Metromile Car Insurance Review for 2026 (Rates & Discounts Analyzed)

Our Metromile car insurance review found that the usage-based insurer is ideal for low-mileage drivers. If you drive less than 10,000 miles annually, Metromile rates start at $41/month for minimum coverage. The downside to Metromile insurance is that it has fewer add-on options and a higher complaint ratio.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated March 2025

Our Metromile car insurance review found that the company may be a good fit for low-mileage drivers who travel under 10,000 miles annually, as it uses telematic car insurance methods to calculate pay-per-mile rates.

However, Metromile isn’t as affordable for higher mileage drivers and is only offered in a few select states.

We took all of these factors into consideration when calculating our rating. Take a look at how we calculated Metromile’s overall car insurance rating below.

Metromile Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 2.8 |

| Savings Potential | 3.6 |

Read on for a full breakdown of Metromile, Inc. insurance. If you want to shop for cheap car insurance today, use our free quote tool.

- Our Metromile insurance rating is 3.5 for low rates but limited availability

- Metromile car insurance isn’t available in every U.S. state

- Low-mileage drivers get the best Metromile insurance rates

Metromile Car Insurance Rates

Metromile insurance rates will vary based on your age, gender, and other factors that affect the price of car insurance. Younger drivers end up paying the most for Metromile car insurance coverage.

Metromile Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $220 | $565 |

| Age: 16 Male | $241 | $591 |

| Age: 18 Female | $179 | $417 |

| Age: 18 Male | $206 | $481 |

| Age: 25 Female | $52 | $139 |

| Age: 25 Male | $55 | $147 |

| Age: 30 Female | $49 | $129 |

| Age: 30 Male | $51 | $136 |

| Age: 45 Female | $45 | $118 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $41 | $104 |

