We’ll cover average rates by coverage type and provider, as well as how age, location, and driving history affect premiums. We’ll also discuss discounts like bundling, low mileage, and good student.

Cheap Subaru Crosstrek Car Insurance 2026 [Cheapest Coverage for Your Vehicle!]

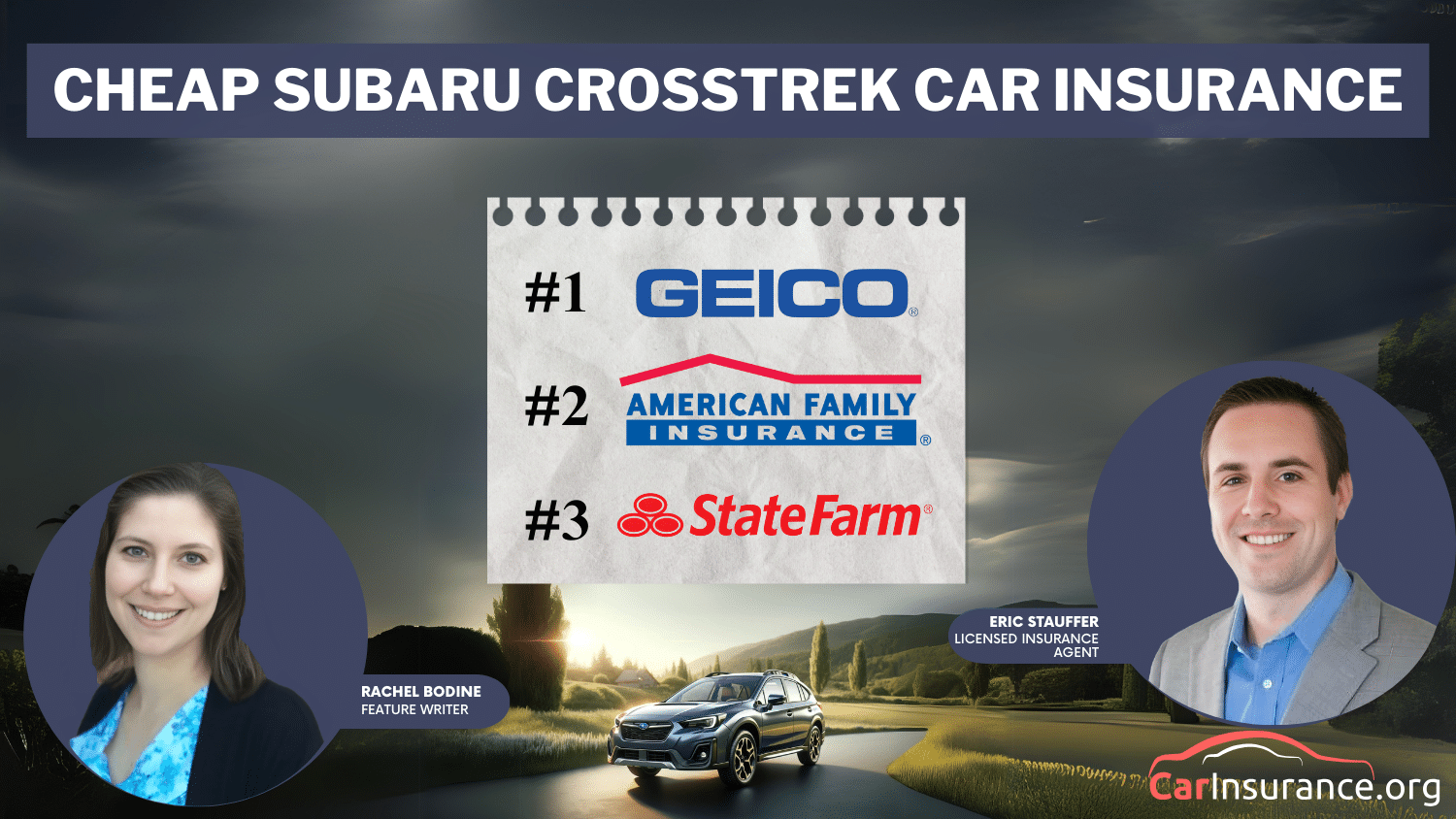

Geico, American Family, and State Farm offer cheap Subaru Crosstrek car insurance. At $42 per month, Geico has the most affordable Subaru Crosstrek auto insurance rates. American Family rewards safe drivers, and State Farm offers low rates across most model years.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated May 2025

2,235 reviews

2,235 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,155 reviews

18,155 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, American Family, and State Farm offer cheap Subaru Crosstrek car insurance. These insurers are known for competitive rates to drivers with good credit, clean records, and multi-policy options.

