Buying a Car: What You Need to Know

Are you considering buying a car? This article covers everything you need to know about the car buying process. From budgeting to negotiating, gain valuable insights and tips to make an informed decision. Don't miss out on this comprehensive guide!

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2025

Buying a car is a significant decision that requires careful consideration and planning. Whether you are a first-time buyer or looking to upgrade your current vehicle, understanding the basics of car ownership is essential. In this article, we will explore various aspects of buying a car and provide you with the information you need to make an informed decision.

Understanding the Basics of Car Ownership

Car ownership goes beyond the convenience of having your own mode of transportation. It also comes with responsibilities and financial considerations. By understanding the importance of car ownership, you can ensure that you make a sound investment and maintain your vehicle properly.

When you own a car, you have the freedom to travel whenever and wherever you want. It eliminates the reliance on public transportation and gives you the flexibility to personalize your driving experience. Whether it’s a spontaneous road trip or a daily commute, having your own car provides convenience and control over your schedule.

Additionally, owning a car can enhance your quality of life by enabling you to explore new places and pursue opportunities that may not be accessible otherwise. You can take weekend getaways to picturesque destinations, visit family and friends in different cities, or even embark on cross-country adventures. The possibilities are endless when you have the freedom to hit the open road.

However, it’s crucial to recognize that car ownership also comes with costs. Besides the initial purchase price, you must consider expenses such as insurance, fuel, maintenance, and repairs. These ongoing costs can vary depending on factors such as the type of car you choose and your driving habits.

Test Image:

Choosing the right type of car is an important decision that can greatly impact your ownership experience. Before diving into the process of buying a car, it’s essential to determine the type of car that suits your needs and lifestyle.

The Importance of Car Ownership

There are various options available, including sedans, SUVs, hatchbacks, and electric vehicles. Each type has its advantages and considerations.

Sedans are known for their comfort, fuel efficiency, and affordability. They are an excellent choice for individuals or small families who primarily drive in urban areas. With their sleek design and smooth handling, sedans offer a comfortable and efficient driving experience.

SUVs, on the other hand, offer more space, versatility, and off-road capabilities. They are ideal for those with larger families or who require extra cargo capacity. Whether it’s a family road trip or a camping adventure, SUVs provide the space and ruggedness to tackle various terrains and accommodate your needs.

Hatchbacks provide a combination of practicality and compactness, making them suitable for city driving. With their smaller size and agile maneuverability, hatchbacks are perfect for navigating crowded streets and finding parking in tight spaces. They offer ample cargo space while still being fuel-efficient and easy to handle.

Electric vehicles (EVs) are gaining popularity due to their environmental friendliness and potential cost savings in the long run. By running on electricity instead of gasoline, EVs produce zero emissions, contributing to a cleaner and greener environment. Although the charging infrastructure and limited range might not be suitable for everyone’s needs, EVs offer a sustainable and cost-effective solution for those looking to reduce their carbon footprint.

Consider your typical driving patterns, the number of passengers you anticipate carrying, and any specific requirements you may have. Consulting with a car expert or conducting thorough research can help you determine which type of car is right for you.

Once you have chosen the type of car that suits your needs, it’s time to embark on the exciting journey of car ownership. From test-driving different models to negotiating the best price, buying a car involves careful consideration and decision-making. Remember to factor in your budget, long-term goals, and any additional features or accessories you may desire.

Car ownership is a significant responsibility, but it also offers numerous benefits and opportunities. By understanding the basics of car ownership and making informed choices, you can enjoy the freedom, convenience, and joy that comes with having your own vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Setting Your Budget

Once you have a clear idea of the type of car you want, it’s crucial to set a budget that aligns with your financial situation. Your budget should not only consider the upfront cost but also encompass the various expenses associated with car ownership.