| Age: 60 Male | $42 | $107 |

| Age: 65 Female | $44 | $116 |

| Age: 65 Male | $43 | $113 |

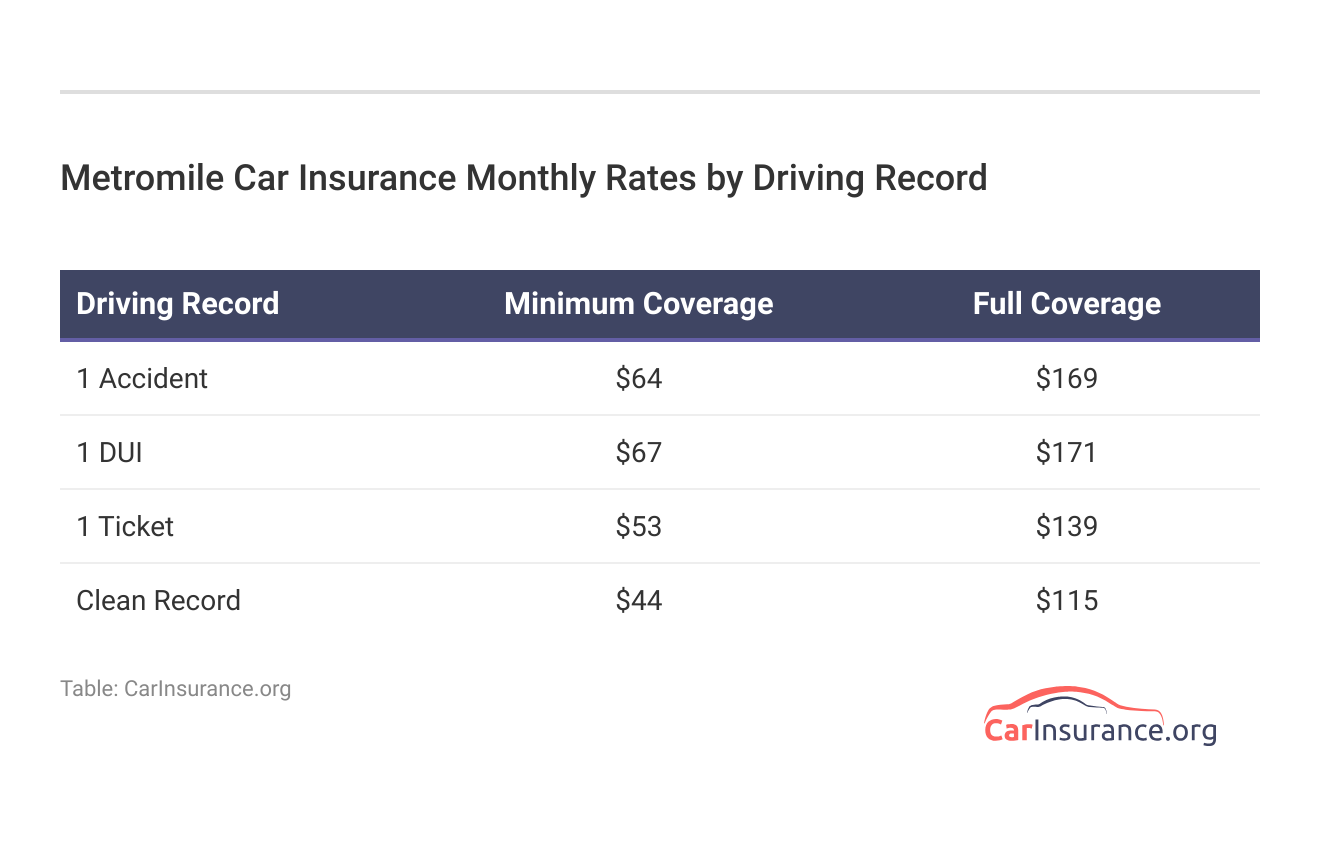

Your driving record will also impact Metromile auto insurance rates, with safe drivers having the most affordable rates from the company.

Drivers with a DUI will be charged the most for car insurance at Metromile, followed by drivers with a traffic ticket.

How Metromile Calculates Car Insurance Rates

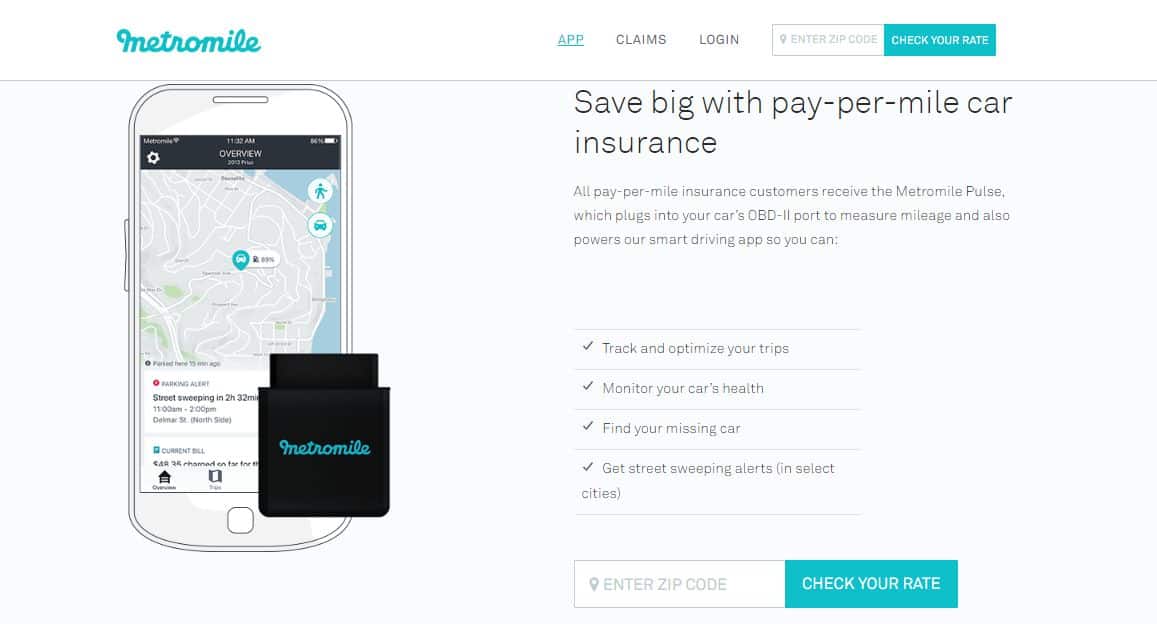

Are you curious how Metromile determines what customers will pay? Metromile, Inc. is a pay-per-mile company — you pay a base monthly fee and then a daily per-mile fee based on how many miles you drive per day.

The company issues a device to every customer that works with your Metromile app to track your miles and calculate your monthly rates.

One of the perks of Metromile is that it caps out miles at 250 per day, so occasional road trips won't cost you an astronomical amount in insurance.Brandon Frady Licensed Insurance Agent

While the Metromile insurance app primarily checks mileage, you can also use it for checking your rates on the app, filing a car insurance claim after an accident, changing your policy, and more.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metromile vs. the Competitions: Car Insurance Rates

While Metromile is usually a cost-effective option for low-mileage drivers, it doesn’t mean it’s right for every driver. See how Metromile pay-per-mile car insurance rates stack up against the competition based on age and gender below.

