Best Car Insurance in Arizona for 2026 [Your Guide to the Top 10 Companies]

The best car insurance in Arizona is offered by State Farm, Geico, and USAA, with rates starting from $24/mo. State Farm's reliable coverage for the state's extreme weather conditions made them the number one insurer. Geico's affordable rates and Progressive's tool to customize coverage for varied needs followed.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are Arizona’s best car insurance providers because of their affordable full coverage, low complaint level, and AM best rating, which is essential when choosing a car insurance provider.

However, these companies provide various options, add-ons, and discounts for its valued customers.

They also have strong financial stability to cover and process claims anytime a customer needs it. Wherever you are in the state, you can check the car insurance guide to get the best you need.

Our Top 10 Company Picks: Best Car Insurance in Arizona

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 10% | A+ | Innovative Tools | Progressive | |

| #4 | 10% | A++ | Military Focused | USAA | |

| #5 | 25% | A+ | Customizable Coverage | Allstate | |

| #6 | 20% | A | Flexible Options | Farmers | |

| #7 | 25% | A | Comprehensive Policies | Liberty Mutual |

| #8 | 20% | A+ | Customer Service | Nationwide |

| #9 | 13% | A++ | Unique Coverage | Travelers | |

| #10 | 25% | A | Loyalty Discounts | American Family |

This guide will offer you more options for the best company tailored to your needs while extensively explaining the pros and cons of each provider. For easier quotes, use our free online tool to get one in just a few clicks.

- State Farm offers extensive coverage and budget-friendly rates of $81/mo

- The top providers offer 10% to 25% bundling discounts to lower your rates

- The financially stable companies have a B to A++ AM Best rate

#1 – State Farm: Top Overall Pick

Pros

- Wide Coverage Options: State Farm provides options for different coverages, such as collision, comprehensive, and liability, that can fit any budget.

- Competitive Rates and Customizable Policies: State Farm policies are considered affordable for low-risk drivers, and coverage can be personalized, saving up to $1,273.

- Extensive Discounts: Drivers who qualify for the Drive Safe & Save Program are offered 30% savings. Check out more of these discounts in our State Farm review.

- Customer-Friendly Agents: With over 19,000 agents that are dedicated to explaining every policy and support for you.

Cons

- Rate Variability: Rate fluctuations happen based on location, driving records, and credit scores.

- High-Risk Drivers Rates: Premiums can be less competitive when there are violations and accidents.

- Discount Requirements: Discounts have conditions to be met in order to be availed of like Drive Safe and Save Program requires you to turn on Bluetooth and location on every trip.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable and Unique Policies: It had the lowest premiums for low-risk drivers, with $75 monthly savings. Also allows you to insure a car not under your name.

- Efficient Digital tools: Number 1 rated insurance app that is easy to navigate online portals for processing claims and policy management.

- Wide Discounts: Provides savings for safe driving, good students, multi-policy bundling (25%), and military personnel.

- Efficient Claims Process: Geico customers had the best and most straightforward claims procedure, and 97% of them were satisfied.

Cons

- Limited Local Agent Support: Geico depends more on digital and online interactions as fewer in-person agents are available.

- High-Risk Drivers Higher Rates: Prices are less competitive for drivers with bad credit or poor records.

- Fewer Personalized Options: Policies are limited, and gap insurance is unavailable for financed or leased cars.

#3 – Progressive: Best for Innovative Tools

Pros

- Unique Customer Tool: The name your price tool detects the best policies and budget-wise rates for customers with varied needs.

- Flexible Claim Handling: Features a convenient digital app and a 24/7/365 claims service.

- Competitive High-Risk Driver Rates: Affordable rates for drivers with accidents and violations than other companies.

- Broad Coverage Policies: Progressive’s insurance review highlights the provision of standard policies alongside add-ons like gap insurance, and custom parts coverage.

Cons

- Rate Variability: Premiums significantly fluctuate according to individual factors.

- High Snapshot Risk: Usage-based discounts through snapshot may increase if driving habits are deemed risky.

- Lower Customer Satisfaction: Compared to competitors, scores slightly low on claims satisfaction and customer service.

#4 – USAA: Best for Military Car Insurance

Pros

- Exclusive Focus: Best offers for military members, veterans, and their families.

- Exceptional Customer Service: USAA had consistently high rates for claims processing and overall satisfaction.

- Comprehensive Discounts: Discounts for military garaging during deployments, savings for safe driving, good students, and more.

- High Financial Strength: This ensures reliability in claim payments with an A++ AM Best rating.

Cons

- Eligibility Restrictions: This is limited to military members, veterans, and eligible families, excluding the general public, according to USAA car insurance review.

- Premium Increase over Time: Some customers reportedly experience an increase over time, particularly after claims.

- Limited Local Support: Relies more on digital and phone assistance, with fewer physical branch locations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

# 5 – Allstate: Best for Customizable Coverage

Pros

- Broad Coverage Options: Offers policies and add-ons, such as accident forgiveness, rideshare coverage, and new car replacement, that fit your lifestyle.

- Strong Local Agent Networks: Extensive network of agents that offer in-person service and advice.

- Safe Driving Rewards: Rewards for Safe drivers include discounts and cashback through the Drivewise program.

- Milewise Program: This is a pay-per-mile program with trusted coverage. It costs $1.5 a day plus the miles you travel. It is ideal for those who don’t drive much.

Cons

- Higher Premiums: More expensive rates if without discounts than Geico and Progressive.

- Discount Complexity: Discounts often require you to enroll in specific programs or bundles like home+auto and renters+auto.

- Usage-Based Program Risks: Drivewise could detect risky behaviors that could cause an increase in premiums.

#6 – Farmers: Best for Flexible Options

Pros

- Customizable Coverage: Diverse drivers can have comprehensive coverages and add-ons for weather-related risks.

- Local Agent Expertise: Expert agents give immediate support for claims, policy customization, and other needs.

- Uninsured Motorist Protection: Farmers offer coverage for uninsured motorists, unlike other providers. Learn more about this policy in the Farmers car insurance review.

- Amazing Discounts: Bundling insurance offers big savings, and drivers are rewarded with lower rates for their clean driving records

Cons

- Expensive Premiums and Add-Ons: Rates and optional coverages may tend to be more expensive for younger or high-risk drivers.

- Mixed Customer Satisfaction: Reports say there are delays in claim repayments, especially in weather challenges.

- Rate Variability: Accident rates in urban areas like Phoenix cause an increase in premiums after claims.

#7 – Liberty Mutual: Best for Comprehensive Policies

Pros

- RightTrack Safe Driving Program: This program offers rewards of up to 30% in premium discounts.

- Great Add-Ons: Liberty Mutual insurance review provides valuable options like new car replacement, gap insurance, roadside assistance, and custom coverage parts and equipment.

- Weather Risks Protection: Provides coverage for risks like monsoon storms, addressing Arizona’s extreme weather conditions.

- Flexible Payment Options: Quickly pay through ID cards from your app.

Cons

- RightTrack Limitation: The program requires consistency in safe driving habits to unlock discounts. Check out more of the program’s rules.

- Claims Issues: File and track claims in the app but delays are reported during monsoon or other high-demand issues.

- High-Risk Drivers Rates: Liberty Mutual premiums can be steep for drivers with accidents, traffic violations, or bad credit.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Customer Service

Pros:

- Coverage Options: Collision coverage pays for your damages regardless of who is at fault. If this is not available, towing and labor coverage can cover it instead.

- Vanishing Deductible Program: $100 off of your deductibles for safe driving if no accident occurs in a year. Get more information here in Nationwide insurance review.

- On Your Side Review: A free insurance review with an insurance professional to check if the policy still works for you and your changing needs.

- High-Demand Weather Claims: The company’s financial stability ensures you can claim payouts reliably even during calamities.

Cons

- Vanishing Deductible Cost: Participating in this program means a slight increase in your premiums, which can offset the deductible savings for some drivers.

- Higher Add-On Cost: Add-ons like gap insurance and accident forgiveness are useful but significantly raise premiums.

- Limited Local Agents: There are fewer in-person Nationwide agents in some areas in Arizona.

#9 – Travelers: Best for Unique Coverage

Pros

- Extensive Weather Coverage: Travelers’ insurance review has car protection against monsoon-related flooding, which is common in Arizona’s climate and is prioritized.

- Variety of Discounts: A new car discount and a student away at school discount if your dependent studies 100 miles away and won’t be driving a car have respective discounts.

- Gap Insurance: This is essential for financed vehicles because it covers the difference between the car’s value and loan balance.

Cons

- Claims Delays: Customers report slow claims resolution during monsoon season and other bad weather conditions.

