Bodily Injury Liability Coverage in 2026 [Coverage Explained]

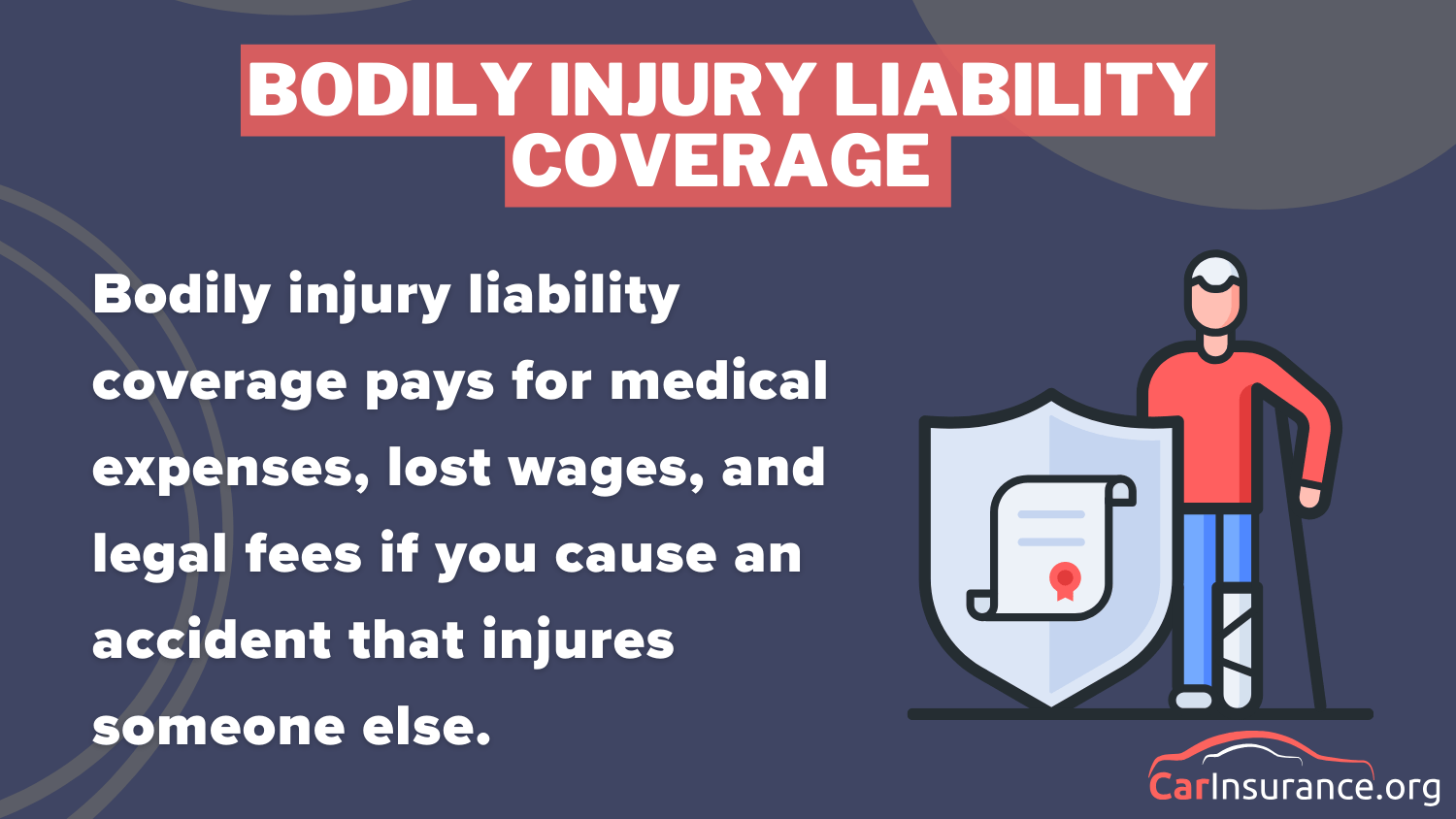

Bodily injury liability coverage (BIL) pays for medical expenses if you're at fault in an accident. Minimum coverage ranges from $10,000 to $50,000, but higher bodily injury car insurance limits help avoid paying out of pocket for excess damages. The average cost of bodily injury coverage is $51 a month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Jeffrey Johnson

Updated March 2025

Bodily injury liability coverage is an important part of car insurance since it helps pay for injuries if you cause an accident. Finding the best company and rates means examining coverage limits, discounts, and customer reviews.

After comparing the top BIL insurers, you will be able to find a company that offers the best balance of low rates and strong protection. This article will help you understand how car insurance works and choose the most affordable bodily injury liability coverage without sacrificing quality.