Metromile Full Coverage Car Insurance Monthly Rates vs. Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | |

| $417 | $481 | $129 | $136 | $118 | $115 | $104 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $148 |

| $417 | $481 | $129 | $136 | $118 | $115 | $104 | |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 |

Metromile is a more expensive choice for 18-year-olds. Younger drivers are better off getting perks from staying on a parent’s car insurance policy at a company like State Farm or Geico.

Another factor to consider is your driving record. Metromile may not be the best company for you if you don’t have a perfect driving record.

Metromile Full Coverage Car Insurance Monthly Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $169 | $171 | $139 | |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

A few other companies are cheaper for DUI drivers, such as Progressive and State Farm, so Metromile may not be the best option for higher-risk drivers. However, high-risk drivers who don’t drive often would get lower rates based on monthly mileage.

Metromile Car Insurance Coverage Options

So, what coverages does Metromile sell with its pay-per-mile plans? Metromile customers can buy the following different types of car insurance coverage:

Metromile Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers injury/damage to others if you're at fault |

| Collision | Pays for repairs after a collision, regardless of fault |

| Comprehensive | Covers non-collision damage like theft or natural disasters |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages, regardless of fault |

| Uninsured/Underinsured Motorist | Protects if the other driver has insufficient or no insurance |

| Medical Payments | Covers medical costs for you and passengers |

| Roadside Assistance | Provides help for breakdowns like towing or tire changes |

| Rental Car Reimbursement | Pays for a rental while your car is being repaired |

| Glass | Covers repairs or replacement of windows or windshields |

| Gap Insurance | Covers the difference between car value and loan balance |

It offers all of the basic coverages but doesn’t have as many add-on coverages available. While it has Metromile roadside assistance and gap, it is missing specialty add-ons like modified car insurance, rideshare insurance, or new car replacement coverage.

Metromile Car Insurance Discounts

Metromile has multiple car insurance discounts customers can apply to their policies, which we cover in the table below.

Metromile Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Affinity | 5% |

| Homeowner | 5% |

| Military | 5% |

| Prior Coverage | 5% |

| Senior Citizen | 5% |

| Welcome Back | 6% |

| Multiple Cars | 10% |

| Good Student | 10% |

| Renewal | 10% |

| Safe Driver | 15% |

However, Metromile car insurance discounts are lower than those of other companies, such as its good student discount, but this is because Metromile already has lower pay-per-mile rates.

So, while the Metromile discounts may seem lower, pay-per-mile insurance is one of the easiest ways to lower your car insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metromile Customer Reviews

You should always check customer reviews online to see what customers think of a company before signing up, such as the pitfalls and perks of car insurance add-ons at a company. Customer reviews will alert you to potential issues, such as the Reddit review posted below.

Negative Reddit reviews about Metromile are based on slow customer service and increased rates. However, there are positive reviews from customers, such as the cheaper pay-per-mile pricing and ease of use.

Metromile Business Ratings

Metromile has mixed reviews from businesses who rated the company, so it isn’t one of the best car insurance companies. See what businesses think of Metromile below.

Metromile Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 845 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 0.85 Fewer Complaints |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: A- Good Financial Strength |

Metromile has a higher number of customer complaints than the national average, and its parent company, Lemonade, also has a poor BBB rating. Overall, Metromile, Inc.’s ratings from businesses could be better.

Metromile Pros and Cons

We’ve covered a lot of ground, so let’s recap Metromile’s pros and cons. There are several attractive features of Metromile car insurance policies, such as:

- Lower Rates: Metromile insurance pricing is ideal for drivers who travel under 10,000 miles annually.

- Online Convenience: Metromile’s policies can be managed online from the Metromile app or website.

- Discount Options: Metromile has a few different additional saving opportunities for customers.

Naturally, there are also downsides to Metromile. The main issues we found with its pay-per-mile insurance model include:

- Coverage Options: Metromile doesn’t offer as many add-on coverages as other companies.

- Customer Complaints: Metromile has a higher number of customer complaints than average.

Metromile may not be right for every driver, such as high-risk drivers needing SR-50 insurance coverage, as Metromile is best for good drivers needing basic coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Metromile Car Insurance is Right for You

Our Metromile car insurance review concludes that the provider is best for low-mileage drivers. Unlike how traditional car insurance works, Metromile has a unique pricing scale.

However, drivers with higher mileage won’t benefit from Metromile’s pricing policy. Metromile also has limited availability, so it may not be sold in every driver’s state. Make sure also to consider what aspects are non-negotiable to you, such as rates or customer service.