- Varied Rates for High-Risk Drivers: Rates tend to be higher for drivers with poor credit scores, traffic violations, and accidents.

#10 – American Family: Best for Loyalty Discounts

Pros

- Modified Coverage: American Family’s review has reasonable policies and add-ons based on the driver’s needs make the company the best car insurance in Arizona for young drivers.

- Unique Discounts: Safety vehicle discounts for cars equipped with safety technologies and significant savings for multi-policy bundle offers.

- Fast Claims: The American Family is known for prompt and responsive claim procedures during loss or accident.

- Accident Forgiveness Feature: This feature prevents premium increases after your first accident, making it the best car insurance in Phoenix, AZ.

Cons

- Limited Discount for Senior Drivers: Younger drivers or those with new cars have better options than seniors.

- Limited National Presence: While it is widely known in many states, its national presence is less than that of State Farm or Allstate, which affects service availability.

- Varied Policy Rates: Older cars without advanced features cost more. Optional add-ons can increase premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Monthly Rates in Arizona

The information listed below answers the question of how much the average car insurance costs in Arizona.

Arizona Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $68 | $180 | |

| $43 | $114 | |

| $51 | $135 | |

| $25 | $65 | |

| $67 | $178 |

| $44 | $116 |

| $32 | $84 | |

| $30 | $81 | |

| $39 | $104 | |

| $24 | $63 |

The average cost of car insurance in Arizona is likely to be higher for 2019 and on. Make sure to make the right fit for you!

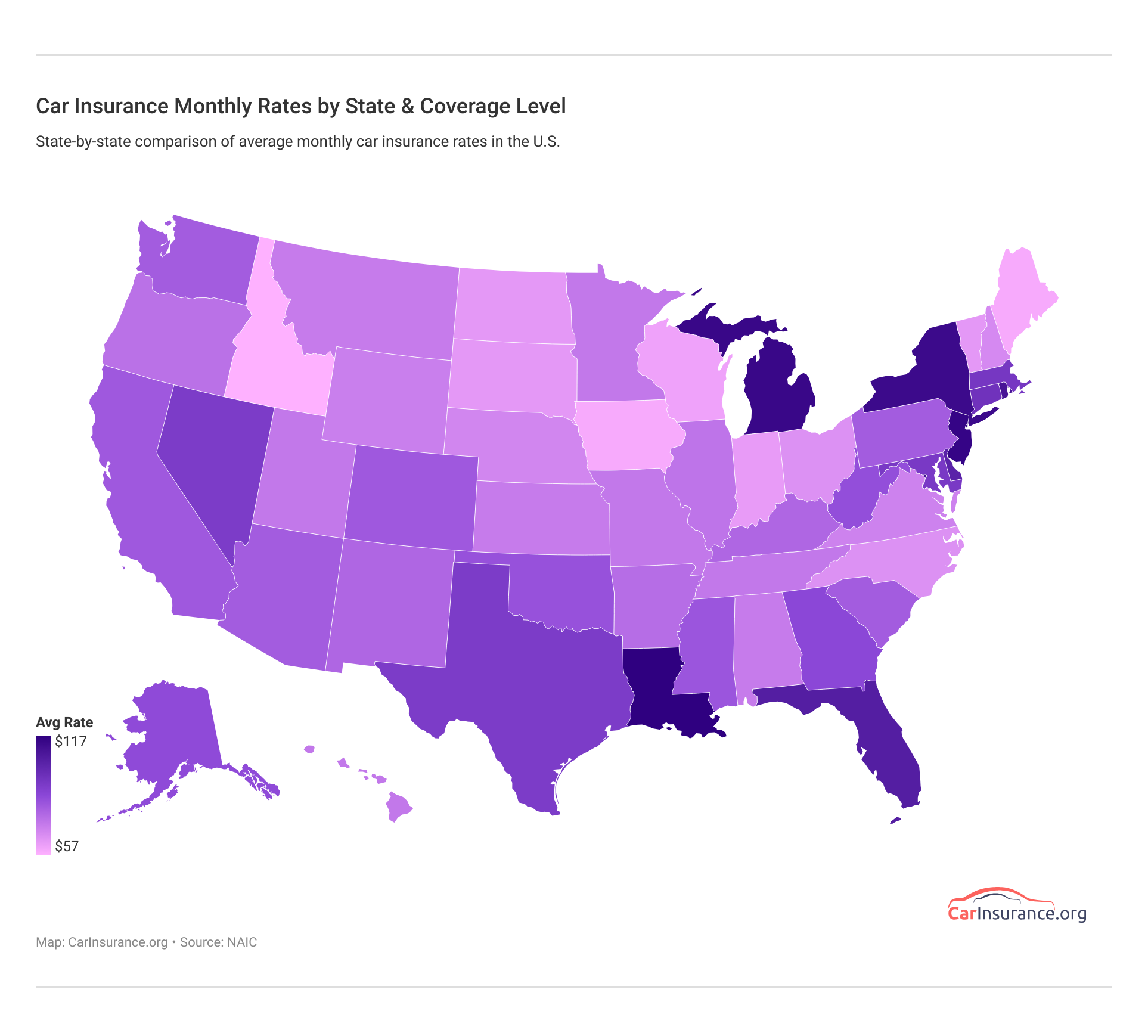

The map shows the comparison of car insurance by state. There are huge differences as rates tend to be relative according to indicators. For example, Arizona had a $3 higher rate neighboring state, New Mexico, and $7 higher than Utah but $11 lower compared to Nevada.

Going to the right place or person to ask for help matters. The same goes for your car insurance; the right company will provide you with the best-tailored service to your needs and offer savings options with the rising prices of car insurance.

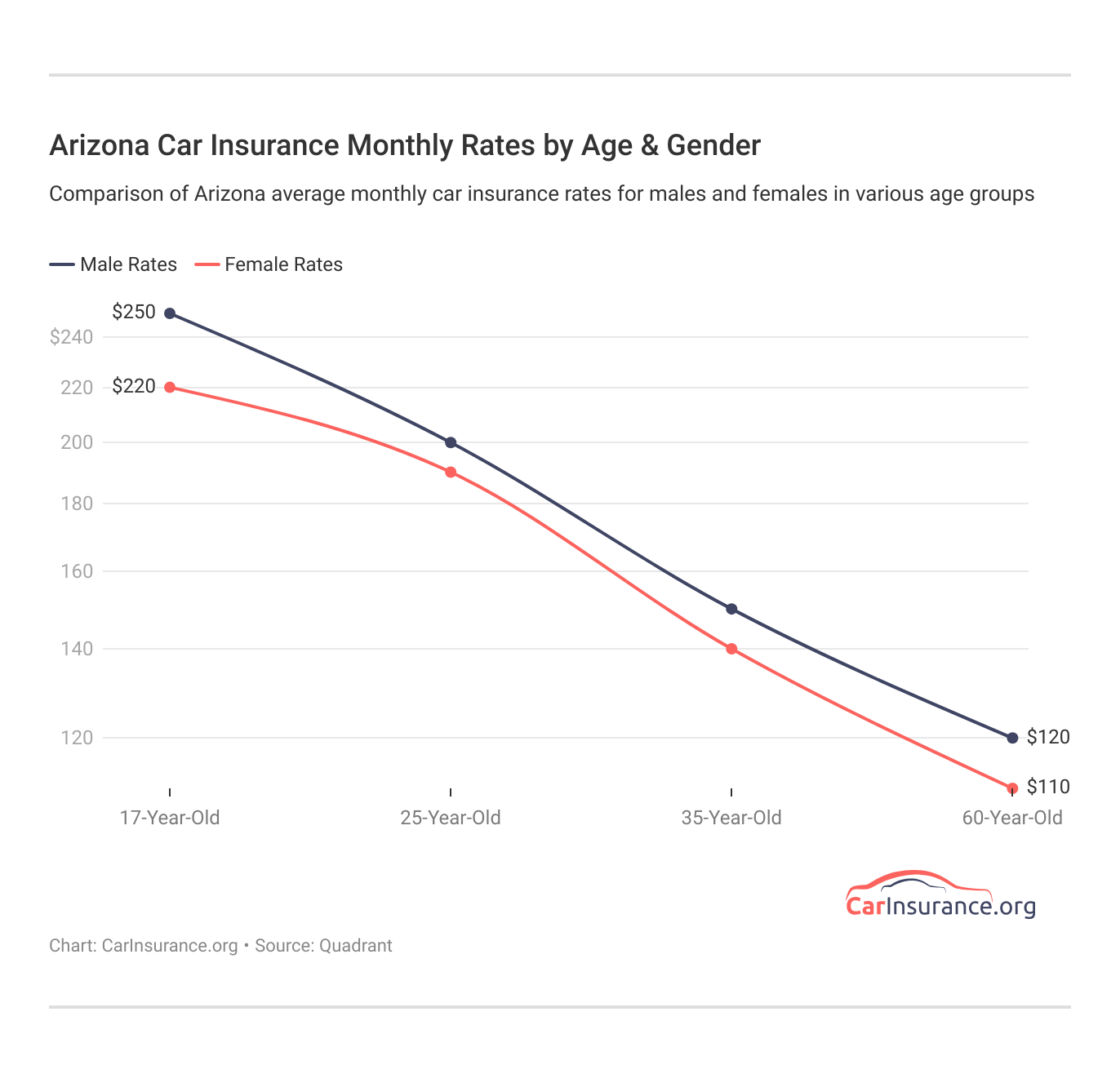

Car Insurance Monthly Rates in Arizona by Age and Gender

As unfortunate as it is, your gender and even your age can sometimes play a role in the amount you’ll pay for your insurance premium. Below we’ve listed both the gender and the age differences among different insurance providers for insurance rates.

