Anchor General Car Insurance Review for 2026 [See Cost & Options Here!]

This Anchor General car insurance review reveals competitive rates starting at $75 per month. Based in San Diego, they specialize in non-standard auto insurance for drivers in California, Arizona, and Texas, offering liability and physical damage coverage with plans for expansion and personalized services.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2025

Read this Anchor General car insurance review to learn about monthly policies starting at just $75. Based in San Diego, Anchor General specializes in non-standard auto insurance across California, Arizona, and Texas.

They offer comprehensive liability and physical damage coverage, managed with a focus on customer satisfaction and tailored to fit a variety of driver profiles.

Anchor General Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.6 |

| Business Reviews | 2.0 |

| Claims Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 1.5 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.1 |

| Digital Experience | 2.5 |

| Discounts Available | 2.3 |

| Insurance Cost | 3.6 |

| Plan Personalization | 2.0 |

| Policy Options | 2.2 |

| Savings Potential | 3.2 |

Explore their competitive rates and services, and see why they’re a favored option for drivers looking for reliable insurance solutions.

Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

- Anchor General car insurance starts at just $75 per month

- Custom auto coverage tailored for CA, AZ, and TX drivers

- Specializes in non-standard auto insurance solutions for diverse driver needs

Anchor General Car Insurance: Rates by Age, Gender & Coverage

Anchor General Insurance Agency provides non-standard auto insurance in California, Arizona, and Texas, offering specialized coverage through its San Diego headquarters for efficient risk management and customer-focused service.

Their policies for a variety of driver needs provide an efficient solution for mitigating risks that are underwritten by Anchor General Insurance Agency, Inc., a specialized program administrator.

Anchor General Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $260 | $460 |

| Age: 16 Male | $280 | $490 |

| Age: 18 Female | $230 | $410 |

| Age: 18 Male | $250 | $440 |

| Age: 25 Female | $120 | $210 |

| Age: 25 Male | $130 | $220 |

| Age: 30 Female | $110 | $200 |

| Age: 30 Male | $115 | $205 |

| Age: 45 Female | $90 | $170 |

| Age: 45 Male | $95 | $180 |

| Age: 60 Female | $80 | $160 |

| Age: 60 Male | $85 | $165 |

| Age: 65 Female | $75 | $150 |

| Age: 65 Male | $80 | $155 |

This detailed guide comprehensively examines Anchor General’s car insurance rates, systematically broken down by coverage level, age, and gender. It shows how differently priced they are, with actual prices for both low and full coverage for males and females throughout different life stages, from teenage to senior.

This information helps potential customers understand how factors that affect the price of car insurance, such as age and gender, influence their insurance costs with Anchor General.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anchor General vs. Competitors: Car Insurance Rates by Credit Score

Compare Anchor General’s monthly car insurance rates to top competitors by credit score. Anchor General offers the cheapest coverage we analyzed, with rates of $150 for good, $180 for fair and $210 for poor credit.

Anchor General Car Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $155 | $185 | $215 | |

| $145 | $175 | $205 | |

| $150 | $180 | $210 |

| $160 | $190 | $220 | |

| $130 | $160 | $190 | |

| $140 | $170 | $200 |

| $135 | $165 | $195 | |

| $145 | $175 | $205 | |

| $155 | $185 | $215 | |

| $125 | $155 | $185 |

See how they compare to industry leaders like Allstate, Geico, and USAA across different credit categories. This provides a clear picture for consumers looking to find the best value in their car insurance shopping.