Not sure if Metromile pay-per-mile car insurance is right for you? Asking for recommendations from families and friends can help you find a better fit. You can also compare rates today with our free tool to find your area’s best car insurance company.

Frequently Asked Questions

Is Metromile a good car insurance company?

Metromile is a good car insurance company for low-mileage drivers.

Is Metromile owned by Allstate?

No, Metromile is not owned by Allstate.

What states is Metromile available in?

Metromile is sold in eight U.S. states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Metromile car insurance rates by state will vary.

Who owns Metromile insurance?

Lemonade, Inc. owns Metromile.

How does Metromile charge for car insurance?

Metromile charges a monthly flat fee and then a per-mile fee based on how many miles you drive each day.

What does Metromile charge per mile?

Metromile’s charge per mile starts at $0.06 but may be higher for some drivers based on demographic and driving record information. Enter your ZIP code to see how much local car insurance companies are charging for coverage near you.

Can I cancel Metromile insurance anytime?

Yes, you can cancel your Metromile car insurance policy at any time without a cancellation fee. However, make sure that you have a new car insurance policy that starts before you cancel, as you need car insurance to meet your state’s requirements.

What is the daily cap for Metromile pay-per-mile car insurance?

Metromile’s daily cap is 250 miles.

What happens if I unplug my Metromile app?

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Metromile track speed?

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

Metromile is a good car insurance company for low-mileage drivers.

No, Metromile is not owned by Allstate.

What states is Metromile available in?

Metromile is sold in eight U.S. states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Metromile car insurance rates by state will vary.

Who owns Metromile insurance?

Lemonade, Inc. owns Metromile.

How does Metromile charge for car insurance?

Metromile charges a monthly flat fee and then a per-mile fee based on how many miles you drive each day.

What does Metromile charge per mile?

Metromile’s charge per mile starts at $0.06 but may be higher for some drivers based on demographic and driving record information. Enter your ZIP code to see how much local car insurance companies are charging for coverage near you.

Can I cancel Metromile insurance anytime?

Yes, you can cancel your Metromile car insurance policy at any time without a cancellation fee. However, make sure that you have a new car insurance policy that starts before you cancel, as you need car insurance to meet your state’s requirements.

What is the daily cap for Metromile pay-per-mile car insurance?

Metromile’s daily cap is 250 miles.

What happens if I unplug my Metromile app?

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Metromile track speed?

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

Metromile is sold in eight U.S. states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Metromile car insurance rates by state will vary.

Lemonade, Inc. owns Metromile.

How does Metromile charge for car insurance?

Metromile charges a monthly flat fee and then a per-mile fee based on how many miles you drive each day.

What does Metromile charge per mile?

Metromile’s charge per mile starts at $0.06 but may be higher for some drivers based on demographic and driving record information. Enter your ZIP code to see how much local car insurance companies are charging for coverage near you.

Can I cancel Metromile insurance anytime?

Yes, you can cancel your Metromile car insurance policy at any time without a cancellation fee. However, make sure that you have a new car insurance policy that starts before you cancel, as you need car insurance to meet your state’s requirements.

What is the daily cap for Metromile pay-per-mile car insurance?

Metromile’s daily cap is 250 miles.

What happens if I unplug my Metromile app?

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Metromile track speed?

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

Metromile charges a monthly flat fee and then a per-mile fee based on how many miles you drive each day.

Metromile’s charge per mile starts at $0.06 but may be higher for some drivers based on demographic and driving record information. Enter your ZIP code to see how much local car insurance companies are charging for coverage near you.

Can I cancel Metromile insurance anytime?

Yes, you can cancel your Metromile car insurance policy at any time without a cancellation fee. However, make sure that you have a new car insurance policy that starts before you cancel, as you need car insurance to meet your state’s requirements.

What is the daily cap for Metromile pay-per-mile car insurance?

Metromile’s daily cap is 250 miles.

What happens if I unplug my Metromile app?

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Metromile track speed?

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

Yes, you can cancel your Metromile car insurance policy at any time without a cancellation fee. However, make sure that you have a new car insurance policy that starts before you cancel, as you need car insurance to meet your state’s requirements.

Metromile’s daily cap is 250 miles.

What happens if I unplug my Metromile app?

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Metromile track speed?

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

If you unplug your Metromile, you will be charged extra, and notifications will be sent to plug your device back in.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Yes, the Metromile app tracks driving behaviors like speed and braking (Read More: Is it bad to have a car insurance driver monitor?).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.