Arizona Car Insurance Monthly Rates by Provider, Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $630 | $816 | $324 | $352 | $289 | $289 | $282 | $282 | |

| $603 | $786 | $229 | $268 | $229 | $229 | $210 | $210 | |

| $961 | $998 | $252 | $262 | $223 | $223 | $198 | $211 | |

| $368 | $388 | $117 | $115 | $128 | $143 | $108 | $138 | |

| $232 | $278 | $116 | $139 | $116 | $116 | $116 | $116 |

| $407 | $203 | $126 | $118 | $126 | $118 | $126 | $118 |

| $676 | $755 | $177 | $176 | $164 | $144 | $148 | $140 | |

| $744 | $935 | $258 | $326 | $239 | $239 | $211 | $211 | |

| $470 | $589 | $171 | $180 | $161 | $170 | $150 | $159 | |

| $525 | $602 | $184 | $198 | $140 | $140 | $130 | $132 |

Luckily, in Arizona, many companies have eliminated gender differences for married individuals by charging the same rates for both males and females. Companies like Allstate F&C and State Farm Mutual charge the same rates for married individuals. Age, however, still plays a large factor in the insurance rate.

The older the person, the lower the insurance premium tends to be. Vice versa, younger individuals typically pay more. You can explore all the factors that may affect your car insurance rates.

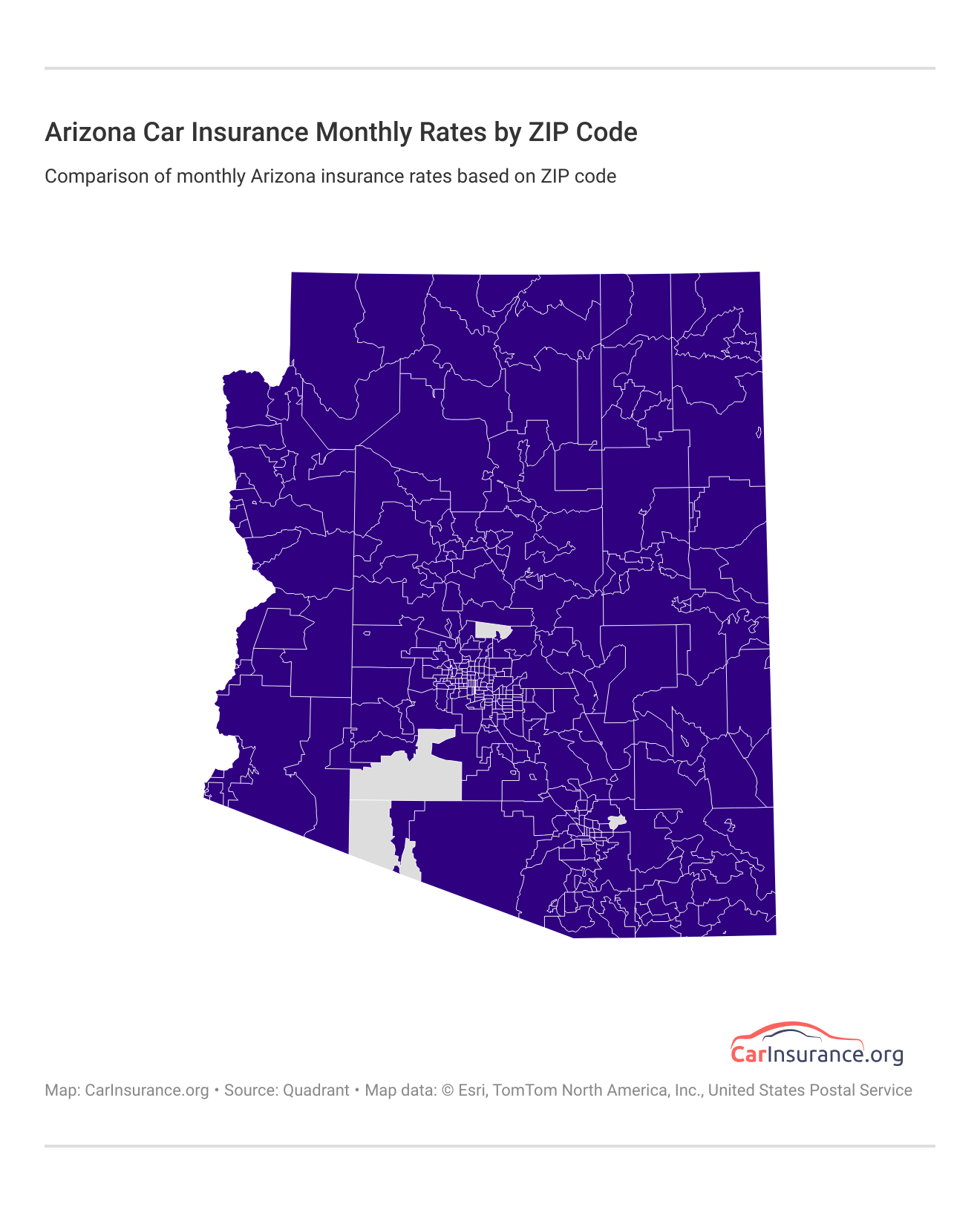

Cheapest Insurance Rates in Arizona by ZIP Code

Where you live in Arizona can also affect your car insurance rates. We’ve collected data on car insurance rates by ZIP code.

Based on updated data, these monthly rates range from $250 to $450, depending on your ZIP code. You can see the difference by clicking on the map.

Check the lists below to see where your ZIP code falls!

Cheapest Car Insurance ZIP Codes in Arizona

| City | ZIP Code | Monthly Rates |

|---|---|---|

| Chandler | 85201 | $120 |

| Gilbert | 85705 | $130 |

| Glendale | 85224 | $145 |

| Mesa | 85251 | $110 |

| Peoria | 85234 | $150 |

| Phoenix | 85282 | $140 |

| Scottsdale | 85022 | $125 |

| Surprise | 85301 | $155 |

| Tempe | 85345 | $135 |

| Tucson | 85374 | $115 |

According to the ZIP code, the cheapest cities are listed below: Mesa, Tucson, Chandler, Scottsdale, and Gilbert. The next list shows the most expensive ZIP codes.

Most Expensive Car Insurance ZIP Codes in Arizona

| City | ZIP Code | Monthly Rates |

|---|---|---|

| Cave Creek | 85331 | $330 |

| Chandler | 85248 | $355 |

| Gilbert | 85295 | $350 |

| Glendale | 85304 | $335 |

| Mesa | 85206 | $345 |

| Paradise Valley | 85253 | $375 |

| Peoria | 85383 | $340 |

| Phoenix | 85016 | $365 |

| Scottsdale | 85255 | $380 |

| Tempe | 85284 | $360 |

As listed above, the expensive cities are Scottsdale, Paradise Valley, Phoenix, Tempe, and Chandler. Does your ZIP code belong to the cheapest or most expensive? Check out this guide to cheap car coverage insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Insurance Rates by City

We’ve also collected data on car insurance rates by city. Check the table below.

Cheapest Car Insurance in Arizona by City

| City | Monthly Rates |

|---|---|

| Chandler | $120 |

| Gilbert | $130 |

| Glendale | $145 |

| Mesa | $110 |

| Peoria | $150 |

| Phoenix | $140 |

| Scottsdale | $125 |

| Surprise | $155 |

| Tempe | $135 |

| Tucson | $115 |

Mesa, Tucson, Chandler, Scottsdale, and Gilbert are among the cheapest cities. Don’t see your city? Check if it’s on the list of most expensive cities for car insurance.

