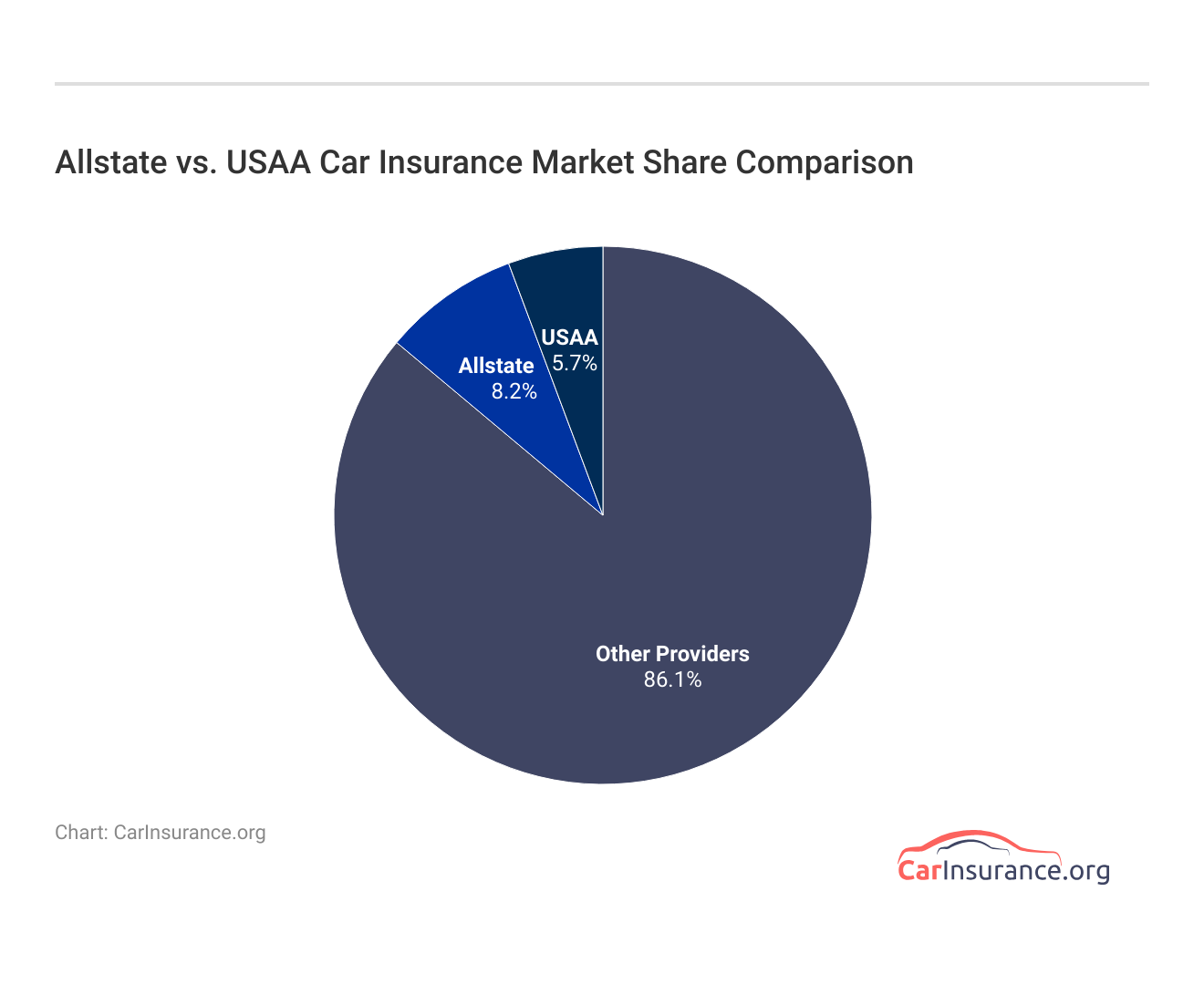

Business Reviews for Allstate and USAA

When comparing the best car insurance companies, it’s wise to factor in Allstate and USAA through ratings from independent third parties, as shown in the table below. USAA always trumps Allstate, scoring a total rating of 4.5 versus Allstate at 4.0.

Insurance Business Ratings & Consumer Reviews: Allstate vs. USAA

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 96/100 High Customer Satisfaction |

|

| Score: 1.45 More Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

USAA is known for higher customer satisfaction and fewer complaints than Allstate, contributing to its more substantial reputation. Furthermore, one who wants to buy a policy would care to learn about lawsuits within USAA membership that could influence their decision and choice.

As seen from business reviews, USAA dominates regarding customer satisfaction and claims processing, which leaves it the apparent winner for the Allstate vs. USAA car insurance debate.Michelle Robbins Licensed Insurance Agent

An informed rating significantly impacts your decision-making, ensuring you do not pick the wrong insurance provider. That’s why you should go through an Allstate roadside assistance review; it provides insights into customer service and claims management.