When setting your budget, it’s important to consider your monthly income and expenses. Evaluate your financial obligations, such as rent or mortgage payments, utilities, groceries, and other recurring bills. By understanding your financial commitments, you can determine how much you can comfortably allocate towards car expenses.

Additionally, it’s essential to assess your savings and emergency funds. Having a safety net is crucial in case of unexpected expenses or emergencies. Allocating a portion of your budget towards savings can provide you with peace of mind and financial security.

Understanding Car Financing

If you plan to finance your car purchase, it’s important to understand the different financing options available. Most buyers either opt for a loan from a bank or credit union or choose dealership financing. Each option has its advantages and considerations.

When considering a bank or credit union loan, you may have more flexibility in terms of interest rates and repayment terms. It’s advisable to shop around and compare offers from different financial institutions to ensure you get the most favorable terms. Additionally, having a good credit score can increase your chances of securing a loan with lower interest rates.

On the other hand, dealership financing often offers convenience and the possibility of special promotions or incentives. Dealerships work closely with financial institutions and can assist you in securing a loan. However, it’s essential to read the fine print and compare offers to ensure you are getting the best deal. Pay attention to interest rates, loan duration, and any additional fees or charges.

The Hidden Costs of Car Ownership

As mentioned earlier, car ownership comes with hidden costs that go beyond the purchase price. These costs include insurance premiums, fuel expenses, regular maintenance, and unexpected repairs. Additionally, you may need to account for parking fees and vehicle registration fees.