Most Expensive Car Insurance in Arizona by City

| City | Monthly Rates |

|---|---|

| Cave Creek | $330 |

| Chandler | $355 |

| Gilbert | $350 |

| Glendale | $335 |

| Mesa | $345 |

| Paradise Valley | $375 |

| Peoria | $340 |

| Phoenix | $365 |

| Scottsdale | $380 |

| Tempe | $360 |

Now, the most expensive cities are Scottsdale, Paradise Valley, Phoenix, Tempe, and Chandler.

Car Insurance Companies in Arizona

Why is car insurance needed? What’s in it for you?

When you own a car, you are expected to get a car insurance. In doing so, make you get the best like State Farm, Geico, and USAA for militaries.Rachel Bodine Insurance Feature Writer

If car insurance is not as needed as you think it might be, consider how many providers are established to offer this service. There are nearly 1,000 licensed providers in Arizona!

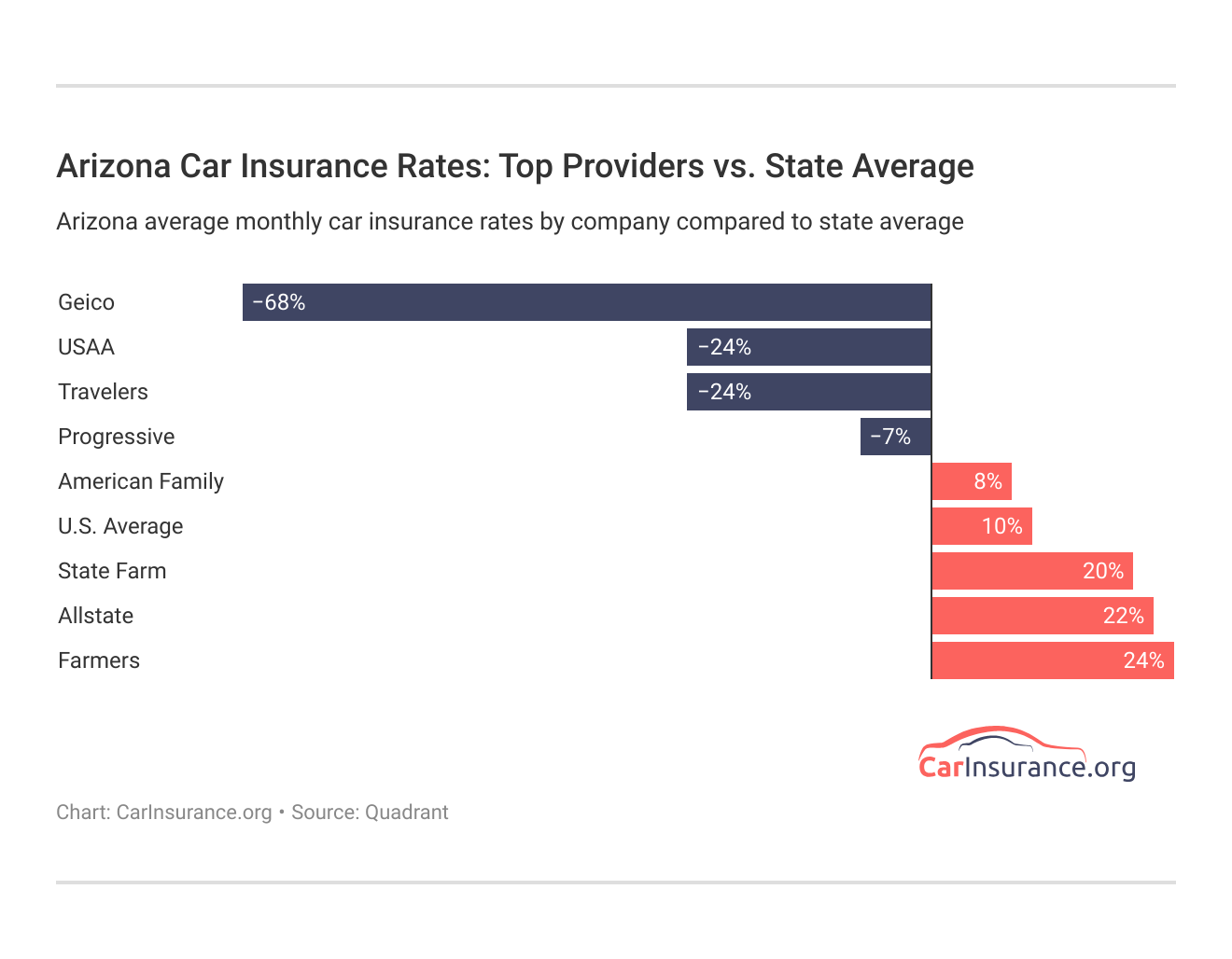

When it comes to cheapest, Geico definitely hit the top 1 with a rating of less than 68% compared to the state average, followed by USAA and Travelers, both of which have less than $24 in the top 2. In contrast, Farmers and Allstate are the highest above the average, with 24% and 22%, respectively.

Number of Best Car Insurance in Arizona

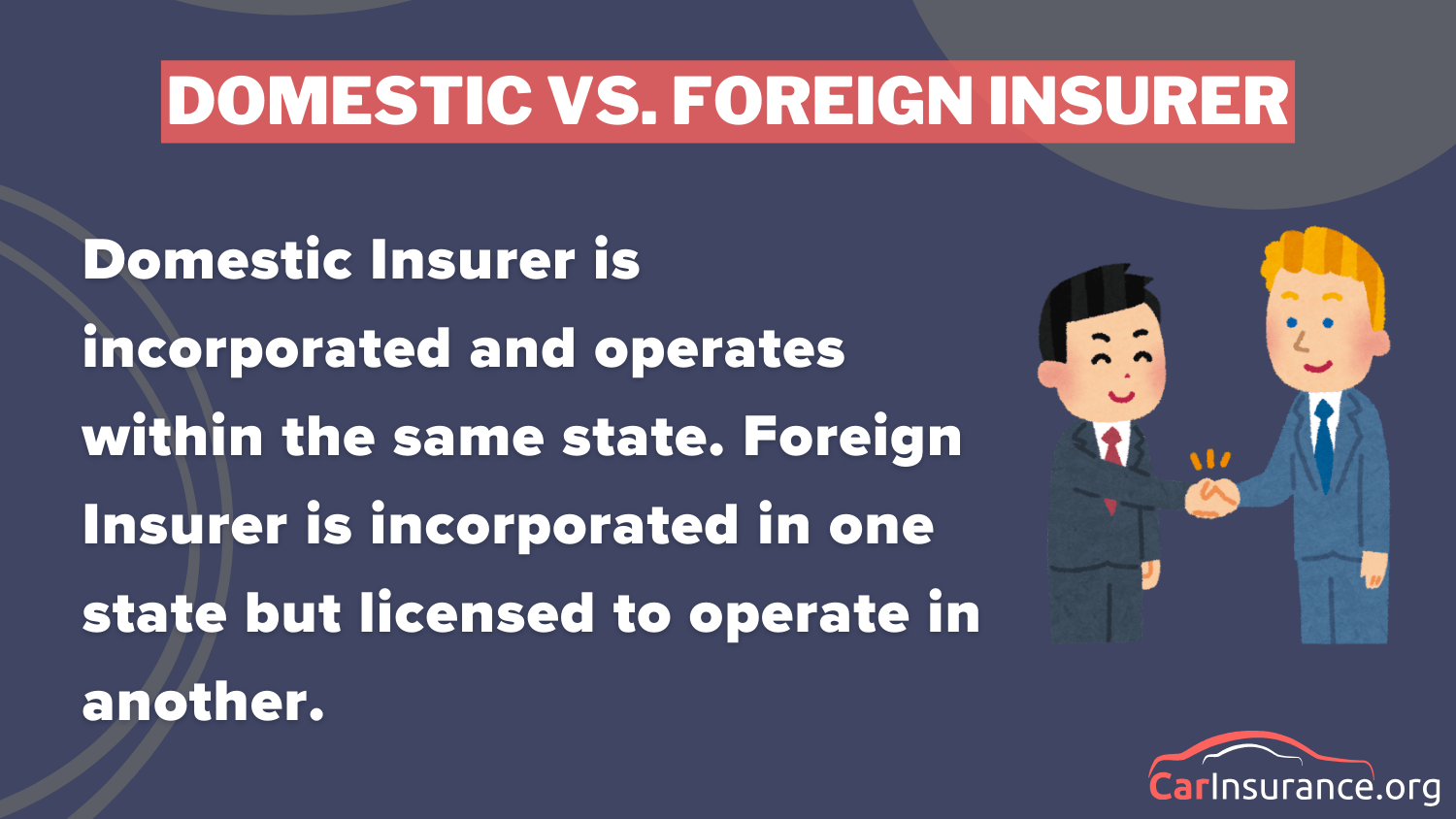

Arizona has a pretty diverse choice of insurance providers. There are 983 providers, 40 of which are considered domestic providers and 943 of which are considered foreign providers. What exactly is the difference between a domestic provider and a foreign provider?