You can compare affordable bodily injury liability car insurance quotes today. It’s as easy as entering your ZIP code into our free quote tool. Get started now.

- Bodily injury liability coverage pays medical and legal costs if you’re at fault

- State laws affect bodily injury liability coverage limits and requirements

- Higher limits offer better protection from expensive claims

Bodily Injury Liability Insurance Explained

Bodily injury liability is a type of car insurance coverage that covers medical expenses. This coverage activates if you’re the party that caused an accident.

Higher bodily injury liability limits protect you from paying medical bills, lost wages, and legal fees out of pocket.Tim Bain Licensed Insurance Agent

For example, let’s say you hit another vehicle with three people inside, and your bodily injury liability insurance coverage is $250,000 per person and $500,000 per accident. Any medical expenses incurred over those limits are your responsibility to pay out of your own pocket.

Your coverage pays for up to $250,000 in medical expenses per person. If person A’s expenses cost $175,000, person B’s costs $50,000, and person C’s costs $300,000, you would have to personally pay $50,000 to cover the remainder of person C’s medical expenses.

However, that number cannot exceed a total of $500,000 for the entire accident. The total costs of the above accident are $525,000, so you are also on the hook for the $25,000 that’s over your limit.

After an accident, how to act and what to avoid are both important things to know.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Bodily Injury Liability Insurance is Important

Unless you live in New Hampshire, you are required to have bodily injury liability coverage. New Hampshire doesn’t make it mandatory, but it’s still a good idea to have it for protection. Every other state requires drivers to carry BIL. Bodily injury liability insurance is also required in Michigan.

This coverage helps pay for medical bills and legal costs if you cause an accident. Each state sets its own bodily injury liability amount, but getting more than the minimum is a smart move. If the damages go beyond what your insurance covers, you could end up paying out of pocket.

Having enough liability for bodily injury protects you from financial trouble and makes sure the injured person gets the help they need. It’s not just about following the law—it’s about making sure you’re covered in case the unexpected happens on the road.

See how much insurance you need for your car to understand how coverage limits affect your protection and find the right policy for your needs.

What Bodily Injury Liability Covers

Bodily injury insurance helps pay for medical bills, lost wages, and legal fees if you cause an accident that injures someone else. Many people ask what bodily injury insurance is, and the answer is simple—it covers the costs, so you don’t have to pay everything out of pocket.

Most states, except New Hampshire, require car insurance for bodily injury to make sure accident victims get the care they need. The average bodily injury coverage depends on state laws, but choosing a higher limit is a smart move.

If the medical bills exceed your policy’s limit, you might have to pay the extra costs yourself. That’s why sufficient coverage is important—it ensures your money and allows hurt individuals to receive the care they deserve. Having proper insurance isn’t about complying with the law; it’s about being a good citizen on the road.

Read more: Where can I get cheap full coverage car insurance?

What Bodily Injury Liability Does Not Cover

Many drivers ask what bodily injury liability is. While it covers injuries to others if you cause an accident, it does not cover your own medical bills.

BIL insurance helps pay for the other person’s medical expenses, lost wages, and legal fees, but if you or your passengers get hurt, you’ll need to buy extra car insurance like medical payments or personal injury protection.

Bodily injury coverage also doesn’t pay for car repairs—property damage liability covers that. Every state sets minimum limits for bodily injury liability insurance, but getting higher coverage is a smart choice to avoid paying out of pocket if damages go beyond your policy limits.

Knowing what this insurance doesn’t cover helps you choose the right protection so you’re not caught off guard after an accident. Having the right coverage means you’re prepared for the unexpected and financially protected.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bodily Injury Liability Coverage Insurance Cost

The cost of bodily injury liability car insurance varies by state since each state has its own minimum coverage requirements. Some states require higher limits, which can make insurance more expensive, while others allow lower limits to keep costs down.

Minimum Liability Coverage Requirements by State

| State | Bodily Injury Liability | Property Damage Liability | PIP/No-Fault Coverage | Other Insurance Types |

|---|---|---|---|---|

| Alaska | $50,000 per person, $100,000 per accident | $25,000 | - | - |

| Arizona | $15,000 per person, $30,000 per accident | $10,000 | Uninsured motorist: $15,000/$30,000 (BI), $10,000 (PD) | - |

| Arkansas | $25,000 per person, $50,000 per accident | $25,000 | - | - |

| California | $15,000 (one person), $30,000 (total per accident) | $5,000 | - | - |

| Colorado | $25,000 (one person), $50,000 (more people) | $15,000 | - | - |

| Connecticut | $25,000 (one person), $50,000 (total per accident) | $25,000 | - | - |