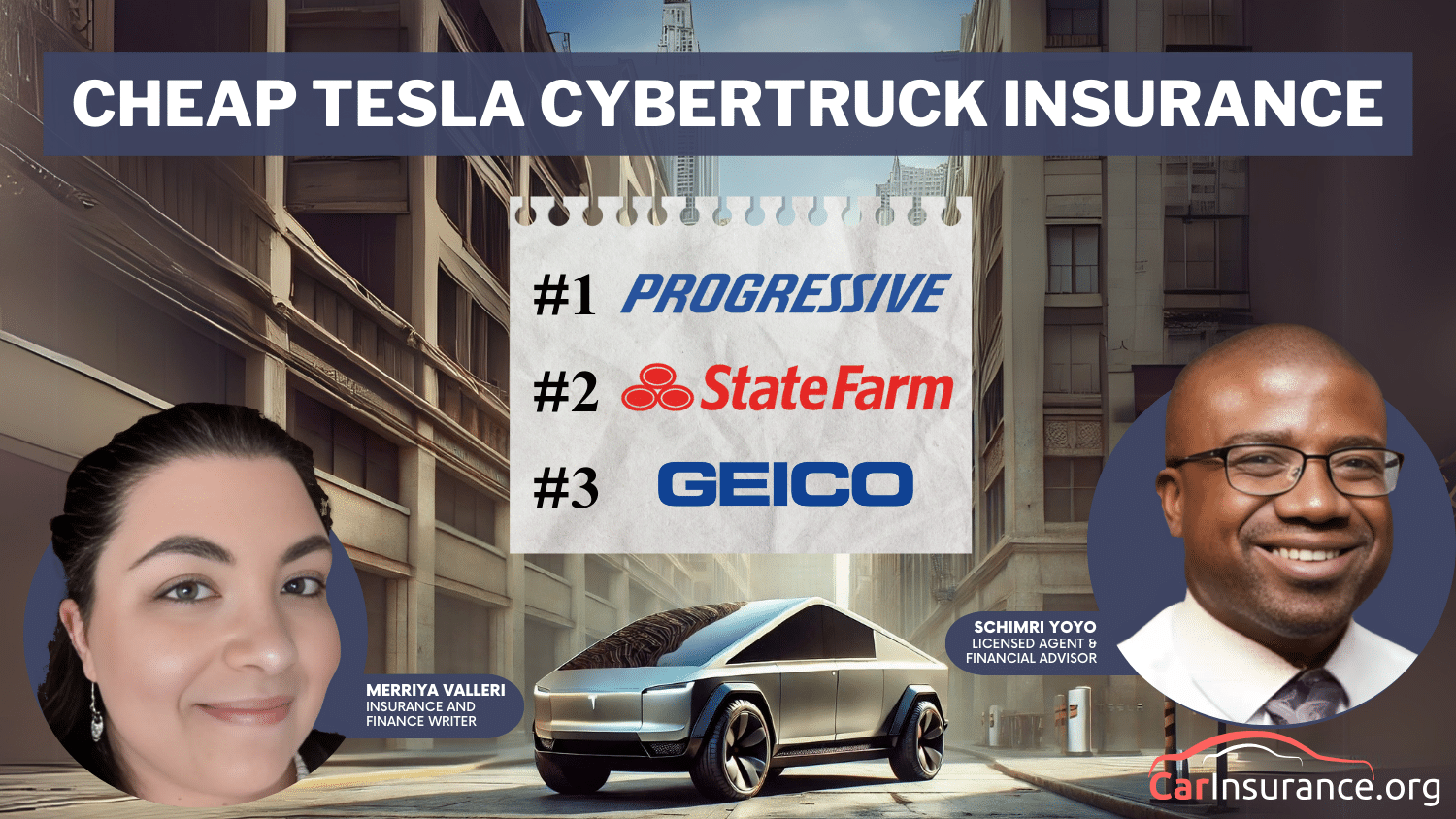

Insurance premiums vary based on factors such as your age, driving history, and the type of car you own. It’s important to research different insurance providers, compare quotes, and choose a policy that offers adequate coverage at a reasonable price.

Fuel expenses can vary depending on the car’s fuel efficiency, your driving habits, and current fuel prices. Consider the average number of miles you drive per month and the estimated fuel consumption of the cars you are considering. This will help you estimate your monthly fuel expenses more accurately.

Regular maintenance is essential to keep your car in good condition and prolong its lifespan. Budgeting for routine services such as oil changes, tire rotations, and filter replacements is important. Additionally, unexpected repairs can arise, so having a contingency fund for car repairs is advisable.

Lastly, don’t forget to factor in parking fees and vehicle registration fees. If you live in an area with limited parking options, you may need to budget for monthly parking fees. Vehicle registration fees vary by state and can be an annual or biennial expense.

By considering these hidden costs and budgeting for them, you can have a more comprehensive understanding of the total cost of car ownership. This will help you make an informed decision and avoid any financial strain in the future.

New vs. Used Cars: Pros and Cons

One of the primary considerations when buying a car is deciding between a new or used vehicle. Both options have their advantages and considerations, and understanding them will help you make an informed decision.

When it comes to buying a new car, there are several benefits to consider. First and foremost, you get the latest features and upgraded technology. From advanced safety systems to cutting-edge infotainment options, new cars often come equipped with the most innovative and exciting features on the market. This can greatly enhance your driving experience and make your daily commute more enjoyable.

In addition to the latest features, buying a new car also offers the peace of mind that comes with a manufacturer’s warranty. This warranty typically covers the vehicle for a certain period, providing you with protection against any unexpected repairs or defects. Knowing that you have this warranty in place can give you a sense of security and alleviate any worries about potential maintenance costs.

Furthermore, new cars tend to be more fuel-efficient compared to their used counterparts. With increasing concerns about the environment and rising fuel prices, having a car that consumes less fuel can save you money in the long run. Additionally, many new cars are designed with eco-friendly features, such as hybrid or electric options, further reducing your carbon footprint.

However, it’s important to consider the potential downsides of buying a new car. One significant drawback is the higher price tag. New cars can be more expensive compared to used ones, and this upfront cost may not be feasible for everyone. Moreover, new cars experience rapid depreciation in value. As soon as you drive off the dealership lot, the value of your car begins to decrease. If you plan to keep the car for an extended period, the initial depreciation may not be a significant concern. But if you anticipate selling or trading in the vehicle within a few years, the loss of value can impact your finances.