How does this affect you? It doesn’t really. The only thing to factor in is if you have a foreign provider that is giving you the minimum liability coverage for Arizona (15/30/10). You have nothing to worry about as long as you have at least that on your policy.

Minimum Coverage Requirements in Arizona

Like other nations, Arizona has minimum liability coverage. This is the minimum insurance coverage you can have to legally drive in the state.

Under Arizona law, it’s required to have what’s known as a 15/30/10 minimum coverage. Let us break down those numbers for you.

- 15 = $15,000 to pay for injuries for ONE person

- 30 = $30,000 to pay for injuries from any ONE accident

- 10 = $10,000 to pay for property damage

In other words, the minimum coverage is pretty low compared to other states. Presuming you were to get into a costly accident, you’d likely run out of money before you finish paying for all of the costs of the accident.

I always encourage drivers to get the full coverage than just the minimum, so when accidents happen, they won't go bankrupt.Tracey Wells Licensed Insurance Agent & Agency Owner

So, getting more than the minimum coverage is going to be extremely important in getting the best car insurance in Arizona. Know every detail of the insurance you need.

Now, that is a comprehensive explanation of Jonathan Negretti on different coverage you must carry. As he advised, getting coverage above the minimum liability coverage is crucial.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Premiums as a Percentage of Income

Your insurance rates are affected by a term known as ‘disposable income per capita.’ This is how much the average state citizen makes each year after taxes. In Arizona, the average monthly per capita disposable income is $2860.

This means the average Arizona citizen makes $34,321 yearly after taxes. Breaking this down, the average monthly disposable income would be $2,860. So, all of the bills you have each month (health insurance, groceries, and your Netflix account) come from this monthly income.

Moreover, the average full coverage premium for car insurance in Arizona is $962, meaning the average Arizona citizen is paying $80 per month for car insurance.

To help put this into perspective, the nation’s average monthly car insurance rate is $82. This implies that Arizona citizens pay LESS than most of the other states. Based on that data, Arizona is actually the 14th cheapest state for car insurance.

Read more: Ways to lower your premiums

Additional Liability Coverage in Arizona

How do you know whether an insurance provider is ‘healthy’? You check their financial health by a loss ratio. A company with a loss ratio too high (over 100 percent) is losing money.

A company with a loss ratio that is too low isn’t paying out as much in claims as it thought it would. You want to find that sweet spot right in between.

Arizona Car Insurance Loss Ratio by Coverage Type

| Coverage | 2022 | 2023 | 2024 |

|---|---|---|---|

| Bodily Injury Liability | 10% | 12% | 12% |

| Property Damage Liability | 6% | 7% | 7% |

| Uninsured/Underinsured Motorist | 8% | 9% | 9% |

| Medical Payments (MedPay) | 5% | 5% | 5% |

| Personal Injury Protection (PIP) | 4% | 5% | 5% |

| Comprehensive Liability Coverage | 2% | 3% | 3% |

The data above show that the percentage has become increasingly healthy in the past few years.

You can explore different car insurance coverage options to pick just the right one for you.

Car Insurance Add-ons in Arizona

Here are some of the most affordable coverage options to add to your policy. Take a look at the coverage options below and see if they’re the right fit for you.

- Gap insurance

- Umbrella

- Rental reimbursement

- Roadside assistance

- Mechanical breakdown insurance (MBI)

- Non-owner coverage

- Modified car insurance

- Classic car insurance

Several add-ons and endorsements are available. Though some drivers think they’re just an additional dollar in the bill.

Add-ons play its own role, but here's the catch, if your gut feeling tells you to get that add-ons or endorsement, trust it. You never knew what will happen in the road, and how handy these add-ons may become.Eric Stauffer Licensed Insurance Agent

Depending on the type of vehicle, field of work, or personal needs, grab the essential add-ons. You never knew an extra dollar in a bill could save you thousands in the future.

Of course, be wise about what add-ons you will include in your policy. Here is a comprehensive guide to know the perks and pitfalls of add-ons.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Financial Ratings in Arizona

A.M. Best Rating system is a global credit rating agency that tends to have a heavier focus on the insurance industry. Just like a provider can run your credit history and financial strength, you can check out theirs with this.

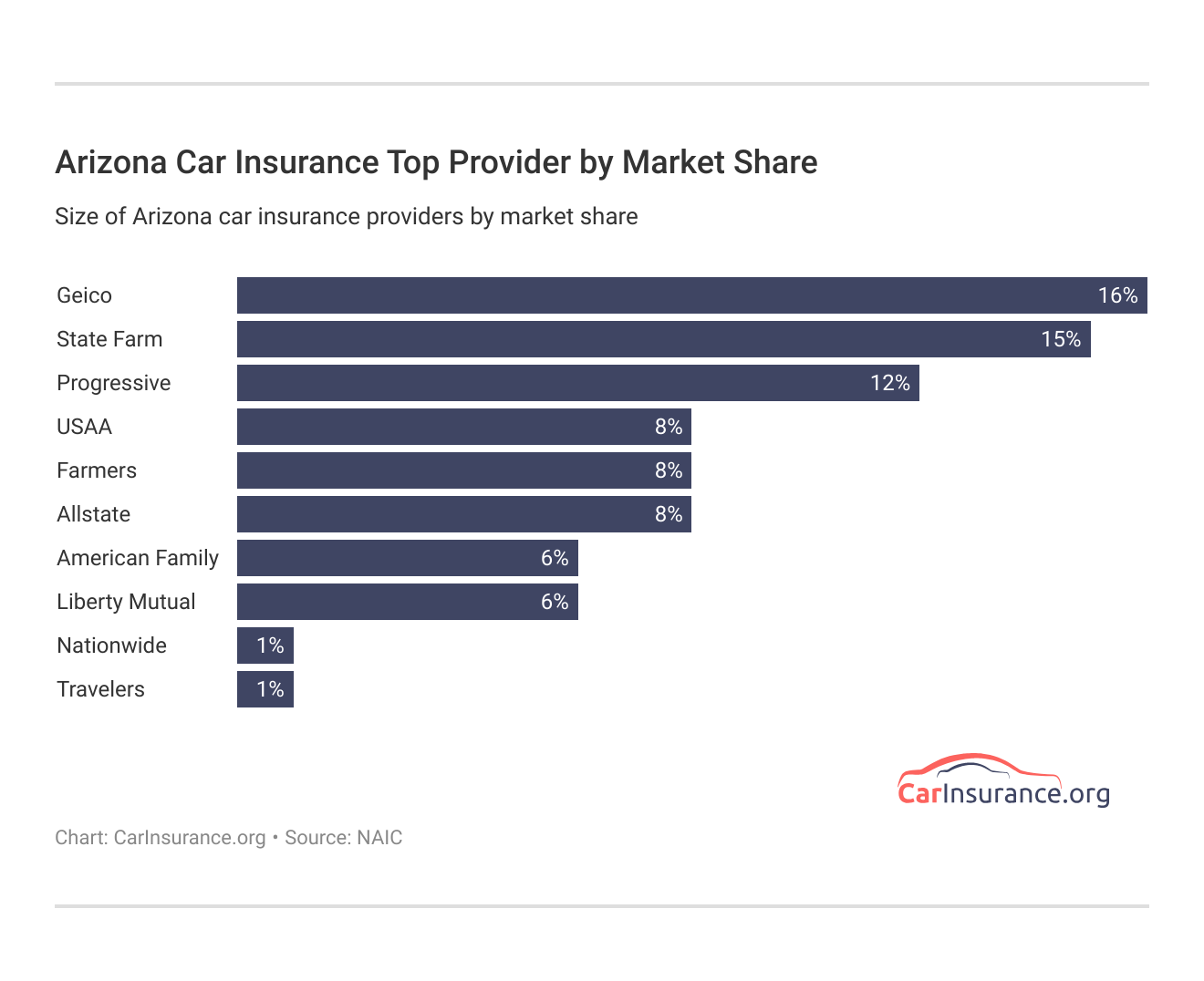

State Farm topped the size of Arizona insurers’ marketplace by ringing 17%, which is higher than other companies. According to State Farm company review, the factors that made its percentage high include a large customer base, financial stability, reputation, and diverse offers.