| Delaware | $25,000 (one person), $50,000 (total per accident) | $10,000 | Personal injury protection (PIP): $15,000 per person, $30,000 per occurrence, $5,000 funeral | |

| Florida | $10,000 Personal Injury Protection (PIP) | $10,000 Property Damage Liability (PDL) | - | - |

| Georgia | $25,000 per person, $50,000 per accident | $25,000 per accident | $25,000 per person, $50,000 per accident | - |

| Hawaii | $20,000 per person, $40,000 per accident | $10,000 minimum | - | $10,000 minimum |

| Idaho | $25,000 per person | $50,000 | $25,000 | - |

| Indiana | $25,000 per person, $50,000 per accident | $25,000 minimum | $25,000 per person, $50,000 per accident | $50,000 minimum |

| Iowa | $20,000 per person | $40,000 | - | - |

| Kansas | $25,000 per person | $50,000 | $25,000 per person, $50,000 per accident | - |

| Florida | Personal injury protection (PIP) | $10,000 Property Damage Liability (PDL) | - | - |

| Georgia | $25,000 per person, $50,000 per accident | $25,000 per accident | $25,000 per person, $50,000 per accident | - |

| Hawaii | $20,000 per person, $40,000 per accident | $10,000 minimum | - | $10,000 minimum |

| Idaho | $25,000 per person | $50,000 | $25,000 | - |

| Indiana | $25,000 per person, $50,000 per accident | $25,000 minimum | $25,000 per person, $50,000 per accident | $50,000 minimum |

| Iowa | $20,000 per person | $40,000 | - | - |

| Kansas | $25,000 per person | $50,000 | $25,000 per person, $50,000 per accident | - |

| Kentucky | $25,000 per person | $50,000 | $25,000 | $10,000 |

| Louisiana | $15,000 per person | $30,000 | $25,000 | $10,000 |

| Maine | $50,000 per person | $100,000 | N/A | N/A |

| Maryland | $30,000 per person | $60,000 | - | $15,000 |

| Massachusetts | $20,000 per person, $40,000 per accident | $5,000 per accident | $20,000 per person, $40,000 per accident | $8,000 |

| Michigan | $50,000 (for drivers enrolled in Medicaid), $250,000 all others | $1,000,000 | $50,000 per person, $100,000 per incident | $50,000 (Medicaid) / $250,000 (all others) |

| Minnesota | $30,000 per person, $60,000 per accident | $10,000 | $25,000 per person, $50,000 per incident | $40,000 per person per accident |

| Mississippi | $20,000 per person | $40,000 | $25,000 per person, $50,000 per accident | - |

| Missouri | $25,000 per person, $50,000 per accident | $10,000 | $25,000 per person, $50,000 per accident | - |

| Montana | $25,000 per person | $50,000 | $25,000 | - |

| Nebraska | $25,000 per person | $50,000 | $25,000 | - |

| Nevada | $25,000 per person | $50,000 | $25,000 per person, $50,000 per accident | - |

| New Hampshire | $25,000 per person | $50,000 | Same amount as liability | $1,000 |

| New Jersey | None required, but optional | $5,000 | $15,000 per person, up to $250,000 (brain/spinal cord) | $15,000 per person, $250,000 for brain and spinal cord injuries |

| New Mexico | $25,000 per person | $50,000 | $25,000 | $10,000 |

| New York | $25,000 per person, $50,000 per accident | $10,000 per accident | $25,000 per person, $50,000 per accident | $50,000 |

| North Carolina | $30,000 per person | $60,000 | - | - |

| North Dakota | $25,000 per person, $50,000 per accident | $25,000 | $25,000 per person, $50,000 per accident | - |

| Ohio | $25,000 per person, $50,000 per incident | $25,000 | - | - |

| Oklahoma | $25,000 per person | $50,000 | $25,000 | - |

| Oregon | $25,000 per person | $50,000 | $20,000 | $15,000 |

| Pennsylvania | $15,000 per person, $30,000 per accident | $5,000 | $5,000 | $5,000 |

| Rhode Island | $25,000 per person, $50,000 per accident | $25,000 | $25,000 | - |

| South Carolina | $25,000 per person | $50,000 | $25,000 | - |

| South Dakota | $25,000 per person, $50,000 per accident | $25,000 | N/A | N/A |

| Tennessee | $25,000 per person, $50,000 per accident | $15,000 | - | - |

| Texas | $30,000 per person, $60,000 per accident | $25,000 | - | - |

| Utah | $26,000 per person | $65,000 | $15,000 | $3,000 |

| Vermont | $25,000 per person | $50,000 | $10,000 | - |

| Virginia | $25,000 per person | $50,000 | $20,000 | - |

| Washington | $25,000 per person, $50,000 per accident | $10,000 per accident | - | - |

| West Virginia | $25,000 per person, $50,000 per accident | $20,000 | - | - |

| Wisconsin | $25,000 per person | $50,000 | $10,000 | $25,000 |

| Wyoming | $25,000 per person | $50,000 | $20,000 | - |

In addition to insurance for bodily injury, many states also require property damage liability and uninsured motorist coverage to ensure drivers have the necessary protection.