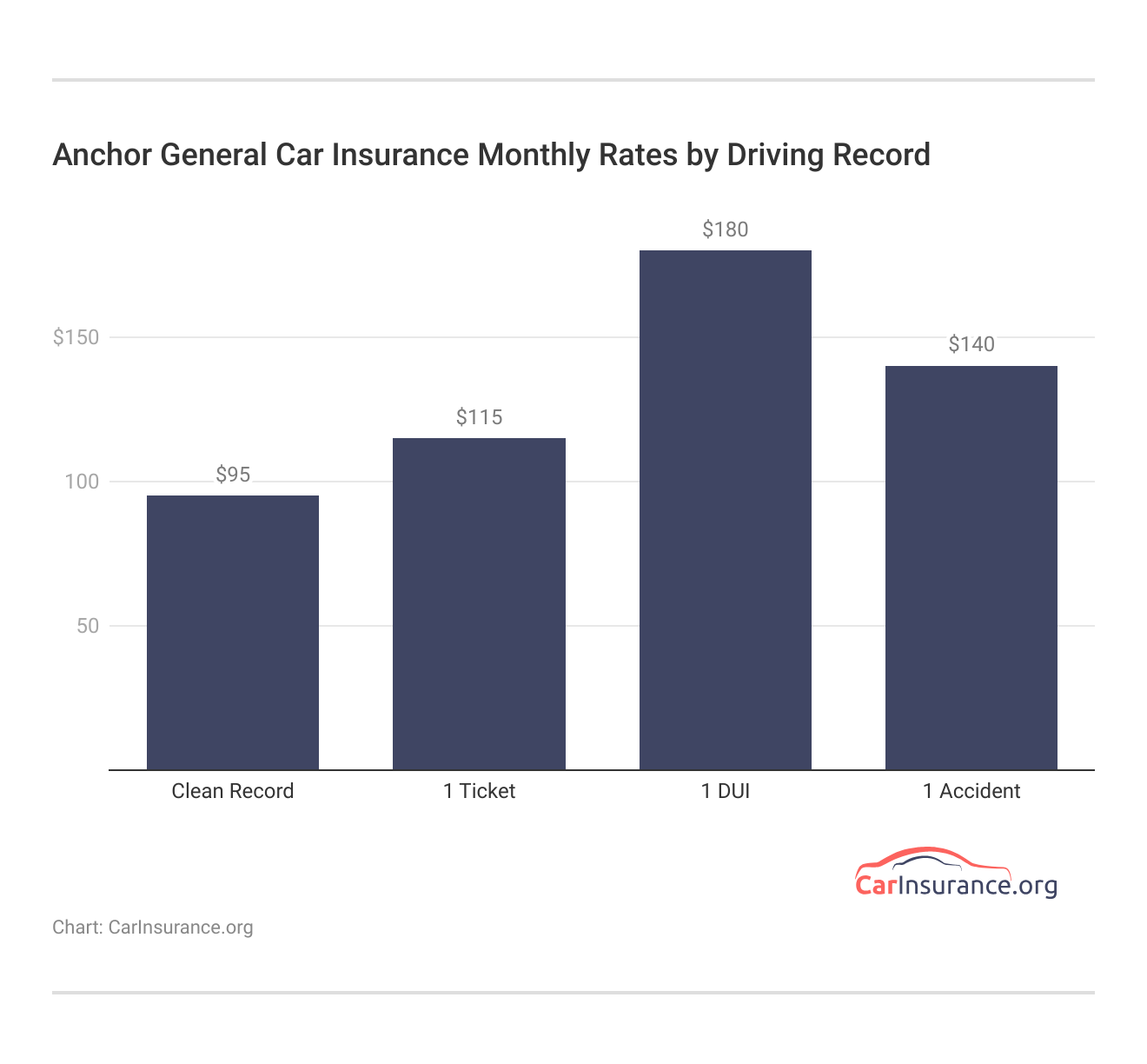

Discover how your driving record affects your car insurance rates with Anchor General. The different types of car insurance coverage impact pricing, with minimum coverage rates starting at $95 per month for a clean record and rising to $180 for a DUI.

Accidents and tickets increase insurance costs. Keep a clean driving record to lower rates. For example, safe drivers often receive discounts.Brad Larson Licensed Insurance Agent

Full coverage rates follow suit, starting at $140 for a clean record and going up to $180 for one DUI, further illustrating the financial reward of keeping a clean driving record.

Anchor General vs. Top Insurers: Competitive Rate Comparison

Anchor General car insurance offers competitive rates, with an average of $104 for minimum coverage and $254 for full coverage, which compares well with some of the top competitors, such as Allstate, Geico, and USAA.

Anchor General Car Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $112 | $255 | |

| $63 | $168 | |

| $104 | $254 |

| $149 | $149 | |

| $44 | $165 | |

| $123 | $123 |

| $157 | $157 | |

| $131 | $131 | |

| $161 | $161 | |

| $38 | $135 |

This thorough breakdown of cross-comparison on Anchor General shows its affordability and complete options that potential customers need to compare coverage options and price among other top insurance companies.

This information is crucial for consumers looking to balance cost with the extent of coverage, helping them find the best cheap full coverage car insurance that meets their needs.

Maximize Savings With Anchor General’s Car Insurance Discounts

Anchor General has several discounts available on car insurance, which can have a major impact on your premiums. Save with a 15% good driver discount, 12% discount for paid-in-full policies, and a 10% discount for insuring multiple vehicles. However, be mindful of things you do that can raise your premiums, such as traffic violations, late payments, or lapses in coverage.