Then, it was followed by Geico at 15% and Progressive at 11%. We’ve compiled the top ten insurance providers’ ratings below just for you.

Arizona Car Insurance Financial Rating by Provider

| Insurance Company | A.M. Best |

|---|---|

| A+ | |

| A | |

| A | |

| A++ | |

| A |

| A+ |

| A+ | |

| B | |

| A++ | |

| A++ |

The table shows that the higher the financial rating, the more pluses behind the letter, and the more likely a company has the funds to pay claims. For example, Geico in Arizona is rated A++. Geico is affordable, and one of its known policies allows customers to insure a car that is not under their name.

This indicates that Geico has one of the highest financial ratings and customer approval in the state!

Car Insurance with Most Complaints in Arizona

Every company is going to have its share of complaints, and the bigger the company, the more likely it is to have complaints. Which companies have the most complaints in Arizona? We’ve listed the number of complaints about some of the bigger companies in Arizona.

Arizona Car Insurance With Most Complaints

| Insurance Company | Complaints |

|---|---|

| 245 | |

| 198 | |

| 215 | |

| 289 | |

| 321 |

| 214 |

| 301 | |

| 220 | |

| 187 | |

| 133 |

Based on these numbers, the companies with the most complaints are Liberty Mutual, Progressive, Geico, and Allstate, while the companies with fewer complaints are USAA, Travelers, and American Family.

Although it is definitely something to consider, it doesn’t necessarily mean a company is bad. It is more of an indicator of how that company handles complaints and customer satisfaction.

Car Insurance Quotes in Arizona by Company

Shopping around for the best car insurance in Arizona can help you save money while still getting the best coverage. Below is some information about the rates across various companies in Arizona.

Arizona Car insurance Monthly Rates by Provider vs. U.S. Average

| Insurance Company | Monthly Rate | Compared to State | Percentage |

|---|---|---|---|

| $120 | +$20 | +20% | |

| $115 | +$15 | +15% | |

| $130 | +$30 | +30% | |

| $110 | +$10 | +10% | |

| $125 | +$25 | +25% |

| $105 | -$5 | -5% |

| $120 | +$20 | +20% | |

| $115 | +$15 | +15% | |

| $125 | +$25 | +25% | |

| $100 | -$10 | -10% |

Evidently, comparing some of the different companies in Arizona can save you thousands of extra dollars. For instance, Geico offers policies that only add $10 to the state average, but Nationwide car insurance review shows $5 less.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Coverage Level Rates in Arizona

The difference between a low-coverage plan and a high-coverage plan could be as little as a hundred extra dollars per year. Check the table for the best full coverage car insurance in Arizona.

Arizona Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $120 | $100 | |

| $110 | $95 | |

| $130 | $110 | |

| $100 | $85 | |

| $105 | $90 |

| $95 | $85 |

| $110 | $95 | |

| $115 | $100 | |

| $110 | $95 | |

| $100 | $85 |

As you can see, there is a slight difference between collision and comprehensive coverage. However, the common thing is that collision is much more expensive and ranges from $5 to $10 than comprehensive coverage. Check this guide to deepen your understanding of policies and coverage.

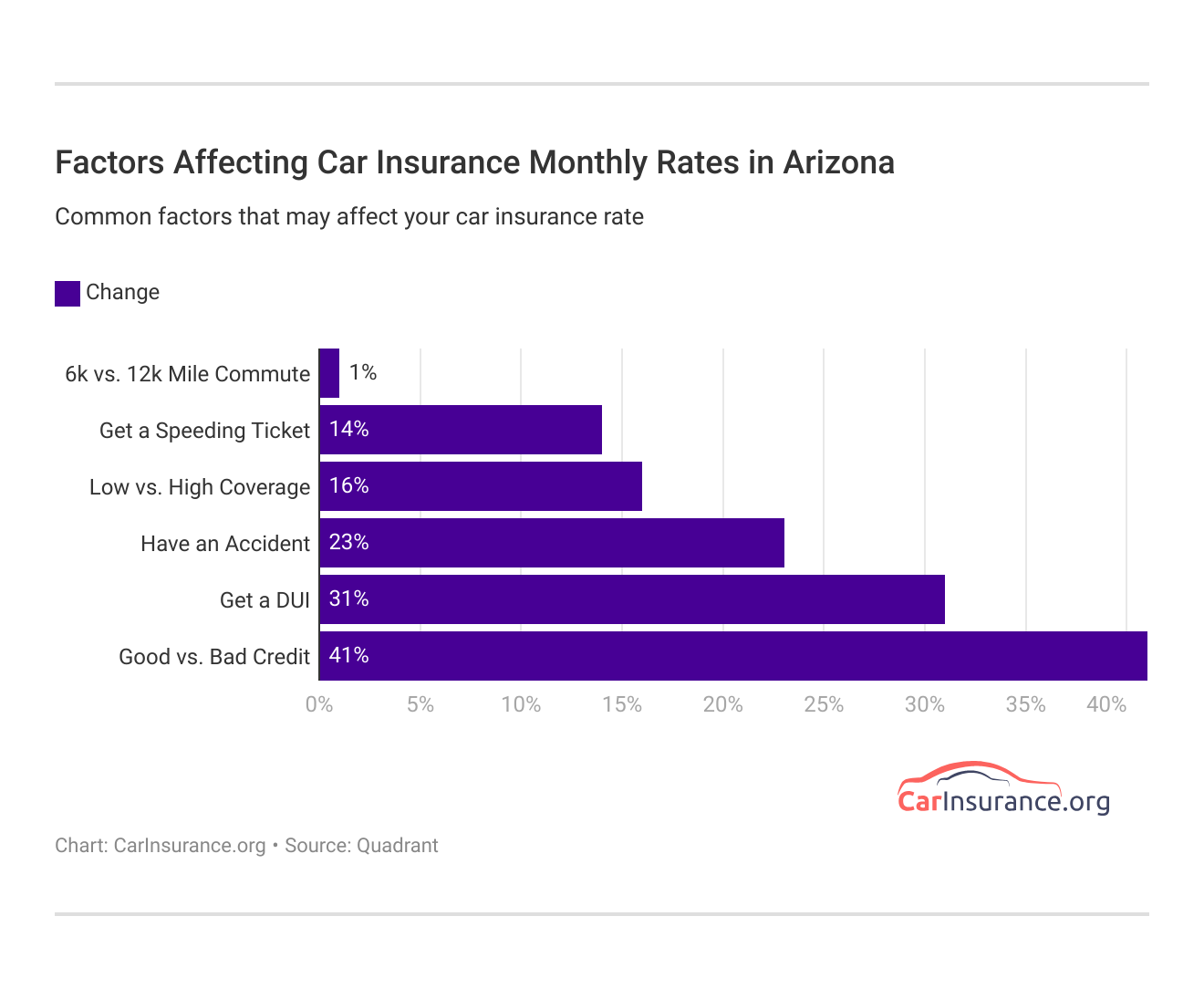

Car Insurance Factors Affecting Rates in Arizona

The indicators shape the rates or policies that a company offers. So expect that if you have higher violation and accident records, bad credit, or speeding tickets, your rates will be higher than those of safe drivers or those with good credit.

Premium rates vary according to the coverage you would like to take advantage of. You must understand the overall policies to get the coverage you deserve and make vital decisions in your car insurance.

Car insurance providers consider various factors when establishing premiums. What is your background shapes your premium rates. Try to revisit your history and evaluate if the rates being offered is just right for you.Daniel Walker Licensed Insurance Agent

Indeed, car insurance provides financial protection against risks, theft, and damages; it is also not wise to dive into whatever the sales agent is selling. Learning these factors helps you assess the level of associated risks as a driver while aiming for the best-fit coverage and policies.

Car Insurance Rates in Arizona by Credit History

Not surprisingly, your credit history also greatly influences the insurance rates you’re offered. The better your credit score, the better your rate is going to be.

Arizona Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $270 | $350 | $440 | |

| $245 | $320 | $400 | |

| $280 | $360 | $450 | |

| $190 | $250 | $320 | |

| $200 | $270 | $340 |

| $210 | $280 | $350 |

| $230 | $300 | $370 | |

| $220 | $290 | $360 | |

| $240 | $310 | $380 | |

| $210 | $280 | $350 |

You could pay thousands of extra dollars each year based on your credit alone. Based on the data above, you could pay just $270 in Allstate if you have good credit but $440 for bad credit. Imagine the huge difference.