On the other hand, used cars have their own set of advantages. The most obvious benefit is affordability. Since used cars have already gone through the initial depreciation, you can often find a vehicle in excellent condition at a lower price. This can be particularly beneficial if you’re on a tight budget or looking to save money.

Additionally, used cars tend to have lower insurance premiums compared to new cars. The cost of insuring a vehicle is often based on its value, and since used cars are generally less expensive, you can expect to pay less for insurance coverage. This can result in significant savings over time.

Another advantage of buying a used car is the opportunity for negotiation. Unlike new cars with fixed prices, used car prices are often more flexible, allowing you to haggle and potentially get a better deal. This can be especially advantageous if you have good negotiation skills or are willing to invest some time and effort into finding the right deal.

However, it’s important to approach buying a used car with caution. Unlike new cars, used vehicles have a history, and it’s crucial to conduct a thorough inspection and research before making a purchase. This includes checking the vehicle’s maintenance records, getting a comprehensive vehicle history report, and possibly even having a trusted mechanic inspect the car. By doing so, you can ensure that you’re getting a reliable vehicle that won’t require excessive maintenance or repairs.

Furthermore, used cars typically come with a limited warranty, if any at all. Unlike the comprehensive warranties offered with new cars, used car warranties are often shorter in duration and may only cover specific components. This means that you may be responsible for any repairs or maintenance costs that arise after purchasing the vehicle.

Ultimately, the decision between buying a new or used car depends on your individual needs, preferences, and budget. By weighing the pros and cons of each option, you can make an informed choice that suits your lifestyle and financial situation.

Researching Your Ideal Car

Before making a final decision, it’s crucial to conduct thorough research on the car models that interest you. Gathering information from various sources will help you make an informed choice and avoid any regrets down the road.

How to Use Online Car Review Sites

Online car review sites are valuable resources when researching your ideal car. They provide detailed information about vehicle specifications, performance, safety features, and user reviews. Reading multiple reviews and comparing different sources will give you a comprehensive understanding of the car’s pros and cons.

When using online car review sites, focus on reputable sources and consider both expert opinions and user experiences. Pay attention to common complaints or recurring issues to identify any potential problems that may arise with the model you are interested in.

Asking the Right Questions When Viewing a Car

While online research is important, it’s equally crucial to physically inspect the car you intend to buy. When viewing a car, be prepared with a list of questions to ask the seller or dealer. These questions should cover topics such as the car’s maintenance history, previous accidents, and overall condition.

If possible, test drive the vehicle to assess its performance and handling firsthand. Be observant and check for any signs of wear and tear or potential red flags. Taking a trusted mechanic with you can provide an expert opinion and further ensure that you are making a wise purchase.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Negotiating the Best Deal

Once you have found the perfect car, it’s time to negotiate the best deal possible. Approach the negotiation process with confidence and a clear understanding of your budget and the car’s market value.

Tips for Negotiating Car Prices

When negotiating car prices, it’s essential to gather information about comparable models and their prices in the market. This knowledge will give you a strong position and help you negotiate a fair deal. Remember to consider any additional features or add-ons when assessing the overall value of the car.

Be prepared to walk away if the seller is not willing to meet your desired price or make any reasonable compromises. There are usually other sellers and dealerships who may be more willing to negotiate. By being patient and persistent, you increase your chances of securing a better deal.

Understanding Car Warranties and Add-ons

During the negotiation process, it’s crucial to understand the warranties and add-ons associated with the car. The manufacturer’s warranty often covers specific repairs and maintenance for a limited period. Additionally, dealerships may offer extended warranties, which provide additional coverage beyond the standard warranty.

Consider whether you need any additional add-ons, such as rust protection, fabric protection, or extended roadside assistance. Be cautious when considering add-ons, as they can add to the overall cost of the vehicle. Evaluate their benefits and costs, and only opt for those that align with your needs and budget.

Finalizing the Purchase

After negotiating the best deal for your desired car, it’s time to finalize the purchase. This process involves completing the necessary paperwork and ensuring that all legal obligations are met.

Paperwork and Legalities of Buying a Car

When finalizing the purchase, make sure to review and understand all the paperwork involved, including the sales agreement, title transfer documents, and any financing contracts. Be vigilant about hidden fees or additional charges that may be included in the paperwork.

Ensure that the seller or dealer provides you with all relevant documents, including the vehicle’s history report, service records, and proof of ownership. Review these documents to verify the car’s condition and confirm that there are no liens or outstanding payments associated with it.

Car Insurance: What You Need to Know

Before driving your new car off the lot, it’s crucial to secure car insurance coverage. In most countries, having valid car insurance is a legal requirement. It protects you financially in case of accidents, damage, or theft.

Contact insurance providers to get quotes and compare coverage options. Consider factors such as the deductible, liability limits, and comprehensive coverage. Be sure to provide accurate information about your driving history and anticipated mileage to receive an accurate quote.

Maintaining Your New Car

Once you have successfully purchased your dream car, it’s important to maintain it properly to ensure its longevity and performance.

Basic Car Maintenance Tips

Regular maintenance is crucial to keep your car running smoothly. Follow the manufacturer’s recommended maintenance schedule, which includes oil changes, filter replacements, tire rotations, and brake inspections.

Additionally, pay attention to warning signs such as strange noises, dashboard warning lights, or changes in performance. Addressing any issues promptly can prevent them from escalating into more significant problems and costly repairs.

When to Seek Professional Help for Car Repairs

While basic maintenance tasks can be done by most car owners, certain repairs require professional expertise. If you are not confident in your mechanical skills or encounter complex issues, it’s best to seek help from a qualified mechanic.

Remember that preventive maintenance is often more cost-effective than waiting until a problem occurs. Regular inspections and addressing small repairs can save you money and extend the lifespan of your vehicle.

Buying a car is a significant investment that requires careful consideration and research. By understanding the basics of car ownership, setting a budget, researching your ideal car, negotiating the best deal, and maintaining your new vehicle properly, you can ensure a smooth and satisfying car buying experience. So, start your journey towards car ownership with confidence and enjoy the freedom and convenience it brings.

Frequently Asked Questions

What are the important considerations when buying a car?

When buying a car, it is important to consider factors such as your budget, the type of car you need (sedan, SUV, etc.), fuel efficiency, safety features, maintenance costs, and insurance premiums.

How can I determine my budget for buying a car?

To determine your budget for buying a car, you should evaluate your financial situation, including your income, expenses, and any existing debts. Consider how much you can comfortably afford for monthly car payments, insurance costs, and ongoing maintenance.

What steps should I take before buying a car?

Before buying a car, it is recommended to research and compare different car models, check their reliability ratings, read reviews, and take test drives. Additionally, you should obtain a vehicle history report, get a pre-purchase inspection by a mechanic, and negotiate the price with the seller or dealership.

What documents do I need when buying a car?

When buying a car, you will typically need documents such as your driver’s license, proof of insurance, proof of income, proof of residence, and a down payment if applicable. Additionally, you may need to provide your social security number for financing purposes.

Should I buy a new or used car?

Whether to buy a new or used car depends on your personal preferences, budget, and specific needs. New cars offer the latest features, warranties, and potentially lower maintenance costs, but they also come with a higher price tag. Used cars are generally more affordable but may require more maintenance and have a shorter remaining lifespan.

How does car insurance work when buying a car?

When buying a car, you will need to arrange car insurance coverage before driving it off the lot. You can contact insurance providers to get quotes and choose a policy that suits your needs. The cost of insurance depends on various factors, including the car’s make and model, your driving history, location, and coverage options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.