Anchor General Car Insurance Discounts

| Discount Name |  |

|---|---|

| Multi-Car | 10% |

| Good Driver | 15% |

| Paid-in-Full | 12% |

| Defensive Driving | 8% |

| Good Student | 7% |

| Anti-Theft Device | 5% |

| Senior Driver | 5% |

| Low Mileage | 5% |

| Paperless Billing | 2% |

| Loyalty | 5% |

Additional savings include 8% for defensive driving courses, 7% for good students, and 5% for anti-theft devices, senior drivers, low mileage, and loyalty.

Even opting for paperless billing can net you an extra 2% off. These discounts make Anchor General a cost-effective choice for diverse drivers looking to save on their car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anchor General: Tailored Car Insurance for Unique Needs in CA, AZ, TX

Anchor General offers a wide array of insurance coverages specifically designed to meet the needs of drivers with unique or non-standard requirements in California, Arizona, and Texas.

- Liability Coverage: Includes bodily injury liability insurance coverage for medical and legal costs from accidents and damages to others’ property, such as vehicles or buildings.

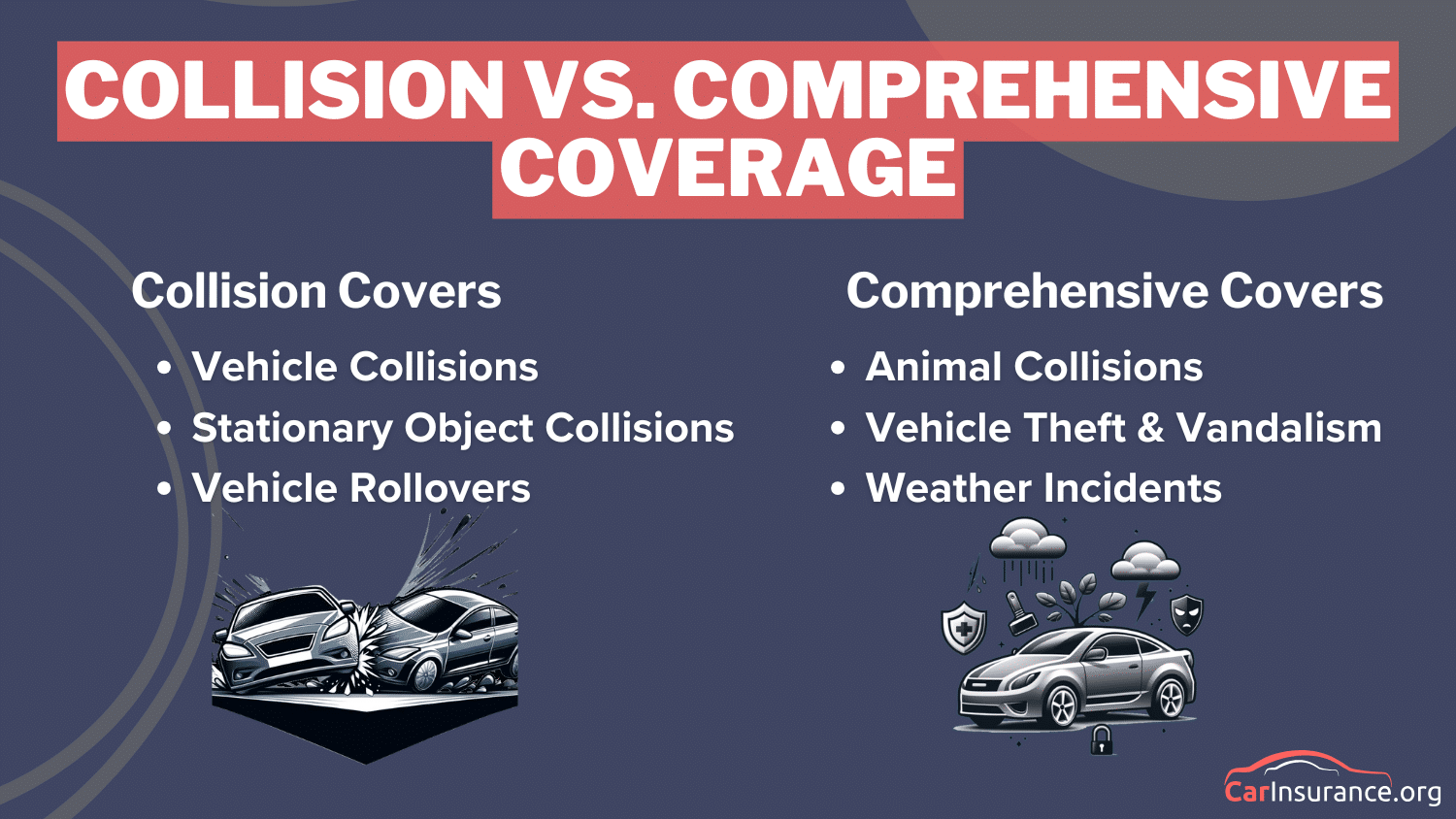

- Collision Coverage: This covers damage to your car from an accident, no matter who’s at fault. It is vital when you go into a ditch or collide with another vehicle.

- Comprehensive Coverage: Covers non-collision risks like theft, vandalism, fire, natural disasters, and falling objects, protecting your car from various incidents.

- Uninsured/Underinsured Motorist Coverage: This coverage protects against accidents with uninsured or underinsured drivers, covering injuries and property damage from hit-and-runs.

- Personal Injury Protection (PIP): PIP no-fault coverage pays for medical expenses and lost wages after an accident, regardless of who is at fault.

Their policy options are extensive, providing coverage tailored to individual needs regardless of whether the driver requires standard or non-standard insurance or has previous claims on record.

Addressing specific needs, Anchor General helps drivers stay legally insured, enhances road safety, and provides financial peace of mind across California, Arizona, and Texas.

Anchor General Insurance Ratings & Reviews

Anchor General Car Insurance received mixed reviews with J.D. Power rating it 745/1000 for below-average satisfaction, BBB giving an A- for good practices, Consumer Reports noting average feedback with a 67/100 score, NAIC reporting a high complaint ratio at 1.85, and A.M. Best assigning a fair B grade for financial strength.

Anchor General Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 745/ 1,000 Lower-Than-Average Satisafaction |

|

| Score: A- Good Business Practices |

|

| Score: 67/100 Avg. Customer Feedback |

|

| Score: 1.85 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

The NAIC shows above-average complaints, 9.28; and A.M. Best’s financial strength rating is “B,” which means fair stability. These ratings provide an overview of Anchor General performing in the insurance market.