Read more: How other factors like your children impact your car insurance policy

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Driving Record Rates in Arizona

How you drive also plays a pretty big factor in getting the best car insurance in Arizona. The safer you are as a driver, the cleaner your driving record is, and the less you’ll have to spend to get the coverage you need.

Arizona Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $240 | $270 | $310 | $400 | |

| $220 | $250 | $290 | $380 | |

| $260 | $290 | $330 | $420 | |

| $150 | $180 | $210 | $280 | |

| $160 | $190 | $220 | $300 |

| $170 | $200 | $230 | $310 |

| $180 | $210 | $240 | $320 | |

| $190 | $220 | $250 | $330 | |

| $210 | $240 | $270 | $350 | |

| $180 | $210 | $240 | $320 |

Having one of these things on your driving record could cost you thousands of dollars annually. Buckle up and drive safely out there! Cruise your way to savings by being a safe driver.

Check out the video below from IIHS to learn more about how to drive safely, even with hazardous roadside conditions.

Arizona State Laws You Should Know

Regarding how you drive on the road, each state has its own set of rules and laws. After all, no state is exactly the same, so why should the laws be? You can ask yourself questions like, is it illegal to not have car insurance in AZ?

You need to know your state’s laws before you start driving. When you’ve chosen the car insurance provider and policy that’s best for you, you’ll need to file the appropriate forms to the DMV and wait 30 days for it to take effect. Click this guide to know all the hows of car insurance in 2025

High-Risk Insurance

Did you know that you are considered a high-risk driver after a certain number of driving violations? Being a high-risk driver can be costly, as many insurance companies charge high rates to provide coverage.

Luckily, an Arizona Automobile Insurance Plan (AZ AIP) was formed to ensure all drivers have access to insurance coverage, regardless of their driving records. All licensed Arizona car insurers must participate in this plan to do business in the state.

If you are accepted into this program, a designated company will have to accept you and provide the necessary insurance coverage; you cannot choose. Instead, you have to accept the terms provided by the designated company.

You can check the cheap companies that only look back three years.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Low-Cost Insurance in Arizona

Unfortunately, Arizona is one of the many states that does not offer low-cost insurance solutions for low-income households. Don’t let this get you down, though! There are still ways to cut down car insurance costs.

Common Car Insurance Discounts You May Quality:

- Accident-Free Discount

- Driver Training Discount

- Good Driving Discount

- Good Student Discount

- Company/Team/School Discount

- Homeowner Discount

- ‘Green’ Discount (you use a paperless billing system)

The top providers we picked for you have offered various discounts that we want you to consider. We think this might save you money while you get the best car insurance in Arizona.

Car Insurance Discounts in Arizona by Top Providers

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

As the table shows, each company offers several discounts, such as multi-policy, safe driver, paperless billing, accident forgiveness, etc.

Windshield Coverage

Some states require a policy that includes windshield coverage, but Arizona doesn’t. However, providers do offer optional “full glass” or “safety equipment” coverage, which you can add to your policy. These coverages help pay for any windshield repairs with no deductible.

Although you’re not required, it definitely is something to consider. It could end up saving you a lot of money down the road if something ever does happen to your windshield.

Read more: What company is best in covering windshields in Arizona

Car Insurance Fraud in Arizona

Insurance fraud is a serious crime in the United States. From 2013-2017, property/casualty fraud amounted to $30 billion each year! As you can imagine, with amounts like this, insurance fraud is taken very seriously.

How does this directly affect you, even though you’re not the one committing insurance fraud? If companies weren’t losing that much money from insurance fraud, you’d be paying lower insurance rates!

Car insurance fraud forms, according to the IIHS:

- Making false claims (faking a claim)

- Adding “extra” costs onto a legitimate claim that isn’t legitimate

What are some of the consequences if you do commit car insurance fraud?

Penalties for Driving Without Car Insurance in Arizona

| Offense | Penalty |

|---|---|

| First Offense | $500 fine, registration suspended, possible impoundment |

| Second Offense | $750 fine, registration suspended, SR-22 required |

| Third Offense | $1,000 fine, suspended registration, SR-22, impound risk |

| Operating a Vehicle Without Proof of Insurance | $250 fine (for a first offense) |

| Driving With Expired Insurance | $500 fine, registration suspended, possible impound |

| Failure to Show Proof of Insurance During Traffic Stop | $500 fine, suspension of registration |

This strict policy imposed by the state without car insurance includes registration suspension, impoundment, or fines ranging from $250 to $1000. Repeat offenses lead to higher fines and mandatory SR-22 insurance filing for three years.

Read more: What you need to know about car insurance fraud

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Statute of Limitations

The statute of limitations is the amount of time that you have in order to make a claim after an accident. In Arizona, you have two years to claim both personal injuries as well as property damages.

This amount of time might seem pretty long, but when you’re dealing with the repercussions of an accident, that time can go by quickly. Make sure you make your claim as soon as you can so you can get the payment you need!

Negligent Drivers

Reckless (negligent) driving is considered one of the more serious misdemeanor offenses in Arizona. A first-time offense results in a class 2 misdemeanor, which has a maximum penalty of four months in jail and a $750 fine.

As this is one of the most serious moving violations, it places eight points on the person’s license and requires them to complete Traffic Survival School—just for a first-time offense!

But the truth is that drivers can practice safe driving. These offenses can be avoided if you seriously care for yourself and others.

Negligent driving can cost you so much, that is why I always tell my clients to get the best coverage that covers everything, not just the minimum. I also encourage them to take safe driving lessons to instill good habits while on the wheels. You can take them too.Michelle Robins Licensed Insurance Agent

This won’t be a problem for safe drivers. For high-risk drivers, check your habits and learn to change them as early as now. Be sure you follow the rules of the road to become the safest driver you can be!

Arizona’s Rules of the Road

Arizona is an at-fault state. What does an at-fault state mean?

Say, for example, you are involved in an accident with an uninsured person, and they are at fault; they likely won’t be able to pay off all the costs of the accident completely.

They may end up bankrupt before they are even able to pay for any injuries you may have sustained or damage to your vehicle. Consequently, some of the costs will fall onto you, even though the accident wasn’t your fault!

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Ridesharing Policy in Arizona

Ridesharing has exploded in popularity over the past decade, with companies such as Uber and Lyft dominating the market. It can be an extremely useful tool for citizens, able to get to where they need to go with the push of a button.

Therefore, if you wish to work for one of these companies, they will require that you have what’s known as ridesharing coverage. In Arizona, House Bill 2135 was passed in 2015, requiring ridesharing services to carry $250,000 worth of liability coverage when a passenger is present.

The mentioned amount is identical to taxi drivers, who are required to have the same coverage. The easiest way to buy this policy is through your personal car insurance provider since some offer this in their policies. Geico, State Farm, Allstate, Progressive, and American Family are the few to mention.

Purchasing rideshare insurance is a necessity. I tell you, it is the only way to close gaps in the personal policy that may cause issues later. Get it and be secured.Eric Stauffer Licensed Insurance Agent

Keep in mind that this coverage is in addition to the minimum liability coverage you are required to have. Moreover, if you consider working for these companies, and you are insured under a provider that doesn’t have this type of coverage, you may be required to get an additional policy/change policies in order to get this coverage.

For a better understanding of the best car insurance in Arizona that offers the best ridesharing policy.

DUI Laws

Driving Under the Influence (DUI) in Arizona is taken extremely seriously. What does Driving Under the Influence mean?

In 2021 alone, there were 421 fatalities due to alcohol-impaired drivers. Due to this, Arizona has many laws regarding this in order to protect Arizona citizens.

DUI Laws in Arizona

| Offense | Description |

|---|---|

| DUI | BAC 0.08% or higher |

| Extreme DUI | BAC 0.15% or higher |

| Super Extreme DUI | BAC 0.20% or higher |

| DUI with Child Passenger | DUI with child under 15 in vehicle |

| Underage DUI | BAC 0.00% to 0.02% for minors under 21 |

| Penalties for DUI | Fines, suspension, DUI education, jail possible |

| Penalties for Extreme DUI | Higher fines, longer suspension, alcohol screening |

| Penalties for Super Extreme DUI | Higher fines, longer suspension, ignition interlock |

| DUI Conviction | Criminal conviction, long-term consequences |

| Ignition Interlock Device | Required for some offenders for a set period |

Washout/Lookback period means that if you have a repeat of this offense in that time frame, you will be bumped up to the next level of penalty. Speaking of that, what are the penalties for offense for a DUI conviction?