Geico is ideal for drivers with strong credit, American Family rewards safe driving, and State Farm offers the lowest minimum coverage for all model years.

Our Top 10 Company Picks: Cheap Subaru Crosstrek Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $42 | A++ | Low Rates | Geico | |

| #2 | $43 | A | Customer Service | American Family | |

| #3 | $54 | A++ | Reliable Coverage | State Farm | |

| #4 | $62 | A | Member Benefits | AAA |

| #5 | $64 | A+ | Policy Options | Nationwide |

| #6 | $72 | A+ | Discount Variety | Progressive | |

| #7 | $73 | A+ | Affordable Premiums | Erie |

| #8 | $74 | A | Custom Policies | Farmers | |

| #9 | $75 | A | Flexible Plans | Safeco | |

| #10 | $91 | A+ | Claim Support | Allstate |

- Subaru Crosstrek insurance rates are cheap due to its safety features

- Subaru Crosstrek insurance starts at $42 monthly, but rates can vary

- Save on Subaru Crosstrek insurance with safe driver discounts

The Subaru Crosstrek is cheaper to insure due to its strong safety ratings. Compare quotes from multiple providers to find the cheapest Subaru Crosstrek car insurance. Find cheap car insurance quotes by entering your ZIP code here.

#1 – Geico: Top Overall Pick

Pros

Pros

- Competitive Premiums: Geico offers affordable rates for the Subaru Crosstrek, averaging $42 per month. Learn more about Geico’s rates in our Geico auto insurance company review.

- Military and Federal Perks: Subaru Crosstrek insurance for military members often includes discounts for active duty and veterans. Many insurers offer reduced rates for military and federal employees.

- Strong Digital Tools: The mobile app and online tools make policy management easy.

Cons

- Minimal Local Agents: Less personalized service compared to agent-based insurers.

- Coverage Gaps: Some optional coverages are more limited compared to those of competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Cheapest For Safe Driver Discounts

Pros

Pros

- Safe Driver Discounts: Subaru Crosstrek insurance with a safe driver discount offers substantial savings for drivers with clean records, helping lower monthly premiums significantly. Find out more about it in our American Family review.

- Family-Friendly Coverage: American Family provides excellent options for multi-vehicle policies.

- Flexible Payment Options: Offers various payment plans to fit different budgets.

Cons

- Limited Availability: Available in fewer states compared to other large insurers.

- Higher Rates for Young Drivers: Rates can be higher for younger, less experienced drivers.

#3 – State Farm: Good Student Discounts

Pros

Pros

- Great Discounts for Students: State Farm offers discounts for good students, helping young drivers save. Read more in our State Farm auto insurance review.

- Strong Customer Service: State Farm is known for providing excellent customer service.

- Large Agent Network: Easy to find local agents for personalized service.

Cons

- Limited Discounts for Low-Mileage Drivers: Discounts for low-mileage drivers are less competitive.

- Slightly higher rates for older vehicles: Rates may be higher for older Subaru Crosstrek models.

#4 – AAA: Cheapest For Roadside Assistance

Pros

Pros

- 24/7 Roadside Assistance: AAA includes comprehensive roadside assistance with most policies. Learn more about AAA roadside assistance in our review of AAA insurance.

- Exclusive Member Benefits: Discounts on travel and leisure services for AAA members.

- Strong Reputation: AAA is trusted for offering reliable services and claims support.

Cons

- Membership Fees: Requires a membership, which could increase costs for some drivers.

- Higher Rates for Non-Members: Non-members may not receive the best pricing on policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Multi-Policy Discounts

Pros

Pros

- Multi-Policy Discounts: Significant savings for bundling home and auto insurance policies. Explore more discount options in our Nationwide auto insurance review.

- Strong Customer Satisfaction: Nationwide has solid customer reviews for claims satisfaction.

- Flexible Coverage Options: Multiple add-ons and optional coverage to fit different needs.

Cons

- Higher Rates for High-Risk Drivers: Drivers with a poor record may face higher premiums.

- Limited Discounts for Safe Driving: It offers fewer discounts for safe drivers compared to others.

#6 – Progressive: Cheapest For Snapshot Program

Pros

Pros

- Snapshot Program: Progressive offers discounts for safe driving through its mobile app. Our complete Progressive review provides more details about this.

- Competitive Pricing: Subaru Crosstrek drivers can find affordable rates, with prices averaging $72 per month.

- Customizable Policies: Allows drivers to tailor policies for specific needs and budgets.

Cons

- Limited Discounts for Older Drivers: Older drivers may not benefit as much from the Snapshot program.

- Claims Processing Delays: Some customers report longer processing times for their claims.