This Yelp review by Marsha L. from LA highlights her positive experience with Anchor General Insurance after a car accident.

Understanding how car insurance works, she was initially concerned by negative reviews but found the claims process smooth and accurate. She rated the service four stars, deducting one for delayed contact.

Anchor General Insurance: Pros & Cons for Targeted States

California, Arizona, and Texas drivers can find competitive rates and coverage options that suit their needs with Anchor. This review covers the advantages and disadvantages of selecting Anchor General for your insurance needs, so you can make an informed decision.

- Competitive Pricing: With monthly prices starting as low as $75, not to mention very competitive rates for those who need non-standard auto insurance.

- Specialization in Non-Standard Insurance: Specializes in insuring drivers in California, Arizona, and Texas with poor driving records who may not qualify for standard insurance.

- Tailored Coverage Options: This firm provides customized services and insurance products, allowing policyholders to own insurance that best fits their exact needs and conditions.

Finding the best car insurance means finding the right balance between cost, coverage and customer service.

While Anchor General car insurance offers attractive rates and specialized services for drivers in certain states, potential customers should consider the geographical limitations and mixed reviews.

- Limited Geographic Availability: Services are restricted to only three states, which might not benefit drivers outside California, Arizona, and Texas.

- Mixed Customer Reviews: Despite competitive pricing and niche services, many customers have complained about poor customer service and claim processes.

As with any insurance quote comparison, it’s wise to seek quotes from other insurers and do some research into what customers say about Anchor General’s service quality and claims process to see if it’s the right fit for your needs.

Anchor General’s affordable rates helped me save, and keeping a clean record unlocked even more discounts.Chris Tepedino Feature Writer

This helps make sure their coverage, pricing, and customer support are what you need and expect. Generally, knowing how to lower your car insurance cost will allow you to get the best car insurance rates by shopping around with quotes and always having a clean driving record while enjoying the discounts that are available to you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximize Your Savings: A Guide to Anchor General Car Insurance

Anchor General focuses on non-standard car insurance in California, Arizona, and Texas, and their rates are competitive, starting at around $75 per month. This Anchor General car insurance review outlines the strengths of this company in terms of its affordable and niche offerings for drivers who face difficulty obtaining standard insurance due to bad driving records.