Pros and Cons of Allstate Car Insurance

Allstate car insurance becomes viable if the pros weigh much heavier than the cons. The following gives a summarized version of the all-important advantages and disadvantages that customers might expect.

Pros

- Comprehensive Discounting: Offers various discounts through safe driving and package offers.

- Extensive Coverage Options: Offers plenty of customization options for varied needs

- Availability Throughout the Country: Available to a large cross-section of consumers, even to civilian consumers

Cons

- Costlier Premiums: Generally expensive compared to USAA, especially for young drivers

- Poor Customer Service Reviews: Some customers experience poor response time and claims handling.

There is a need to deeply analyze the pros and cons to settle on the best company for insurance. To learn more, you may read an Allstate car insurance review or call USAA for further help, including their USAA phone number, to ask questions.

Pros and Cons of USAA Car Insurance

Understanding the advantages and disadvantages of USAA car insurance will allow you to determine whether it is the best automobile policy for you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros

- Military Personnel Pay Less: The company charges substantially lower premiums for military families, making it a budget-friendly policy for active service people.

- Very Good Customer Service: It is known for excellent customer service and has received numerous accolades for efficient service and claims handling.

- Military-Specific Benefits: The company provides unique policies and discounts tailored explicitly to military members and their families.

Cons

- Restrained Coverage: The coverage is basically for military personnel and their relatives

- Diminished Discounts for Civilians: Military discounts are great (especially compared with Allstate), but civilian ones are a little more skimpy.

Knowing how your insurance works could help you decide whether to report the incident to the police or file a claim when something wrong happens.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Findings from Allstate vs. USAA Car Insurance

A comparison between Allstate and USAA car insurance indicates a considerable variance in the coverage cost and customer satisfaction levels. Though USAA charges very cheaply, USAA, especially for Military members, Allstate offers higher discounts and coverage plans.

Key findings in the Allstate vs. USAA car insurance comparison show that USAA leads in service and claims to handle, making it the top pick for eligible military members.

USAA excels in customer service and claims handling, while Allstate offers a variety of discount options. When buying car insurance, your choice between Allstate and USAA will depend on eligibility, budget, and coverage needs.

Don’t pay too much for your car insurance. Use our complimentary quote comparison tool to get estimates from top providers in your area, like Allstate vs. USAA, by entering your ZIP code below.

Frequently Asked Questions

Does Allstate offer a military discount?

Yes, Allstate provides a military discount for active-duty service members, but availability can vary by state. To ensure you qualify, check with an Allstate agent for specific details in your area. If you’re wondering how you can get Allstate accident forgiveness, understanding this benefit can help you save in case of an at-fault accident.

Is USAA cheaper than Allstate?

USAA is typically less expensive than Allstate, especially for military professionals and their families. USAA’s rates are generally lower because the company only writes policies for military professionals, but rate quotes sometimes vary based on your location, driving record, and coverage needs.

Is USAA better than Allstate?

USAA cares better for military families’ financial services because of its specialized services, cost-effective rates, and essential customer service. Allstate may be the better alternative for ordinary people or those wanting a comprehensive portfolio of insurance offers and discounts.

How much is USAA car insurance?

USAA car insurance costs vary depending on location, age, driving history, and coverage levels. On average, USAA premiums range from $50 to $100 per month for standard coverage, but your rate may differ based on your circumstances.

Get the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to compare it with other companies like Allstate and USAA.

Is USAA a good insurance company?

USAA is a reliable insurer; one can get coverage with limited benefits exclusively for military personnel and families. They are known for excellent customer services, competitive rates, and different insurance products suited to military life. If you are looking for car insurance rates by state, you may consider USAA because of competitive offers.

How much is USAA’s good student discount?

USAA offers a good student discount of up to 10% on car insurance for students who maintain a GPA of 3.0 or higher. This discount may vary depending on state regulations.

Can civilians get USAA insurance?

USAA insurance is primarily available to active-duty military members, veterans, and their families. Civilians not connected to the military are typically not eligible for USAA insurance products.

Does Allstate offer accident forgiveness?

Yes, Allstate offers accident forgiveness as part of its optional coverage. With accident forgiveness, your premium won’t increase after your first at-fault accident. Availability may vary by state.

How does USAA handle claims?

The USAA shines here in the fast and efficient processing of claims because most clients compliment this institution for the prompt reply time and its beneficial online facilities to process and track their claims. Another good thing is that the USAA has a particular unit for settling concerns on military-related claims. Read our all-inclusive guide to know how these features can help you with your car insurance.

What is the difference between USAA and Allstate roadside assistance?

USAA’s roadside assistance includes services like towing, jump-starts, and fuel delivery, which are available as an add-on to their auto insurance. Allstate offers similar services and a stand-alone roadside assistance plan even if you don’t have an Allstate policy.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.