Meeting the minimum coverage is required by law, but many drivers choose higher limits to avoid paying out of pocket if an accident results in serious injuries.

To find the best coverage at a reasonable price, it’s important to compare quotes from different providers. Knowing the costs and requirements in your state helps you make informed decisions and ensures you have the right protection while driving.

Read more: Is it bad to just carry minimum coverage car insurance?

The Right Amount of Bodily Injury Liability Coverage

Car accidents can be expensive, and according to the CDC, injuries and deaths from crashes can lead to overwhelming costs. Not having enough coverage could leave you paying out of pocket, which might cause serious financial trouble.

Bodily Injury Liability Coverage Monthly Rates By Provider

| Insurance Company | Monthly Rates |

|---|---|

| $45 | |

| $48 | |

| $50 | |

| $34 | |

| $55 |

| $60 |

| $40 | |

| $40 | |

| $65 | |

| $35 |

That’s why it’s important to understand what is bodily injury coverage and how much you should carry. If you’re at fault in an accident, you could be responsible for medical bills, lost wages, and even legal fees. The safest choice is to buy as much coverage as you can afford to protect your finances.

The average cost of liability insurance in the U.S. is $611 a year, or $51 a month.Merriya Valleri Expert Insurance Writer

Bodily injury liability auto insurance covers these expenses, so you don’t have to pay them out of pocket. Although every state has a minimum coverage level, selecting a higher limit provides additional protection. Having the proper coverage provides peace of mind and prevents you from having serious financial issues after filing a car insurance claim for an accident.

Why Choosing the Right Bodily Injury Liability Coverage Matters

Having the right bodily injury liability coverage is important because accidents can lead to serious financial trouble. If you’re at fault in a crash, you could be responsible for medical bills, lost wages, and legal fees.

Every state, except New Hampshire, requires drivers to have bodily injury liability insurance to protect accident victims. However, the minimum coverage may not be enough. Selecting a higher bodily injury liability limit safeguards your finances and ensures proper medical attention for injured parties.

If you don’t have sufficient coverage, you will have to pay out of your own pocket, which risks ruining your assets. To remain financially secure, it’s best to purchase as much coverage as possible.

Understanding bodily injury liability insurance and how it works allows you to make better decisions about your policy. Comparing car insurance rates by state can also help you find the best protection.

Get bodily injury liability insurance rates by using our free quote tool. Enter your ZIP code and get started now.

Frequently Asked Questions

What is bodily injury liability coverage?

Bodily injury liability coverage helps pay for medical expenses, lost wages, and legal fees if you are at fault in an accident that injures another person.

What does bodily injury liability per accident mean?

Bodily injury liability per accident refers to the total amount your insurance will pay for all injuries in a single accident, regardless of how many people are injured. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

How much bodily injury liability do you need?

The amount of bodily injury liability you need depends on your state’s minimum requirements, but higher limits are recommended to protect your assets in case of a severe accident.

Read more: Why do you need car insurance?

What are bodily injury limits?

Bodily injury limits specify the maximum amount your insurance will cover per person and per accident for injuries you cause to others in a crash.

Is bodily injury liability insurance required in all states?

Most states require BIL coverage, except New Hampshire, which is optional.

Which insurance companies offer the best Bodily Injury Liability rates?

Companies like Geico, Progressive, State Farm, and USAA offer competitive rates. Comparing quotes is the best way to find the lowest price.

Read more: Progressive Car Insurance Review

Does bodily injury liability cover passengers in my car?

No, it only covers injured parties in the other vehicle. You’ll need MedPay or PIP for passengers in your car.

What is the difference between bodily injury liability and personal injury protection (PIP)?

If you’re at fault, BIL covers other people’s injuries, while PIP covers your medical expenses regardless of fault.

How do I increase my bodily injury liability coverage?

Contact your insurance provider and ask to increase your policy limits. Higher limits will increase your premium but offer more protection.

Read more: Can I get car insurance without a license?

What is split-limit vs. combined single-limit coverage?

- Split-Limit (e.g., 100/300) means separate coverage amounts per person and per accident.

- Combined Single-Limit (CSL) offers one total coverage limit for all injuries.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.