However, its limited coverage and mixed reviews on service and claims may deter some drivers. Comparing car insurance rates by state can help find better coverage and pricing options.

Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

Frequently Asked Questions

How do Anchor Specialty Insurance reviews compare to other insurance providers?

Anchor Specialty Insurance reviews are mixed, with some praising low rates and others citing service issues. Comparing multiple reviews and getting quotes from different providers can help you decide if it’s the right choice.

Why is it important for policyholders to regularly access their My Anchor Policy account?

Regular access to the My Anchor Policy account helps policyholders stay updated on coverage details, payment due dates, and policy documents. It also enables them to make necessary changes, file claims, and access essential resources for managing their insurance efficiently.

Avoid expensive premiums using our free comparison tool to find the lowest rates possible.

Why should drivers consider getting an Anchor General insurance quote?

California, Arizona, or Texas drivers can benefit from an Anchor General insurance quote. If your vehicle is damaged, they offer liability and physical damage coverage for high-risk drivers, starting at $75 per month. Comparing quotes helps assess savings and policy benefits before choosing a plan.

When should customers check Anchor General Insurance reviews before selecting a provider?

Prospective customers should check Anchor General Insurance reviews to assess pricing, service, and claims. Reading positive and negative feedback offers a balanced view of the company’s reliability.

Which features are available on the Anchor General Insurance app?

The Anchor General Insurance app allows users to manage their policies, make payments, view digital ID cards, file claims, and track claim status in real-time. It is designed to provide a convenient way for policyholders to handle their insurance needs from their mobile devices.

Is Anchor General Insurance a Good Choice for Auto Coverage?

Anchor General Insurance suits high-risk drivers in CA, AZ, and TX, with rates from $75 per month. While affordable, reviews on claims and services vary. It may be an option for budget-friendly coverage, but it is recommended that you compare reviews and the best car insurance in California alternatives.

Where can customers find the Anchor General Insurance roadside assistance number?

Customers who need roadside assistance can locate the Anchor General Insurance roadside assistance number on their insurance policy documents, the company’s official website, or by contacting their customer service department directly. Policyholders should keep this number easily accessible in case of emergencies.

Where can customers find the Anchor General Insurance customer service phone number?

Anchor General Insurance provides customer support through its dedicated service line, which can be found on its official website or policy documents. Customers can call for assistance with claims, policy inquiries, or general support related to their coverage.

Why is Anchor Insurance based in San Diego significant to policyholders?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Why do drivers choose Anchor General for car insurance coverage?

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Anchor Specialty Insurance reviews are mixed, with some praising low rates and others citing service issues. Comparing multiple reviews and getting quotes from different providers can help you decide if it’s the right choice.

Regular access to the My Anchor Policy account helps policyholders stay updated on coverage details, payment due dates, and policy documents. It also enables them to make necessary changes, file claims, and access essential resources for managing their insurance efficiently.

Avoid expensive premiums using our free comparison tool to find the lowest rates possible.

Why should drivers consider getting an Anchor General insurance quote?

California, Arizona, or Texas drivers can benefit from an Anchor General insurance quote. If your vehicle is damaged, they offer liability and physical damage coverage for high-risk drivers, starting at $75 per month. Comparing quotes helps assess savings and policy benefits before choosing a plan.

When should customers check Anchor General Insurance reviews before selecting a provider?

Prospective customers should check Anchor General Insurance reviews to assess pricing, service, and claims. Reading positive and negative feedback offers a balanced view of the company’s reliability.

Which features are available on the Anchor General Insurance app?

The Anchor General Insurance app allows users to manage their policies, make payments, view digital ID cards, file claims, and track claim status in real-time. It is designed to provide a convenient way for policyholders to handle their insurance needs from their mobile devices.

Is Anchor General Insurance a Good Choice for Auto Coverage?

Anchor General Insurance suits high-risk drivers in CA, AZ, and TX, with rates from $75 per month. While affordable, reviews on claims and services vary. It may be an option for budget-friendly coverage, but it is recommended that you compare reviews and the best car insurance in California alternatives.

Where can customers find the Anchor General Insurance roadside assistance number?

Customers who need roadside assistance can locate the Anchor General Insurance roadside assistance number on their insurance policy documents, the company’s official website, or by contacting their customer service department directly. Policyholders should keep this number easily accessible in case of emergencies.

Where can customers find the Anchor General Insurance customer service phone number?