#7 – Erie: Cheapest For Multi-Vehicle Policies

Pros

Pros

- Multi-Vehicle Discounts: Save on insurance when insuring more than one car with Erie. Dive into our in-depth Erie auto insurance review.

- Excellent Customer Support: Erie provides strong customer service and claims satisfaction.

- Competitive Rates: Erie offers rates starting at $73 per month for Subaru Crosstrek drivers.

Cons

- Limited Availability: Erie is not available in all states, reducing access for some drivers.

- Fewer Digital Tools: Online tools and mobile apps are not as advanced as those of other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Customizable Coverage Options

Pros

Pros

- Customizable Coverage: Farmers allows for more flexibility with coverage options and add-ons. Take a look at our Farmers insurance company review to learn more.

- Strong Local Agent Network: Personalized support from local agents across the country.

- Competitive Discounts: Offers a range of discounts, including bundling and safe driver discounts.

Cons

- Higher Rates for New Drivers: Farmers can be more expensive for young or new drivers.

- Fewer Digital Tools: The online and mobile experience is not as user-friendly as those of our competitors.

#9 – Safeco: Telematics Discounts

Pros

Pros

- Telematics Program: Safeco offers discounts based on safe driving behavior through its telematics program. Compare Safeco’s rates to other providers in our Safeco auto insurance review.

- Affordable Rates: Subaru Crosstrek insurance rates average $75 per month with Safeco.

- Strong Roadside Assistance: Many plans include 24/7 roadside assistance.

Cons

- Higher Rates for Older Vehicles: Rates can be higher for older Subaru Crosstrek models.

- Limited Availability in Some Areas: Safeco may not be available in all states.

#10 – Allstate: Cheapest For New Car Discounts

Pros

Pros

- New Car Discounts: Allstate offers discounts for drivers insuring newer Subaru Crosstrek models. Read more about this provider in our Allstate auto insurance review.

- Strong Claims Process: Allstate is known for its efficient and reliable claims process.

- Multiple Discount Opportunities: Allstate offers various discounts for bundling and safe driving.

Cons

- Higher Rates for Teen Drivers: Teens may face higher rates when they are insured with Allstate.

- Less Competitive for Low-Mileage Drivers: Rates for low-mileage drivers may not be as competitive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Subaru Crosstrek Car Insurance Rates

The table below shows the monthly insurance rates for the Subaru Crosstrek by provider and car insurance coverage level.

Subaru Crosstrek Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $187 |

| $91 | $255 | |

| $43 | $117 | |

| $73 | $229 |

| $74 | $232 | |

| $42 | $133 | |

| $64 | $184 |

| $72 | $211 | |

| $75 | $200 | |

| $54 | $149 |

Geico offers the cheapest Subaru Crosstrek insurance rates, starting at just $42 per month for basic coverage.

Strong safety ratings and advanced vehicle features help lower Subaru Crosstrek car insurance costs.Brad Larson Licensed Insurance Agent

The Subaru Crosstrek has strong fuel efficiency and a 5-star 2022 safety rating from the National Highway Traffic Safety Administration. Its safety features can reduce insurance rates compared to similar cars, including:

- Front, back, and side airbags

- Disc brakes and anti-lock braking system

- Brake assist, traction control, and electronic stability control

- Lane departure warning and lane-keeping assist

- Daytime running lights

- Child safety locks

A Reddit user’s harrowing account of surviving a high-speed head-on collision in their Subaru Crosstrek proves just how life-saving the vehicle’s safety features can be.

For those seeking affordable Subaru Crosstrek insurance, stories like this highlight why insuring a car known for its crash protection and reliability can be both inexpensive and a smart choice.

Subaru Crosstrek Insurance Rates by Age

Car insurance rates vary significantly by age. Subaru Crosstrek insurance for young drivers is more expensive, but rates generally decrease with each passing decade. Check Geico’s site to see how age impacts your quote.

Subaru Crosstrek insurance for teens is the most expensive due to inexperience. The largest decrease occurs from the teens to the 20s, averaging $1,833 per year. Moving into the 30s brings another drop, averaging $1,614. Reductions beyond that are smaller. You can use our free online tool to compare quotes and find cheap Subaru Crosstrek car insurance at any age.