DUI Offenses and Penalties in Arizona

| Number of Offenses | License Revocation/ALS | Jail Time | Fine |

|---|---|---|---|

| 1st Offense DUI | 90 days | 10 days minimum | $1,000 |

| Extreme DUI (1st Offense) | 90 days | 30 days minimum | $2,500 |

| Super Extreme DUI (1st Offense) | 1 year | 45 days minimum | $3,000 |

| 2nd Offense DUI | 1 year | 90 days minimum | $2,500 |

| Extreme DUI (2nd Offense) | 1 year | 120 days minimum | $3,000 |

| Super Extreme DUI (2nd Offense) | 1 year | 180 days minimum | $4,000 |

| 3rd Offense DUI | 3 years | 4 months minimum | $4,000 |

| Extreme DUI (3rd Offense) | 3 years | 180 days minimum | $5,000 |

| Super Extreme DUI (3rd Offense) | 3 years | 1 year minimum | $5,000 |

Your BAC determines how severe the penalties are. If your BAC is above 0.15 percent, you may be faced with an Extreme DUI conviction, which carries the following penalties:

- First Offense:

- 30 consecutive days of imprisonment

- $2,500 fine

- Ignition Interlock Device: required

- Other: Alcohol screening/education/treatment as well as to perform community service

- Second Offense:

- 120 days of imprisonment

- $3,250 fine

- Ignition Interlock Device: required

- Other: Alcohol screening/education/treatment, performing community service, and the license is revoked for one year

To further discuss, the ignition interlock device is an instrument that tests breath alcohol levels and is connected to the ignition and power of the vehicle. So, having this device installed in your vehicle means you have to blow into the device in order to turn it on.

Read more: Driving tips to keep you safe on the road

Occurrence of Crash Fatalities in Arizona

Road Type: What type of road you drive on affects the number of fatalities

Typically, there is a general trend for rural roads to have more fatalities than urban roads. This is usually because rural roads tend to have higher speed limits, which means any impacts are far more deadly.

Moreover, this trend isn’t the case in Arizona. Urban roads see more fatalities than rural roads. This is likely due to the fact that urban roads are busier than rural roads and, therefore, have more drivers on them at one time. Rush-hour traffic is a prime example of that.

Fatal Accidents in Arizona

| Year | Number of Fatal Crashes | Number of Fatalities |

|---|---|---|

| 2020 | 1,050 | 1,000 |

| 2021 | 1,120 | 1,080 |

| 2022 | 1,150 | 1,100 |

| 2023 | 1,200 | 1,150 |

| 2024 | 1,250 | 1,200 |

Fatal accidents increase each year. This is why you should always be alert on the roads! Here is a guide to help you be prepared.

Person Type: Who is on the road can affect the rate of fatalities

Here, we’re not talking about demographic information such as race, gender, or anything like that.

Person type, in this case, is more about the type of vehicle being driven and whether or not the person in that vehicle is an occupant, a pedestrian, or a cyclist.

Fatalities in Arizona by Person Type

| Person Type | Number of Fatalities |

|---|---|

| Drivers | 650 |

| Passengers | 250 |

| Pedestrians | 180 |

| Motorcyclists | 120 |

| Bicyclists | 40 |

| Other/Unknown | 30 |

Most people involved in fatal crashes are drivers and passengers. This must be a reminder to you to be extra careful.

Crash Type: How a crash occurs

Was a single vehicle involved in the accident? Did the vehicle roll over during the accident? Was someone speeding just before the accident?

Fatalities in Arizona by Crash Type

| Crash Type | Number of Fatalities |

|---|---|

| Single-Vehicle Crashes | 450 |

| Head-On Collisions | 350 |

| Rear-End Collisions | 100 |

| Side-Impact Collisions | 150 |

| Rollovers | 250 |

| Motorcycle Crashes | 120 |

| Pedestrian Involved | 180 |

| Hit-and-Run Accidents | 50 |

| Speeding-Related Crashes | 200 |

| Drunk-Driving Crashes | 150 |

Hit-and-run cases are the least common in Arizona, with 50 reported incidents, whereas single-vehicle crashes had the most incidents, with 450 cases.

Speeding is one of the major causes of driving fatalities in the nation. For that reason, Speed limits were created. And when drivers exceed that limit, they can lose control of their vehicle and end up in an accident. We found the number of speeding fatalities in each county in Arizona from 2020 to 2023 and listed it below.

Fatalities in Arizona by County Involving Speeding

| County | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Maricopa | 150 | 160 | 175 | 180 |

| Pima | 50 | 55 | 60 | 65 |

| Pinal | 25 | 30 | 35 | 40 |

| Yavapai | 15 | 18 | 20 | 25 |

| Coconino | 10 | 12 | 15 | 18 |

| Mohave | 12 | 14 | 16 | 20 |

| Yuma | 8 | 10 | 12 | 15 |

| Navajo | 5 | 6 | 8 | 10 |

| Apache | 3 | 4 | 5 | 6 |

| Santa Cruz | 2 | 3 | 4 | 5 |

Another major contribution, and one of the most avoidable, to vehicular fatalities is drunk driving. We’ve gone through the alcohol-related fatalities for each county from 2020 to 2023 in Arizona.

Fatalities in Arizona by County Involving an Alcohol-Impaired Driver

| County | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| Maricopa | 100 | 110 | 120 | 130 |

| Pima | 35 | 40 | 45 | 50 |

| Pinal | 15 | 18 | 20 | 25 |

| Yavapai | 10 | 12 | 15 | 18 |

| Coconino | 8 | 9 | 12 | 15 |

| Mohave | 9 | 10 | 12 | 15 |

| Yuma | 6 | 8 | 10 | 12 |

| Navajo | 4 | 5 | 6 | 7 |

| Apache | 3 | 4 | 5 | 6 |

| Santa Cruz | 2 | 3 | 4 | 5 |

When it comes to fatal crashes due to alcohol-impaired drivers, Maricopa still came first, and Santa Cruz with the least cases.

There you have it! All the things you need to know to get the best auto insurance in Arizona, different laws you should be aware of to avoid penalties, and important data to remind you to be extra careful on the roads.

We hope this comprehensive guide gave you the confidence you need! Don’t forget to check out our FREE online tool to help you compare rates of the best full-coverage car insurance in Arizona!

Frequently Asked Questions

What is the highest type of car insurance?

Full coverage insurance is the highest type of car insurance, covering liability, collision, and comprehensive coverage.

What is the lowest form of car insurance?

The lowest form of car insurance and the minimum requirement in Arizona is liability insurance, which only includes the injuries and damages you cause to others during an accident.

Is car insurance higher in California or Arizona?

The average monthly rate in California is $176, higher than Arizona’s $151. This is due to California’s increased traffic congestion, higher population density, and stricter insurance policies, though individual rates may vary according to location, coverage level, and driving history. Compare rates in California and Arizona instantly—just enter your ZIP code to get started. Here is detailed information about California’s best car insurance.

Does AAA insure in Arizona?

AAA (American Automobile Association) provides car insurance in AZ from basic liability to full coverage and add-ons. Arizona resident members can also benefit from premiums, discounts, and other services.

What kind of car insurance do I need in Arizona?

Arizona only requires the least minimum liability insurance to drive in the state legally. If it meets the legal requirement, you can include comprehensive and collision coverage for better protection.

How much is car insurance in AZ for an 18-year-old?

Younger drivers’ rates are higher than adults’ because of their inexperience and high risk of accidents: $412 a month and $4938 yearly. One way to save is adding an 18-year-old to a family policy, which can significantly lower costs.

How much is the average car insurance in Arizona?

The average cost of car insurance in Arizona for full coverage is around $151/mo, though it may vary depending on factors like coverage needs, location, and driving history. Minimum liability is cheaper at only $64/mo. Rates do fluctuate according to credit score, age, and vehicle type. Get more information about your car’s insurance rates.

Do I need a car to live in Arizona?

Yes, having a car is recommended for living in Arizona because it has limited transportation options, especially in urban areas.

How long do you have to get insurance on a car in Arizona?

You must have car insurance in place before driving a new car. Arizona requires all drivers to carry proof of insurance that meets the minimum liability requirement at all times. If you’re transferring ownership, most companies provide a grace period of 7-30 days to update your policy, though it varies between insurers. So always ask and confirm with them.

What is the cheapest AZ car insurance?

Factors like driving history, location, and coverage must be considered when seeking the cheapest car insurance in Arizona. One provider that stood the most in affordability is Geico, both among cities and in Arizona as a whole. This is followed by USAA, but note that it is limited to the military, then State Farm, Progressive, Travelers, and American Family. Read more about this in the Cheapest car insurance in AZ.