Anchor General Insurance provides customer support through its dedicated service line, which can be found on its official website or policy documents. Customers can call for assistance with claims, policy inquiries, or general support related to their coverage.

Why is Anchor Insurance based in San Diego significant to policyholders?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Why do drivers choose Anchor General for car insurance coverage?

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

California, Arizona, or Texas drivers can benefit from an Anchor General insurance quote. If your vehicle is damaged, they offer liability and physical damage coverage for high-risk drivers, starting at $75 per month. Comparing quotes helps assess savings and policy benefits before choosing a plan.

Prospective customers should check Anchor General Insurance reviews to assess pricing, service, and claims. Reading positive and negative feedback offers a balanced view of the company’s reliability.

Which features are available on the Anchor General Insurance app?

The Anchor General Insurance app allows users to manage their policies, make payments, view digital ID cards, file claims, and track claim status in real-time. It is designed to provide a convenient way for policyholders to handle their insurance needs from their mobile devices.

Is Anchor General Insurance a Good Choice for Auto Coverage?

Anchor General Insurance suits high-risk drivers in CA, AZ, and TX, with rates from $75 per month. While affordable, reviews on claims and services vary. It may be an option for budget-friendly coverage, but it is recommended that you compare reviews and the best car insurance in California alternatives.

Where can customers find the Anchor General Insurance roadside assistance number?

Customers who need roadside assistance can locate the Anchor General Insurance roadside assistance number on their insurance policy documents, the company’s official website, or by contacting their customer service department directly. Policyholders should keep this number easily accessible in case of emergencies.

Where can customers find the Anchor General Insurance customer service phone number?

Anchor General Insurance provides customer support through its dedicated service line, which can be found on its official website or policy documents. Customers can call for assistance with claims, policy inquiries, or general support related to their coverage.

Why is Anchor Insurance based in San Diego significant to policyholders?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Why do drivers choose Anchor General for car insurance coverage?

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

The Anchor General Insurance app allows users to manage their policies, make payments, view digital ID cards, file claims, and track claim status in real-time. It is designed to provide a convenient way for policyholders to handle their insurance needs from their mobile devices.

Anchor General Insurance suits high-risk drivers in CA, AZ, and TX, with rates from $75 per month. While affordable, reviews on claims and services vary. It may be an option for budget-friendly coverage, but it is recommended that you compare reviews and the best car insurance in California alternatives.

Where can customers find the Anchor General Insurance roadside assistance number?

Customers who need roadside assistance can locate the Anchor General Insurance roadside assistance number on their insurance policy documents, the company’s official website, or by contacting their customer service department directly. Policyholders should keep this number easily accessible in case of emergencies.

Where can customers find the Anchor General Insurance customer service phone number?

Anchor General Insurance provides customer support through its dedicated service line, which can be found on its official website or policy documents. Customers can call for assistance with claims, policy inquiries, or general support related to their coverage.

Why is Anchor Insurance based in San Diego significant to policyholders?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Why do drivers choose Anchor General for car insurance coverage?

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Customers who need roadside assistance can locate the Anchor General Insurance roadside assistance number on their insurance policy documents, the company’s official website, or by contacting their customer service department directly. Policyholders should keep this number easily accessible in case of emergencies.

Anchor General Insurance provides customer support through its dedicated service line, which can be found on its official website or policy documents. Customers can call for assistance with claims, policy inquiries, or general support related to their coverage.

Why is Anchor Insurance based in San Diego significant to policyholders?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Why do drivers choose Anchor General for car insurance coverage?

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Based in San Diego, Anchor Insurance serves California, Arizona, and Texas, specializing in non-standard auto coverage. They offer tailored policies with localized support, making them a strong choice for high-risk drivers seeking the best car insurance in Texas.

Anchor General focuses on non-standard auto insurance, which is for high-risk drivers who may have difficulty getting coverage through a typical insurance company. Their policies cater to people who have had prior driving violations, accidents, or other issues that make it more challenging to obtain standard insurance.

Where can payments be made for Anchor General Insurance policies?

Which details should be prepared before calling the Anchor General Insurance claims phone number?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Does Anchor General Insurance offer full coverage insurance policies?

Why is it important to contact Anchor General Claims immediately after an accident?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

What services does Anchor General Insurance offer?

How can I pay my Anchor General bill online?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

What makes Anchor General Insurance different from other providers?

Why should customers contact Anchor General Insurance customer service?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which benefits are included in the Anchor General Motor Club membership?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.