Ways to Save Money on Your Subaru Crosstrek Insurance

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Multi-Vehicle, Good Driver, Student |

| New Car, Safety Features, Multi-Policy, Responsible Payer, Good Student, Anti-Theft Device | |

| Multi-Vehicle, Loyalty, Good Student, Defensive Driver, Low Mileage, Safety Equipment | |

| Safe Driver, Multi-Policy, Vehicle Safety Equipment, Young Driver, Annual Payment Plan |

| Multi-Policy, Multi-Vehicle, Good Student, Mature Driver, Alternative Fuel, Safety Equipment | |

| Multi-Vehicle, Good Driver, Defensive Driving, Military, Federal Employee, Anti-Theft System | |

| Multi-Policy, Multi-Vehicle, Good Student, Defensive Driving, Accident-Free, Anti-Theft Device |

| Multi-Policy, Multi-Vehicle, Continuous Insurance, Teen Driver, Good Student, Homeowner | |

| Multi-Policy, Safe Driver, Accident Prevention Course, Anti-Theft Device, Low Mileage | |

| Multi-Policy, Good Driver, Defensive Driving Course, Student Away at School, Vehicle Safety |

Subaru Crosstrek insurance discounts are typically offered by most insurers to help lower your car insurance costs. Common options include:

- Good driver

- Safe driving

- Defensive driving course

- Good student

- Student away from home

- Multi-vehicle

- Multi-policy

- Pay-in-full

- Paperless billing

- Autopay

Shop for insurers offering multiple discounts you qualify for.

Top insurers offer discounts for safe driving, bundling, and low mileage, helping drivers get cheap Subaru Crosstrek car insurance.Eric Stauffer Licensed Insurance Agent

You can also save by choosing higher deductibles, but be prepared to incur higher out-of-pocket expenses if you need to file a claim.

Factors That Affect Subaru Crosstrek Insurance Cost

The Subaru Crosstrek’s average insurance cost is $1,320, but rates can vary depending on the driver and situation.

Key factors affecting your premium include:

- Driver’s age: Teens pay the most; rates drop with age.

- Driving record: A clean record gets lower rates than one with violations.

- Credit rating: In most states, lower credit ratings can mean higher premiums.

- Car year: Older models usually cost less to insure due to depreciation.

- Location: Urban areas tend to be more expensive; rates vary by city and region.

- Safety ratings: The Crosstrek’s 5-star safety rating helps lower premiums.

- Discount eligibility: Safe driver, bundling, and other discounts reduce costs.

Compare rates from multiple insurers regularly. Rates, limits, and discounts often change, and switching providers can result in lower premiums.

Find the Cheapest Subaru Crosstrek Insurance Company

Finding the right car insurance for the Subaru Crosstrek is easier when you have the right information to compare rates. The average monthly rate is $42, but your rates depend on personal and vehicle factors.

Using discounts and comparing companies can help lower your auto insurance costs. When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool and find cheap Subaru Crosstrek insurance companies.

Frequently Asked Questions

How to get the cheapest insurance?

Compare quotes from multiple providers like Geico, American Family, and State Farm, which offer the lowest monthly rates for Subaru Crosstrek drivers.

Can Subaru Crosstrek drivers qualify for multiple insurance discounts?

Multi-policy, low mileage, safe driver, and good student discounts help secure cheap Subaru Crosstrek car insurance.

Is a Subaru Crosstrek expensive to insure?

Subaru Crosstrek insurance averages around $161 per month, but top providers like Geico ($42), American Family ($43), and State Farm ($53) offer significantly lower rates.

Read More: How to Lower Your Car Insurance Costs

What is the cheapest Subaru to insure?

The Subaru Outback tends to be the cheapest to insure overall, but the Crosstrek has highly competitive rates, especially from Geico, American Family, and State Farm.

How much does it cost to insure a Crosstrek?

While average rates are about $161 per month, Geico offers Crosstrek insurance for just $42 per month, making it one of the most affordable SUVs to insure.

Do safety features reduce Subaru Crosstrek insurance costs?

Yes. Standard features like lane-keeping assist, electronic stability control, and multiple airbags help lower your insurance risk, which can qualify you for cheaper Subaru Crosstrek car insurance. Learn how to lower auto insurance rates.

Why are Subarus so cheap to insure?

Subarus, like the Crosstrek, have excellent safety ratings and low repair costs, which lowers insurer risk and makes them cheaper to insure.

Which company offers the cheapest car insurance?

For the Subaru Crosstrek, Geico is the cheapest at $42 per month, followed by American Family at $43 and State Farm at $53.

How to get the lowest car insurance rates?

Compare rates from the cheapest car insurance companies, such as Geico or State Farm, and apply all discounts for which you qualify, like bundling or good driver discounts.

Are Subaru Crosstrek’s high maintenance?

With average maintenance costs of around $41 per month, the Crosstrek is a low-maintenance vehicle, helping to keep overall ownership costs down. Avoid overpaying for your car insurance by entering your ZIP code in our free comparison tool to find which company has the lowest rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros